While learning to use credit responsibly can be a challenge, the best credit cards for building credit can help. Cards geared to consumers with limited credit history or imperfect credit are often easier to qualify for, so they give you the chance to build credit when other cards won’t. Not only that, but some cards for credit newcomers offer rewards, free credit scores, and other perks that can make carrying them worthwhile.

Table of Contents

If your credit profile is thin or nonexistent, or if you have made some credit mistakes in the past, your best bet is to look for a credit card for fair credit, bad credit, or no credit at all. This guide highlights some of the best credit cards for building credit when you have none, as well as the best practices to improve your credit score over time.

Best Credit Cards for Building Credit

- Petal® 1 Visa® Credit Card: Best Overall

- Discover it® Secured: Best Secured Credit Card for Building Credit

- Petal® 2 Visa® Credit Card: Best for Rewards

- Platinum Mastercard® from Capital One: Best for Fair Credit

- Discover it® Student Cash Back: Best for Students

Petal® 1 Visa® Credit Card: Best Overall

Why It Made the List: The Petal® 1 Visa® Credit Card considers factors other than your credit score — like your checking account history — when you apply. From there, they use alternate information to gauge your eligibility, making it easier to get approved with no credit or limited credit history.

Who Can Qualify? Individuals with a bank account may be able to qualify for this credit card regardless of their credit history or lack thereof.

The Petal® 1 Visa® Credit Card is worth considering if you don’t have any credit history but are ready to build credit. This card uses alternative information to approve you for an account, yet it’s still unsecured, meaning you don’t have to put down a cash deposit as collateral. You won’t earn any rewards on regular purchases, but there is no annual fee, and there are no foreign transaction fees.

| Pros | Cons |

|---|---|

| • Qualify for a credit line increase in as little as six months • No annual fee and no hidden fees • Easy to qualify for with a bank account • You can get pre-approved online without a hard inquiry on your credit report | • No rewards for regular spending • Initial credit limit could be as low as $300 • High APR if you carry a balance |

Discover it® Secured: Best Secured Credit Card for Building Credit

Why It Made the List: Individuals without any credit may prefer to get started with a secured credit card that requires a cash deposit as collateral. The Discover it® Secured is the best-secured credit card on the market today since it lets consumers earn rewards and doesn’t charge an annual fee.

Who Can Qualify? Discover says on its website that this card “is for people new to credit as well as people looking to rebuild their credit.”

This card doesn’t charge any fees, yet you get the chance to earn 2% back on up to $1,000 in combined spending at gas stations and restaurants each quarter (then 1% back) and 1% back on other purchases. Discover will also double all the rewards you have earned after the first year. If you use your card responsibly, Discover says you may get your deposit back and be upgraded to an unsecured version of this card in as little as eight months.

| Pros | Cons |

|---|---|

| • No annual fee and no hidden fees • Earn rewards on your spending • Discover doubles all your rewards after the first year • Free credit score | • Security deposit required |

Petal® 2 Visa® Credit Card: Best for Rewards

Why It Made the List: The Petal® 2 Visa® Credit Card is another credit card that uses some alternative data to gauge your eligibility. There are no fees, and you get to earn rewards for each dollar you spend.

Who Can Qualify? Where the first version of this card is geared toward people with little or no credit, the Petal® 2 Visa® Credit Card is for people with some credit history or “fair” credit.

The Petal® 2 Visa® Credit Card doesn’t charge an annual fee or any hidden fees, yet you start off earning 1% back on all your spending right away. From there, you can graduate to 1.25% back when you make six on-time payments on your credit card, then to 1.5% back when you make 12 on-time payments. You can also earn more rewards when you use your card for purchases with select merchants.

