We’ve all had those fantasies of getting into a DeLorean and going back in time. We think about all the little changes that we’d make in our lives. If you’re like me and have invested in the brain, then maybe you wish you would have gone back in time and started investing earlier.

This is exactly what I was thinking when I had a chance to meet with the son of one of my friends. Her son had recently turned 16 but had been mowing lawns “since he was a kid.” Haha.

The son had talked to a cousin recently who had told him about how he needed to start investing. Intrigued, he told his mom to contact that investment guy that she had mentioned in the past. In case you’re not sure who he was referring to, that investment guy was me.

If you are ready to begin your investing journey, make sure you check out our guides such as our Online Investing for Newbies for your reference!

Table of Contents

There are not many things that excite me more (with the exception of In-N-Out Burger) than seeing a young investor get started for the first time. The fact that this investor was at the ripe age of 16 makes it that much more exciting.

With any new investor, I walk them through the process of explaining what a stock is, how that relates to a mutual fund, and how easy it is to get started investing by buying mutual funds.

One tool that I use is Thomson Reuters which is a database of almost 30,000 different mutual funds that exist. One mutual fund that I use for hypothetical purposes is not the best mutual fund in the world.

In fact, it’s an average mutual fund and by average I mean that when you look at how it compares to other mutual funds in its peer group it’s been pretty middle-of-the-road. I like showing this mutual fund, for two reasons:

1. It gives us a good variety of market conditions since the fund was established in the late 60s.

2. By showing an average mutual fund, I’m not showing the best, I’m not showing the worst, I’m just showing a possible scenario of what it looks like to make money in the stock market.

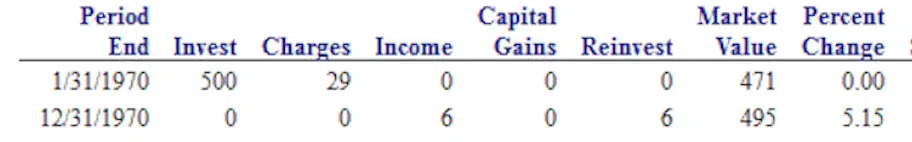

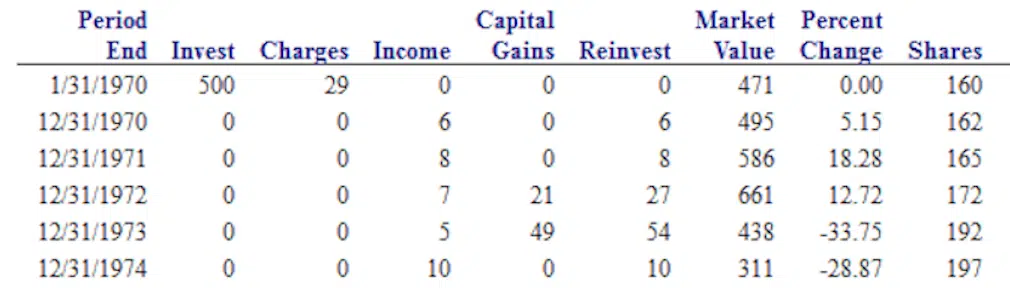

In this hypothetical scenario, since the 16-year-old only has $500 that’s what we’ll use for this example. When looking at the illustration, you’ll notice charges. That’s because in this example we’re looking at A Share, otherwise known as load mutual funds.

Now you might be gasping and asking, “Oh my gosh, why is he showing a loaded mutual fund?” Please keep in mind that back then load mutual funds were very common.

Load or no-load aside, you should get a good sense of what the power of compounding interest looks like and how the impact of investing $500 means a lot – especially when starting at that early age.

The time machine is steaming, watch your head as you enter under the falcon wing doors, and let’s take a trip back in time. Don’t worry, I’ll bring you back safely. You have enough plutonium, right? 😉

