Being a college student doesn’t necessarily mean you need to take an oath of poverty. If you’re tired of Ramen noodles and empty pockets, it’s time to learn how to make money in college.

Though it can seem like a daunting task, with a little bit of ingenuity and investigation, you can either find a job that’s glove fit with your school schedule, or even the beginnings of a multi-million dollar business idea.

If you doubt it, check out these ideas now! And while you do, realize that other students have already figured out how to make money in college, and some of them are even making a lot of it. You could be one of them!

Table of Contents

Start With These Tips

The biggest hurdle with how to make money in college is usually figuring out exactly what to do. After all, you’ve already got your school schedule to contend with.

Not only will you need a money-making activity that will fit neatly within that schedule, but one that will also be interesting and maximize both your current skills and income potential.

That may take a bit of self-analysis – we recommend spending some time thinking about a few of these:

How soon do you need the money? If you need to start making money right away, getting a job may be the best solution. You’ll get paid only a week or two after you start. The best place to start is by checking the college job boards to see what will work best for you.

Can you earn money from work related to your coursework or interests? Give serious thought to anything you’re studying in school or have a strong interest in, and investigate ways to monetize what you already know.

For example, are you good enough with computers that you can help other students set theirs up or troubleshoot them? Are you studying accounting or marketing, and if so, could you apply those skills to do freelance work for local businesses?

Are there ways to make extra money at school? Talk to your professors, guidance counselor and department chair, and see if there are any opportunities to earn and learn.

For example, you might be able to get paid work doing research for your major department, or even for one of your professors.

They may also be able to direct you toward tutoring students in need. Or, one of them may be aware of a paid internship. Sniff around, ask questions, and be open to whatever might be available.

Tune into your fellow students. You may be able to identify a common need that will present an opportunity to earn extra money. It could be providing help with term papers, tutoring, or helping other students become more fluid with their computers.

If you find a niche, you may even be able to turn it into a future business. You’re probably aware that Mark Zuckerberg founded Facebook out of his college dorm room. Think big – you could be next!

15 Ways to Make Money in College

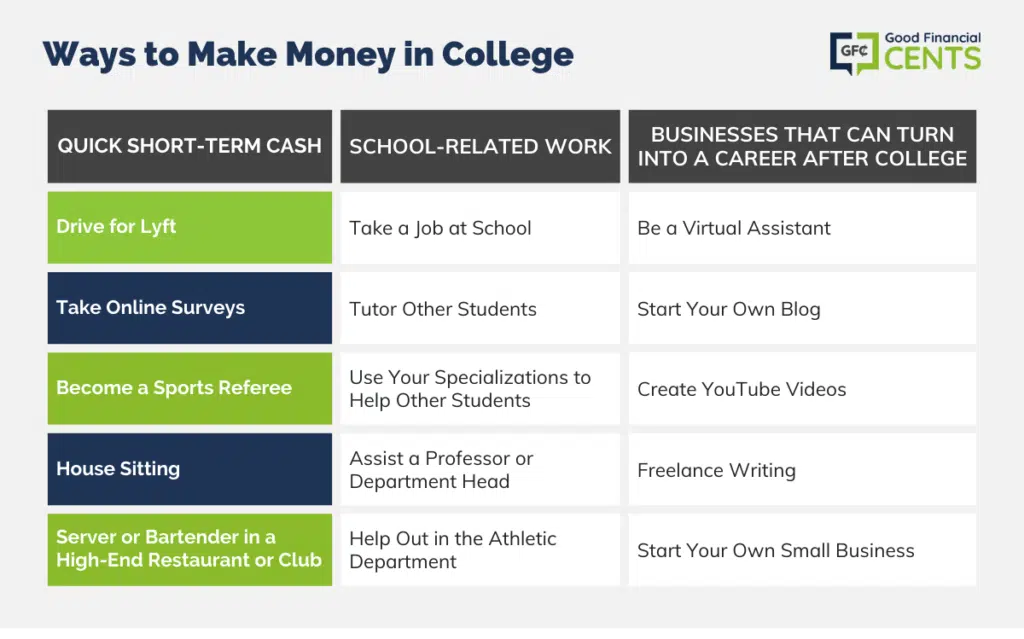

There are more ways to make money in college than you can imagine. To make it easier, we’re going to break those ideas down into categories, based on the specific need to make money you may have.

