A major goal for most parents is to see their children graduate from college and receive a good job so that they can live a long and fruitful life.

The recent financial fiascos in the United States have put a strain on the ability of the government to contribute to the ever-increasing costs of college.

Historically, tuition fees rise by around 8% on average annually. This could pose a major problem when your average investment return will be in the range of 7% annually based on the historical returns of the S&P 500.

This sounds overwhelming at first, but starting to save early is crucial to your success.

From the day your child is born, you will have approximately 18 years to be ready for the day your son or daughter is ready for college, but the question is, how much should you save?

This whole question became even more apparent in my life as we welcomed our third son into the world. Can you say, “College tuition x 3 = Big Bucks?”…..Yikes!

I know many other parents are in that same situation, so I thought it would be best to help them figure out how much to really save for college.

Do you really have to pay the whole bill? That’s a discussion that you’ll have to have with you and your spouse.

Both my wife and I have different college funding experiences. My tuition was self-funded with the GI Bill that I received for joining the National Guard, and the difference was paid for by me working 30 hours a week. Here’s was also funded, except it was done by her parents.

We both turned out good students with good careers, but I’m sure you can imagine that we have conflicting views on how much we should pay for our kids’ college.

There isn’t a right answer. You’ll have to figure that out on your own. What the numbers below will help you figure out is a ballpark figure on how much damage you’ll be looking at.

If you’re not sitting down yet, maybe you should…..

Table of Contents

College Costs How Much? Gulp.

To estimate the cost of college, there is a great website that you can use to figure out how much you will need to save based on the type of University, as well as the years you are planning to attend. The website is BigFuture.

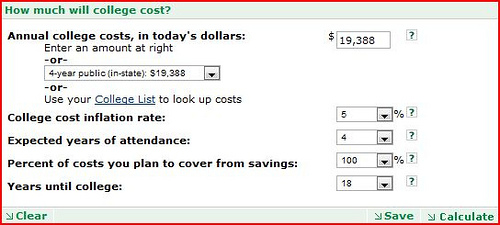

This website gives you the ability to pick the inflation rate of college costs, the years anticipated on attending, the percent of the total cost you would like to cover, as well as the years until your child has to enter the University.

For our example, I will be using four-year public (in-state) tuition to figure out how much you need to be saving per month to pay for your child’s complete college bill. These inputs are pictured below.

According to the college cost calculator, the average cost of four-year (in-state) tuition is $19,388 dollars per year.

With the five percent inflation figure, planned attendance of four years, and 18 years until college, the total cost of your child’s complete education will be $201,108.

Start Saving When Your Child Is Born

This figure seems scary, but you have to consider the fact your wages will also likely increase at a constant rate to differ some of the excess costs.

If you were to start saving the day your child was born and were planning on paying the $201,108 with an 8% average return on your investments, you would need to save $418.90/ month to be able to pay for your child’s total college expenses.

If you were to only receive a 6% return on your investments, you would need to save $519.19/ month for the next 18 years to pay for your child’s total college expenses.

Start Saving When Your Child Is 5 Years Old

Keeping all the same variables in place except for changing the time to college to 13 years (now assuming you start saving when your child is 5 years old), how much would you need per month?

Due to the shortened time frame until college, the estimated total cost of college is now $157,574. This is a counterintuitive figure because it is less than the numbers above; this is not actually the case.

It is just the case because the total cost had less time to inflate, but you also have less time to save!

Earning an 8% return on your investment for the next 13 years would leave you to save $577.36/ month. If you were only able to earn 6% on your investment, you would need to save $669.25/ month.

For those of us working on a tight budget as it is, the extra hundred dollars a month more of savings by waiting the extra five years may not be attainable.

Late to the Game: Your Kid Is Ten

The final figure we will investigate is if you did not start saving until your child was ten, therefore leaving only 8 years until they will need to enter college.

According to the college cost calculator, you would need to have saved up $123,463 to pay for the entire bill. If you were to earn 8% on your investments, you would need to save approximately $922.27/ month.

This is a huge increase in savings per month compared to the amount needed if you were to start saving for your child’s education earlier in their life. If you were to earn 6% on your investments, you would need to save $1,005.17/month to pay for all of your child’s tuition.

As you can see, just because you are late doesn’t mean it’s over. It is just a long road ahead.

Paying Your Kids Tuition Bill

When you look at the examples above, the only thing that you can control is the year in which you start saving. You will most likely not be able to determine a higher return for your portfolio and should not be relying on this to pay for your child’s education.

Of course, the simulations above also have the expectation that you will be paying for 100% of your child’s tuition when, in reality, the majority of students graduate with some type of college loan.

If you were to only pay for, say, 78% of your child’s college costs, you would need to save significantly less than the figures above.

Key Takeaway:

The Bottom Line – How Much Should You Really Save For College?

Planning for your child’s college education is undeniably one of the most daunting financial responsibilities parents face. Tuition fees are rising consistently, outpacing average investment returns. Therefore, the importance of starting early cannot be overstated.

A variety of scenarios highlight the significant difference in monthly savings required depending on when parents initiate their savings plan.

Ultimately, while fully funding your child’s education might seem an overwhelming goal, even partial contributions can significantly alleviate future debts.

The overarching message is clear: the sooner you start, the better positioned your child will be to embark on their higher education journey with minimized financial constraints.

Hello!

I’m a ten year old kid now, and my parents have been working hard to save money for me and my sibling for college. At the moment we own a piece of land, a clinic, three cars and a big house, but still is under 100,000 dollars per year to spend.

My dad has started a biotech co., and they have 1.3 million dollars for the co.

The amount of income per month for us is probably 1000. I’m worried for our future. What will we do?

I agree there is a tuition bubble and the costs are out of control. I don’t know what event will pop the bubble, but I do think it will happen in the next 5-10 years. The job prospects for most graduates don’t justify the very high costs of college.

Have you heard that many experts (on FOX anyway) are predicting a ‘college tuition bubble’ similar to what the real estate market experienced? Personally, I do not think that tuition levels can continue to increase at the same rates. At the same time, I am not sure I actually believe that they will ever go down. It would be interesting to hear your thoughts…..