Most people have heard of passive income, but what about residual income? In this article, I’ll explain how residual income works and share residual income ideas that will allow you to earn money while you sleep (once you’ve put in some hard work!)

Table of Contents

- What Is Residual Income?

- How To Make Residual Income (For Beginners)

- 1. Invest In the Stock Market

- 2. Real Estate Investing

- 3. Peer-to-Peer (P2P) Lending

- 4. Start a Blog

- 5. Start a YouTube Channel

- 6. Build an App

- 7. Sell Digital Products Online

- 8. Build a Niche Website and Earn Affiliate Income

- 9. Start a Dropshipping Business

- 10. Rake In the Royalties

- How Residual Income Is Taxed

- Bottom Line on Residual Income

What Is Residual Income?

After an initial investment of time or money, residual income can last for many years with little to no work required on your part.

Residual income is a type of passive income that requires an initial investment of time and effort. To earn residual income, you often need to do a lot of work upfront before the money begins to flow.

Book and songwriting royalties are some of the best examples of residual income. An author spends many months toiling away at their latest novel, but once it’s published, they can sit back and enjoy the steady stream of royalty income from their share of book sales.

The same goes for songwriters. They spend hundreds of hours crafting songs and recording them in the studio. But once their music hits the airwaves, the royalties become a source of residual income.

Depending on the type of residual income you earn, it can last for many years with little to no work required on your part.

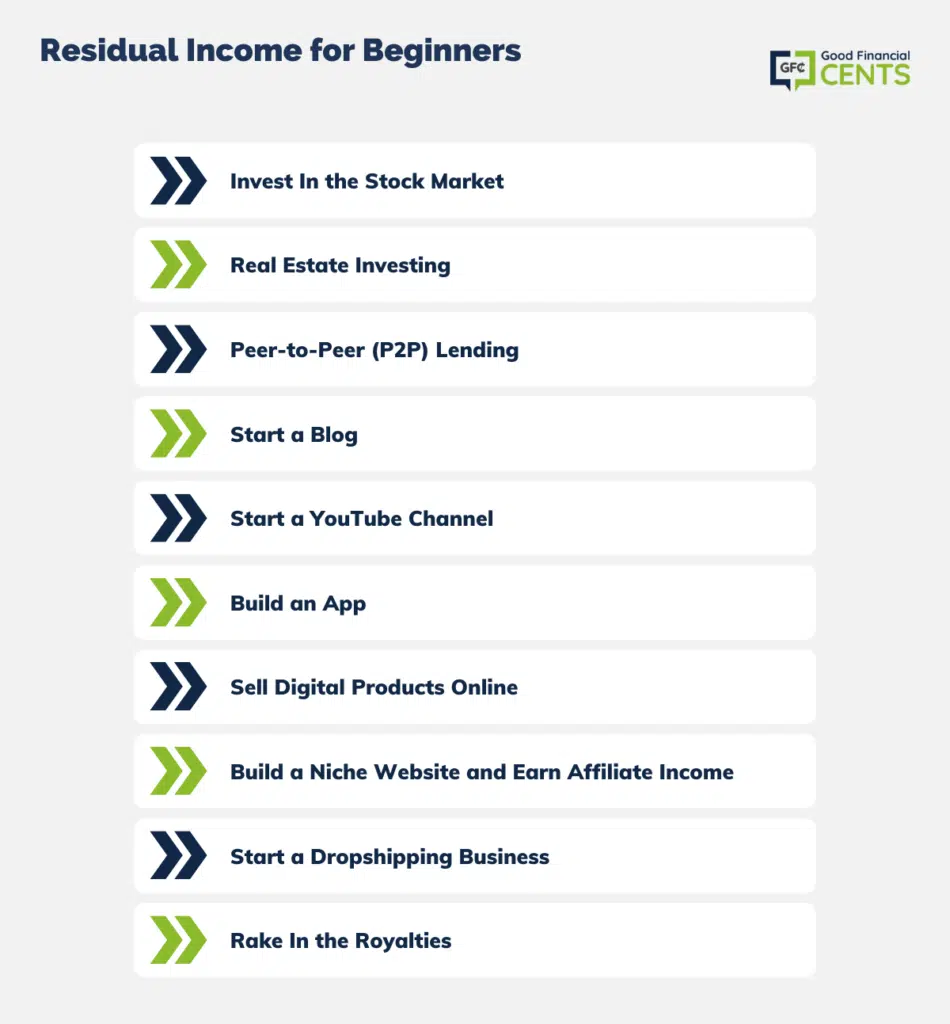

How To Make Residual Income (For Beginners)

If you’re a beginner looking to make residual income, the first step is to identify a source of income that aligns with your interests and skills.

This could involve creating digital products like eBooks, courses, or webinars. Alternatively, you could explore investing in dividend-paying stocks or rental properties.

Once you’ve identified a potential income source, it’s important to put in the initial work required to generate passive income. This may involve writing a book, creating a course, or purchasing a rental property.

