In these tough economic times, many recognize the importance of financial planning. You want to ensure that your resources are directed to the best effect, and that means creating a spending plan that works well for your situation and helps you prepare for the future.

Good budgeting software can help you take charge of your finances. Happily, a large number of free online budget tools exist. You can get help for nearly any budgetary need you have.

Table of Contents

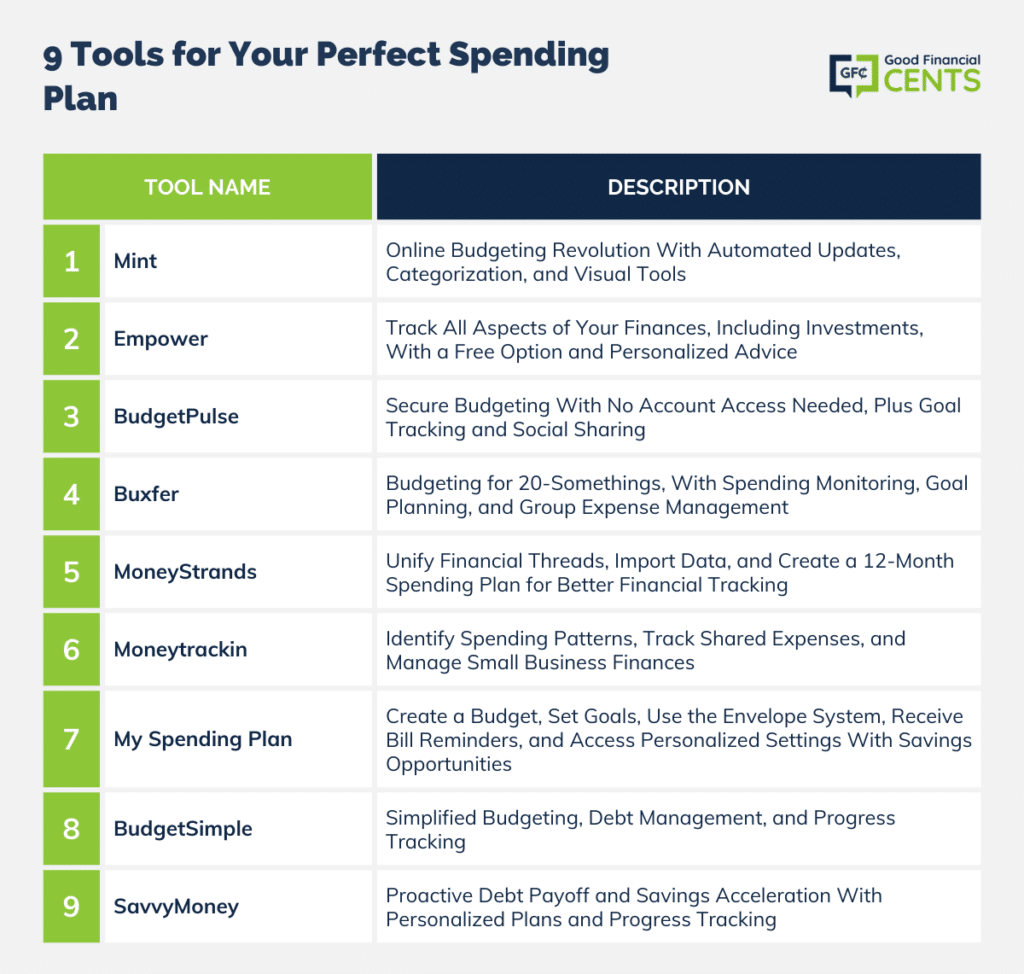

9 Resources for Creating a Spending Plan That Works for You:

Best Free Online Budget Tools for Charting a Course to Financial Freedom

Mint

This is the online budget tool that started a revolution. You can link your financial accounts — savings, checking, credit cards — to Mint.

Your information is automatically updated as it appears in your accounts. In many cases, categories are automatically assigned to your spending.

You can also track your progress toward retirement goals, as well as use Mint to create a debt pay-down plan. Visual tools, including graphs and reports, clearly illustrate your situation and help you chart a course.

Empower

Sign Up for Free |

|

For those who want to add tracking to various aspects of their budget, Empower is an option. Your financial dashboard allows you to see everything that is going on in your financial life. You can see the big picture, and track your progress as you work toward your goals.

On top of that, you can track your investment portfolio, and even receive objective investment advice. If you want help actually managing your investments, you can get personalized ideas, as long as you are willing to pay a 1% fee.

However, the regular service is free, and you can manage your finances — and investments — with the help of this budgeting tool. Check out our full Empower Video Review and Walkthrough.

Empower vs. Mint: Which Is Better?

Mint came first and essentially created the free online budgeting tool category. Empower is much more focused on tracking your investments across multiple accounts.

Which is better for you? It just depends on your needs: if you need straight budgeting, then Mint might be better. If you do want to track your portfolio while also monitoring cash flow then Empower is a great option.

BudgetPulse

If you are wary of allowing an online app access to your accounts, you might consider BudgetPulse.

You don’t give away your account usernames and passwords, and you can track your spending and set goals. The ability to visualize your money is available with charts and graphs. On top of that, you can create financial goals to share with your friends and family.

The social aspect can keep you accountable, as well as provide an opportunity for your loved ones to contribute to your objectives via PayPal or Amazon Payments.

Buxfer

Monitor your spending, and keep track of your upcoming bills with the help of Buxfer. This online budgeting tool is aimed at 20-somethings interested in getting their finances under control and starting out right.

