For many Americans struggling to make ends meet, a 401(k) hardship withdrawal appears to be a viable option.

When job loss, unexpected health issues, or recession hit, you may find yourself in dire need of help.

House or rent payment. Utility bills. Late credit card notices. Debt collectors call you every hour on the hour.

Table of Contents

Read on to decide whether or not to pursue a 401k hardship withdrawal to alleviate the burden.

401(k) Hardship Withdrawals FAQs

Do People Really Make 401(k) Hardship Withdrawals?

401(k) Hardship withdrawals have been on the rise. It rose by 24 percent over the 12 months that ended in September 2022, according to an Empower report released in November. The findings are based on an analysis of 4.3 million accounts in corporate retirement plans that Empower administers, and a survey of about 2,500 Americans.

Are you thinking of becoming part of the 24%? Sometimes the withdrawal rules can be confusing, so it’s important to know when you are allowed to pull money from your 401(k) because of hardship.

Read on to learn what actually happens when you make a 401(k) hardship withdrawal.

What Is a 401(k) Hardship Withdrawal?

A 401(k) hardship withdrawal is legally allowed if you meet the Internal Revenue Service criteria for having a financial “hardship” and if your employer allows for it.

Most companies providing 401(k) plans allow hardship withdrawals – check with your human resources department or plan administrator if you’re not sure.

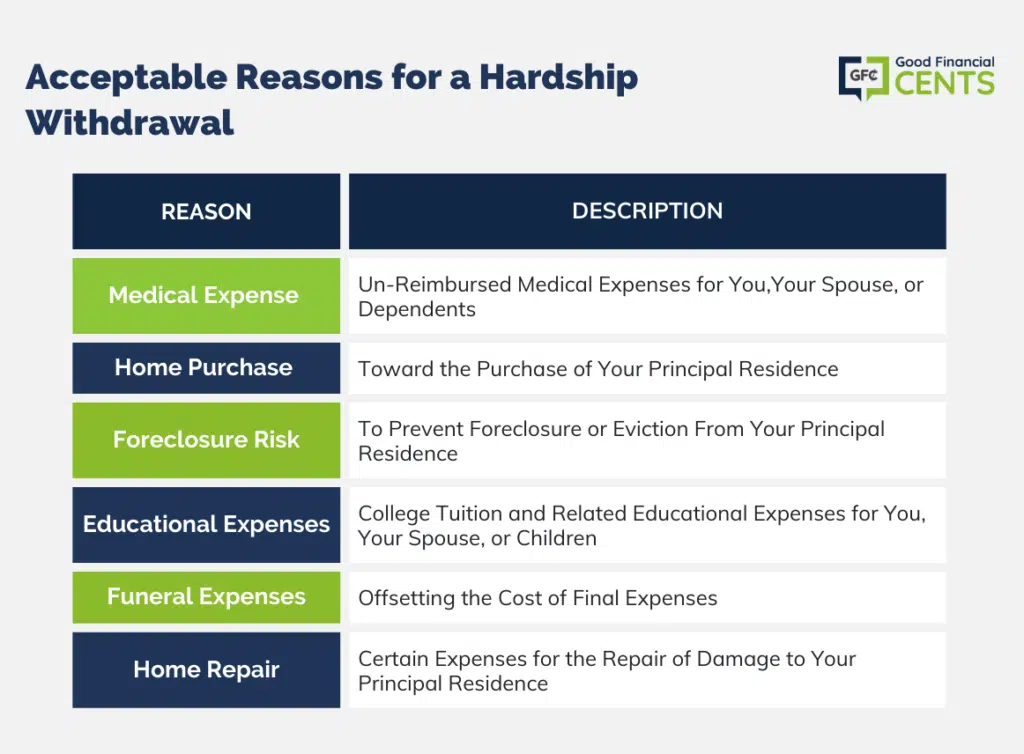

What Are Acceptable Reasons for a Hardship Withdrawal?

The IRS considers the following list of items acceptable reasons for withdrawing money from your 401(k) under the hardship withdrawal.

The Pension Protection Act of 2006 extended your need for a hardship withdrawal to the needs of your beneficiary, even if the beneficiary is not your spouse or dependent.

- Medical expense: Un-reimbursed medical expenses for you, your spouse, or dependents.

- Home purchase: Toward the purchase of your principal residence.

- Foreclosure risk: To prevent foreclosure or eviction from your principal residence.