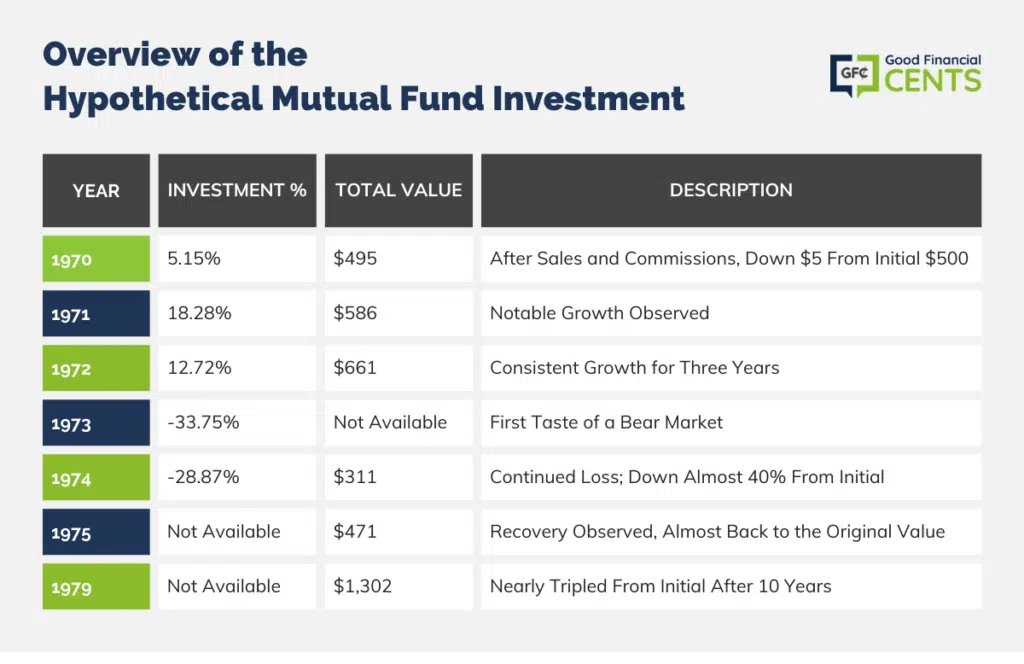

1970

In 1970, I showed investing $500 with total upfront charges of $29. After a year’s time, the mutual fund averaged 5.15% for a total end-of-year value of $495 so after one year, after paying sales and commissions, he’s down $5.

Not too exciting, especially since he could have put it in the bank and made a lot more. Moving on to the next year.

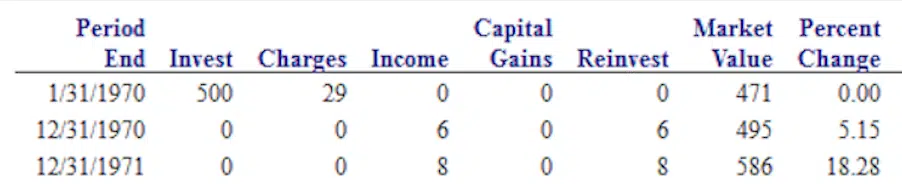

1971

After two years of investing, we’ve averaged 5.15% and now 18.28% for a total value of $586. Not too shabby.

1972

We experienced another year of good growth with 12.72%. The total value now is $661. Typically at this point, I try to remind any new investor that three years of growth at these amounts, 5.15%, 18.28%, and 12.72%, is outstanding.

We’ve averaged good returns but since we only made $161 it might not be that exciting.

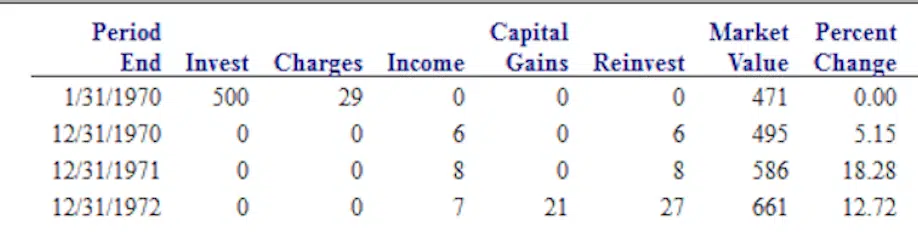

1973

Now the fun begins. Okay, not really that much fun, but we get our first true taste of a bear market. In 1973, the fund was down 33.75%, #ouch.

People hate losing money and now imagine you’ve been investing for four years and after seeing some modest growth you are now down $62. Most people agree that this is not what we hoped or expected from investing in the stock market. This is a big reason why most people don’t invest in the market because they have a very short-term perspective.

I explained to the investors that if they were concerned and came to me I would suggest for them to stay the course and to stay invested and let the market do its thing. Let’s see what next year holds.