There are no late or returned payment fees with this card, although you may start out with a relatively low credit line.

| Pros | Cons |

|---|---|

| • Earn rewards on your spending • No annual fee and no hidden fees • No late or returned payment fees • Get pre-approved without a hard inquiry on your credit report | • Minimum credit limit can be as low as $300 |

Platinum Mastercard® from Capital One: Best for Fair Credit

Why It Made the List: The Platinum Mastercard® from Capital One is for consumers with fair credit or an incredibly limited credit history. We chose this card for our ranking due to the fact there is no annual fee, and you can get pre-approved online without filling out a full credit application.

Who Can Qualify? Individuals with “fair” credit may be considered, which can include FICO credit scores as low as 580.

The Platinum Mastercard® from Capital One doesn’t offer any rewards, but it does give users the chance to build credit with no annual fee. Capital One will even consider you for a higher credit limit after six months of on-time payments. There are no foreign transaction fees, and you get access to Capital One’s credit building and credit monitoring tools.

| Pros | Cons |

|---|---|

| • Free credit score • Qualify for credit line increase in as little as six months • Get pre-approved without a hard inquiry on your credit report | • No rewards • High APR for spending |

Discover it® Student Cash Back: Best for Students

Why It Made the List: The Discover it® Student Cash Back lets students build credit history while earning rewards. It’s easy to qualify for, and there are no hidden fees.

Who Can Qualify? Students with no credit or limited credit history may be able to qualify.

The Discover it® Student Cash Back was created for students who need help building credit from scratch. This card is easier to qualify for when compared to many other rewards credit cards, yet it is still offered with no annual fee and no hidden fees. Cardholders also get the chance to earn 5% back on up to $1,500 spent in quarterly bonus categories (then 1% back) and 1% back on other purchases. Discover will even double all the rewards you have earned after the first year.

Students with good grades can also qualify for a $20 Good Grade Reward each year they report a GPA of 3.0 or higher. New cardholders even get 0% APR on purchases for six months, followed by a variable APR of 12.99% to 21.99%.

| Pros | Cons |

|---|---|

| • Earn rewards on your spending • No annual fee and no hidden fees • Bonus cash for good grades • Intro APR for purchases | • Potential for the low credit limit to start |

Best Credit Cards for Building Credit Comparison Table

| Rewards | Annual Fee | Cash Deposit Required? | APR | |

|---|---|---|---|---|

| Petal® 1 Visa® Credit Card | None | $0 | No | Variable APRs range from 19.99% to 29.49% |

| Discover it® Secured | 2% back on up to $1,000 in combined spending at gas stations and restaurants each quarter (then 1% back) and 1% back on other purchases | $0 | Yes | Variable APR of 22.99% |

| Petal® 2 Visa® Credit Card | 1% to 1.5% back | $0 | No | Variable APRs range from 12.99% to 26.99% |

| Platinum Mastercard® from Capital One | None | $0 | No | Variable APR of 26.99% |

| Discover it® Student Cash Back | 5% back on up to $1,500 spent in quarterly bonus categories (then 1%) and 1% back on other purchases | $0 | No | 0% APR on purchases for six months, followed by a variable APR of 12.99% to 21.99% |

What Is a Good Credit Score?

If you haven’t checked your credit score yet, you may want to get started on this step right away. Even if you believe you have no credit history, it’s possible some loans or bills you have paid have made their way onto your credit report. Plus, it can help to know where you stand before you select a credit card that suits your needs.

What makes a good credit score? And how do you know what your score means? While there are several types of credit scores out there, the most popular credit score used by 90% of top lenders is the FICO score. This type of credit score ranges from 300 to 850, and here’s how FICO breaks these scores down by category:

- Exceptional: 800+

- Very Good: 740 to 799

- Good: 670 to 739

- Fair: 580 to 669

- Poor: 579 or Below

If you have no credit history or limited credit, chances are good that your credit score will fall within the poor or fair range. However, you can build credit and boost your score regardless of your income. You just need to learn about the factors that make up your credit score, as well as how to maximize each one.

