I knew nothing about managing money in college.

Even though I was a finance major, I was horrible at actually managing money.

How horrible?

How about unnecessary student loan debt, 2 credit cards nearly maxed out, and literally, nothing in my savings account even though I had two part-time jobs and National Guard money coming in each month? (I share many of my early money struggles in my book, Soldier of Finance)

Yes, that’s horrible.

I can’t go back in time and make it right. Trust me, there are many times I wish I could.

Table of Contents

What I can do is make sure that other college-bound kids don’t make the same mistake, especially my own kids!

Whether you have a senior in high school eager for his independence or a college sophomore who is struggling with his finances, there’s no better time than the present to teach your teens the financial lessons that will serve them well past college graduation.

Is Your Teen College Bound?

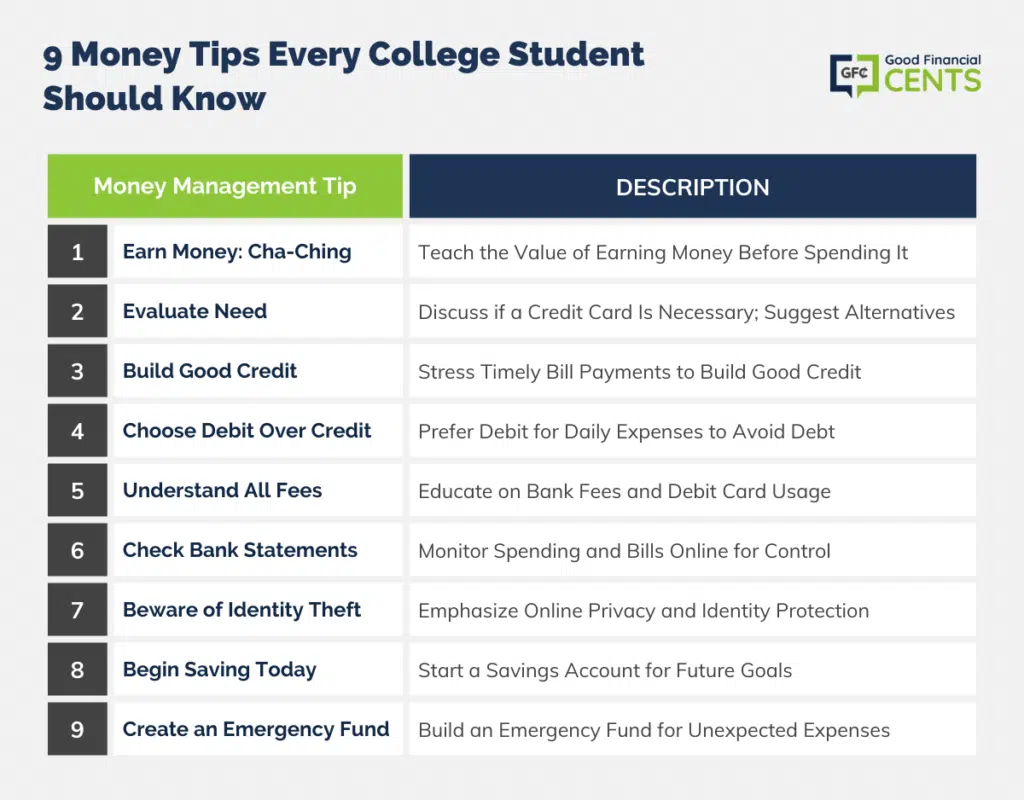

Pack these money management tips in his/her suitcase:

1. Earn Money: Cha-Ching

Your students will have a better appreciation for money when they earn it themselves. Your student will learn it takes a lot longer to earn money than it does to spend it.

As I mentioned above, I worked all my way through college. In fact, during my senior year in college, I had a mall job (worked at GNC), a part-time job at a brokerage firm (this is where I eventually worked after I graduated), and my monthly National Guard obligation. Finding a way to make money on the side while in college can be a really important step in graduating without a huge amount of debt.

2. Evaluate Need

Does every college student need their own credit card? In many cases, college students are better off not having a credit card so they aren’t faced with the temptation of overspending or thinking that they have more money than they actually do. Or at least have some sort of restrictions like a secured credit card where they can learn the basics of using a card.