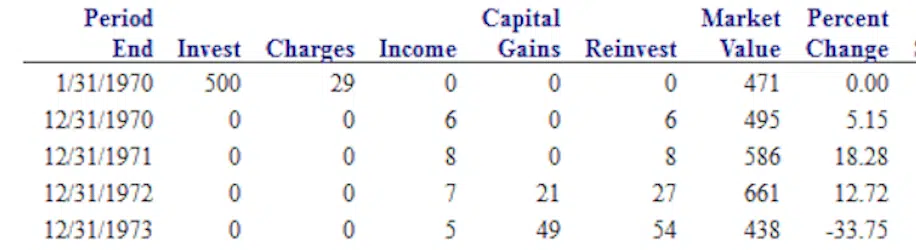

1974

#doubleouch. We followed a 33.75% loss with another 28.87% loss, #thatsucks.

In 2008, the market was down 37% and many claimed that it was the worst market since the great depression.

While in 1973 the market was also down big – this fund was down 33% followed by 28%. That seems like a lot worse than what happened in the 2008 financial crisis.

Our initial $500 investment has grown to $661 at its high and now it’s down to $311 – so after five years of investing we’re down almost 40%.

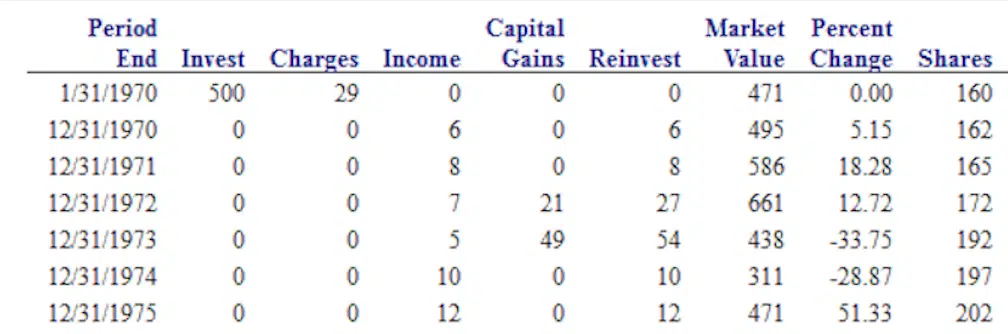

1975

If you decide to stay the course then kudos to you. You’ve done what most people can’t.

The stock market is one of the only few places where when things go on sale, nobody wants to buy; when there is a clearance sale, instead of flooding the store people are running away in mad hordes.

This investor – who started with $500 and saw it climb to $661 only to see it drop by over 50% in the next two years – would’ve seen almost a complete recovery back to their original investment amount if they held on just for another year. At the end of 1975, the total value is now $471.

The one thing I don’t want any of you to discount here is think about how long five years really is. Could you wait five years to see your investment basically go nowhere? Would you actually have confidence in the stock market? Would you have confidence in your financial advisor and their investment recommendations?

Based on prior experience, I would make an educated guess that 99.9% of you wouldn’t, and that’s why most people aren’t defensible investors.

Prior to revealing the 1975 return, this is what I like to ask the individual sitting across from me – which is the same thing I asked the 16-year-old – what would you hope would be your total value after 10 years?

Essentially, what would you hope to have in 1979 – in 10 years of being vested in the stock market? Actually a majority of the time, most people would be happy to make their money back. Some like to see at least a $100 or $200 gain from their $500 investment.

