Figuring out how to get out of debt is one of the most freeing things any person can do with their finances. The problem is that so many people do not see how to make their dream of a debt-free life a reality.

According to a study by Experian last February 2023, the average American has $90,460 in total debt. Mortgages account for the highest debt type with an average balance of $203,296, while student loan and auto loan debt account for $35,620 and $19,231, respectively.

Some of this debt was planned for and is still considered “good debt,” but it still takes a toll on our finances – and our lives.

But, how did it get this way?

Sadly, we are programmed to take on and accept debt from the moment we are born. Starting from childhood, we are tempted by a barrage of television ads for cars, boats, and luxury items we can easily finance through any number of financial products and loans.

“Twelve months – same as cash” is a phrase we all heard repeatedly growing up.

Can’t afford something? Hey, that’s okay. Just keep up with your loan and you’ll be fine.

Visit a car dealership and the first question you’re asked is how much you can afford to pay each month – not what you can afford to pay overall. And the same is true of nearly anything you can buy – from clothing to furniture.

Can’t afford it today?

Just open a store credit card and you can pay it off later, they’ll say. Want to go to college? Just sign on the dotted line and you can borrow the money you need. You might have to pay it back for ten, twenty, or even thirty years, but it will all be worth it, right?

Table of Contents

How to Get Out of Debt

If you’re struggling to make ends meet or hoping for a life with less stress and worry, you need to learn how to see debt in a brand new way.

Instead of seeing debt and credit cards as the easiest way to afford what you want, you should start seeing debt for what it really is – a curse that stands between you and your lifelong goals.

There are numerous ways to get out of debt, and not everyone needs to choose the same path. For some people, a slow and steady pace will work just fine. But for others, the desire to get out of debt is so great that they will do anything to speed the process along.

The very first step anyone should take is to sit down with all of their bills and bank statements in order to figure out how much they owe and to whom. Sometimes taking a comprehensive look at all of your debts is the easiest way to figure out where you should start.

Regardless, no matter what, the first step out is debt is coming to grips with exactly how much money you owe.

You may not like what you see, but you’ll have to deal with it either way.

Credit card debt can be crippling. Obtaining a personal loan with a lower interest rate to pay off credit card debt could be a great option.

Once you have confronted your debts, there are several strategies you can use to dig yourself out:

Try the Debt-Snowball Method

The debt snowball method for debt repayment is often touted as the best and most efficient way to become debt-free. If you choose this option, you’ll start the process by listing all of your debts in order from the smallest balance to the largest.

Once your debt reduction spreadsheet is ready, you’ll create a budget that accounts for making minimum payments on all of your debts except for the smallest one. When it comes to your smallest loan balance, you’ll pay everything you can towards it until it’s gone.

As each small balance is paid off, you’ll move down the list, throwing all of your extra funds at the smallest balance and making minimum payments on the rest. Over time, your small balances will be wiped off the face of the Earth, leaving only your largest balances behind.

Without forced payments on your small balances, however, you’ll be able to snowball your payments towards your remaining, larger loans and get rid of them at a much faster pace.

Derek from LifeandMyFinances.com has a very helpful debt snowball calculator you should check out if you’re interested in this method.

Take on the Debt Avalanche

The debt avalanche works similarly to the debt snowball but takes a slightly different approach. Instead of prioritizing your smallest balances first, you’ll list your loans and balances by their respective interest rates instead.

Each month, you’ll pay as much as you can towards your highest-interest debt while making minimum payments on everything else. Over time, your high-interest debts will be paid off, leaving only low-interest debts. Month by month, you’ll continue attacking all of your balances until they are gone – and gone for good.

While you may pay on some loans longer with this method, using the debt repayment plan of paying off high-interest debts first (instead of your smallest balances) will save you more money in the long run.

Pay Off Debt Faster With a 0% APR Credit Card

It can be difficult to accept the fact that a credit card might be the solution to credit card debt but hear me out. In reality, certain types of credit cards, 0% APR and balance transfer credit cards, offer introductory offers that can help you save money and get out of debt.

Related: Best 0% APR and Balance Transfer Credit Cards

With balance transfer credit cards, you’ll get 0% APR for anywhere from 12 – 21 months. If you transfer several or all of your high-interest balances over – then use your introductory period to absolutely destroy your debts – you’ll save money on interest and become debt-free at a much faster pace. When you’re not forced to pay interest on your balances, every penny you pay goes directly towards the principal of your loan.

