Investing strikes fear into the hearts of many people. Why? Because they think it’s complicated, time-consuming, and too risky for their tastes

At the same time, many of these people believe deep down they should invest in their future. They understand retirement costs money. They know they might not be able to produce income forever.

Two relatively new services are seeking to make investing easy and automatic:

While they may not provide the same level of face-to-face support many investors desire, their strengths wash over their weaknesses in the eyes of a growing number of investors.

Just so you’re aware, I have a Betterment account, but I don’t have a Wealthfront account. Still, I’ll review some of the features of each and you can make a determination as to which company is right for you.

Table of Contents

What’s a Robo-Advisor in the First Place?

Robo-advisors are investment advisors who are primarily online and automate much of the investing process. Here’s how it works . . . .

Instead of sitting down with a financial advisor to discuss your personal investing objectives, you go online. There, the robo-advisor may ask you for some information regarding your objectives and determine your tolerance for risk.

Once the initial setup process is complete, and you have connected your bank account to the service, investing happens automatically.

You can automate how often money is pulled from your bank account and invested, and your investments are determined by the programming of the software using a number of criteria.

Because robo-advisors are online and automate much of the investing process, they are able to keep their fee structure lower than many traditional financial advisors.

In some ways, traditional financial advisors are similar to robo-advisors in that many of them offer ways to track your investments online.

Either way, the job gets done, but it’s important to understand these differences.

Because traditional financial advisors meet with their clients face to face and execute trades manually, they often have the business structure to completely customize their clients’ portfolios and take very specific requests. This option may not be available with robo-advisors.

However, robo-advisors will often allow you to invest small amounts of money, unlike many financial advisors.

Now that you generally understand how robo-advisors work, let’s take a look at Betterment vs. Wealthfront.

Betterment

Betterment is the largest robo-advisor on the market, and it’s easy to understand why. Let’s take a look at four key areas important to investors and see how Betterment stacks up.

Customer Service

One of the most important features of an investing service is customer service. And on that, Betterment delivers. They have email, chat, and phone support so you can talk with real people.

They also have a handy support center that allows you to get answers to many of the most frequently asked questions right away.

Another huge benefit of Betterment is their ability to give you advice for your particular situation. Jon Stein, CEO of Betterment, said it best:

One major thing that sets us apart from the other robo-advisors is our focus on giving customers advice. For example our retirement planning feature, RetireGuide™, takes into account your entire financial picture.

We look at outside assets, spousal situation, Social Security benefits, where you want to retire, etc. Based on your personal information, we advise you on how you should be saving to reach a comfortable retirement.

We’ll tell you what to put in your 401(k), what to put in a taxable account, what to put in an IRA and what type of IRA. This is the type of advice that everyone needs and we’re able to deliver it seamlessly via our platform.

This is amazing. In fact, this addresses one of the reasons why someone might want to stay with a traditional financial advisor: to get personalized advice. Way to go Betterment!

User Interface

The user interface at Betterment is one of the most attractive reasons to use the service. It’s slick. With sliders and buttons and charts that move as you adjust inputs, you’ll get the information you need to make wise decisions in a flash.

Betterment obviously invests heavily in its user interface and carefully thinks through what’s relevant to investors. Really, it’s a joy to use.

If you’re new to investing online with a robo-advisor, and you’re a bit concerned about a potential lack of control, don’t be. You’ll have everything you need at your fingertips.

Investments

Betterment uses stock ETFs and bond ETFs in its portfolios. ETFs or exchange-traded funds, are securities that trade like common stock on a stock exchange. These funds are known for their flexibility and low costs.

Betterment’s strategy is to ensure their stock ETFs give their clients exposure to the total U.S. market with a slight tilt toward value and small-cap stocks. They state that this tilt has tended to beat the market over the long term.

Depending on your risk tolerance or investment goals, Betterment will add what they believe to be the proper asset allocation of stocks and bonds to your portfolio.

As you increase your risk tolerance, you’ll find more stocks being recommended. As you decrease your risk tolerance, you’ll find more bonds being recommended. You can adjust your target allocation and rebalancing happens automatically.

