Want to hear a shocking number? There were 13.5 million people in the United States who were impacted by identity theft in 2022. Close to 14 MILLION people!

Some cases of identity theft are pretty minor. Maybe you notice a couple of transactions you didn’t make on your credit card statement, and a quick call to your bank about the fraud resolves the issue. But other forms of identity theft can be a nightmare to recover from and can wreck your credit score in the process.

Here’s how it happens.

Table of Contents

Personal Identifying Information Gets Into the Wrong Hands

In today’s world, there are so many ways for identity thieves to get hold of our personal identifying information.

Each time we buy something online, fill out paperwork at a doctor’s office, or even throw a financial document away in the trash, we are risking our identities.

Fraudsters can do all kinds of things with one or more pieces of identifying information, such as our name, date of birth, Social Security number, or PIN number.

They can open bank accounts, apply for credit cards and other loans, sign up for cell phone service or another utility, rack up medical costs, or, worst of all, sell our info on the black market, which multiplies the potential for damage.

This sounds terrifying, having your personal info for sale on the black market. Thankfully, there are some tools you can use to keep this from happening and protect yourself, and it’s definitely the easiest way to see if you’re a victim is to use a free credit report.

How an ID Thief Can Wreck Your Credit Score

When someone else takes out a loan in your name, what’s their incentive to pay back the debt? That’s right, pretty much nil. They rack up debt in our names and leave us holding the bag.

In fact, you may not even know an identity thief is working against you until you get a notice from a collection agency saying you owe money. By that point, you can bet that your credit score has already taken a nosedive.

Your Free Credit Report Will Reveal If You Are The Victim of Identity Theft >>>

An identity thief’s actions can add negative activity to your credit report, which in turn lowers your credit score, limiting your ability to qualify for new loans. Many a horror story exists in which an identity thief made it impossible for the victim to get a new, desperately needed loan.

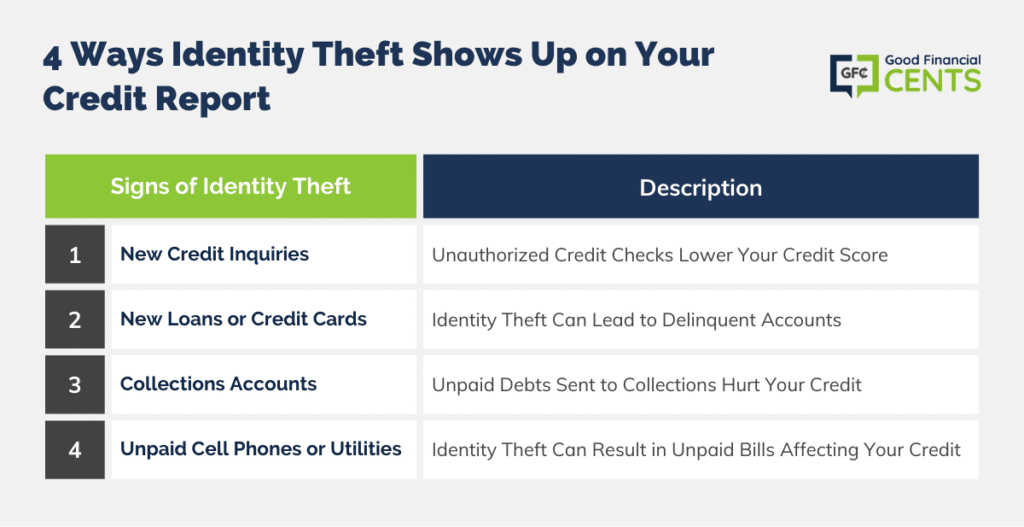

Four Ways an Identity Thief’s Actions Can Show Up on Your Credit Report and Lower Your Score:

New Credit Inquiries

- Each time an ID thief applies for credit in your name, the lender is likely to check your credit report. These credit checks (also called “inquiries”) appear on your credit report and typically ding your credit score by a few points. Every time someone does a hard pull of your credit, it’s going to pop up on your report. Look for those pulls; if you didn’t request it, it’s a clear sign your identity has been stolen.

New Loans or Credit Cards

- New loans or credit card accounts taken out by an identity thief don’t necessarily hurt your credit by themselves. The problem starts when those accounts become delinquent because the ID thief isn’t paying the bill. Your credit score takes a hit each time a month of non-payment passes.

Collections Accounts

- After a certain period of time (usually six months to a year), lenders turn the unpaid debt over to a collection agency. When this happens, a collection account appears on your credit report, and that has a very damaging effect on your credit score. Medical identity theft often results in a collection account: Thieves use your information to receive medical services or treatment, and when those debts go unpaid, the medical provider sends the debt to a collection agency.

Unpaid Cell Phones or Utilities

- When a thief opens a wireless plan or home utility using your personal information and doesn’t pay the bill, those providers are likely to report the default to the credit bureaus. This results in a negative account appearing on your credit report, which hurts your score.

What You Should Be Doing

Identity thieves are constantly changing their techniques. They are staying on top of new technology and avenues, but there are some ways you can ensure you don’t become a victim.

There are two very important things you should be doing to prevent and monitor for identity theft:

First, Protect Your Identity as Much as You Can

You don’t have to give every sales clerk or waitress the evil eye when you hand over your credit card to, but a healthy dose of caution can go a long way. Start by checking out these great tips for shopping safely online.

Shield your PIN and Social Security number from lingering strangers. Shred your financial mail, and don’t leave bank statements, checks, or tax paperwork sitting in your mailbox.

And don’t fall for phishing schemes! If someone calls or emails you asking for personal or account information, chances are they are trying to scam you.

In 99% of cases, if a company needs personal information, they probably aren’t going to call you. This is especially true for government agencies. Doing a little research can save you a lot of trouble.

Second, Check Your Credit Reports Often

Each major US credit bureau (Experian, Equifax, and TransUnion) maintains a credit history for us. Under the Fair Credit Reporting Act, we are legally entitled to a credit report from each bureau once a year at absolutely no cost.

Go to annualcreditreport.com, the government-run website, to get yours. Look for accounts and credit inquiries you don’t recognize, as well as incorrect personal information. These could be signs of someone tampering with your credit.

If you don’t regularly check your credit, there’s no other way to know if someone is out there using your personal information to his advantage. If you do discover that you have fallen victim to fraud, you’ll need to file disputes with the credit bureaus, contact your bank(s) immediately, and possibly even file a police report.

For more information on recovering from identity theft, download the free Identity Theft Recovery Guide from SpendOnLife.

The Bottom Line – How Identity Theft Destroys Your Credit Score

Identity theft, which impacted a staggering 13.5 million individuals in 2022, can have profound repercussions on one’s credit score. Our personal identifying information, when mishandled or misused, becomes a gateway for fraudsters to wreak havoc on our financial lives.

From opening unauthorized bank accounts to neglecting payments on loans taken under a victim’s name, these malicious acts lead to a significant drop in credit scores.

Protection against such threats includes proactive measures like safeguarding sensitive information, avoiding phishing schemes, and routinely checking credit reports.

In the event of suspected identity theft, swift actions such as filing disputes, contacting banks, and seeking assistance can aid recovery.

This is a guest post by Carrie Davis, who is a personal finance blogger at SpendOnLife.com, a site dedicated to giving readers true and accurate information about credit, debt, and identity theft. She is FCRA-certified and has a passion for educating others on how to achieve financial independence.