If you’re thinking a balance transfer might actually work for your financial situation, here are some details on one of the best balance transfer cards on the market today:

Discover it® – The Discover it® is another top balance transfer card that has taken the market by storm. With this card option, you’ll get 0% APR on transferred balances for a full 18 months. In addition, you’ll also earn 1 point for every dollar you spend on the card, along with 5 points per dollar spent on the first $1,500 you spend in categories that rotate every quarter. You can redeem your points for cash back or gift cards, and this card also comes without an annual fee. Read here to learn more about the Discover it®.

Consolidate or Refinance Your Debts

By refinancing certain loans, you may be able to get a better deal and save money in the process. With private student loans, for example, it can make sense to refinance with a different lender to get a loan with a lower interest rate and better terms.

If your current private student loans are charging higher interest rates than you believe you could get elsewhere, make sure to connect with SoFi or LendEDU. Here’s a review of SoFi if you want to learn more about how they can help.

You can also consolidate your high-interest-rate credit cards with a personal loan. Consolidating your debts can help you get on a structured payment plan to help you get out of debt faster. Debt consolidation loans are amortized over time (similar to a mortgage) and you’ll end up paying less interest versus paying minimum payments on your credit cards.

Both online student loan providers can help you determine whether you could, in fact, get a better deal with a debt consolidation loan and get that student loan debt out of your life much faster.

Related: Does it Make Sense to Refinance My Student Loans?

the mortgage on your home began before 2008, you may also be able to save money by refinancing your home at today’s low rates. While starting your loan over may extend your repayment timeline, having a lower monthly payment can free up cash to pay down other debts.

If you are able to refinance at a much lower interest rate, on the other hand, you might be able to get a fifteen-year mortgage for around the same monthly payment as your current, thirty-year loan. If that’s the case, you should at least consider that option to get out of debt faster.

By and large, the best option for your finances depends on how much debt you have, what kind of debt you feel comfortable carrying, and your individual goals.

Debt Settlement

If you are way behind on many debts and are unable to pay them off, you may be able to settle your debts for a much smaller amount. To do this, you will need to have a lump sum payment that you can offer the lender. This works particularly well with old credit cards and consumer debt.

You can also go through a debt settlement company, but you will pay more by using them.

With any type of debt settlement program make sure you get the agreement in writing and keep all receipts so that no one can come back later and accuse you of not paying off the debt.

Drastically Cut Your Expenses

If you can’t seem to get ahead, you’re probably spending more money than you should most months. If that’s the case, it can pay off to drastically hack your monthly expenses to free up cash.

If you’re not sure where to start, get out your bank statements from prior months to figure out where your money has been going thus far. Are you spending a lot of money dining out at restaurants? Are your trips to the mall hurting your bottom line? Are your car payments killing your budget?

The easiest way to hack your spending plan is to start with the low-hanging fruit.

While you’re trying to pay down debt, stop dining out and start cooking at home. Quit destructive habits like smoking if you can – or at least cut down.

Take a close look at your grocery budget, too. If you’re spending a lot of money on food each month, focusing on cheap and easy meals for a while can help you cut back. Also, look at your “discretionary bills,” and consider cutting them out of your life. If you’re paying a lot for cable television, smartphones, entertainment, or subscriptions, it can pay off to cancel those services while you focus on paying off debt.

Just remember, any amounts you cut from your budget need to be thrown at your debts in whatever order you see fit. If you end up spending that money elsewhere in your budget, you aren’t really helping yourself.

Get a Part-Time Job or Pick up a Side Hustle

Once you have figured out the best way to pay off your debts and cut your spending, the other way to speed up your journey is to pick up a side hustle or take on a part-time job. By earning income through additional labor – or through passive means – you can earn more cash you can use to pay down debt faster.

Related: 65 Home-Based Businesses That Are Easy to Start

There are myriad ways to earn extra money if you look hard enough. Depending on your situation, you might be able to pick up more hours or even overtime at work. Or perhaps you can start a side job or hustle you can run from home. You can also look into becoming an Uber driver, which is a great side hustle because you can create your own schedule according to your flexibility and schedule.

Mow yards. Trim hedges. Start a small painting business from home. Pick up freelance writing and editing jobs. Babysit your neighbor’s kids or pets. Pick up overtime at your full-time job. Wash cars, run errands, or house sit.

If you’re creative enough, you’ll find there are plenty of ways to earn extra cash. And once you start earning, you’ll be able to accelerate your debt payoff.