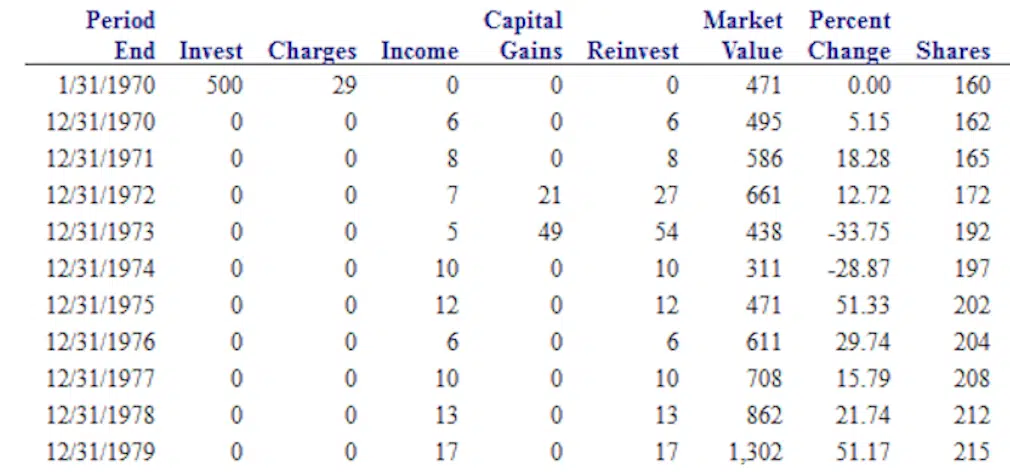

1979

For those who want to just get their money back, as I’ve already shown in 1975, we’re almost there. Now if we fast forward until 1979, exactly 10 years from when we started, you can see that the total value is $1302. We’ve almost tripled our original investment. Was it a roller coaster ride getting there? Absolutely. Once again, it just shows the importance of having time in the market, being patient, and letting the market do its thing.

Later Years + Total Return

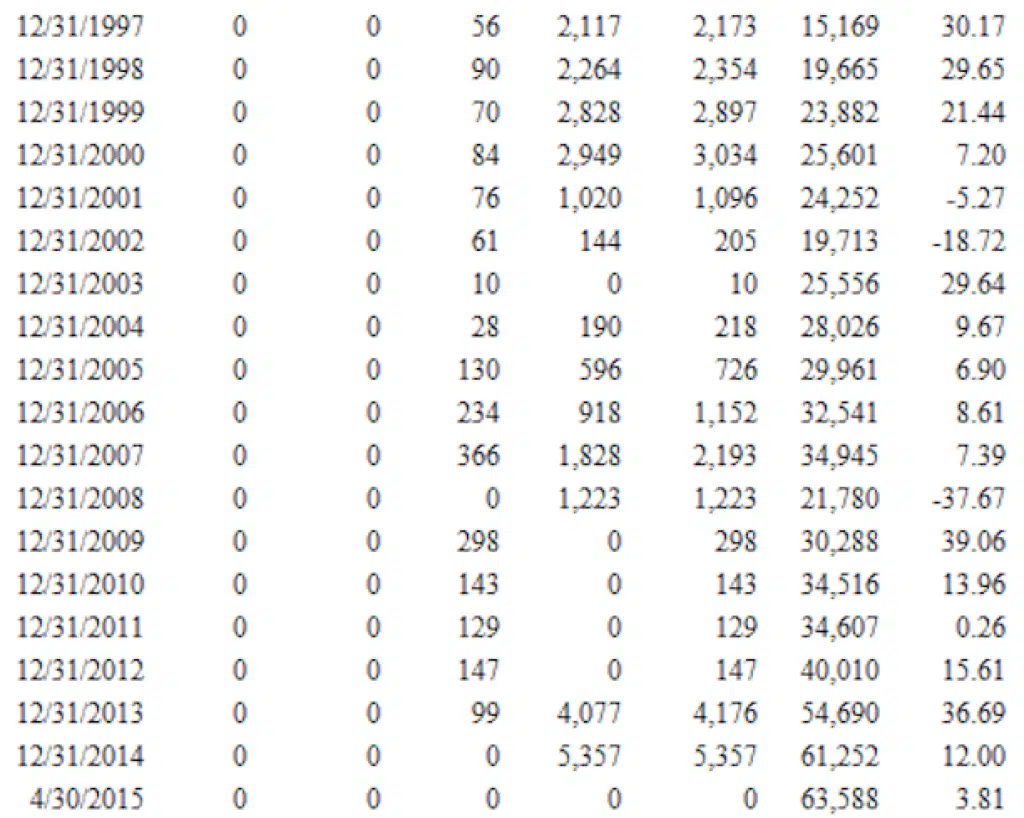

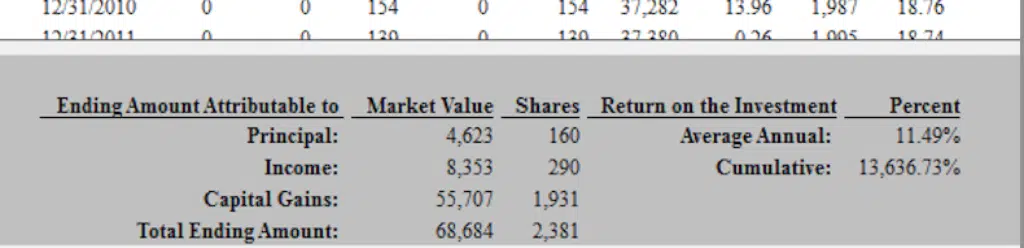

If we keep playing this scenario out over the next 35+ years, we can see that the value grows from a starting point of $500 all the way to $68,684 for an average annual rate of return of 11.49%. Not too shabby for a $500 investment that you just let sit as a mutual fund.