Factors that Affect Your Credit Score

According to myFICO.com, there are five main factors that make up your FICO score. Here’s how these factors break down and the percentage each one contributes to your score:

- Payment History: 35%

- Amounts Owed: 30%

- Length of Credit History: 15%

- New Credit: 10%

- Credit Mix: 10%

Payment history is determined based on whether you pay your bills early or on time each month. While timely payments will help you score well in this category, late payments can be catastrophic.

Amounts owed are often referred to as your credit utilization. This factor takes into account how much money you owe in relation to your credit limits, and low credit utilization is always better.

New credit is measured by how many new accounts you have opened in the recent past, and you can score better in this category by applying for new credit only when absolutely necessary.

Credit mix is a factor that is determined by the different types of credit you have. You’ll score better in this category if you have several types of accounts like revolving credit accounts, a mortgage, and a car loan.

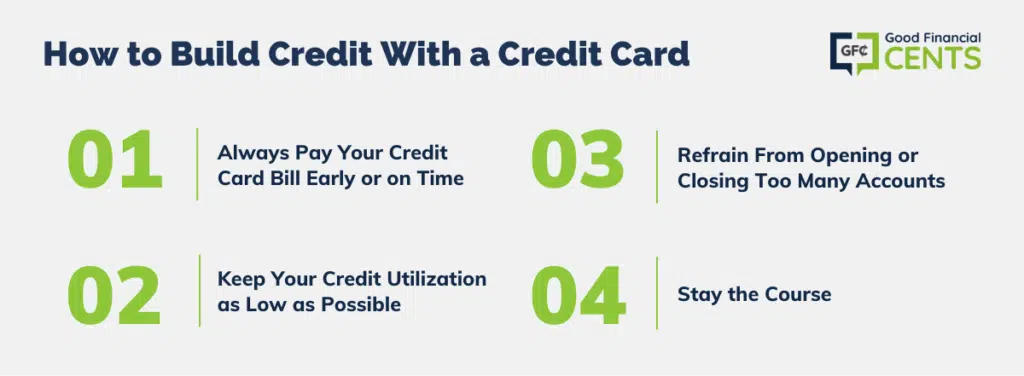

How to Build Credit With a Credit Card

The factors we explain above show exactly how your credit score is determined, but what should you do next? Once you apply for one of the credit cards we highlighted on this page, here are your best next steps:

- Always Pay Your Credit Card Bill Early or on Time. Since your payment history is the most important factor that determines your credit score, you’ll want to avoid late payments at all costs. Make sure to pay your bill on time every month, even if you have to set up payment on autopsy.

- Keep Your Credit Utilization as Low as Possible. Experts suggest keeping your credit utilization below 10% for the best results. As an example, this would mean keeping your revolving balance below $50 if your credit limit is $500.

- Refrain From Opening or Closing Too Many Accounts. Opening new accounts can damage your credit score, so try to avoid it whenever possible. Also, keep older accounts open so they can add depth to your credit history.

- Stay the Course. Building credit with a credit card takes time. Continue following the steps above until you see improvements to your credit score, at which point you may be able to qualify for a new credit card with better perks or rewards.

Methodology

To choose the credit cards for our ranking, we looked for advantages like easy approvals and pre-approval options online. We also looked for cards with no fees or minimal fees, and we gave preference to credit cards that let users earn rewards on their spending. Other perks we looked for include the potential for credit line increases, free credit scores, and other credit-building tools.

The Bottom Line – Best Credit Card to Build Credit When You Have None

Navigating the world of credit can be daunting, especially for those with limited or no credit history.

However, the right credit card can be an invaluable tool in building or repairing one’s credit profile. The key lies in choosing cards tailored to those with fair, bad, or no credit.

From the unsecured Petal® 1 Visa® Credit Card that factors in alternative data for approval to the reward-rich Discover it® Secured and student-friendly Discover it® Student Cash Back, there are options designed to suit various needs.

By understanding factors affecting credit scores and adopting responsible credit habits, anyone can pave the way to a stronger financial future.