Whether it is $50,000 or $100,000 in student loan debt you are facing, or 2nd mortgage loans you are trying to pay off, a debt load that large seems insurmountable. Unfortunately, if you are facing this much debt when you get out of college, you are not alone.

With an average student loan debt of $29,000, the 2015 class of college graduates is the most indebted in history. Worse, total student loan debt in the U.S. has ballooned to 1.7 trillion in the last few years – with no end in sight and no real legislation to curb the problem on the table.

Over 43 million borrowers own a piece of this pie, with the vast majority carrying balances of $25,000 or less. Then there are the college graduates who borrowed so much money they could have bought a ranch house in the Midwest instead.

We’re talking about graduates and students drowning in six figures worth of student loan debt, a small pool of graduates that make up just 5.6 percent of borrowers overall. The thing is, knowing you’re part of the minority is likely no consolation if you fit into this demographic.

Table of Contents

When you owe the money, you have to look out for yourself. Whether you racked up six figures in debt in graduate school or at a tragic for-profit doesn’t really matter. Since student loans aren’t dischargeable in bankruptcy, you’re stuck repaying them either way. But how?

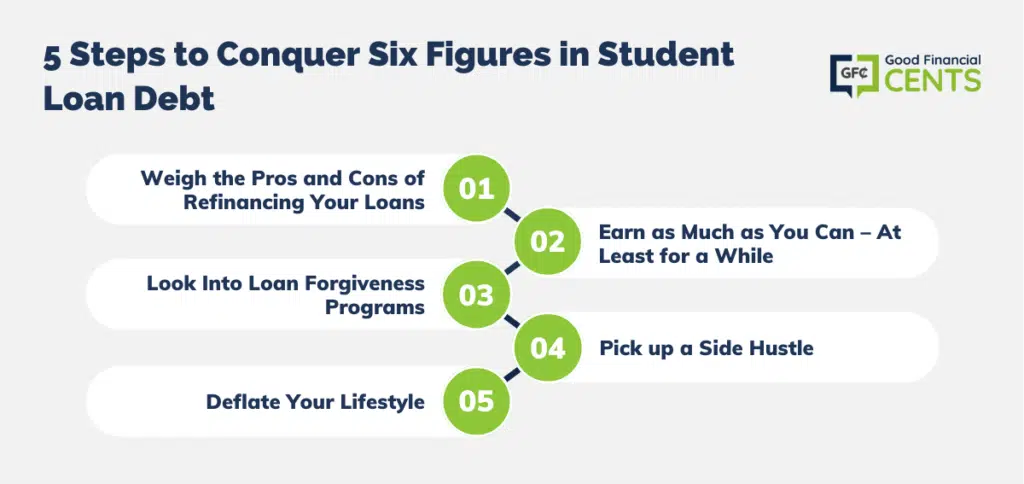

5 Steps to Conquer Six Figures in Student Loan Debt

If you’re struggling under the weight of six figures in student loan debt, you need a lifeline of your own making. The following steps can help you take control and ultimately whittle your loans down to a more manageable level – or wipe them off the map for good.

Step #1: Weigh the Pros and Cons of Refinancing Your Loans

During the last few years, a number of firms have begun offering innovative student loan refinancing options that can cut years – and thousands of dollars in interest – off of the face of your loans. That list includes SoFi, which promises a consumer-focused approach to student loan refinancing and banking. Further, firms like LendEdu.com let banks compete for your student loan refinance with just one loan application.

Whichever path you choose, you should know you will lose certain protections when you refinance federal loans with a private lender. That includes options for deferment or forbearance, along with the ability to sign up for income-driven repayment plans or public service loan forgiveness. Many of the companies have come to the table to offer relief if you were to lose your job, but you need to check the fine print before you sign up for a loan.

Also, you have to have good credit to refinance a student loan without a co-signer. So if you currently have poor or no credit, many of the private lenders will not consider your application. That includes any peer-to-peer lenders like Lending Club or Prosper.

If your loans are lingering at a high-interest rate, you are not able to get a personal loan, and you don’t plan to take advantage of any government programs in the future – or your future income will preclude you from taking advantage anyway, student loan refinancing is one move you must consider.

Step #2: Earn as Much as You Can – At Least for a While

If you earned a degree in a profession that isn’t known for high pay, you might be tempted to take the first “dream job” that comes along – high paying or not. But you might want to reconsider that move if you really want to pay down your loans. Instead, look for – and apply for – jobs in related fields where you might have the opportunity to earn higher pay.