In case you can’t do the math, that means that this 16-year-old would have roughly $70,000 by investing $500 and waiting until the age of 61. Okay, you’re probably wondering based on the title of this article where the $500,000 comes from. Let me show you.

$500 + $25/month

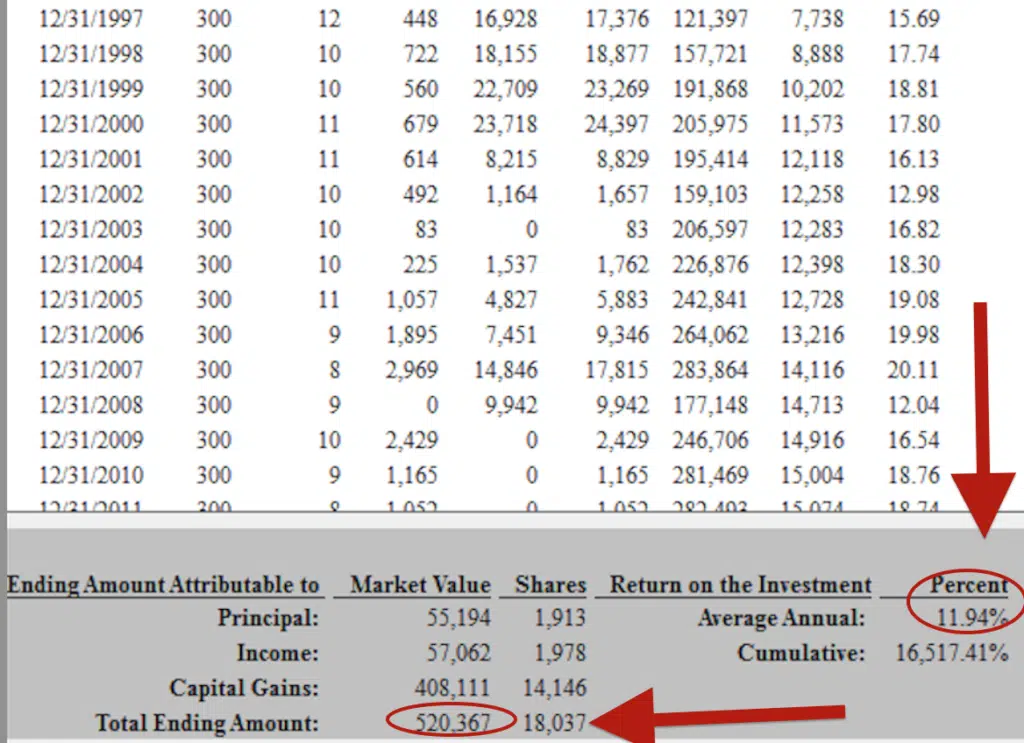

This 16-year-old was ambitious and I could see him salivating over seeing his $500 grow to be a very large number in his eyes. Remember, this kid mowed lawns and did landscaping on the side. The next chart I showed him was taking that $500 and then adding $25 per month. By simply adding $300 per year over the exact same timeline, the amount grew from $68,000 all the way up to $520,000.

Another part that I use to help drive the point home is that the money that he actually invested was only $55,194. Everything else was dividend, interest, and capital gains. A $55,000 investment over the course of 45 years grew to an astronomical $520k.

Calling Out the Skeptics

I can hear many of you now thinking, “Okay Jeff, but the market doesn’t average 11.94% like it used to.” That’s a fair argument, but also keep in mind investing in the S&P 500 at the time of this writing has returned 7.71%. Well, that’s considerably less than what this fund returned. At least it gives us some type of ballpark range to consider.

The final thing I like to point out to people is the $500,000 in this example is a lot of money. We very may well never get close to having those types of returns. That being said, what if I was half wrong meaning that instead of having $500,000 we only have $250,000? That’s still $250,000 from an initial investment of $500 plus $25 per month. That’s still huge and will set this kid apart from 98% of his peers.

The moral of the story is to start investing, let the markets do their thing, and let time be on your side. If you haven’t started investing yet, check out great online platforms like Ally Invest and Betterment.