Choose the group that best fits your situation and look at each of the money-making ideas in it. Even if none are exactly what you’re looking for, use those that are shown as an inspiration for others you can pursue.

You may even find it helpful to choose one that pays you cash immediately, while you parlay another idea into a profitable business you can keep building even after graduation.

Quick Short-Term Cash

- 1. Drive for Lyft

- 2. Take Online Surveys

- 3. Become a Sports Referee

- 4. House Sitting

- 5. Become a Server or Bartender in a High-End Restaurant or Club

- 6. Babysitting

School-Related Work

- 7. Take a Job at School

- 8. Tutor Other Students

- 9. Use Your Specializations to Help Other Students

- 10. Assist a Professor or Department Head

- 11. Help Out in the Athletic Department

Businesses that can Turn into a Career After College

- 12. Be a Virtual Assistant

- 13. Start Your Own Blog

- 14. Freelance Writing

- 15. Start Your Own Small Business

Quick Short-Term Cash

You can certainly get a part-time job, but you’ll earn no more money than the number of hours you put in. There may also be a long line of other students applying for a very limited number of available part-time jobs in your school’s area.

If you want to make more money, and do it on your own schedule, consider some of the following:

Drive for Lyft

This one sounds almost cliché, but it’s one that can work around your schedule. It’s also an opportunity to make a lot more than you can with a part-time job. According to Indeed.com, the average Lyft driver earns more than $73,604 per year.

It works best in and around larger cities and popular tourist destinations. But it can also work well in large college communities, where car-less students are in regular need of transportation.

You’ll need a decent car, a smart phone, and a clean driving record. But if you have all three, and you want to take the plunge, you can sign up to be a Lyft driver.

Take Online Surveys

This is another money-making venture that’s also mentioned frequently. You probably won’t make a fortune taking online surveys, but it has the advantage of being totally flexible. You can do it in your own time, and in the comfort of your dorm room or apartment.

If you want to investigate the possibilities, check out my post on the best online survey and research sites to make money.

Become a Sports Referee

If you played recreational sports when you were a kid, you probably didn’t like the referees much as a player. But did you know they often get paid? And a lot of them are college students.

If you played a sport in high school, you may have everything you need to know to be a referee in a recreational league. And don’t worry about what you don’t know, you’ll be provided with a referee’s guidebook to fill you in on the details.

Check the local recreational sports leagues in the area where your school is, give them a call and volunteer your services.

Referees can make between $25 and $50 per game, and they rarely last much longer than an hour. If you can referee two or three games on a Saturday, you can easily make over $100.

House Sitting

This can be the very easiest way to make money in college. You’ll be paid to stay at someone’s house while they’re away, and sometimes only to look in on the house on a regular basis.

In addition to earning money, it may give you an opportunity to get out of a crowded dorm room for a few days. It can even allow you to do your homework while you’re getting paid.

Some people don’t like leaving their homes unoccupied, and admittedly many are also looking for someone to care for housebound pets. Or they may simply want someone at the house to collect the mail and take in delivery packages.

You can look for house-sitting opportunities in your school newspaper, on Craigslist, or anywhere people post special needs. But you can also register for a house-sitting service, like MindMyHouse.com or HouseSitter.com.