Online Tools to Help You Get Out of Debt

These tools are all built to help you get started quickly. Their websites and smartphone apps are intuitive. All of them are free of charge so you don’t have to worry about adding to your debt in order to get out of debt. All four are proven to help their users.

Plainly put, all of these are great options. In fact, the companies below all together would make an excellent debt payoff toolkit. Check them out and get going.

You can also combine these with some of the best financial software around to manage all of your finances. Check out our list of the 11 Best Personal Finance Software.

Credit Sesame

If you have debt but have maintained a good credit score you may be able to expedite your payoff plan by getting better credit offers to move your debt to.

First, a word of warning. You will never pay off your debt if you don’t get serious about sending in extra principal payments each month. You can work more, cut back, or do both to get that extra money to pay down the debt faster. Moving your debt from one company to another can help, but you can’t play hot potato with your creditors and hope to get out of debt fast.

That having been said one of the best ways to cut your interest is to lower your interest rate. And that’s exactly what Credit Sesame does for you.

The company automatically pulls all of your credit, debt, and payment information from your credit history for no charge. They then use this data to compare to other offers with their credit partners in order to save you money.

For example, you might get a refinance offer for your mortgage and a balance transfer offer for one of your balances. Not only will these offers save you money, but you will also be able to plainly see through Credit Sesame exactly how much money you will save.

One last thing: you get access to a free credit report each month. This report isn’t your FICO score, but still holds some value as you track the ups and downs of your score.

Credit Karma

Credit Karma is very similar to Credit Sesame with just a few slight differences. Just like Credit Sesame, the company pulls your debt and payment information to offer you better credit offers.

Here are the differences:

- Credit Karma will update your credit score daily versus monthly for Credit Sesame. (You have to manually log in and click update to get the daily score, but you can get it daily.)

- Credit Karma uses a different credit bureau score than Credit Sesame. However, they are similar in that they are both non-FICO scores.

- The company offers a Credit Report Card to help you understand why you are receiving a certain score. Is it too many recent credit inquiries or an error on your credit report? The Credit Report Card helps you with that.

It doesn’t hurt to track two of your free credit scores online, so we recommend signing up for both Credit Sesame and Credit Karma.

If I Receive a Large Sum of Money Should I Put it All Toward Debt?

This is a great question for people who are just starting to pay off their debt and come into an inheritance or other windfall. What is important is that we set ourselves up for success not just paying off debt.

Make Sure You Have a Savings Cushion

The question involving windfalls, and particularly inheritances, is almost always between paying off debt or investing. I would suggest that there is a third option that can’t be overlooked in a lot of cases.

Before you either pay off debt or invest in the future, the first thing you need to do is to create a cash cushion for the present.

One of the biggest reasons for financial stress – and even for the inability to achieve long-term financial independence – is a lack of liquidity. The absence of any kind of liquid savings forces you to rely on debt any time there is a cash shortage.

It doesn’t take much imagination to realize that an absence of savings is a surefire recipe for a lifetime on the debt treadmill. Unfortunately, it starts early with most people. Because they never have a basic savings account, credit dependency becomes a lifestyle. Debt can suck the life out of your finances because it represents a perpetual drain on your income.

In addition, having enough savings to cover your living expenses for a few months will do more to reduce financial stress in your life than just about any other single strategy. It eliminates worry over an unexpected expense or even a temporary loss of a job.

For all of those reasons, my recommendation would be to first make sure that you have enough money in a savings account or money market fund to cover your living expenses for at least three months. That will give you the breathing room that need to do everything else.

The Case for Paying Off Debt

Using an inheritance to pay off debt is usually a can’t-miss strategy. That’s because the rate of interest that you pay on debt is just about always higher than what you can in an interest-bearing account. For example, if you’re paying 20% on your credit card debt, but you can earn no more than 1% in a savings account, you’ll be losing 19% per year if you put the money into savings, rather than toward paying off your credit cards.

Still, another factor is income tax. Interest earned is taxable, while interest paid on consumer debt is not tax deductible. That means that even if the spread between interest on debt and interest on savings were closer, the tax imbalance would continue to work against you.

Some financial advisors recommend that you eliminate consumer debt, particularly credit cards and other unsecured lines of credit before you even begin investing. While I don’t necessarily believe that advice applies in all cases, it’s still a sound strategy.

After all, the elimination of debt with a 20% interest rate effectively translates into an investment that pays 20% guaranteed!

