61% of Americans own stocks, and that translates into tens of millions of people!

But how many of those people actually understand how the stock market works?

My guess is only a small percentage.

Millions invest in stocks because they’ve proven to be a successful investment, especially over the long term. Since so many are invested, there’s often an assumption that there’s no need to know exactly how it works.

The analogy is similar to computers.

Tens of millions of people know how to use them, but only a small sliver actually knows how they work.

But if you’re interested in knowing how the stock market works, and you should have at least a high-altitude concept, let’s drill down into the details.

Table of Contents

- What the Stock Market Does

- Why Companies Issue Stock

- Why Investors Invest in Stocks

- How the Stock Market Came to Be

- How the Stock Market Works

- Stocks vs Bonds

- Bonds and Interest Rate Risk

- Why You Need to Invest in the Stock Market

- How to Invest in the Stock Market

- Bottom Line: Stock Market Mechanics

What the Stock Market Does

This is a good place to start because it explains why the stock market exists in the first place.

The stock market is just that – a market. It’s a network where companies offer stocks for sale, and investors purchase them.

In the days of old, this was done strictly in physical exchanges. But today, it largely takes place electronically.

There isn’t even necessarily the need for a brick-and-mortar facility to run a stock exchange.

The shares being offered for sale by the companies are so-called because each represents a share of ownership in that company.

Why Companies Issue Stock

Why do companies issue stock rather than just getting bank loans or selling bonds?

Selling stock is a way for a corporation to gain access to a large amount of capital.

For example, the company may need a large amount of money to roll out a new product, expand operations, or acquire another company. That may be more money than they can get from a bank loan.

Meanwhile, both bank loans and bonds require the payment of interest on a regular basis.

This is a direct expense to the issuing company. What’s more, the loan or the bonds will eventually need to be repaid.

However, when it issues stock, it may or may not pay dividends on that stock.

And even if they do, they can lower or eliminate the dividend payment should that become necessary. And at least as importantly, the company doesn’t have to repay the capital raised from the sale of stock.

It will have the effect of spreading ownership of the company out among more shareholders.

However, the company may be willing to accept that outcome in favor of an improved cash position that comes with not having to pay interest or make loan payments.

Why Investors Invest in Stocks

Investors buy the shares in the hope of taking advantage of the issuing company’s income stream or future growth. Or both.

The Income Stream on Stock Is Dividends

This works similarly to interest on bonds and certificates of deposit. From an investor standpoint, the main difference is that while interest is a contractual obligation of the company, dividends are not.

Dividends can be increased, decreased, or even eliminated completely by the issuing company.

Still, there are a large number of companies that have a long history of paying dividends consistently. There are also some with a long history of increasing their dividends annually.

These stocks are referred to as Dividend Aristocrats, and there are more than 50 of them.

They must be in the S&P 500, have increased dividends consistently for at least 25 years, and meet size and liquidity requirements.

The Other Attraction for Investors Is Price Appreciation

That’s usually driven by increases in company revenues, profits, and dividends.

The hope is a $10 stock that will turn into a $100 stock in just a few years. That’s more of a fantasy than a reality, but a portfolio of growth stocks can provide impressive returns nonetheless.

But to illustrate the point of the value of portfolio investing, the average annual rate of return on the S&P 500 – the 500 companies with the largest stock market capitalization – since 1928 has been about 10%.

At least two-thirds of that return has been price appreciation, with the rest from dividends.

For the average investor, capital gains are more important than dividends when investing in stocks for the long term.

How the Stock Market Came to Be

History of the Stock Market

The origins of the stock market are somewhat fuzzy.

The first evidence of at least an informal stock market may have begun in Venice during the 14th century. Brokers began trading government debt, but companies also began issuing ownership shares.

The first formal stock exchange opened in 1611 in Amsterdam.

The Dutch East India Company became the first company to issue bonds and shares of stock to the general public.

The London Stock Exchange began in 1698. The founding of the New York Stock Exchange, currently the world’s largest by a wide margin, happened in 1792.

Today, there is a stock exchange operating in virtually every major economy in the world.

Despite the fact that people – even seasoned investors – often refer to it in the singular stock market, there are actually many stock markets. At any given time, a well-diversified portfolio will be invested in stocks in several markets.

The Stock Market Today

There are at least 20 major stock exchanges in the world.

The largest are (with recent market capitalization):

- New York Stock Exchange: $24.22 trillion

- NASDAQ: $11.86 trillion

- Japan Exchange Group (Tokyo): $6.288 trillion

- Shanghai Stock Exchange: $5.02 trillion

- Euronext (European Union): $4.65 trillion

- London Stock Exchange Group: $4.6 trillion

- Hong Kong Stock Exchange: $4.44 trillion

- Shenzhen Stock Market (China): $3.55 trillion

- TMX Group (Canada): $2.9 trillion

- Bombay Stock Exchange (India): $2.3 trillion

Note:

How the Stock Market Works

Despite the numerous legal, financial, and logistical technicalities in bringing a company to sell its stock together with investors, the process flows effortlessly and even in real time.

That’s the benefit of technology, and especially of the Internet.