- Educational expenses: College tuition and related educational expenses for you, your spouse, or children.

- Funeral expenses: Offsetting the cost of final expenses.

- Home repair: Certain expenses for the repair of damage to your principal residence.

The IRS code will allow hardship withdrawals for the above-mentioned reasons only if you have no other funds or means to fulfill the need, and the withdrawal would be enough to satisfy the need (but not more than what you need).

You can, however, include the cost of withdrawal (penalties and taxes) in the amount you need.

Thanks to the Bipartisan Budget Act of 2018, you’re no longer required to take a loan from your 401(k) before being able to file for a hardship withdrawal.

Remember:

What Are the Tax Implications of a 401(k) Hardship Withdrawal?

If you must make a hardship withdrawal from your 401(k) before you reach the age of 59 and a half years old, your withdrawal will be subject to income tax and a 10% withdrawal penalty.

You don’t have to pay back the money withdrawn like you would a loan from a 401(k), which means your retirement account balance is permanently reduced by the amount of your hardship withdrawal.

How Do You Prove Need for 401(k) Hardship Withdrawal?

Each plan administrator can specify what documentation is required for proof of the financial need for a hardship withdrawal.

If the money is used to prevent home foreclosure, the administrator may require documentation from the mortgage company that the home is about to enter foreclosure, for example.

What Is the Allowed Amount of Hardship Withdrawals?

How much money can be taken from a 401(k) plan in the form of a hardship withdrawal? Rather than setting a specific number, the maximum amount cannot exceed the total amount of your contributions, and cannot be more than your financial need.

Alternatives to a 401(k) Hardship Withdrawal

529 Savings Plan

If you have saved up money for your kids’ college, you may be better served by tapping your 529 College Savings Plan first. Why?

While earnings are subject to tax, you can withdraw your contributions penalty-free. Even if there are earnings in the account, they may be minimal compared to the penalties you would pay for your 401(k) hardship withdrawal.

P2P Lending

Peer-to-peer lending sites have become increasingly popular nowadays. With these programs, you apply for a loan just like you would through a bank.

But instead of a financial institution lending you the money, peers or other individuals loan you the money. One of the more popular peer-to-peer lending sites is Lending Club.

Personal Loan

Another option might be to get a personal loan. You might be able to borrow or refinance your mortgage to save money. You might want to also consider applying for an unsecured consumer loan.

Use PersonalLoans.com to get matched up with a good lender and see what your interest might be. Take those rates and compare that figure with your penalty for the hardship withdrawal.

Should You Use a 401(k) Hardship Withdrawal?

Using a 401(k) hardship withdrawal should only be done as a last resort. Look for all other options for accessing money before tapping into your 401(k) retirement savings.

A 401(k) hardship withdrawal reduces the amount of your retirement account permanently. While it may help you in the short term, a 401(k) hardship withdrawal can throw a real wrench in your long-term retirement goals.

Since it’s never repaid, you’ll miss out on compounding interest and earnings, and most likely pay both income taxes and penalties on the amount withdrawn, making it an expensive option for gaining access to your money.

Personally, I would like to see people attempt another option. Before you take the leap and withdraw from your 401(k), be sure to meet with a financial advisor to explore all your options.

This information is not intended to be a substitute for specific individualized tax, legal, or investment planning advice. We suggest that you discuss your specific tax issues with a qualified tax advisor.

My husband made a 401k hardship withdrawal of $21000. I had a work injury and have been disabled since 2015 and got behind on the mortgage as well as bills. Would we still have tax penalties for making this withdrawl?

Hi Arce – You have two factors working in your favor, your disability and saving your home. Please discuss this with your tax preparer, preferably a CPA. You should be able to avoid the penalty – but not the ordinary taxes – on the withdrawn amount, but you’ll need proper justification and documentation with your tax documents.

my husband and I had some bad luck this past year, we had to replace a farm well, came short on a mortgage needed for home repairs, (new roof, electrical, gutters, new exterior doors and windows) a water pipe broke in the ground and now a furnace issue. My husband also had some medical issues this past summer incurring another $1000.00 in medical expenses. We borrowed $9,000.00 2 years ago from his Prudential 401K to replace a septic system. we currently need about 18,000.00 to repay all these bills. His company was sold and Fidelity will be his new 401K administrator as of January 3rd. Will we be able to acquire the money from Fidelity for hardship? We have documentation for the funds needed. He has over $45,000.00 in his account at this time. We have no other options short of filing bankruptcy and that IS NOT an option.