There’s also an imbalance in regard to the rate of return. For example, the interest rate that you pay on debt is usually locked in. But the return that you earn on your investments is not, at least in the case of equity investments, like stocks and mutual funds. In fact, those asset values can drop in a market decline, while your debt level will only fall to the extent that you make payments to reduce it.

Then there’s the point that by paying off debt, you free up your income for other purposes, including savings and investments. It’s often true that people who have a lot of debt are never able to save and invest. By paying off debt, you will be in a position to do just that, and that can change your financial life for the better forever.

You really can’t go wrong with paying off debt.

The Case for Investing the Money

A strong case can be made for investing an inheritance. This is especially true if you currently have no investments, and don’t have any history of having them.

Sometimes the money from a windfall can jump-start you into investing. You get a basic nest egg to invest, and then you start adding periodic contributions to the account. The investment then grows steadily, through a combination of continuing contributions and investment returns.

Long-term, this is a sound strategy. Your wealth will grow along with the size of your investment portfolio. As you become wealthier, it’s entirely possible that your debt problems will eventually become smaller. That is, the amount of your investments can outstrip the size of your debt. When it does, you’ll be in a position to both pay off your debt and still have investment assets for continued investing.

This can be especially true if the investing is being done through some sort of tax-sheltered savings, like an IRA, Roth IRA, or even a 401(k) plan. The fact that you have an inheritance can even free up more of your paycheck to contribute to an employer-sponsored plan.

In a tax-sheltered plan, your investment value grows even faster, because there is no tax liability to reduce your rate of return. This is a way to build your investment worth quickly. And it goes without saying that it creates the kind of long-term financial stability that can improve your entire situation.

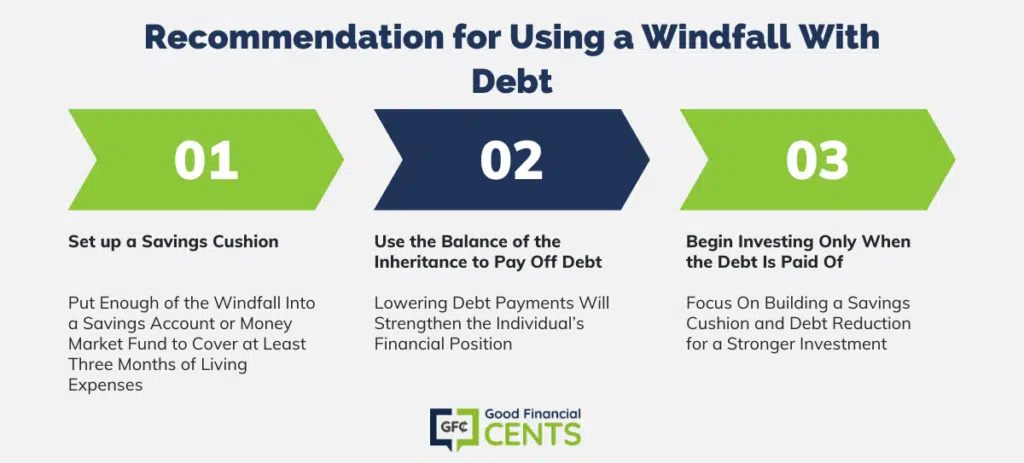

My Recommendation for Using a Windfall With Debt

Every circumstance is a little different, but in most cases, I would suggest a person choose the following – in order:

- Set up a savings cushion. The first recommendation is that you put enough of the windfall into a savings account or money market fund to cover at least three months of living expenses. The savings cushion will give you the room you need to maneuver to seriously attack paying off her debt.

- Use the balance of the inheritance to pay off debt. Obviously setting up the savings cushion will leave her with even less money to pay off her debt. But it would also leave her in a stronger financial position. By using the remaining balance to pay down her debt, you will also lower her debt payments. Any savings from those reduced payments should be applied to paying off the credit cards sooner. You should also look to find other ways to either reduce your spending or increase your income to pay off the debt completely.

- Begin investing only when the debt is paid off. Investing in the future has a lot of advantages, but in Katie’s particular situation, I think that her priority has to be centered on improving her current circumstances. If you invest money immediately, you risk losing some of the money – without improving her situation. But if you create a savings cushion and pay off your debt first, you will be in a better position to throw everything you have at investing later on.

Interview with Jason Larkin – A Debt Survivor

Jason Larkins found himself being suffocated under $110,000 of debt at the early age of 23. He could have given up, filed bankruptcy, crawled under a rock and pretend it didn’t happen. He didn’t though. He made a commitment to pay if off and has currently paid off $60,000 of it. Here’s his story….