You can project your earnings and savings interest into the future, and use the information to plan your finances. You can break down your goals, set short-term and long-term goals, and work toward them.

Additionally, Buxfer helps you manage group expenses. You can split different bills up, figure out who owes what, and even make payments online, taking care of IOUs with ease.

MoneyStrands

The threads of your financial life meet together with the help of MoneyStrands. This software is one that can important your financial information from your banking institutions and credit issuers. Create a 12-month spending plan, and then use this software to keep you on track.

Moneytrackin’

Once you know where your money is going, it’s easier to spot money leaks and change behaviors. Moneytrackin’ helps you see where it all goes. It also provides help with tracking and dividing shared expenses and creating shared budgets. Moneytrackin also includes helpful tools for small business accounting. If you have a home business, this software can help you keep track of relevant income and expenses. It’s a great tool that can help you manage various aspects of your finances.

My Spending Plan

You can put together a budget to help you better live within your means. Quickly create a plan that helps you with long-term goals, as well as with short-term goals, including special events and more. This software makes use of the envelope system to help you plan your budget.

My Spending Plan also sends you emails and alerts and reminds you of bills that need to be paid. On top of that, you can personalize your settings to see your own big picture. My Spending Plan also includes coupons and promotions that can help you save money and live within your means.

BudgetSimple

If you are looking for something straightforward and simple, BudgetSimple might be helpful. The main point of this budgeting tool is to help you get out of debt. You track your expenses, manage your bills, and learn how to live within your means. There are no frills with BudgetSimple, but it is one of the easiest ways to create a budget. Plus, you can view your progress with the help of charts and other visuals.

SavvyMoney

For those looking for a proactive approach to debt paydown and accelerate savings, SavvyMoney can help. The idea is that you start out by understanding your current situation. After putting together a picture of your current situation, you create a debt repayment plan based on what works best for you. SavvyMoney can help you stay on track, as well as keep up with your progress. You can even receive tips on accelerating your paydown.

Looking for more software tools or budgeting spreadsheets to help you manage your money? Check out the 11 Best Personal Finance Software.

Bottom Line: Top 9 Free Online Budgeting Tools

In today’s challenging economy, effective financial planning is crucial. Several free online budget tools, such as Mint, Empower, and BudgetPulse, offer varied functionalities, from linking accounts and tracking expenses to managing investments and visualizing financial goals. While Mint is great for straightforward budgeting, Empower focuses on investment tracking.

Others like MoneyStrands and Moneytrackin cater to international users or small business owners, and tools like SavvyMoney emphasize debt paydown. Regardless of individual needs, these platforms aim to empower users to achieve financial freedom and make informed decisions, ensuring a secure financial future.

I have been using Dave Ramsey’s EveryDollar for years. A person can upgrade and pay for a fancier version, but I just use the free one. There is an app that goes with it. I like it. Veronica

Thank you for sharing this informative information.It is very helpful to those who want to know more about online invoice application . Hope you post such content in future.Keep Posting.

BudgetSimple is closing its doors at the end of the year.

I use Mint but lately I have noticed some serious inaccuracies with account balances, paycheck listing missing, transactions missing. It’s very frustrating and you can’t talk to a real person to correct anything. It’s all online chat and the times that I tried to get anything fixed NOTHING was resolved. I need to find a better service for my budgeting but not sure were to go. So many different sites. Does anyone recommend any of these based on accuracy?

Myannualbudget.com is another option. It’s a personal finance budget calculator that does all the math for you, including an estimate of your taxes owed. Works great on desktop and mobile.

All these you mention are good, I personally like MoneyStrands for its simplicity and ease of use 🙂

I enjoy reading manufactures comments and claims about their products. I like to try the products and do my best for a fair test and then either to change or let the manufacture what I experienced.

Thank you,

Joseph Murphy

O

I am a black man homeless without any income living under a bridge and who eats out of dumpsters. So I don’t know how if any program is going to help me. I am trying to get a job so that I don’t have to live like this. I sometimes feel like I am about to go crazy but somehow I tend to keep holding on.

Hi Tyrone – I don’t have much advice to offer. Maybe you can check with Goodwill and see if they can help. They hire people to help them get back into the job market. I’m not sure what the pay is, or even if there is pay, but they can help you get started, and maybe point you to some resources in your area.

I have been using billorganizer.lol. super simple. Free. It’s been a life saver.

Depending on business types business owners select the suitable platform for managing business process. Myself switched onto Apptivo, through this accounting tool, I’m managing my business accounts easily without missing any records and facing difficulties possibility is very less.

I use Geltbox money -automatic download from any website (banks,credit cards).

I like that I can keep my data locally instead of in the cloud.

An excellent home finance planner and tracker.

I use Budget Tracker Inc., and personally, I think it should be on this list. You can track everything in your money, and their are additional features too.

Tried MINT. The first thing it asked for was my credit card information. I could not get past that screen to start creating a budget and enter some expense info to see what it could do with that. I deleted my account ASAP. What if you have no credit cards? What if you use cash only? What if you wanted to enter and categorize your expenses using information not provided by the CC companies or banks? I’ll keep looking. I do all this now manually using spreadsheets.

Thanks for sharing, I definitely need these tools as I’m one of those whose not good at managing my money which most of the time leads me to overflowing debts. Hopefully, one of these tools can help me manage my expenses and somehow save some.

I’ve been using Bucktrak.com for a while now. It’s also free, and lets me upload bank statements without having to give any third-party app access to my accounts!

I use WAVE accounting more than Mint these days and I really like it. It is intuitive and works both for my side business and my personal finances.