Many of us have a lot of our net worth tied up in our homes. Indeed, the equity that is built up in a home can be a source of funding when needed.

If you have equity in your home, you might be considering tapping it to make home improvements, consolidate debt, or pay for your child’s wedding.

Most people, when deciding to access the equity in their homes, choose either a HELOC or a second mortgage. Depending on what you are planning, one might work better than another for your situation.

The Difference Between a HELOC and a Second Mortgage

In order to determine which type of funding you should consider, you need to first understand what a HELOC and second mortgage are and see how they operate.

A home equity line of credit is a revolving line of credit that allows you to tap into the equity you’ve built in your property. The HELOC provides borrowers with flexibility, functioning much like a credit card.

After appraising your home, and approving you based on your credit score, payment history, and DTI, the lender will set a borrowing limit and interest rate. To qualify, you’ll need close to 20% equity in your home.

How Does a Second Mortgage Work?

Table of Contents

A second mortgage is similar in some respects to a HELOC as they use your home’s equity as collateral.

The primary difference is how you receive the payment of your loan. A second mortgage is a lump sum, whereas a HELOC is a line of credit.

While the HELOC functions like a credit card with a credit limit and minimum monthly payments, you make fixed-rate payments on your second mortgage. Think of its payment structure as your first mortgage.

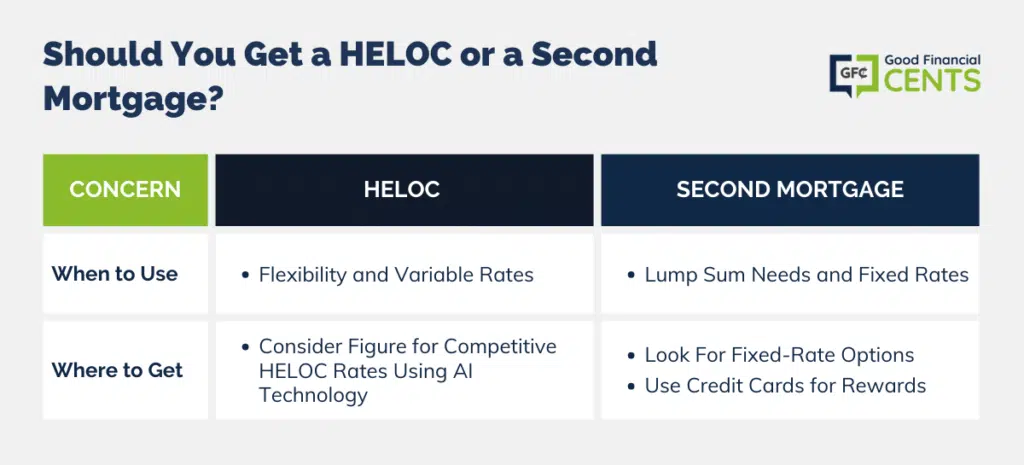

Should You Get a HELOC or a Second Mortgage?

When to Use a HELOC

You should note that a home equity line of credit (HELOC) is actually a type of second mortgage. However, we often think of it as something different.

This misconception is due to the characteristics of a HELOC. As mentioned above, instead of receiving a lump sum, you end up with an approved credit amount.

You can access the money as you need it, much as you would access a line of credit on a credit card. Some HELOCs even come with linked debit cards so that it is easy to access your line of credit.

Most HELOCs feature variable interest rates, so your rate — and your payment — can change, and go higher.

HELOCs can be useful, however. One of the most common uses for the home equity line of credit is the home improvement loan. This is because it allows you the flexibility to borrow as much — or as little — as you need.

If you end up needing more money, you can get it from your line of credit (if there is still availability) without having to re-apply for another mortgage loan.

Where to Get a HELOC

Many big banks and established companies offer competitive HELOC rates. But, an interesting new option in this market is a FinTech start-up called Figure.

An overnight success, Figure has received high marks for its business practices, customer experience, and competitive rates on HELOCs. The figure uses advanced AI technology to provide quick appraisal, approval, and funding to homeowners.

They also provide customers with free educational resources and a loan comparison calculator to help homeowners through the lending process.

When to Use a Second Mortgage

Which type of equity-based funding you pursue depends upon your needs and financial standing. If you have an abundance of other debts and struggle with making payments on credit cards, a HELOC may not be the wisest option to pursue.

In some cases, it makes sense to use a second mortgage that provides you with a lump sum. If you know exactly how much money you will need, for something like debt consolidation or to contribute to a child’s college education, a lump sum can be helpful.

The second mortgage is also helpful if you know that you will be paying off the loan for a long time.

In many cases, it is possible to get a fixed interest rate on a lump sum second mortgage, so you don’t have to worry about rates rising and forcing a higher payment later on. There are also advantages of paying off the second mortgage by using credit cards for rewards points.

Things to Know About HELOCs and Second Mortgages

There are a number of factors you should consider before you start shopping for a HELOC or second mortgage. Pursuing one of these lending options is a major financial decision that will impact your budget and credit score.

Here are a few considerations to keep in mind:

- Deductions: You will often be able to deduct the interest you pay on a HELOC or a second mortgage. Check into the possibilities so that you can get this benefit if you decide to turn the equity in your home into cash.