Hi Terry – Unless you’re in jeopardy of losing your home, you may not qualify for a hardship withdrawal. But that may not be as bad as it sounds. Any withdrawal of funds from your plan will be subject to ordinary income tax. But if you can work a hardship withdrawal, the 10% early withdrawal penalty is eliminated. If the plan doesn’t allow a hardship withdrawal, you may have to bite the bullet, take a withdrawal, and pay both the tax and the penalty. I assume he’s no longer working for the company, so a loan is out of the question.

Yes my husband still works for the company, but it is under new ownership. All his previous benefits are under new administrators as well. He had Prudential as his 401K administrator for 24 years and as of Jan 3, 2017 it will be Fidelity. Prudential would not let him take a loan since there was a prior loan with a balance of 5000.00 still owing for the replacement of a sewer system. Not sure whether Fidelity will require the old loan to be paid as well. The hounds are at the door, and the repairs to the house need to be paid, so our only option may be to take the hardship withdrawal and pay the taxes and penalty.

I am 60 now. I have been on Social Security since 2010 and will not be able to work again. I just withdrew 20% from my 401k annuity. I was over 591/2. They said that now I can only withdraw 10% every year with a penalty of 20%.

Apparently it’s a condition in my contact. Am I stuck with the penalty?

Hi Randy – That sounds excessive, but employers are permitted to define the conditions and terms of hardship withdrawals. It doesn’t make any sense to me since you’re over 59.5. You might want to discuss this in detail with the pension administrator. And if the balance is large enough, you may want to consult a pension or employee benefits attorney.

I have gotten a hardship withdrawal before from my 401k and I had to provide my employer proof of hardship. My question is, my husband recently applied for a 401k LOAN not a hardship withdrawal. Will he be required to provide the same type of documentation as a hardship withdrawal??

Probably not Amy, it’s an entirely different situation. But that said, each employer establishes its own rules for both hardship withdrawals and loans, so anything is possible.

My husband has been off on a medical leave of absence since Jan 2016 he is to have surgery next month. While it’s nice.to have California state disability for.some income now he got switched to Cobra plan and it’s nearly 1/2 of his state disability income. He needs surgery and he has a 401k. But does he have to quit his job before he can access it.

Hi Karen – He doesn’t have to quit his job to make the withdrawal. But the final determination as to whether or not the hardship will be allowed will be up to your employer.

My 401K plan allows for Hardship withdrawls without submitting paperwork, but states the documentation may be requested after the fact. I only have 700 in the fund, and I know that I will need it to pay for rent and electricity, but I don’t have an eviction notice yet. If I submit for the withdrawl saying I’ve already received an eviction notice, what could my penalty be if they ask for something I don’t have? Am I breaking the law?

Hi Topher – The $700 will be added to your ordinary income, and therefore taxable, plus a 10% early withdrawal penalty. Those are the financial implications. But keep in mind that your employer may also see it as a trust violation issue, causing you to face employment issues. There’s no way to know how that will play out, but I can’t give you advice that will endorse misrepresenting a hardship withdrawal.

I need a hardship withdrawal to pay rent or I’ll be kicked out of my house. The thing is, I live with my parents and they want $200 per month for rent. Would I be able to get the hardship withdrawal even though my parents are technically my landlords ?

Hi Bruce – I don’t think you’ll be able to do it. The problem is that it’s not an arms length transaction since it’s your parents. But check with the plan administrator to see what they think. That’s what really matters.

Luckily they did approve it. The check is on it’s way. I answered the questions they needed to know the answers to on the hardship withdrawal form and had it notarized at the bank. Then mailed it in. Merrill Lynch said it was approved last week.

Since my parents are my landlords and I’d be kicked out of the house if I didn’t pay rent, they accepted it as a hardship.

i have a 401 from a previous employer that i no longer work for. i also have a 401 with the employer i am currently working. i am having very bad car problems and dont know how much longer my car will last. i live alone and only have the one car. is it possible to cash out my 401 from my previous employer to purchase a new vehicle?

Hi Mark – Unfortunately, there is no exception to the 10% penalty that’s related to cars. But you may be able to borrow against your 401k to finance the car. If you’re employer allows it, you can borrow up to 50% of the plan value, or $50,000.