Become a Server or Bartender in a High-End Restaurant or Club

This is one of the most traditional money-making opportunities for college students. And if you’re working as either a server or a bartender in a popular or high-end restaurant or club, you can make way more than minimum wage

There are age restrictions that may or may not affect you. For example, you may need to be at least 18 years old to work in an establishment that serves liquor. But you may need to be at least 21 to be a bartender

You can check the classifieds in your area to find opportunities. But it may be better to go and apply directly at local establishments. One characteristic common to restaurants and clubs is that they’re often looking for someone immediately, and they’ll hire you just for showing up.

Babysitting

If you like kids, babysitting is an option that can earn $15 to $20 per hour – often plus tips. You can check the local classified ads, but it might be better to register with a service like Care.com.

It’ll help your resume, and probably your pay level, if you also complete a CPR course. It’ll give parents a higher assurance that their children are in good hands.

School-Related Work

The best ways to make money may be right on campus – you just have to know where to look. A college is a business organization, and all organizations have jobs that need to be filled.

And even apart from formal jobs, there may be opportunities to make some extra cash just helping out where there are specific needs.

Take a Job at School

Your college or university needs people to fill all kinds of jobs. It could be working in the cafeteria, providing cleaning services, maintaining the grounds, or any one of a number of jobs. It would have the advantage of keeping you on campus for work, rather than needing to go to a remote site.

Check with your school’s human resources department, or even get information from people who are already in those jobs. They can probably point you toward the person who does the hiring.

Tutor Other Students

Do you have a specific subject or two where you’re particularly strong? If so, you may be able to earn money tutoring other students who aren’t.

There are two ways you can approach this. You can see if there’s a formal tutoring program set up on campus. If so, you can sign up and get assignments as they come in.

But a more lucrative opportunity may be to offer your services directly to other students. You can do this by word-of-mouth, but it may be better to advertise your services in the campus newspaper, website or Facebook page.

As an independent, you can easily make $25 to $50 per hour, particularly if your specializations are in more technical subjects, like math, science, and computer science.

Use Your Specializations to Help Other Students

You probably have certain skills many others don’t. For example, if you’re really good at designing presentations or providing graphic arts, you may be able to help other students with term papers and projects for a fee.

If you’re fluid with computers, you may also be able to teach or troubleshoot the technology for other students.

Advertise your services in the school newspaper, website, or Facebook page. You can also market your services through your own social media. If you start getting referrals from existing customers, you’ll have plenty of income to keep your bank account full throughout your time at school.

Assist a Professor or Department Head

A professor or department head has all kinds of tasks that need to be performed. That includes everything from making copies, to creating audiovisual aids, or doing research.

Check with your professors and with the head of your major department and see what kind of opportunities there are. But also check any online school related media where faculty or administrators might be looking for people to perform certain tasks.

Help Out in the Athletic Department

You’re probably familiar with the concept of a bat boy/girl. But virtually all sports organizations have a need for a bat boy/girl equivalent, or even several.

Maybe you’re not playing in any sports in college, but if you played in one or more sports in high school, you can become an equipment manager, or assist the coaching staff in some capacity.

Check with the athletic department or directly with specific teams to see what’s available. And while football and basketball may be the big money making sports in college, there are dozens of other less known teams at your school where fewer students will be signing up to help.

Those might be your best opportunities.

Businesses That Can Turn Into a Career After College

Starting a business in college may seem unlikely, but it may turn out to be the most lucrative and flexible money making arrangement you can have. Not only are there usually no specific hours to keep, but you can make as much money as your time and talents allow.

What’s more, it may be a real opportunity to get some serious, hands-on business experience that will make you a more interesting candidate when you graduate and start looking for that first job after college.

An even more exciting possibility is the potential that the business you start college could enable you to start making some serious money. If that happens, you won’t need to find a job when you graduate – you’ll already have one coming out of the gate!

Be a Virtual Assistant

Business is increasingly moving online at every level. There are many solo entrepreneurs and small businesses that need services performed that don’t rise to the level of hiring employees. If you can provide some of those services, you can earn money as a virtual assistant.