- Additional Loans: It is vital to remember that both HELOCs and second mortgages are loans on top of your first mortgage.

- More Payments: This means that you will have an extra payment to make. You want to know that you can truly afford your house payment with the addition of another mortgage payment.

- Alternatives: If you don’t want another mortgage payment, you might want to consider attempting a cash-out refinance to tap your equity without having to contend with two separate mortgage payments.

- Risk: You should also consider the risk you are taking any time you tap your home equity, no matter the type of financing you receive. You are using your ownership in your home as collateral, and you could lose your house if you fall behind in your payments.

Pros and Cons of a HELOC vs Second Mortgage

When considering borrowing against the equity in your home, two common options are a home equity line of credit (HELOC) and a second mortgage. Each option has its own advantages and disadvantages, so it’s important to carefully consider your financial situation and goals before deciding which option is right for you.

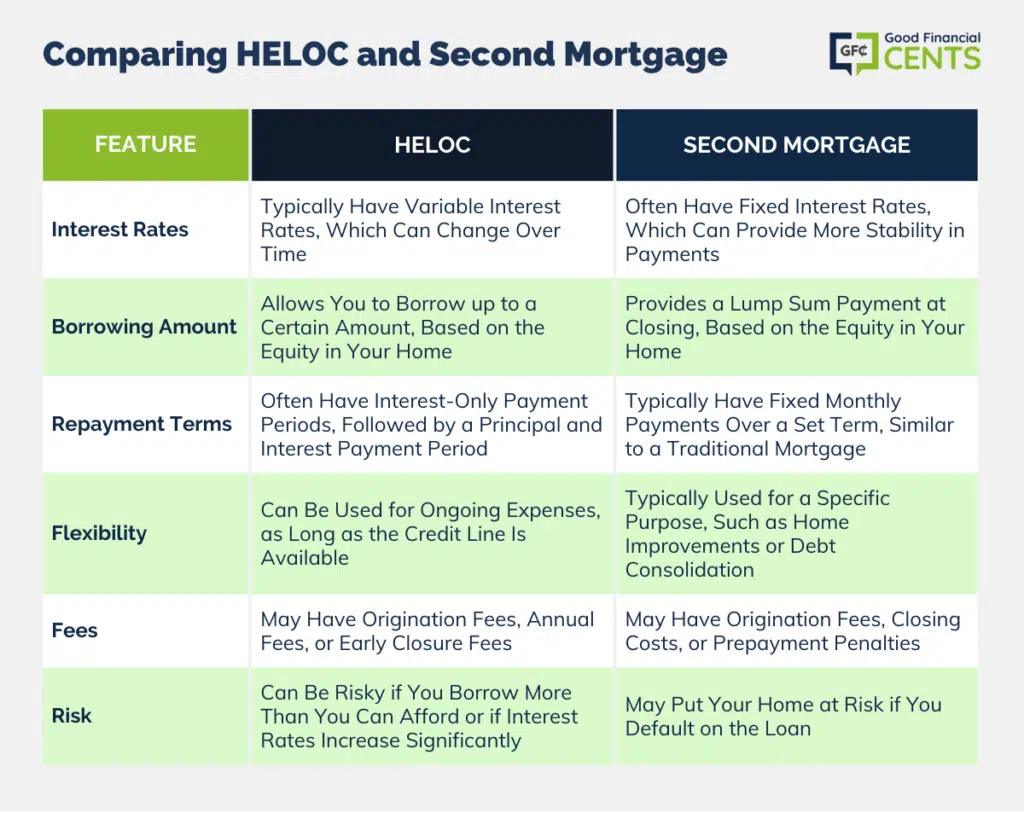

One of the main differences between a HELOC and a second mortgage is the way you access the funds. With a HELOC, you can borrow up to a certain amount based on the equity in your home, and access the funds as needed, similar to a credit card. On the other hand, a second mortgage provides a lump sum payment at closing, based on the equity in your home.

Another key difference is in the interest rates. HELOCs typically have variable interest rates, which can change over time, whereas second mortgages often have fixed interest rates, providing more stability in payments.

When it comes to repayment terms, HELOCs often have interest-only payment periods, followed by a principal and interest payment period. This can be advantageous for those who need flexibility in their payments. Second mortgages, however, typically have fixed monthly payments over a set term, similar to a traditional mortgage.

It’s important to keep in mind that each option also has its own set of fees and risks. HELOCs may have origination fees, annual fees, or early closure fees, and can be risky if you borrow more than you can afford or if interest rates increase significantly. Second mortgages may have origination fees, closing costs, or prepayment penalties, and may put your home at risk if you default on the loan.

Bottom Line – HELOC vs Second Mortgage

Home equity lines of credit and second mortgages can be helpful, but you should consider all your options before deciding to take the plunge.

If you do decide to utilize your equity in your home to obtain funding, be sure to do so wisely. See which options you qualify for, then weigh the pros and cons of each lending source to determine which one is the best fit for you.

You should also shop around and look for rates to ensure you get the best option on the market.

This information is not intended to be a substitute for specific individualized tax or legal advice. We suggest that you discuss your specific situation with a qualified tax or legal advisor.