First of all for those that don’t know you, tell us a little bit about your background and why you started your blog.

Well, my name is Jason Larkins and I’m a financial advisor with a Registered Investment Advisor firm located in Kansas City, MO. The decision to become a coach/advisor really spurred from my personal struggle, and eventual successes, with money.

After a lot of pressure from one of my close friends, I started my blog, WorkSaveLive, in November 2011. After much thought and contemplation, I couldn’t ignore the reality that having a blog would extend my reach and ability to impact thousands of peoples’ lives – why only help 500 people a year when you can get thousands that visit your site on a monthly basis?

What first caught my attention was your tweet of how you were able to pay off such a large amount of debt in a relatively short amount of time.

Can you talk about some of the reasons that led to you getting into so much debt?

During my “younger” days (yes, I’m still only 27) I viewed myself as just a normal person. Much of how I learned to manage money was through witnessing what my parents did as I was growing up, and seeing what my friends and others around me were doing at the time.

This lack of true financial education: knowing how to budget, understanding the importance of living on less than you make, and saving for the future, led to making some extremely stupid financial decisions such as:

- Going to an out-of-state school to play football (despite any scholarships).

- Spending far more than I made (taking friends out, partying, and eating out for every meal).

- Having no understanding of priorities (choosing to go out rather than paying my rent on time)

What was your “aha moment” that made you realize that your debt had gotten out of control?

I’ll preface this with: I know that many people reading this will be shocked about how dumb someone can be, but I’m comfortable with what I’ve learned and where I’ve come so being brutally honest doesn’t bother me. I’ll also willfully acknowledge that I was extremely stupid and stubborn at the time.

Despite receiving multiple collection calls a day, having a bank account that was negative for 30 days straight (thank goodness I had another one), and being so afraid and stressed out that I didn’t know what to do, my ‘AHA!’ moment didn’t come until:

A night that I took my girlfriend at the time (wife now) to eat at the Cheesecake Factory. I had done a pretty good job of hiding all of my struggles from her, but in the middle of dinner I received a call from my roommate notifying me that our rent check had bounced.

I was responsible for paying all of the bills: the roommate would give me her portion of the money (terrible idea at the time) and I would “pay” the bills. Who wouldn’t trust a roommate that was making $50,000+/year at 21 and lived a life that appeared to be to be that of someone with no financial problems?

So, realizing that I now had a negative balance in my OTHER checking account, I just looked at my girlfriend and told her the mess I was in. I didn’t really want to borrow the money from her so I offered to ask the Cheesecake Factory if I could do the dishes for the night, but she ended up paying for dinner and loaning me $1,000 on top of that.

Since that day everything has changed.

Once you had the aha moment what steps did you implement to begin the get out of debt process?

The first step was simply learning to get on a written budget and limit my spending. At that age I thought I was invincible because I made quite a bit of money, but the reality is that I still had bills to pay and I couldn’t keep living the lifestyle I wanted.

Dave Ramsey loves to say that finances is 80% behavior and 20% knowledge and I’m a perfect example of that. Budgeting isn’t hard. Managing money well is REALLY SIMPLE!

The problem is the person you look at in the mirror. It’s the unwillingness to make sacrifices, to be disciplined, and to tell people “NO!” That’s the difficult part and that’s why so many of us fail.

In my upcoming book I talk about having a battle buddy. Someone that supports you in all your endeavors. How important was it having a battle buddy in getting out of debt?

I don’t know if I would have ever been able to do this on my own. I dated my wife for 4 years and we’ve now been married for 2 1/2. She’s seen me at my worst and she’s been with me through the best.

Despite our progress, we’re certainly not at the end of our journey and even to this day it’s vitally important to have somebody that’s willing to tackle the mountain with me; to encourage you when you fall and to be your cheerleader when you succeed.

What were some of the hardest obstacles that you faced in trying to pay off all your debt?

There have been, and will continue to be, many obstacles. Shortly after that Cheesecake Factory dinner I decided to make a career move and take a job making 50% less than what I had been.

Talk about a tough time: I obviously didn’t know how to limit my spending when I was making around $60k so thinking I could live off of $30,000 was rather scary. However, after I had got on a strict budget I realized I could make the sacrifices necessary to drop down to $30,000/year.