Small businesses and entrepreneurs need virtual assistants to do all kinds of tasks. Examples include proofreading, social media marketing, invoicing, customer contact, setting up events, and research, just to name a few.

Inventory your own skill set, design a resume, and sign up for some sites where you can find virtual assistant work. Those include Upwork, TaskRabbit, or FlexJobs.

Start Your Own Blog

Is there a topic that really interests you, or a story you want to tell? You can start your own blog and turn those ideas into a steady income. This is one of the more challenging money-making opportunities on this list, but it can also be one of the most rewarding.

Not only can you make money blogging, but a successful blog is a business that can be sold for big money in the future. And many people – like me – have turned blogging into a career.

One of the great things about blogging is that there are blogs about just about every topic. You name it, there’s a blog for it – cooking, travel, photography, computers, fitness, nutrition – I can go on and on.

One of the very best niches is finance, which is where I found success. In fact, if you’re a finance major, you may want to put some of what you’ve learned to work with the finance blog.

You don’t have to be an expert, but just someone with a fresh perspective and a compelling story to tell.

If you’re interested in launching your own blog, I’ve got a guide to get you started. And if you’re doubting being able to pull it off as a college student, just know that some of today’s most successful blogs were started by people when they were still in college.

Create YouTube Videos

You’re a college student so you’re probably well aware there are thousands of people making money creating YouTube videos. Some people have even become YouTube superstars, earning millions of dollars in the process.

Much like blogging, creating YouTube videos has unlimited possibilities. You can make videos about serious topics, like finance, fitness, cars, or relationships. Or you can make more lighthearted content, like video games, cooking, music, hobbies, or social commentary.

The first thing you need to do is create a YouTube account. From there, you’ll need to learn how to create YouTube videos.

You can learn the basics from YouTube Help, but to perfect the art, check out some of the many “how to” videos offered on the platform by people who are already doing it successfully. It may even be worth signing up for a course that will provide all the details.

Freelance Writing

If you like to write, there are a number of ways you can convert that passion into a money making opportunity. For example, if you have specializations – let’s say you like to write about computer games – you may be able offer your services to businesses engaged in that industry.

You may also be able to find work writing articles, research papers, e-books, and even full-length books for individuals who don’t have the time or inclination to do it themselves.

Such people advertise writing gigs on Craigslist all time. (Just be sure to get at least some money up front, and at certain intervals during the project, when you’re working with clients for the first time.)

This is a potentially serious money making opportunity. If you like to write, and you’re committed to doing it for money, Holly Johnson can show you how to make $20,000 per month as an online freelance writer.

Start Your Own Small Business

If you have an inner entrepreneur, one of the best ways to make money in college is to start your own business. You can do this by monetizing specific skills and talents you have, or even drawing from previous work experiences.

For example, if you cut lawns as a kid, offer your services to homeowners in the community. If you have a knack for fixing what’s broken, becoming a handyman is a potentially lucrative business.

On a more technical side, if you have computer or Internet skills, like building websites or social media marketing, you may be able to sell your services directly to small businesses.

Probably the hardest part of starting your own business is marketing. After all, you probably don’t have a budget for marketing, so you’ll have to be able to do it on the cheap. And with the Internet, that’s very doable.

For example, you can advertise your services on Craigslist or Facebook. Or if you want to approach small businesses, you can use email marketing.

That’s a simple matter of getting business emails – which are usually readily available on their websites – and sending them a compelling email advertising your services.

The Bottom Line – How to Make Money in College

I hope you’re getting a sense that you have more control over your money situation than you ever imagined, even as a college student. You don’t need to wait until graduation to start making money!

The extra income can make your college experience more exciting by giving you options other students don’t have.

There’s another benefit to making money in college – one that many students don’t fully appreciate – and that’s that the work you do in college will help you to build both a resume and the hands-on experience that will help you in your career when you graduate.

The transition from student to full-time employee after graduation can be a bit of a shock. But if you’ve already been working while you’re in college, or you’ve built a business, you’ll have already completed that transition.