I had to request a hardship withdrawal for medical expenses because I don’t have health insurance the company responsible for my 403b sent me a notice saying they need to see proof that my insurance won’t cover my bills how do I go about this

Hi Tim – It may be more complicated than it seems – after all, how do you prove that you don’t have something? I’d start by asking the 403b custodian what they would consider to be adequate proof that you have no health insurance. That might be paystubs that show no deduction for health insurance, but you’ll have to see what they’ll accept. Unfortunately, the plan custodian has final authority in this area.

I am looking to take a hardship withdrawal from my 401k for my first house. (I would have preferred to take a loan instead, but it’s not offered with my plan.) I have to submit paperwork with the amount I’m asking for but won’t know the exact amount until a few days before closing. As an example, if I say I need $15k, but only end up needing $13k, what kind of trouble can this cause? I keep hearing that you can only take what you truly need (not for decorating, etc) but what happens if you DO have funds left over? I don’t want to not take enough, but without an exact total I don’t want to be penalized anyore than I already will be for making the withdrawal.

Hi Kimberly – Discuss your concerns with the plan administrator. Find out what the procedure is for returning unused funds to the plan. If it’s allowed, then take a little bit more than you think you’ll need. It really depends on the rules of the individual plan.

If I am going into foreclosure, and I got fired before I could put in for a hardship withdrawal. Is there anyway I can access that money? Or only if I have an employer?

Hi Kerri – Contact the plan administrator. It will depend on the rules set out in the employer’s plan.

looking to get a hardship to fix my car but its not on the list can i get in trouble for using the money other than what i say im using it for

Hi Andy – Your employer will most likely ask you to document your hardship. If you can’t show them documents related to a recognized hardship, it probably won’t be granted.

We lost our home to a fire in 2013. In 2014, my husband pulled money out of his 401k so we could rebuild. We had already gotten our insurance money (which covered less than 1/2 the cost of a rebuild-$65,000), taken a loan for $20,000 against his retirement, and still needed about $40,000 to pay for the house. (We built very modestly…) My husband withdrew and received $28,000 after taxes. My question with a total home loss as our hardship, does this not qualify for a penalty exemption for the IRS? We had the taxes withheld at the time of distribution.

Hi Linda – It should, but how it will be classified will be determined by your husband’s employer. But understand that even on a hardship withdrawal you still have to pay regular income tax, and that’s why there was tax withheld. It’s the penalty that should be waived.

We are first time home buyers and young we are wanting to hardship withdrawal from our 401k to cover down payment (our 401k has only been open 1 year and 1 month) so we feel we are well aware of how to grow it back… we have a prequalificationketter letter from our loan officer and are house shopping and plan on buying asap… our loan officer wants that most eyes from our 401k to be “seasoned” in our bank account at least 60 days… does a pre qualification letter stand for us being able to withdrawal? Also a loan against the 401 isn’t nearly enough but need to cash our our vested balance.

I apologize from the autocorrect. Should have revised.

Hi Chastity – Actually, the hardship withdrawal for first time homebuyers relates to IRAs not 401ks. You’ll have to pay the penalty on a 401k withdrawal. That 60 days seasoning requirement is something that usually applies to cash deposits or gifts, but not 401k’s, so I’m a bit confused why he wants that.

How many times could you get hardship funds if you already done it before?

Hi Shay – As far as I know there’s no limit to how often you can make hardship withdrawals, but it may be limited by your employer’s policies.

I have 401 k I take hardship in end of June now that I get fired what should I do concerning the rest of my money am so broke I can’t pay my rent I have two kids am a single mother

Hi Fredelyne – I get the impression that the hardship withdrawal emptied your 401k. If you are broke, and you have kids, you should immediately go to the state or county welfare office to apply for assistance. At a minimum, you should be able to get unemployment insurance, but you also should check out to see if they can offer assistance for housing, utilities, health insurance and food. You have two children that need to be provided for. After that, you should start looking for a new job. Sorry I can’t offer more advice.

Will a letter of Intent to Foreclose qualify for a hardship withdrawal or does it have to be the actual beginning of a foreclosure?

Hi Linda – It will depend on what your employer decides. They have the latitude in hardship cases, even to the extent of whether or not they will allow them at all.