Let’s say you finished your master’s degree in psychology with the hope of finding work as a marriage and family therapist – a career that paid an annual mean wage of just $48,040 in 2014. After perusing BLS data and figuring out which career options could arise from your degree, you might find that it makes sense to look for work as a human resources specialist instead – a job that paid an annual mean wage of $62,000 instead.

Imagine how much faster you could become debt-free if you earned twice as much for even a few years. Remember, dream job or not – it doesn’t have to be forever.

Step #3: Look Into Loan Forgiveness Programs

A wide range of public student loan forgiveness programs are available for graduates who meet certain income guidelines or agree to work in the public sector for a predetermined length of time. The short list includes Public Service Loan Forgiveness (PSLF) which forgives the remaining balance on your Direct Loans after you make 120 qualifying payments over the course of ten years. The big caveat here is that you must work full-time for a qualifying employer in the public service sector.

Other income-drive plans are also available, including Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn Repayment Plan (REPAYE), and the Income-Contingent Repayment Plan (ICR). These plans require you to fork over anywhere from 10-20 percent of your discretionary income for a period of 20-25 years, but your loans will be discharged once you complete the process.

If you owe six figures and never plan on earning much, these programs may offer your best shot at living a financially prosperous life.

Step #4: Pick up a Side Hustle

Whether you opt to refinance or tackle your existing loans the way they are, earning more money can help you put a stake in it – once and for all. You might be able to pick up more hours at your job – pick up some overtime, take on a new project, or finally go after that promotion you’ve been eyeing.

If more money at your current job isn’t an option, another approach to consider is starting a side hustle or side job out of your home. In our post on 47 home businesses you can run from your kitchen table, we list a slew of side hustle options nearly anyone can consider. That list includes:

- Bookkeeping

- Massage Therapy

- Home Inspection

- Copywriting

- Editing

- Web Design

- Mystery Shopping

- Blogging

Still, there are many side job options we didn’t mention. Tasks like mowing grass, laying down mulch, or cleaning houses can be taken on by nearly everyone and can lead to huge paydays, too. The best part is, that all the extra money you can earn can be thrown directly at your student loans to speed up their demise.

Step #5: Deflate Your Lifestyle

Graduating from college may invoke images of your first house, your first new car, and the extra money you’ll have to burn on your new, adult lifestyle. Sadly, graduating with six figures in student loans means some things will have to wait. At the very least, you should try to hold off on those major milestones as long as possible so that you can pay your loans down sooner.

Continue eating Ramen. Keep driving that banged-up ol’ car. Renew the lease on the apartment you share with three roommates until you just can’t take it anymore.

If you continue living poor for as long as possible, you’ll have a better chance of killing your debts that much sooner.

The Bottom Line

Six figures in student loan debt seem like a lot, but it may not prove fatal if you tackle them with fervor right away. Consider this: The average new car price was $33,543 in 2015, which means that most people are spending that much on a new ride every fifteen years anyway.

Paying off your loans might mean forgoing a new car altogether or making sacrifices in a different part of your budget. Or it might mean refinancing into a loan with better terms and a lower interest rate in order to speed up the process.

No matter what, you should keep all of your options on the table. With six figures in student loan debt, you’ll need all the help you can get.

How inspiring! Wishing your travel channel just as much success as this blog. An interesting YouTube travel channel I watch is Kara and Nate. Their goal is to travel to 100 countries by 2019. I watched that channel grow from 9k to over 60k in a year so they might have some ideas as to how to get started. Best of luck!

A lot of people that I know that have $100K+ student loan debt, have very lucrative careers (i.e. dentists, lawyers, pharmacists, RN’s, etc). They can easily work additional hours per diem or do side hustles WITHIN their area of expertise. This is huge because most people who do side hustles make very little additional income. Whereas a lot of these jobs with certifications and licenses, command a certain stable market wage. It’s a huge advantage.

Many lawyers graduate with well over $100,000 in student loan debt. It can feel unsurmountable and crippling at first.

#2 (Earn as Much as You Can – At Least for Awhile) is great advice for young lawyers. I’d only add to it that while you’re earning as much as you can, you need to be managing that income and diverting a massive amount to student loans. Often earning more money = higher stress, so it’s easy to spend the extra income as a way to blow off steam.

If you stick to it though, you can knock out $100K+ student loans in a few years. Going forward you will have so much more freedom.

#4 and #5 are my favorites. Most people really need to cut a ton of shopping out of their budgets. Also, side hustles often become full time jobs, so everyone should at least do Something on the side. Who knows where it will lead

side hustles are easy to start, cheap to start, and can grow into something big enough to replace your fulltime income! I just think you need to go ahead and start something!