To ensure that your residual income stream lasts for many years, it’s important to put in the effort upfront to create high-quality products that meet the needs of your target audience.

This will involve conducting market research, investing in professional editing or design services, and marketing your products to attract customers.

By identifying a suitable income source, putting in the initial effort required, and producing high-quality products, you can enjoy a steady stream of passive income that lasts for years.

1. Invest In the Stock Market

Did you know? You can generate residual income by investing in the stock market. While the effort level is minimal, you need to make an upfront investment before earning residual or passive income.

The two easiest ways to invest in the stock market are through a robo-advisor platform or an online broker. Let’s take a closer look at each option.

Robo-Advisors

A robo-advisor is an automated algorithm that creates an investment portfolio for you based on the information you provide about your investment objective, time horizon, risk tolerance, etc.

With a robo-advisor, you can open an account and start investing within minutes without speaking to a human advisor. While there are several robo-advisors available today, M1 Finance is one of the leading platforms.

The M1 Finance platform includes several useful tools, automated portfolio rebalancing, goal setting, and various investment calculators. For more information, check out our full M1 Finance review.

Online Brokers

If you are looking for an affordable way to invest but want more hands-on control than what a robo-advisor offers, you may want to invest through an online brokerage like Charles Schwab, Ally Invest, or Robinhood.

With an online broker, you can buy and sell stocks and bonds, ETFs, etc., and receive residual income through regular dividends and capital gains when you sell your shares.

Because of the up-and-down nature of the stock market, it’s best to maintain a long-term mindset. You can read up on the best online brokerage accounts or check out my Robinhood review.

2. Real Estate Investing

I’ve written about real estate investing many times over the years, and for a good reason. By and large, real estate offers a proven way to become extremely wealthy over a lifetime.

Becoming a landlord isn’t for the faint of heart, but you can set yourself up with residual income if you invest time, effort, and money upfront.

If you purchase a few rental properties while your kids are young, you can pay off the mortgages from the monthly rent and own the properties outright by the time you reach retirement age. Note that you may have to renovate the properties before renting them out.

Depending on where you live and the quality of your rentals, you could earn several thousand dollars in residual income every month!

If being a landlord doesn’t appeal to you, consider investing in crowdfunded real estate through platforms like Fundrise. I highlighted how people who use this service earn average returns of 8.7-12.4 percent.

Real Estate Investment Trusts (REITs) are another option.

The best part about REITs is that they are entirely hands-off, letting you earn residual income built on an underlying real estate investment. And just like stocks or bonds, you can sell REITs anytime. For more ideas, here is a list of 12 ways to invest in real estate.

3. Peer-to-Peer (P2P) Lending

Peer-to-peer lending is a crowdfunded lending platform that connects borrowers who need personal or business loans with investors looking to make an above-average return on their money.

Lending Club is just one example of a peer-to-peer lending company that connects investors and borrowers. When you sign up with Lending Club as an investor, you’ll have an opportunity to browse and select the right lending opportunity.

As the borrower repays the loan, the investors get their principal back along with interest.

You may be wondering how this qualifies as residual income. While there’s no major time commitment upfront, you must make an initial investment to receive an eventual return.

P2P lending provides a way to diversify your stock market investments, but there is some risk involved. Your investment isn’t insured, and you could lose your money.

4. Start a Blog

I’ve earned a lot of residual income through blogging. But unlike peer-to-peer lending, there’s a steep learning curve. Namely, professional blogging takes time and money.

You’ll need to create and promote content consistently as you grow your audience. Eventually, you can monetize your blog with affiliate partnerships, advertising, selling courses, etc. Start small and see if you can gain some traction.

Blogging also means being very open with the world about your life.

If you’re an extrovert, remember that blogging means having your work critiqued by the masses. However, it might pay off if you can devote some serious time to your blog.

5. Start a YouTube Channel

A YouTube channel has two benefits for an influencer: you can use it to establish yourself as a credible source in your niche, and you can earn residual income as your brand grows and your videos get more views.

Attach Google AdSense to the videos, which will overlay your videos with automatic ads. When viewers click on those ads, you will earn money from AdSense.

The key is to create compelling videos, promote those videos on social media, and create enough of them so that they make money.

Don’t worry if you aren’t skilled in video editing. Some apps make it much easier these days. If your channel is making enough money, you can even outsource those tasks to someone else.

6. Build an App

Even if you aren’t the most tech-savvy person out there, building an app isn’t out of your reach.

Whether you have a brilliant idea for organizing tasks or a treasure trove of travel advice, you can create an app to help people out.

The key is creating something unique.

Do that, and you can make quite a bit of money. Simple – yet unique – apps can be pretty passive. Of course, you need to build the app first.

If coding is a foreign language to you, check out freelancer marketplaces like Fiverr, Freelancer.com, and Upwork, where you can hire a developer to build the app based on your idea or get live programming assistance. It’s hard to beat!