Pricing

Pricing for Betterment’s services, like other robo-advisors, is pretty low.

Betterment recently updated its pricing structure to make it super simple. While they used to have three tiers of pricing, they now charge a low 0.25% annual fee on your account. This fee is charged up until you have $2 million in investments with them. After that, there are no additional charges.

Those are pretty low prices (comparable to major mutual funds like Vanguard). Plus, Betterment doesn’t have a minimum deposit or balance. That’s great for those who want to throw in a few bucks to start.

Let’s take a look at Wealthfront next.

Wealthfront

Wealthfront, with over five billion in assets under management, is certainly no small contender. They have built a very successful business and differ from other robo-advisors in a few ways. Let’s take a look.

Customer Service

Customer service is available by sending them a message and they are really good at responding via Twitter. You can reach them by phone but they are structured to respond online.

Wealthfront prides itself on you not having to contact them. They are the only robo-advisor that offers investments and financial planning completely through their software.

Their model is to make it easy to manage your investments directly from your phone and not need personal contact to get things done.

Their client services are staffed by licensed investment professionals and are very quick to respond.

They are also led by an investment research team supported by seven Ph.D. researchers from top institutions like Harvard, Princeton, and Yale.

User Interface

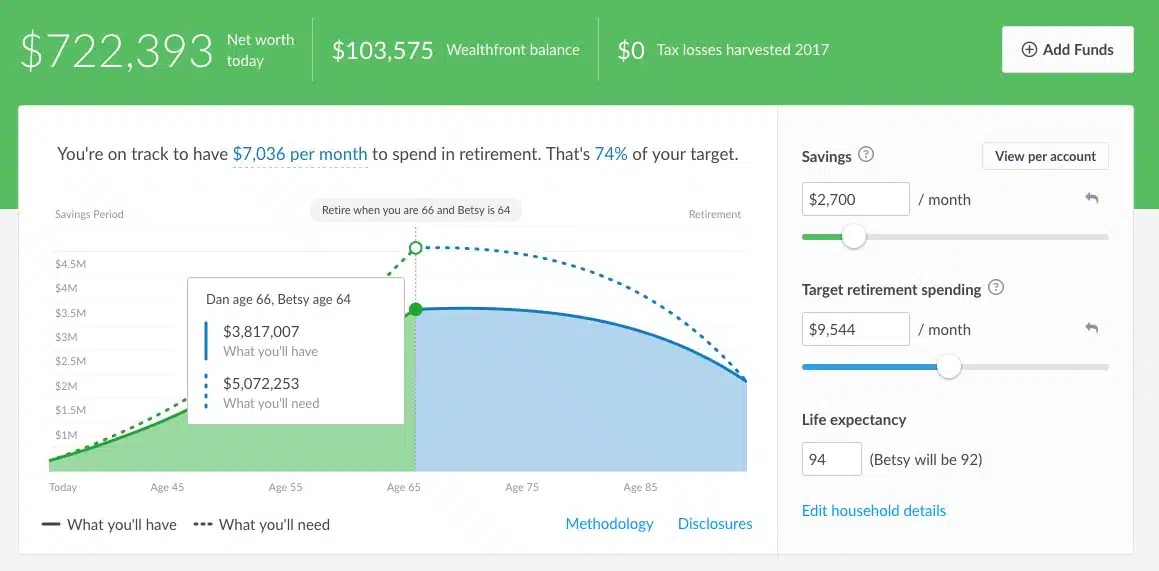

Wealthfront describes their investing experience as simple and elegant. While I haven’t seen their user interface, I have no doubt that it’s as slick as the rest of their website.

One image from their website shows a section called “Portfolio Review” with a chart on it that gives recommendations for the investor. I would certainly describe it as simple and elegant.

I don’t think you’ll have many qualms about Wealthfront’s user interface.

Investments

Wealthfront offers personalized and globally diversified investment portfolios of index funds. Based on Modern Portfolio Theory, they are designed to adjust according to your personal risk tolerance while staying diversified and tax-efficient.