It was extremely challenging and the budget was very tight (considering all of my debt payments) but it worked out! Our obstacle today is continuing the grind that getting out of debt is. When you start $110,000 in the hole (with the majority of the debt being student loans), the only way to get out is to sacrifice for a LONG period of time. It’s been 5-6 years now and we still have a few more to go.

Did you allow yourself to celebrate any milestones in the debt paying off process?

The first year and a half that I was on “the plan,” there was no play or celebrations: no eating out, no vacations, no movies, concerts, or other entertainment. It was all business.

It took me a little while but I eventually realized you can’t live like that forever, so we have scaled back our intensity and live life while still being responsible.

Over the past 6 years we’ve: paid cash for two cars (an old beater and two weeks ago we bought a 2011 Camry), we paid cash for our wedding, wedding rings, honeymoon, and we’ve gone on two vacations in addition to that as well.

What advice would you give to others that are in a similar situation but feel hopeless that they’ll never be able to actually pay all their debt off? Especially when you have a 2nd mortgage you’re trying to pay off.

The remedy for hopelessness is progress and seeing that there is a light at the end of the tunnel. I’ve done some of the dumbest things a person can do, and I knew nothing about managing money, creating a budget, or living on less than you make.

If I can do it, then anybody can. (That isn’t intended to sound arrogant or any other way somebody wants to misconstrue that). It starts with getting on a budget and creating a plan.

I firmly believe that a budget is the foundation to establishing a solid financial plan.

Don’t Let Debt Stand in the Way of Your Dreams

These days, living with debt is the norm – not the exception. Nearly everyone you and I know is struggling with some form of debt. Worse, most people are letting it hold them back from their dreams.

The best thing you can do for yourself – and your finances – is to pay down debt and avoid it like the plague. Try not to keep up with others, and instead, build an enjoyable and realistic lifestyle you can actually afford.

Debt may be normal these days, but you don’t have to be. Dare to be different, and you’ll be much happier – and much richer – in the long run.

Have you ever paid down debt? How much, and how did you do it?

Hi Jeff,

I have about $80K in debt (student loans and credit cards). I am starting my first full time job this month and they offer a 403(b) retirement plan. I am interested in investing in this retirement plan, but I haven’t decided because I have this debt to pay off. Any advice? Thank you, Paige.

Hi Paige – I’m a big advocate of “getting started” when it comes to retirement plans. The sooner the better. Getting started, even with a small amount, means you have something to build on later when you’re in a better position. If your employer offers a matching contributions (they usually on 403b plans), I’d make the minimum contribution needed to get the highest match. It’s virtually free money, and you need to pursue it.

Failing that, start with say a 3% contribution. Since it’s tax deductible you’ll hardly know it’s missing. Then try to build up an emergency fund while you’re paying off the credit cards. As far as the student loans, concentrate first on the emergency fund and the credit cards. Once one is filled and the other is paid off, increase your 403b contributions, as well as the monthly payment on your school loans. It’ll take patience, but it will all pay off in the long-run.

Good advice, being in over $20k at one point plus $40k in student debt made me question a lot of decisions I made. One of them being the value of going to school for 4 years only to get a job where you make only 35k a year.

Looking back I probably would have gotten into a trade straight away instead of doing 4 years of college and then getting into a trade.

There is a lot in deciding what to do first. For me, a balanced approach of saving cash, investing, and paying down debt has worked for me. Depending on different conditions, I will weigh one more than another as different opportunities arise. Thank you for the informative article.

I love the debt-snowball method. It is technically better financially to pay off the highest interest debts first, but for people who have ten different debts, just seeing the number of debts go down can be more emotionally rewarding and cause a feedback loop to keep the process going. Also usually the smallest debts tend to be higher interest anyway since big debts like mortgages and student loans tend to be lower interest than smaller debts like credit card debts on s single card.

Ania – The debt snowball also enables you to build momentum. By paying off the smallest, you free up some cash flow for bigger debts. It helps to set the stage and keep you rolling.

Amazing post this is, and I was in same situation when I was in college days the time when I received my scholarship offer, I was confused whether to invest my scholarship money or to pay off my education loan dept. But I choose to invest the money instead of paying off my debt and it really helped me clear my debt and make money out of investment.

For everyone who are in dilemma between whether to invest the money or pay off their debt, I suggest invest the money in a strong valued shares and make sure you are well aware of what you are doing and it will definitely help you.

We really expect more posts like this from you regarding the money investment

Hi Rajkumar – I see that investing worked for you, but I’d stop short of making it a general recommendation. It really depends on your personal situation, and whether or not you can afford to take a loss on your investments (it can happen) and still pay your debts. I will try to do more posts like this in the future! Thanks!