Where the process was once brokers and dealers face-to-face in a dedicated building, today, it all takes place electronically.

As an investor, you can buy and sell stocks on just about any exchange in the world through an online investment broker.

But just as there are numerous stock markets, there are also different kinds of stock. The two primary types are as follows:

Common Stock

This is the most common type of stock and the one most people invest in. Common stock represents ownership in the company, as well as a claim on a portion of profits.

The investor gets one vote for each share of stock in the company he or she owns. That vote enables the investor to elect board memberswho oversee the operation of the company.

While common stock is typically the main beneficiary of capital appreciation, it also comes with some risk.

For example, upon bankruptcy or liquidation, owners of common stock are considered to be general creditors.

That means they won’t be paid until after creditors, bondholders, and preferred stockholders are paid.

Preferred Stock

This type of stock floats somewhere between common stock and bonds. The owner of preferred stock is often guaranteed a fixed dividend.

In the event of a bankruptcy liquidation, preferred stockholders will be paid ahead of common stockholders.

However, preferred stockholders typically have limited voting rights, if they have any voting rights at all.

Stock Buy Backs

We’re not going to spend much time on this topic, but we’ll go over it briefly because you’ve undoubtedly heard about it.

While most stock is held by investors, companies often buy back their own shares. Stock buybacks have become very common in recent years.

By buying their own shares, a company reduces the number of shares outstanding.

This increases the earnings per share of stock and often causes the value of the stock to increase.

Stocks vs Bonds

Two other terms that are often used interchangeably are stocks and bonds. That may be because a balanced portfolio contains both types of securities. But how much do they actually have in common?

In reality, very little. A bond is a debt of the issuer.

When a corporation issues bonds, it must pay interest on the securities each year at regular intervals. The bonds are issued for a specific term, generally 20 years.

At the end of that term, the company must pay back the bonds. Within that arrangement, the company is acting as a guarantor of the debt.

Investors primarily buy bonds to earn interest income. However, since principal repayment is guaranteed by the company, bonds are considered to be less risky than stocks.

This is why a diversified portfolio holds both stocks and bonds. While stocks can rise and fall in value, bonds are guaranteed, at least if held until maturity.

By contrast, stocks have no guarantee of value or of payment of dividends. The investor is purchasing the stock with the expectation that either the value of the stock will increase or the company’s dividend will steadily increase.

But for any number of reasons, including a decline in revenues or profits, as well as regulatory changes and international instability, the value of a stock can fall, and even fall a lot.

This is particularly true if the company experiences a sudden or consistent decline in revenues or profits or is forced to either reduce or eliminate its dividend.

Bonds and Interest Rate Risk

Now, there is the risk of losing investment value even with bonds. Long-term bonds are subject to interest rate risk.

That’s the risk of rising interest rates. If interest rates rise above what the bond is paying, the value of the bond will fall in value.

For example, if you purchase $10,000 of company bonds paying 4% (or $400), and interest rates rise to 5%, the market value of the bonds may fall to $8,000.

This is because, at $8,000, the $400 in interest the company pays will produce a 5% yield. If you sell the bonds at that point, you’ll suffer a $20,00 capital loss.

But the opposite is also true. If you make the same bond purchase but with a 5% (or $500) interest rate, and rates fall to 4%, the value of the bond will rise to $12,500.

The $500 annual interest payment will be a 4% yield on the bonds at that value, and you’ll have a $2,500 capital gain if you sell the bonds.