. I would like to take a hardship withdrawal from my 401k to purchase and build my primary residence. I currently have my home for sale, but would like to move ASAP. The withdrawal amount would cover the whole amount of the purchase and new build, leaving me without a mortgage. Once my current house I would take the profit and pay back 40k loan and deposit the rest into another type of retirement account like a Roth IRA or something similar. My question is..does this sound like a reasonable or good idea? I know I would have to pay taxes and penalties, but without a morgage I would be able to double my contributions once the 6 months are completed.

I Melissa – I don’t think this would work the way you’re hoping. The 401k hardship withdrawal for the purchase of a home is limited to $10,000 and it’s for first-time homebuyers, which you aren’t. You also mention a 401k loan, which is a possibility. But the limit on those loans is the lesser of $50,000 or 50% of your vested balance in the plan. Will that be enough to build the new house? If not, and you just pull money out of the 401k, you’ll have to pay regular income tax, and a 10% penalty if you’re under age 59.5.

Can I pay federal income tax debt that’s from 2013 with a 401k withdraw how old does the debt have too be to be eligible

Hi Lawrence – Not unless the IRS puts a levy on the plan. But look into taking a 401k loan instead. Under IRS rules, you can borrow up to 50% of the value of the plan, up to $50,000. You can make payments out over as long as five years. That will get you the money you need to pay the tax debt, without creating a new tax liability.

i want to pull closing cost out of my 401k sent all documents to the right party now there giving me a hard time about pulling out 6,200 dollars.I have closing in 3 weeks and the 401k people are messing around

Hi Pete – Unfortunately your employer determines the whole process on a hardship withdrawal, and even has the ability to deny allowing certain hardships purposes even the the IRS allows them. Can you take a 401k loan to get the funds?

Hi, I have quit my job a month ago to go to school; I took out federal loan for school. Should I cash out my 401k instead of taking out a federal loan? Do I just leave my 401k alone or what should I do?

Hi Julie – You really haven’t given enough background information to answer the question fully. You can consider cashing out your 401k to reduce the student loan, but it will depend on a few factors. First of all, what is your tax bracket? If you have no earnings for the year, the tax bite on the withdrawal from the 401k may not be that high. Also, how large is the 401k? Will it push you into the 25% (or higher) tax bracket? You will also have to pay a 10% early withdrawal penalty the early withdrawal, so it may cost you a lot of money to take out the 401k. Alternatively, you can let the money sit in the 401k plan, or consider rolling it over to an IRA account. You may want to sit down with a tax expert who knows your specific situation, and can give more solid answers.

If I am trying to get a hardship withdrawal to avoid eviction from my rental home does the eviction letter have to come from the landlord or the person I pay rent to who then pays the landlord?

Hi Taylor – Hardship withdrawals are determined by your employer, and your employer does not have to allow them. If they do, the documentation required will largely be determined by your employer, so you should check with them. If you’d like to read more about the process, you can check out Retirement Plans FAQs regarding Hardship Distributions from the IRS. But first check with your employer.

I have a 401k for an old employer that currently has to either be cashed out or transferred to a safe harbor IRA. I am currently buying a home and I’m trying to figure out the best way to avoid the 10% tax fee. It looks like a home purchase doesn’t qualify as a hardship with a 401k but does it qualify with an IRA? I have until July to either cash out or make the IRA switch. Any reccomendations?

Hi Angelica – You’re correct that buying a home doesn’t qualify as a penalty exemption for a 401k. The short answer is to delay the home purchase until after the rollover to an IRA. But please check with a CPA, as you are in a gray zone here. There may be a waiting period on the rollover before it qualifies for the IRA withdrawal exemption. That’s a research question best answered by a CPA. And you may need a CPA in the event that the IRS asks questions later, so it will be well worth the effort now.

Where in the tax code does it say that hardship withdrawals are exempt from the 10% penalty? I have checked all over but find nothing saying this. The IRS website does not specifically say this either. The article infers that it would be subject to the penalty then a comment from what looks like the author seems to contradict this!

I would appreciation your clarification.

Thanks

Jim

Hi Jim – Here it is for IRA accounts, and here it is for 401k accounts.

Hi,

I apologize if my comprehension is a bit dim. I clicked the link and no where does it read hardship distributions are exempt from the 10% tax penalty.

Are you sure this is true? If so, can you verify the IRS link?

Hi Jenil – Check this page and look at the last line before the chart.