Hi my name is Jules

I really think this is a great article. Just one quick question when you talk about resolving your debt, are you including a mortgage or just unsecured debt, (i.e. Credit cards, car loans)

Hi Jules – It could include mortgage debt, but that’s not what I addressed in the article. With a mortgage, you really have to look at the big picture. That includes interest rate especially. For example, if you are paying 3.5% on your mortgage, but you can earn 7% on your investments you probably don’t want to payoff your mortgages. You also have to consider whether or not your mortgage payment is a serious problem or if you are managing it easily. If you’re not having any problem with the payment, you might want to keep it open. After all, it’s a tax write-off, and it will eventually amortize down to zero even if all you do is make the monthly payments.

Thank you for posting this. It reminded me of what track I need to stay on… I had gotten distracted & this article literally re-focused me. Thanks a bunch!

One additional thought specific to Katie’s situation — 8 years is a long time to carry credit card debt, and implies a cycle of continually using credit and running a balance. Without addressing the underlying cause for that behavior, she could very well throw the inheritance at the debt and continue to revolve the remaining 15% and/or run up additional balances. My thought is that, in this case, her best course of action would be to first resolve the issues driving her to maintain a credit card balance and build the habit of paying off the loans with her monthly income before then using the remaining inheritance to pay off the debt. This pertains to step 2 of your recommendation, and I agree that the first priority should be to set some money aside in case of emergency.

Great advice. I think that if she didn’t have debt, splitting between saving and investing would be the good choice, but I see no reason not to advise paying down a portion of debt.

Unrelated observation, but the full screen popover that appears is a bit intrusive. I’m not sure if there are any settings that could prohibit it from coming up while a person is typing. Just a thought.

In any case, good post.

Nice post! Thank you for sharing. I’d like to hear more from you.

Picking up a part time job is definitely a good idea as well as cutting back on expenses will definitely help you pay off debt, as well as save some money in general. Thanks for sharing the tips!

I love that you included a section about side hustles/part time jobs in this — I feel like that’s an aspect a lot of people trying to get out of debt forget about. To me that’s almost like dieting without exercising. While I do worry that some people might spend too much just trying to get a side hustle together and create an even larger problem for themselves, I think all of your examples are spot-on.

I’m at the end of a debt snowball. I was just tired of paying a mini loan that was not helping me. I really don’t know why I did not do it sooner. But!!!! This is the final month and then on to the big one.

The snowball method gets a lot of attention, so I love that it that you mention the avalanche method – that’s my preferred method because as you say, it saves you money over the long term!

I think that if you can cut expenses and increase your income, you can get out of debt yourself. The challenge is actually doing it! That’s why having a mentor, coach, financial planner, etc. are so critical to success. Great tips!!

Yes, Natalie! The challenge is actually doing it. Good intentions won’t get you anywhere if you don’t put in the work.

I’ve seen notices that Manilla is shutting down in July, 2014 — see http://techcrunch.com/2014/05/09/manilla-shuts-down/

what is your recommendation to use instead?

The best replacement that I’ve found thus far is Finovera.com.

Oh my word! Good for you! I’ll be 23 next month and I’m crying over my $2,000 debt, lol. All the best, and good luck paying that off! 😛

Good advice Jeff. I get a knot in my stomach when I see someone contemplating paying off debt (unsecured even more so) with their 401K.

Yes, the 10% IRS penalty and the loss of compounding over time is enough reason in and of itself to not go the 401K route.

The reader can focus on the credit card with the highest finance charge rate as priority to pay down the cards.

Great question, and great response! You’ve struck a balance between style and content. Love it.

Oh man, the phrase “$100,000 in consumer debt” just feels me with anxiety!

I have to pay off about 200k in some odd years. This was very helpful! Thanks for the post!

Great insight! Any tips for managing cash flow, i.e. methods of recording/calculating?

I’ve heard that checking your credit score online will lower it a few points every time you look it up. Since Credit Karma and Credit Sesame use non-FICO credit scores is that something to worry about?

I use Credit Karma religiously and it helped tremendously in the lead up to my Condo purchase. Not only did it help me optimize my credit but when it came time for the bank to run a credit check on me, it turned out that it was actually better than Credit Karma projected; pretty much the opposite if what you would expect!

Thanks for turning me on to Manilla, it’s a rare occasion that I forget a bill but when I do it absolutely sucks and I can definitely do without the stress!