And who knows, the business idea you hatch while you’re in school could end up being your full-time career when you get out. Remember Mark Zuckerberg’s Facebook story – you could be writing your own millionaire entrepreneur story while you’re still in school.

Never underestimate yourself – it could happen!

I’m currently a junior in college getting my undergrad. I’ve been working multiple jobs since Age 16, and over the years, while living off of Ramen, i’ve been able to save up about $9,000. I’ve been reading your different blogs about low-cost small businesses and different ways to invest. Is there any additional advice you would give a 20 year old trying to grow their savings? How do I build a more professional portfolio being young in a competitive business world?

Hi Kay – You might want to begin investing some of it. A Roth IRA is a good way to do it. Your contributions can be withdrawn at any time without having to pay income tax or an early withdrawal penalty. Within the Roth, you might consider investing through a robo-advisor, like Betterment or Wealthfront. Just remember though that no investment is guaranteed to make money for you, and might even lose money if the stock market falls.

Thanks for the article, Jeff! Great suggestions. I graduated college in 2014 from West Virginia University and I wish I had thought of Uber at the time. It existed but wasn’t main stream yet. What a great college job that would have been. I would have started blogging much sooner, too. I did finally start this year as you have helped open my eyes to the potential. I worked as a financial analyst, now an insurance broker, and I own several of my own side businesses and now my blog. So I’m hoping that background will help me get success in it.

What were some of the things you did in the early days of your blog to drive traffic to it? How did you connect with individuals and other bloggers without risking being to spammy? Thanks, Jeff!

Read this article Nick: How I’ve Made Over $1,097,757 From Blogging.

Thanks, Jeff! I should have known you already had a great article on that exact topic! lol

These are awesome tips! I personally went with the blog option and got into that a while back and have built my site DollarSignUniversity.com from the ground up! It’s tough, but definitely an enjoyable option to make some side cash during college!

Hi Zachary – Congratulations on making a success of blogging. Not many people do. I can tell from the blog name that it’s probably making money! Keep it going for as long as you can, it might even become your primary career after graduation. A blog is very much a business that can lead to a lot of good things!

That was a great article. It really opened my eyes to some jobs I had not realized would work well with a college schedule before. Do you have any advice on how to advertise your skills in order to be successful in blogging or freelance writing?

Hi Elizabeth – For blogging, check out my article GFC 096: How to Make Your First $1,000 Blogging (22 step action plan). For freelance writing, you can advertise on Facebook and other sites, or approach blogs and websites by email.

I was told that bar tending was a good job in collage

Hi Lance – It can be. But you have to get trained, and it usually requires working Friday and Saturday nights, which a lot of college students don’t want to do. If you’re willing to learn and work the hours it can be a really good part-time job.

How do I get started on freelance writing? What are the best websites to get started with?

Hi Ava – Approach blogs you read regularly and feel that you have something to contribute. See if they’ll accept content for pay. You may need to offer to write for free for a bit to get a list of published work. Keep working at it, and you’ll get there.

Great list just one question. Is donating the plasma in your blood a good way to make money in college? I heard it from a few people now and im interested.

Hi Tyler – I’ve heard of it. It’s not my thing, but look into it and see what you find out.

Those are such great suggestions. And another job what really helped me out during college is was being a part-time employee at the Real Estate agency. This job not only helped me to pay bills but I also learned a lot of sales skills.

Jeff,

Hope you can add another option of mentoring High school kids and their parents with academic planning and tips on college admission process and make money for their time via sites like Ivymentorship.com.

Best

Steve

Hi Steve – I wasn’t aware you could make money mentoring high school kids, and have never heard of the website you mentioned. But I’m approving your comment, and that will make others aware of it. But not being familiar with it, I’m not endorsing it.

I was a big babysitter in college, but I wish I had known about freelance writing. You can get paid and get better at a skill at the same time! It’s my go-to side hustle now.