The best mortgage refinance companies can help you save time and money as you upgrade your mortgage.

Not only do they have smart and streamlined processes in place to make the entire process hassle-free, but they offer plenty of loan options, competitive interest rates, and flexible closings.

If you’re in the market for a mortgage refinance, it helps to know which lenders offer the lowest mortgage rates and the best shopping experience.

We compared all the major mortgage refinance lenders available today to find options with low rates and fair terms. Keep reading to see how they stack up.

Table of Contents

Company Reviews for Best Mortgage Refinance

The mortgage refinance process requires some upfront legwork, but the effort can be worth it if you wind up with a better loan. The companies we chose for our ranking of mortgage lenders can help you save money, pay off your loan faster, or both.

Read over the basic information for each home loan company to find the best option for your needs.

Quicken Loans

Also referred to as Rocket Mortgage, Quicken Loans is known for its seamless online mortgage refinancing process and how easy it is to get started.

Through Quicken’s dynamic online platform, a borrower can upload all the required paperwork, oversee their process, and finish the bulk of the refinance process online.

The company also boasts excellent reviews from past users, and it earned the second spot in J.D. Power’s U.S. Primary Mortgage Origination Satisfaction Study.

Quicken Loans offers origination loans, traditional refinancing, cash-out refinancing, and more through its online portal. Customers can also lean on this lender for help with conventional home loans, VA home loans, FHA loans, USDA loans, and more.

Loans Offered:

Better

Better promises mortgage refinancing with no lender fees or commissions, and it has streamlined the entire process with modern-day technology. Better applicants get instant mortgage rates after answering just a few questions, and the process is visible and transparent all along the way.

Although the company has only been in operation since 2016, Better has already funded over $1.7 billion in loans. Applying for a mortgage refinance can be done entirely online, and you’ll get a quote immediately without having to speak with a mortgage officer.

Loans Offered:

AmeriSave

AmeriSave is an online mortgage lender that offers new home loans as well as mortgage refinance products. This company lets you qualify for lower rates than many brick-and-mortar banks, and you can even wrap your loan closing costs into your new loan if you agree to a slightly higher APR.

AmeriSave also lets you get a free quote for your new loan online. From there, you can complete the entire loan application process using their website and online portal to upload documents.

When it comes to closing on your new loan, they’ll complete the closing anywhere you want — even in your home.

Loans Offered:

loanDepot

If you’re wondering how to get a mortgage and hoping to complete the bulk of the process from the comfort of your own home, look no further than loanDepot.

This online lender promises refinance products with lower interest rates and/or lower monthly payments than you have now, and with a seamless application process, you can complete entirely online.

After you refinance with loanDepot once, they’ll also waive all the lender fees the next time you use them to refinance a mortgage.

While newer in the industry than some of the other refinance companies out there, loanDepot has funded more than $100 billion in loans since 2010. It’s also important to note that loanDepot scored higher than average in J.D. Power’s U.S. Primary Mortgage Origination Satisfaction Study.

Loans Offered:

Bank of America

Bank of America promises consumers who want to refinance a “digital mortgage experience” that makes the process more convenient. You can apply for a refinance online, over the phone, or in person, and you can choose from a wide range of mortgage products to suit your needs.

Online preapproval is also offered, and Bank of America offers competitive interest rates and low down payment options.

Bank of America Preferred Rewards clients can also qualify for a $200 to $600 reduction in their loan origination fee. This makes Bank of America an especially lucrative option for consumers who already have a working relationship with them.

Loans Offered:

Veterans United Home Loans

Veterans United Home Loans is a premier mortgage company for veterans and active-duty military who meet “the basic service requirements set by the Department of Veterans Affairs (VA), have a valid Certificate of Eligibility (COE), and satisfy the lender’s credit and income requirements.”

This means you must have a qualifying military affiliation to refinance your mortgage with this lender.

Veterans United can help connect you with the best VA home loans today — often with lower closing costs and the most competitive rates out there today. Veterans United has also received excellent reviews with an average star rating of 4.9 out of 5 stars across more than 10,000 reviews on Trustpilot.

Loans Offered:

Chase

While Chase Bank is popular for its banking products and rewards credit cards, it also offers home loans and mortgage refinancing.

Their mortgage refinancing product lets you replace your home loan with a new one that offers better rates and terms, and you can likely complete the bulk of the mortgage refinance process online.