Don’t put off investing and kill your ability to watch compound interest work its wonders. Cut through the excuses, and start investing something – even if it’s a small amount. Check out 9 Ways to Invest $100. Just about everyone can afford to invest 100 bucks, feeling adventurous, check out 7 Smart Ways to Invest $1,000!

Now you might also be thinking, “I’m not 16 years old, Jeff. I’m about 10 years from retirement.” I feel you. Instead of giving up, there’s so much you can do to better your finances. Read 10 Years from Retirement at RetirementByJeff.com. I’ll walk you through the problem of having a lack of time!

I encourage you to invest something – what you reasonably can – toward a better future. Who knows, maybe later today you’ll meet your future self thanking you for being smart and investing more in the future. 😉

This post originally appeared on Forbes.com.

hey jeff im a 16 year old and i saw your post and i thoughjt it was really intresting and i always wante to

invest but i never knew how and im still a little confused and i still dont know how to do it but i would like to learn how to invest like you did with this 16 year old.

How can you turn 900 dollars into more money I want to save and invest and a do a lot more for myself and family with time what do I do? Email me the answer please and thanks I’m really struggling with life

Hi Mark – There’s no magic secret. Invest the money with a robo-advisor, like Betterment, and make regular contributions to increase it. Over the years your financial situation will improve.

I really like this idea. Been following your videos on YouTube for financial advice. Saw this videos and seems like a great way to put money away for my kids college fund.

Thanks Jose.

This is a very motivating post! I’ve recently become discouraged because my 401k, roth ira, and other taxable brokerage accounts were down between 1 and 3% or so, haha. This just goes to show I need to just sit back at let time and compounding factors do there job and not worry so much!

A great lesson! When I was 18, I read The Motley Fool’s Investment Guide for Teens, which covered similar lessons. Unfortunately I was from a poor family and already taking on considerable student debt at the time, but the lessons stuck with me, and 11 years later I have a positive net worth and a good head start on my retirement investments, despite those early student loan decisions. I totally agree that it’s best to show this sort of thing to any teen, regardless of whether they have the money to invest right then, since the lesson will stick with them (it did with me!).

I only wish someone had shown me this when I started my first business, at age 6! Alright, maybe 6 is too young for understanding investments, but if I had saved up the money from my little newspaper (seriously, that’s what it was), I could have had a few hundred dollars in a savings account when I was a teenager, and then could have learned about where to start investing it.

@ Stephonee A positive net worth is quite the accomplishment, especially coming from what sounds like a mountain of debt. Great work!

Great post! I also love talking with younger people about investing and saving and how important it is to start at a young age. Hopefully you made an impression and set this kid in the right direction to having financially stability once he grows up.

It’s no wonder that compounding interest is considered as the 8th wonder of the world. I wish I could have saved earlier than I started but everyone wishes that way. It’s so important to explain this concept to your kid(s) so they can take advantage of this powerful tool.

Best way to start investing is to . . . start investing! I had started young, but was too ambitious. I wish I had followed technique like you described above when I was 16 instead of gambling on risky stocks. Good advice!

-DP

Would you recommend actually doing this with a kid’s money? Say a seven year old with $300 to $400 from allowance, birthday gifts, etc? Obviously they would keep a percentage of their money as cash to do whatever they want and are cool with the idea… It kills me that my son has a wad of cash sitting rolled up in a jar, I would love for it to be working for him.

@ Adrienne Would I? I did! 🙂

I’ve already bought my oldest son (he’s 8 now) some stock so he can keep up with the share price. Once he gets a bit older, we’re going to invest into some mutual funds so he can track the growth.

Thanks for your response! I’ve been thinking about this for quite a while but have run into too many naysayers. I appreciate the encouragement; it’s on the to do list for the weekend now!

May I ask… Did you put the account in your son’s name or keep it with yours, knowing it’s his? And if A, did you go with betterment or anyone in particular?

@ Adrienne I had to open a custodial in my name with him as the beneficiary. When he’s 18 it will legally be his.

The stock was purchased through the brokerage firm I clear though. One perk of being a financial advisor. 😉

I have a son who will be 3 years old in March… I would love to teach him the value of money as early as possible. When did you start talking to your son about saving/investing?

Would you encourage them with a match maybe once a year? if they put in $100 then you toss in another $100?

I’m glad to hear that some people are encouraging their kids to save and invest, and that you were able to help this kid get started. Great story!

I think the biggest lesson here is the saving piece in general. If you start early and continue to contribute you can end up with a nice amount in the end. A good lesson to be teaching all 16 year-olds.