One note about the risk assessment. Instead of asking a couple dozen questions asked by traditional advisors, Wealthfront uses behavioral economics research to identify their clients’ risk tolerance with just a few questions. It seems they’ve done their homework.

It’s what you’d expect from a good robo-advisor.

Rob Berger at DoughRoller.net interviewed Adam Nash, the former Wealthfront CEO.

In the article, Rob writes that Adam points out Wealthfront’s superiority to target-date funds which, according to Adam, fail to take into account investor preferences and risk tolerance. Therein lies the strength of Wealthfront.

Pricing

Wealthfront has made a real push to lead the industry with its pricing model.

First, Wealthfront will manage your first $10,000 free of charge. Yep, that’s right, for free. For those who are just starting out investing, that’s a big deal. However, there is a $500 account minimum.

After the first $10,000, they have a 0.25% annual advisory fee. That’s it. No other tiers. Pretty simple.

This makes Wealthfront the robo-advisor to go after if you are an investor with limited funds to get started.

Betterment vs Wealthfront

Let’s summarize some of the key differences between Betterment and Wealthfront.

When it comes to giving financial advice and customer service, it appears that Betterment has thought through a lot of the features investors need.

RetireGuide™ gives their customers automated advice to help their investors determine how much to save and invest for retirement. And again, you can always talk with a Betterment representative over the phone.

Wealthfront has pushed full force into providing financial planning advice entirely through its online platform. This is achieved through their Path platform.

The path is fully customizable and connects to all of your bank and brokerage accounts to give you a complete picture of your finances without having to set up a phone call or in-person meeting with a financial advisor.

The platform allows you to see the impact of different variables on your life goals to get answers to questions right away.

The user interfaces on both platforms will please most investors. These are high-tech companies and there really shouldn’t be any difficulty there.

The investment strategies between Wealthfront and Betterment are similar, although Betterment does appear to advertise its tilt toward value and small-cap stocks. Here again, you would probably be wise to select either company.

One key area of difference is pricing. If you’re just starting out investing, and you don’t see yourself reaching a $10,000 balance anytime soon, Wealthfront offers the better deal.

However, if you have over $2 million you’d like to invest with one of the two robo-advisors (or think you’ll reach that balance shortly), Betterment would be the best choice for you. This, of course, is overlooking their various approaches to investing.

REMEMBER:

Take a look at Wealthfront and decide which one is best for you.

Betterment vs Wealthfront

| ASPECT | BETTERMENT | WEALTHFRONT |

|---|---|---|

| Customer Service | Offers Personalized Advice and Multiple Support Options | Emphasizes Minimal Contact and Online Responsiveness |

| User Interface | Slick and User-Friendly Interface | Simple and Elegant Interface Design |

| Investments | Uses Stock and Bond ETFs, Focuses on U.S. Market | Offers Diversified Index Fund Portfolios, Unique Risk Assessment |

Pricing | 0.25% Annual Fee, No Minimum Deposit, Competitive | Manages First $10,000 Free, 0.25% Fee, $500 Minimum |

Final Thoughts on Betterment vs Wealthfront

In the world of investing, Betterment and Wealthfront are two prominent robo-advisors simplifying the process. Robo-advisors use online platforms to automate investments based on your risk tolerance. They’re cost-effective compared to traditional advisors.

Betterment, the larger of the two, shines with excellent customer service, offering personalized advice through features like RetireGuide™.

Their user interface is user-friendly, making investing hassle-free. They primarily use stock and bond ETFs in their portfolios, tailored to your risk level.

Pricing is straightforward, with a low annual fee. Wealthfront is competitive, managing the first $10,000 for free. Both platforms offer solid options; Betterment’s customer service gives it an edge.

Both Wealthfront and Betterment are great, but I by far prefer SigFig as of early 2017 for free portfolio analysis – SigFig’s free offering is pretty much the best one in my opinion.

Great article – thanks for the information

This article is extremely helpful. Thank you Jeff!

Just FYI Betterment recently announced new pricing, I only know because I am a customer.

@Josh Yup! We’ll be updating this post soon with the new details. Thanks!