Chase promises some of the lowest rates available, and you can even begin the mortgage refinancing process online. The bank also offers a closing costs guarantee that promises you’ll close on time in as little as three weeks, or you’ll get a check for $5,000.

Loans offered: Traditional home loans, adjustable-rate mortgages, jumbo loans, VA loans, FHA loans, USDA loans.

Loans Offered:

LowerMyBills.com

LowerMyBills.com is not a mortgage lender, but it is a marketplace that lets you compare multiple home loans in one place.

This platform lets you enter basic information about your current mortgage, your monthly payment, and your credit score range to get an idea of the new loan term you could qualify for.

If you decide to move forward and apply, you can enter your information once and get quotes from multiple lenders on the same day. LowerMyBills.com also offers a nifty mortgage refinance tool that lets you see how much you could save with a new home loan.

Loans Offered:

Mortgage Refinance Guide

If you’re wondering what to do before refinancing, when to refinance, or how to begin the process, you’re in the right place. Read on to learn more about what goes into refinancing your mortgage, why refinance rates are higher than purchase rates, and the paperwork and forms you’ll need to get started.

Benefits of Refinancing a Mortgage

The benefits of a mortgage refinance depend on the homeowner and their specific situation. For example, many consumers refinance in order to decrease the length of their loan term or lower their monthly mortgage payments.

Due to the fact that you get the chance to change up your loan term, refinancing is also one of the best ways to pay off a mortgage early.

If interest rates are considerably lower than they were years ago, refinancing to secure a lower interest rate can also help consumers save money on interest over the life of their loan.

Another benefit of refinancing right now could come into play if the value of your home has increased but you’re still paying private mortgage insurance (PMI) on your original home loan.

By comparing mortgage options, applying for a refinance, and seeking out an appraisal, homeowners with considerable home equity can get the PMI removed from their mortgage.

Cost to Refinance

According to ClosingCorp, the average cost of refinancing worked out to $6,837 nationally including taxes and $3,836 excluding taxes in 2021. Further, closing costs as a percentage of purchase prices declined in 2021 to 1.03% when compared to the 1.06% average in 2020.

That said, your personal closing costs will depend on a broad range of factors including your current income, your debt-to-income ratio, your credit history and credit score, the type of loan you choose, the loan amount, and your loan term.

Potential costs to watch out for and compare include closing costs, loan origination fees, points, and more.

Best Time to Refinance

Generally speaking, there are a handful of times it makes sense to trade your current home loan for a new one. Should you refinance your mortgage, one of the scenarios below will likely come into play:

- Securing a lower monthly mortgage payment

- Getting a lower interest rate

- Reducing the loan term on your mortgage

- Switching loan products from a 15 vs. 30-year mortgage

- Refinancing to remove PMI

- Switching from a variable rate to a fixed rate (or vice versa)

Any of these situations can create a prime opportunity for mortgage refinancing, but you should still run the numbers to make sure you’ll still end up ahead.

A mortgage calculator can help you compare your future monthly payment to your current one, as well as see how much you could save on interest based on current mortgage rates.

Requesting for Refinancing a Mortgage

After you compare loan offers and decide on a mortgage lender, you’ll need to gather some documentation to begin the refinancing process. Documents you’ll need to have ready can include:

- Proof of income, including W2s or pay stubs

- Homeowners insurance information

- Documents relating to other debts you have

- Statement of assets

- Tax returns

According to Quicken Loans, you may also need to present other documentation based on your situation.

For example, you may need to prepare letters of explanation for past credit issues or employment gaps, documentation that shows child support or alimony payments, or documentation related to bankruptcy on your credit history.

While knowing what you need and gathering this documentation may feel overwhelming, remember that the best mortgage lenders can help walk you through the process. The majority also lets you upload required documentation online and from the comfort of your own home.