Great post. I had never heard of ReadyForZero. Sounds like something that would really help you see the end in sight when paying off debt!

Interesting list, I use mint for my personal budgeting needs and Quicken for my business but I don’t use anything to track paying down my debt. Right now I just have my mortgage do you think one of these would be helpful in encouraging me paying down a mortgage or are these tools better built to help people with multiple debts?

very happy for you Jason. You are showing the way. All the best for rest of it. How the cheesecake factory episode woke you up is not clear to me. Ego thing?

I like how you say you can manage to live off $30,000 a year. That is inspiring to many folks, including myself. Keep up with the debt battle and good luck!

This is such an inspirational story. Congratulations on working your way out of that massive debt! The first 18 months must have been the toughest: all work and no play. But it’s all worth it now! A great example of how we should all keep our “eyes on the prize”.

I am a big fan of Jason. His story is truly inspiring. He has learnt his lesson and learnt it well. Its great to see is such a short period he has risen from financially careless person to a financial adviser.

Kicking debt in the arse is always fun. 🙂 congrats.

Thanks Jai! It certainly is fun every time you knock one of those debts out of your life!

I absolutely love this article. The fact that you have been able to do what you have done after you took a cut in pay is absolutely incredible. Hiding from any problem will never get it solved. You have proven that facing up to your problems is the only way to get them solved. Kudos.

Hiding is certainly what I tried to do. Having been there myself and also having coached people through tough times, I’ve learned that the fear associated with debt, the situation itself, and the unknown is tough to overcome.

It boils down to the fact that many are just clueless about how to get started. They’re unsure of what to do and they’ve fallen into the trap of believing there is no way out.

Thanks StR!

That was an amazing interview. It’s really good that you can be making such huge strides to financial freedom.

Thanks Sean! I appreciate it.

Wow! Congrats on your progress and best of luck with your continued success!!! I tried picturing myself at the Cheesecake Factory with my future husband in this situation and I truly hope that I would be as sympathetic as your now wife was. You found your “one”, congrats on that too!!!

Yeah…we hadn’t been dating for that long of a period when she loaned me the money so I was pretty fortunate that she gave it to me.

I’m certainly lucky to have her though and I’m glad she put up with all of the non-sense in my “younger” days. My struggles did help us get on the same page with money though because she is/was a saver. If I wouldn’t have gotten my act together she probably wouldn’t have stuck around. 🙂

Great interview, Jeff and exciting story Jason! Thanks for sharing. I can’t imagine having to ask to do dishes to pay for dinner. 🙂

Yeah, it was a pretty awful night. I wasn’t going to answer the call but the roommate called like 5 times! Good thing she did though because the debit card would have been declined and then it would have made for a more awkward situation.

I really enjoyed this interview! Jason is such an inspiration to all of us. I totally get where he was coming from when he said this –

The problem is the person you look at in the mirror. It’s the unwillingness to make sacrifices, to be disciplined, and to tell people “NO!” That’s the difficult part and that’s why so many of us fail.

This is SO true. I remember feeling this way after swimming in consumer debt, granted I was only $10k in debt, but still – when that $10k was a result of all the sacrifices I WASN’T willing to make, it was awful. I had to really sit myself down and discipline myself. At the time it was rough, but it pays off. Also Jason and his wife remind me of my BF and I when we work on our finances together. Awesome interview.

Thank you! I’m glad you enjoyed it!

It’s so important to communicate well with your spouse or BF. If you aren’t on the same page financially it’s only a disaster waiting to happen.

Jeff,

I appreciate the opportunity to do the interview and I’m glad I was able to share parts of my story.

There’s no doubt that your questions were quite challenging but I believe they reveal some of the core issues that I faced (and that many of us face).

Thanks again!

Jason

That is a great story. Very inspirational, I think some people get so far in that they think there can never be a light at the end of the tunnel. This story shows the exact opposite. My wife and I are in the process of tackling our CC debt that we knowingly put on while my wife stayed at home with our 2 kids. Now the fun part paying down those bills and man it feels great.

It is a lot of fun when you start making progress and start winning! It’s difficult to start but once you get the ball rolling downhill it’s tough to stop!

Good luck Christopher!

Inspirational story, there Jason. You have done a great job in paying down a mountain of debt, and done it all on half of your previous salary. That is amazing.

BTW.. Work Save Live is one of my favorite financial sites, and is highly recommended for everyone. It is awesome that you chose to feature Jason’s story, Mr. Rose!