Remind your child that heading off to college with a credit card isn’t mandatory. Encourage them to get a part-time job to give them spending money and put a little extra cash in their pocket while away at school.

3. Build Good Credit

It is important to reiterate the fact that building good credit now can save your teen a lot of money in the long run. While your college-bound student may not have the future on their mind right now, reinforce that making timely payments on bills such as car insurance or a credit card will help build good credit. And good credit will make it easier to secure affordable car loans, obtain lower interest rates on credit cards, and when the time is right, even get an attractive mortgage loan.

A previous intern found out the hard way when he realized that he had zero credit history. The result was him having an embarrassing low credit score. Luckily, he caught it in time and was able to raise his credit score by over 110 points.

4. Choose Debit Over Credit

For college students, it’s often easier to stash the cash for fast food and use a credit card for necessities like books and meal plans. Unfortunately, racking up a credit card bill larger than your teen can handle is easier to do than to undo. So, talk to your teen about the importance of spending within their means and using a debit card over a credit card whenever and wherever possible.

5. Understand All Possible Fees

However, when using a debit card instead of a credit card for college expenses, make sure your college student understands all possible bank fees. Teach them to avoid overdrawing their bank account and give them the resources they need to secure overdraft protection if it’s available.

6. Check Your Bank Statements Regularly

One of the best ways for your teen to avoid overdrawing their bank account is to teach them to check their bank statements regularly and balance their checkbook if they keep one. With many online banking services, it’s easier than ever to track spending, pay bills, and stick to a college-sized budget with the convenience of a laptop computer.

7. Beware of Identity Theft

Keeping an eye on your bank statements can also be the first defense against identity theft. However, it’s also vital to teach your teen the importance of online privacy. Whether through their profiles on Facebook, Twitter, or other social sites, reiterate the importance of keeping personal information private, always shred paperwork that includes personal details, and never share passwords or PINs with anyone, including close friends.

Identity theft is the real deal. We’ve had our credit cards hit a few times, and trust me, it’s not fun. Especially since we have many of our bills on auto-pay with our cards. If you think you’re protected from identity theft – think again. Learn more about how you can protect yourself from identity theft.

8. Begin Saving Today

It’s never too early to start a savings account. Once they’ve learned the banking basics, it is now time to encourage your teen to start saving for the future. While your college student may not have a lot of money to put away right now, it’s important to show them the importance of setting and reaching long-term goals. With an online savings account that accrues valuable compound interest, it’s easier than ever to earn more on the money you save.

Whether they choose to save a percentage of every paycheck from their part-time college job or put away some of that food allowance you send each month for a future goal, use a goal-based savings calculator to see how a little bit goes a long way when it comes to saving for the future.

9. Start an Emergency Fund

Once a savings account is started, it’s also a good idea to ensure that your student has a little bit of cash in the bank in case of an emergency. From a car that needs a tow to a shop near the dorm, to an unexpected fee in a particular class, it’s always smart to put a few hundred dollars away for the unexpected expenses that are sure to come up. This is also a great money management tip to teach your college students to take with them well past graduation.

Teaching money management tips to your college-bound students is an important part of preparing them for the real world outside your home. This is the first time they will most likely be managing their own finances and will certainly benefit from the money management tips you offer them free of charge! If not now, they’ll surely come to appreciate your financial wisdom to help them make smart decisions with their money.

I polled my Facebook fans and asked a few people on Twitter for their top money management tips for college students. Here’s what they had to say:

@jjeffrose don’t sign up for the credit card no matter how cool the free shirt is!! #precollegefinancetip

— Paul Harding (@prharding) April 14, 2014

@jjeffrose save/invest 20%, live off 80%

— Kevin Gillin M.B.A. (@realkevingillin) April 14, 2014

Final Thoughts

To summarize, dear college scholars, we’ve traversed the terrain of financial wisdom, equipping you with nine essential money tips that can spell the difference between graduating with financial stress or financial success. As you navigate the challenges of academia and embark on the exciting journey of adulthood, remember these pearls of financial wisdom.

Congratulations on taking this important step toward securing your financial well-being, and may your college journey be both enriching and financially empowering!

What’s your best money management tip for college students? Please share in the comments below!