Different Kinds of Refinancing Products

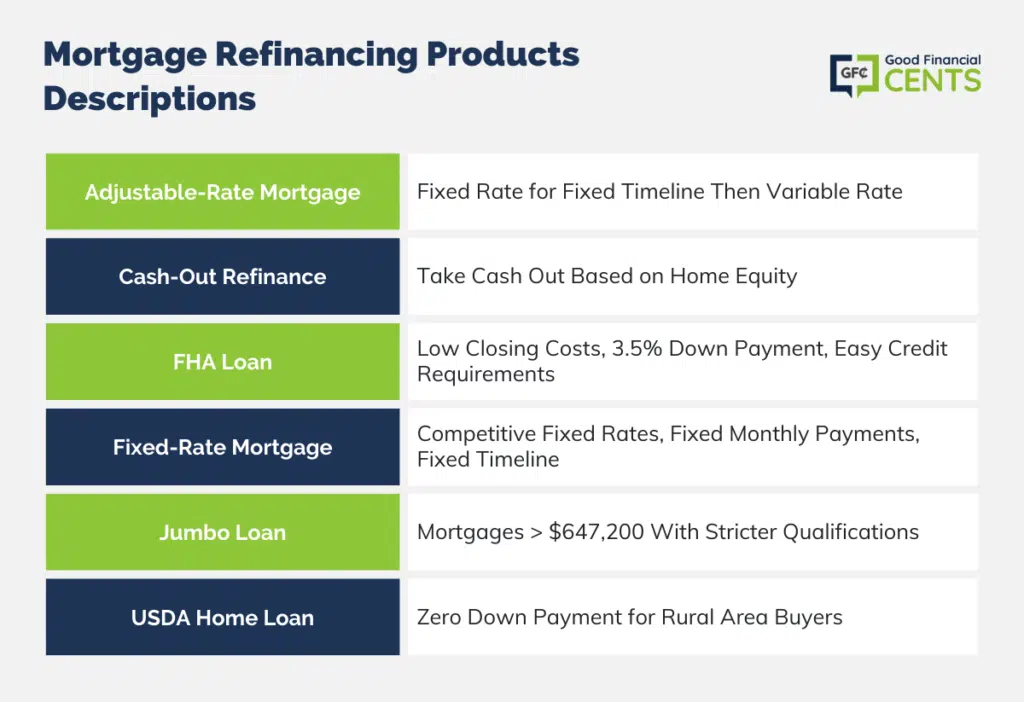

When it comes to refinancing your home mortgage, you get to choose from nearly any type of mortgage out there. Generally speaking, your options can include the following:

Adjustable-Rate Mortgage

- Adjustable-Rate Mortgage: An adjustable-rate mortgage comes with a fixed rate for a fixed timeline followed by a variable interest rate for the duration of the loan. With a 7/1 ARM, for example, consumers pay a low fixed rate for seven years followed by a variable rate that changes based on market conditions.

Cash-Out Refinance

- Cash-Out Refinance: While you can refinance your mortgage to secure a lower monthly payment, a lower interest rate, or both, you may also be able to take cash out based on how much equity you have.

FHA Loan

- FHA Loan: FHA loans come with low closing costs, down payment requirements as low as 3.5%, and easy credit requirements.

Fixed-Rate Mortgage

- Fixed-Rate Mortgage: Fixed-rate mortgages come with competitive fixed rates, fixed monthly mortgage payments, and a fixed repayment timeline.

Jumbo Loan

- Jumbo Loan: Jumbo loans are mortgages for homes that cost more than $647,200, and they have stricter qualification requirements as a result.

USDA Home Loan

- USDA Home Loan: USDA loans are zero down payment mortgages that are aimed at buyers in rural areas of the United States.

How We Found the Best Mortgage Refinance Companies

To find the best mortgage lenders of 2024, we looked for mortgage companies that offer transparency when it comes to their mortgage rates, their loan processes, and their loan options.

We compared mortgage lenders based on their ratings from third-party agencies like the Better Business Bureau (BBB) and J.D. Power, and we sought out companies that let consumers complete their refinance process online or over the phone with the help of a mortgage broker.

Ultimately, we chose the top home mortgage companies that offer mostly positive reviews, a broad range of mortgage options, competitive mortgage rates, and plenty of educational content for their customers.

We also gave preference to lenders who let consumers get a rate quote online without a hard inquiry on their credit report.

Bottomline – Best Mortgage Finance Companies

In 2024, for those on the hunt to refinance their mortgage, the landscape is rife with promising options. With companies like Quicken Loans leading in customer service and Better offering competitive rates, homeowners have a robust selection.

Whether you prioritize online processes, loan comparisons, or specific discounts, there’s a lender tailored to meet those needs. Before diving into the decision, it’s worth exploring these top contenders to ensure a smooth refinancing experience.