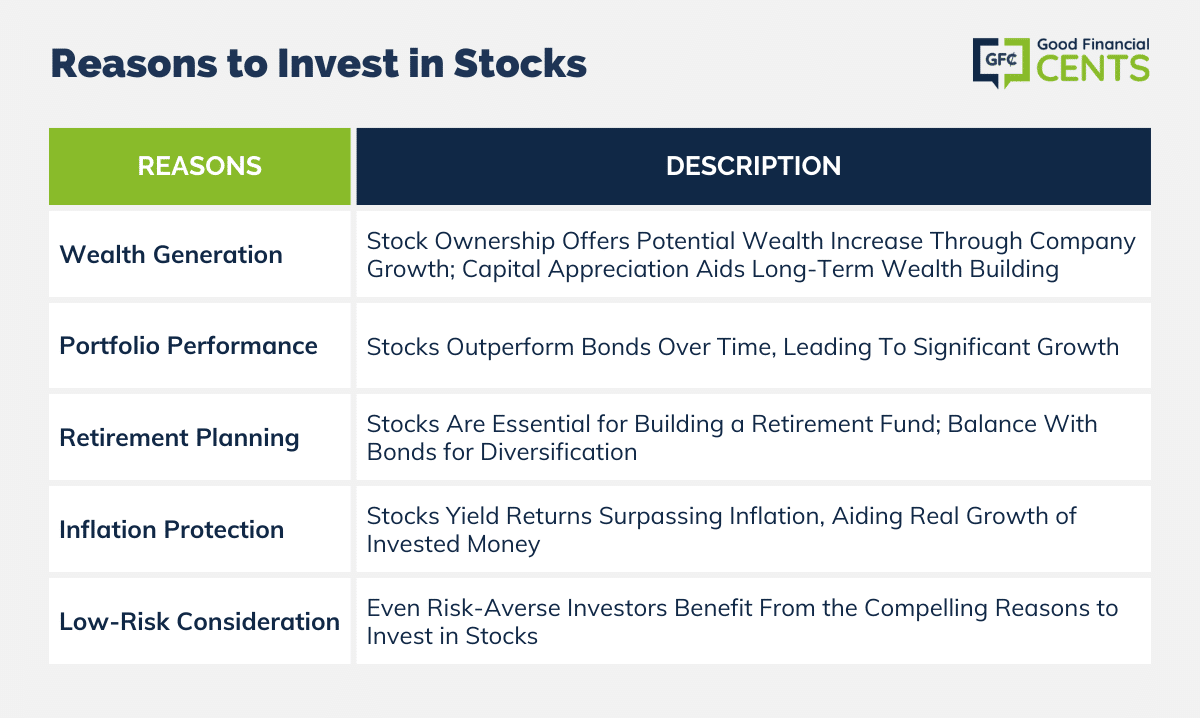

Why You Need to Invest in the Stock Market

Despite all the risks involved in owning stock, holding it is practically a necessity.

There are several reasons why this is true:

Investing in Wealth Generation

Bonds and CDs may pay steady interest, but it’s very difficult to seriously increase your investments in interest-bearing securities alone.

Since stock represents ownership in companies that provide products and services, they hold the potential to seriously increase your wealth.

By buying stock, you’re investing in the means of production.

The capital appreciation gained from investing in strong growth companies is one of the best ways to build wealth over the long term.

Stocks Improve Portfolio Performance

Let’s say you invest $100,000 in a bond paying 3%. In 20 years, it will grow to $134,392.

If you invest the same money in the S&P 500 at 10% per year, you’ll have $672,750 in 20 years.

Retirement Planning

You’ll need a lot of money in retirement. Based on the example above, the only way to get where you need to be is by investing heavily in stocks.

You shouldn’t have 100% of your money in stocks – at least some should be in bonds. But most of your retirement savings should be in stocks, particularly when you’re young.

Inflation

Since 1990, the US inflation rate has been averaging about 3% per year. If you invest strictly in bonds, the best you’ll do is keep up with inflation.

But with stocks, you can earn a healthy return above the inflation rate. That will enable your money to grow in real terms.

All of the above make a strong case to invest in stocks, even if you have a very low risk tolerance.

How to Invest in the Stock Market

How Investors Traditionally Approached the Stock Market

Now, we’re at the most important part of this discussion. Since you know what stocks are and why you need to invest in them, let’s turn to how to invest in stocks.

Traditionally, investors took part in the stock market by buying individual stocks. This was often stocks in blue-chip companies.

These were large companies with well-established patterns of rising income and profits and often paid high dividends.

They tended to perform well in rising markets and resist falling markets.

But in today’s more complicated economic environment, as well as rapid evolution in technology, holding a small number of stock in individual companies isn’t necessarily the best strategy.

As well, investing in individual companies is not recommended for new investors.

The better way is to invest in stock portfolios. This can include mutual funds or exchange-traded funds (ETFs).

How to Invest in the Stock Market Today

Mutual funds are typically actively managed, which means they attempt to outperform the market by investing in the best-performing companies. ETFs are index-based, which means they invest in broad markets.

For example, a common ETF is one that invests in the S&P 500.

That means it holds a portfolio that’s representative of every stock in that index. ETFs match the market but don’t outperform it.

Interestingly, ETFs tend to outperform mutual funds over the long term because the vast majority of mutual funds fail to beat the market.

If you’re new to stock market investing or you have a very small amount of money to invest, your best strategy is to do it through funds.

You can eventually begin trading individual stocks as your portfolio gets larger and your investment in knowledge and confidence grows.

Where to Invest in the Stock Market

If you decide to invest in funds, where can you do that?

If you feel comfortable selecting the funds you want to invest in – and you want to have the option to eventually begin trading individual stocks – the best place to invest is with a diversified investment broker.

Here are some of the top brokers you can work with:

If you don’t feel comfortable selecting your funds, the better option is to go with what are known as robo-advisors. Robo-advisors are automated investment platforms that provide professional investment management at an extremely low cost.

They create a diversified investment portfolio, including stocks and bonds at a minimum, but sometimes also real estate, sector funds, and alternative investments.

Once your portfolio has been created, it’s managed for you continuously. This includes periodic rebalancing to keep the asset allocations on target, as well as reinvesting of dividends.

Bottom Line: Stock Market Mechanics

When you invest with a robo-advisor, all you need to do is fund your account. The robo-advisor does all the work, and you don’t need to concern yourself with any of the details.

Robo advisors worth investing with include Betterment and M1 Finance.

Robo advisors have another big advantage. You can begin investing with little or no money. And with even a few dollars, a robo-advisor can create a fully diversified portfolio for you.

Now, you have all you need to know about how the stock market works. You also know the benefits of investing in the stock market and why you need to do it.

And finally, you have recommendations for where to begin investing.

So what are you waiting for???