Repeat comment! Our hardship withdrawal was denied by my employer (state of RI) quoting “Proposals from contractors do not qualify under IRS regulations.” What IRS regulation?? Actually they are estimates which will become the bill. Can you shed some IRS light on the refusal?

Hi Dale – I actually answered Ethel who had the same question. The employer does not have to provide hardship withdrawals, so my suggestion it to work with them to get them whatever they need to make it work. You really don’t have any “rights” here in the usual sense, since it’s all up to the employer’s discretion.

We have applied for a hardship withdrawal to cover storm (3) damage repairs that were not fully covered by insurance, We submitted contractor formal estimates to the employer (state of RI). The response was “Proposals from contractors do not qualify under IRS rules.” We are elderly, have no other source of funds, and we do not understand what the refusal says in terms of IRS rules?? The estimates will become the bills! Please enlighten us.

Thank you.

Hi Ethel – Unfortunately, hardship withdrawals are determined by the employer. They don’t even have to grant them, or they can choose to allow some but not others. They also have discretion in regard to how the hardship is documented, so there may be no alternative to working closely with the state in this case to come up with documentation that will satisfy them. It may be that you won’t have a case until the work is done and actual invoices have been presented. But please find out what the employer wants, and get the requirements in writing before you do anything.

Do you pay taxes on a hardship withdrawal from your 401k?

You do Pam. But you won’t have to pay the 10% early withdrawal penalty tax as long as it’s a qualifying hardship withdrawal.

If your in a hardship situation like I am , most likely the person does not have a good credit score anymore !! How are you supposed to look for cheaper ways to take money out if your going to get charged insane interest rates on any kind of loan you have available to a person in the 550-600 credit score range !!! I would think in most situations this is used for preventing a foreclosure and if your late on a house payment your credit score is going to be hit hard.

Hi Josh – Your question isn’t just tax related. If you’re facing needing to secure financing to avoid foreclosure, you’re going to have to look at the big picture. Will the new funds solve your mortgage problem on a permanent basis? If it won’t, then you probably shouldn’t take money out of your retirement plan. Not only will you face taxes and penalties for the early withdrawal, but you will be “throwing good money after bad” by using retirement money to pay for a temporary fix on the mortgage. Better to save the retirement money – you’ll need it to help rebuild your life after the smoke clears.

I think you (or the person you’re referring to) would be well advised to talk with a bankruptcy attorney to explore legal options. You don’t want to make any serious moves now that you’ll regret later.

Really, now I need permission from the IRS to access my funds! What the h—!! The last time I checked the IRS had not placed any funds into my account, so I don’t see how they can justify telling me if I can access my money.

And what happened to our right to privacy. If I wanted the IRS to be apprised of my problems I would take out a full page ad in every major newspaper, but I don’t. and that information has absolutely no value what-so-ever as far as the IRS is concerned. I am an adult and fully aware of the penalties for early withdrawal and resent the fact that I’m not allowed to touch my money w/o permission once I have aired my problems and proven hardship. It’s unconstitutional and feels like a dictatorship with the illusion of freedom rather than the free country we claim to be.

The IRS has entirely too much power and now to infringe upon my right to privacy and control of my money, that’s going top far.

I agree, but what can we do? I feel the same way about how I am taxed, & where the tax dollars are going (or being spent). I should have a say in how my tax dollars are used. I wish not to contribute to every tax. I understand that some of our tax dollars help repair roads etc, but not when they are used for nonsense research.

why does the IRS get to decide whether or not I make a withdrawal from my 401K while still employed at the same company?

If I want my money as well as my privacy and control of my money I have to quit my job or provide information to the IRS that has absolutely no value to them what so ever.

This is an unconstitutional act and I opted for my privacy and now must find new employment, which now is a deterrent in ever opening another account to save for retirement.

Is this a law or the IRS flexing their muscles?

If it is a law it is very unconstitutional giving the feeling that this country is more dictatorship with the illusion of freedom rather than a democracy with the rights to privacy and the ability to control your money.

Should you take a hardship withdrawal and show proof of tuition expenses, do you also have to prove that the tuition was actually paid off?

We should consider other options. Hardship withdrawal must be our last option, or should not be an option. Thanks for a very great topic and insights, really helped a lot here! I hope it will helped a lot more depressed people too..

I totally agree that a hardship withdrawal should not be done. Our retirement is coming whether we are prepared or not. We should just act as if the 401k does not exist and deal with emergencies from that point of view. Thanks for the insight.