When I was younger I struggled with debt racking up credit cards and student loans like no one’s business.

I couldn’t ask for sympathy because I was the one to blame for my financial plight.

One debt that I’ve been fortunate to avoid is medical debt.

For those who have it realize how much of a financial drain medical debt is.

As it stands now medical debt accounts for over 50% of the type of debt that people have in collections.

Almost 1 in 6 credit reports contain a medical debt collection, according to the Federal Reserve. And about 40% reportedly received a lower credit rating because of their unpaid medical debt.

Medical debt is for real.

I recently had a reader contact me who was dealing with some serious medical debt issues. Since this isn’t my forte I reached out to the only person I know, Gerri Detweiler at Credit.com that is the expert in this stuff.

Gerri’s response (as usual) was so thorough that I knew others would benefit so asked if I could share her response on the blog.

I have been following you for a while. I had signed up for the Debt Movement and am still working on our debt reduction, but we are DROWNING in medical bills.

My husband again just had a 3 week hospital stay. Most of the bills are not a big deal, I either pay them off or make small payments until someone complains. However, we received the bill from the hospital and our share is $1,300.00, payable by tomorrow. I called up and asked what the monthly payments would be and they said that I had to pay over $100.00 a month.

I am currently paying $100.00 a month on a bill from 2 years ago and cannot keep making these kind of payments. I asked what would happen if I didn’t pay that and pay what I could and was told that I could do pay what I wanted for 3 months but than on my 4 month I would be turned over to a collection agency. We have worked really hard for the good credit that we now have and don’t want to ruin it with medical bills. If I pay them off by tomorrow they will discount down to about $1,050.00.

So this is what I am going to do, only because of the discount, but I really hate to hit my savings like this because it is so hard to put it back. I wish medical billing was a little more lenient.

Do you have any insights on medical expenses, especially for people that always seem to be paying medical bills? Thanks.

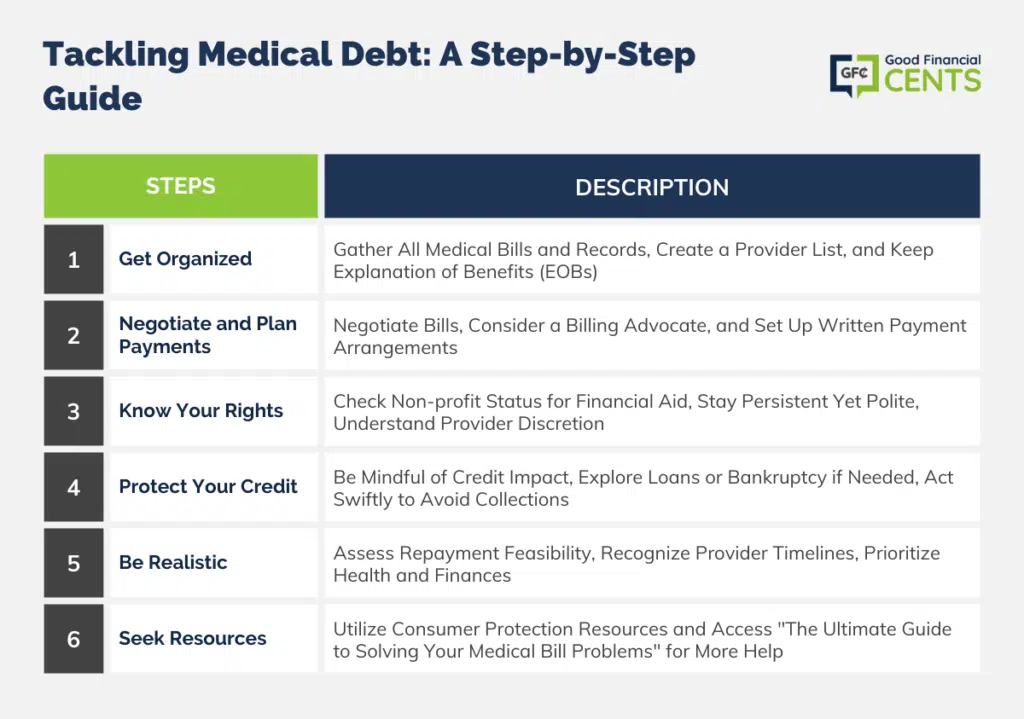

How to Tackle Your Medical Debt

Here’s Gerri’s response:

Your reader – I’ll call her “Beth” – is experiencing a problem millions of Americans encounter at one time or another.

First, she says she is drowning in medical bills but only mentions one – $1300. There are clearly more: how much more?

Later she says, I either pay them off or make small payments until someone complains. Her current strategy is not a good one. I understand it may be a necessity right now if the money isn’t there to pay all of them outright, but she needs an overall plan to take care of all of the bills.

Otherwise, she is going to keep putting out one fire only to see another one pop up somewhere else. That’s very stressful.

Get Organized

So job number one is to get organized. Beth needs to get a three-ring binder, folder, or some system to organize all the paperwork.

She needs to make one master list of all providers who may bill her husband, and try to figure out what’s owed to each.

It sounds like her husband has insurance (otherwise he wouldn’t owe just $1300 to the hospital for a three-week stay) so the folder should include her Explanations of Benefits (EOBs) from her insurance company.

This is helpful for figuring out what insurance is paying and what they aren’t paying, as well as providing information on how to appeal if they think anything has been denied erroneously.

Once she’s organized she should have two goals:

1. Negotiating (more in a minute) and

2. Working out a payment plan in writing for all of them.

As far as the urgent hospital bill goes, is this a non-profit hospital? If so then under the Affordable Care Act they can’t take any extraordinary collection efforts until they give her written information about their financial assistance policy and the chance to apply for it. She should check into that if it is a non-profit hospital.

Get Some Details

Next, she needs a detailed, itemized bill from the hospital. After a three-week hospital stay, there are very likely mistakes in the bill. That just goes with the territory.

If she’s truly overwhelmed she can bring in a medical billing advocate. That will cost her part of the money she saves through their services but may be cheaper than paying the full amount on all of these. (If she or her husband are labor union members they may be eligible for free medical negotiation assistance through Union Plus.)

The people who handle medical billing for large practices or hospitals are dealing with thousands of patients. They are going to push her to pay as much as possible. That’s their job.

She needs to be persistent but polite to try to work something out.

If she understands the total she owes in the context of her budget she’ll be in a better position to try to work out something reasonable.

Beth also needs to understand that medical providers are NOT obligated to accept what she can afford. (The exception is some non-profit hospitals which may have to offer financial assistance in certain situations.)

And even if she’s making payments, the account can be turned over to collections at any time. That’s why I encourage getting something in writing so she and the provider are on the same page. She just has to do the best she can.

Beth says she wants to protect her credit rating. As part of that she needs to be aware that at any time any provider may turn one of these over to collections and her credit score will drop dramatically. She may not get notified before this happens!

Get Real

She also has to be realistic. I’ve heard from consumers who have tens or hundreds of thousands of dollars in medical bills. They are trying to pay what they can afford, but at that rate, they are going, the bill won’t be paid off for 30 years.

Providers aren’t going to wait that long and they aren’t obligated to do so. I don’t know the total she owes, but if she really can’t afford to pay off these bills soon she is at significant risk of being sent to collections.

- Could she get a loan to pay off these bills if she can’t work out payment arrangements?

- Or perhaps she should be talking to a bankruptcy attorney?

Impossible for me to say with this limited information, but it is something to think about. I realize there is such a burden on patients and their caregivers in these situations. They are trying to get or stay healthy plus protect their financial health!

I don’t mean to be doom and gloom here. Hopefully, her husband is on the road to recovery and this will just be a bump in the road for them.

Unfortunately, though, consumer protections when dealing with medical bill problems are few and far between. I’ve written a lot about these issues.

My story that summarizes most of my stories and links to them for more information can be found here: The Ultimate Guide to Solving Your Medical Bill Problems.

Hope this helps!

****

Thanks for your help, Gerri!

####photo credit: BLW Photography via photopin cc

The Bottom Line – I’m Drowning in Medical Debt. Help! (Reader Q&A)

While medical bills may seem insurmountable, careful organization, negotiation, and understanding of your rights can lead to manageable solutions. Protecting your credit rating is essential, but it’s equally important to prioritize your physical and financial well-being. Remember, you’re not alone in this journey, and seeking professional advice or assistance when needed is a sign of strength. By following these strategies and staying persistent, you can navigate the complexities of medical debt and work towards a healthier financial future.

Good information in this article. Having paid $1,200/mo for a Kaiser HMO independent plan for 2 adults, and not having all the additional paperwork and 20%, and in/out of network thing is new to us. My husband has bad eyeballs, and his ocular care, surgeries, and pharma is expensive. Sometimes you don’t sign up for this journey, but you accept it. What pisses me off is the lack of disclosure regarding costs. I ask, so I don’t get surprise medical bill anxiety, but the lies and push-back is disconcerting. Us smart proactive women are considered *itches for actually reading docs, and asking for and wanting disclosure. I’ve been given the 20% without the amt billed. I have an Acct’g background, and I find it appalling. Trying to get facts is amazingly a challenge. HCA is a pita. Surgical Centers (freestanding) have been ridiculous in giving me insight into who will be billing us. I made a list and asked her, center -yes, anesthesiologist-yes, surgeon-yes…I mean, just give me the macro picture, and lets be done with it. She tried to avoid my persistence. Where are the medical disclosure consumer protection laws?

They’re well hidden. The practice of multiple practices sending multiple invoices is “normal”, and there’s usually no upfront disclosure, other than having you sign an agreement that you’re responsible for whatever your insurance company doesn’t pay. The good part is that many will settle for uncovered expenses. It may be worth trying to negotiate a partial payoff. That works best with older bills.

This is an incredibly helpful post. So many people feel powerless to do anything when faced with a big medical bill. It also is really unfortunate that there are very few protections in place for people who are over their heads in medical bills. I have a close friend who needs this information right now, I’m passing it on to them. Thank you for the help.

All great tips Gerri! Medical bills can easily get out of hand, especially where there is no insurance involved. But sometimes it can get pretty high even when you do have insurance.

That’s why it’s absolutely necessary to maintain a healthy emergency fund. It might not cover the whole thing, but it will surely help mitigate the damage. I know this from personal experience as I had 2 heart attacks this year, even though I’ve always been healthier and in better physical shape than most people I know.

I’ve also written a couple of posts about dealing with medical debt that might be helpful as well:

“How to Pay Off a Mountain of Medical Debt- What Not To Do”

http://www.cfinancialfreedom.com/how-to-pay-off-medical-debt-1/

Our medical system is in shambles here, so it’s getting expensive to get a decent service. Anyway, we still don’t have too many people who’d get into debt for medical reasons and the State system, while very flawed, still can take care of the people. It’s really sad to see many US citizens who PAY TAXES and INSURANCE have to deal with all this crap and even get into debt to cover their medical needs. There’s something clearly wrong with this world 🙁