7. Sell Digital Products Online

Yes, you can sell stuff online.

Thousands of people are building online courses, digital books, and printables and selling them to their followers online through platforms like Gumroad.

This is a fantastic residual income idea because once you’ve created the product, there’s little to no work involved. You can continue to sell your products indefinitely.

If you’re interested in selling through Gumroad, you might want to use ConvertKit to market your products to your audience.

ConvertKit is an email marketing tool that allows you to send “drip” emails to your followers. It’s what I use, and I love it. What’s drip email? It’s a way to create a series of emails upfront and have them “drip” to your email subscribers at a certain interval over a period of time.

One of the best parts about using Gumroad and ConvertKit is they integrate together for a seamless experience for your followers.

8. Build a Niche Website and Earn Affiliate Income

Even if you have no desire to become a “blogger,” there are other ways to build residual income through niche websites.

People often use niche websites as an affiliate income strategy. With affiliate marketing, you insert links into your content and then get paid when people click through and make a purchase. To get you started, here are over 100 referral services online that will pay you money.

Affiliate marketing is a great way to earn residual income that pays off. Take a look at my latest income report, and you’ll see exactly what I mean.

Another strategy is to build a niche website to sell a specific product.

Let’s say you are obsessed with hockey to the point where you live and breathe it. Setting up a hockey-focused niche site creates a space to write about the sport and sell hockey gear and products.

At the end of the day, the sky is the limit when it comes to finding ways to get paid online!

9. Start a Dropshipping Business

Dropshipping is almost like a heightened version of affiliate marketing. You curate items from online vendors that are tailored to your followers.

Although you set up a storefront on your site, the actual products are not your own.

When people buy the products on your website, they make purchases from a third party. Because you guided them there, you take a cut of the profit.

And dropshipping is a big business. According to Fundera, 23% of all online sales are fulfilled by drop shipping.

Tip:

A Daily Something is an excellent example of a dropshipping business, with a shop section leading followers to the product purchase pages of vendors.

Starting an online business doesn’t have to be hard. You can set up a storefront similar to the one above by building a store on Shopify.com, being as involved or passive as you prefer.

10. Rake In the Royalties

In the introduction to this article, I mentioned that royalties are perhaps the purest form of residual income.

That’s because almost all of the work is done upfront, and once the income starts to flow, there’s little to no work involved. While you can earn royalty income in various ways, the most common might be through books and music.

Books

Writing a book is a one-and-done activity that can lead to long-term earnings. It requires a lot of work at the onset, but if writing is something you love, penning a book could be worth your while.

You can either sell the book on your own website or offer it as an affiliate arrangement with other websites that provide content related to your book.

Many successful book authors say that selling books feels like finding free money. Once the book is published, it really is passive income.

With a print book, a publisher might pay you royalties for the distribution and sale of the book. You’ll get a percentage of each sale made, and if the book is fairly popular, the royalties could be substantial.

Music

Calling all songwriters!

If you create a piece of music, whether background music for videos, lyrics, a song, a ringtone – you name it – you could earn residual income through royalties.

Imagine getting paid every time someone downloads a digital copy of your music. If you’re talented enough, you may get your songs on the radio and receive royalties whenever they are played over the air.

And with the right licensing, you could get paid every time someone plays or performs your song at an event or in a public setting.

How Residual Income Is Taxed

Residual income, often derived from investments, royalties, rental properties, or ongoing business activities, is subject to taxation, much like regular income. The tax treatment of residual income largely depends on its source and nature.

For instance, dividends from investments are typically taxed at a different rate than ordinary income, often benefiting from lower capital gains tax rates in many jurisdictions. Rental income, on the other hand, is usually taxed as ordinary income, but it allows for deductions such as depreciation, maintenance, and other property-related expenses, which can reduce the taxable amount.

Royalties, whether from intellectual property or other sources, are also generally taxed as ordinary income, but they may involve complex rules regarding amortization or categorization of the income. It’s important to note that tax laws vary significantly by country and even by region within countries, and they can change frequently.

Therefore, consulting with a tax professional is advisable for accurate and personalized advice regarding the taxation of residual income.

Bottom Line on Residual Income

Residual income is the stuff of dreams. Unlike the money you earn at your job, residual income gets paid whether you show up or not.

If you don’t mind putting in the work up-front, you may earn enough residual income to replace the 9-5 altogether.

The options listed above can help you rake in some serious cash. If you’re struggling to decide which residual income idea to try, find one that combines your skillset with your interests.

If you don’t have much money to invest upfront and are willing to put in the effort, consider starting a blog or YouTube channel.

If you have money, investing in stocks or real estate will require less time and effort but could be just as profitable in the long run.

The bottom line is that the opportunity is out there. It’s up to you to find it!

I need every information to be successful in doing this job . I am New here

Well.them are good ideas and glad people are looking at Residual Income and glad my Business has it and has had it for over 48 yrs

I found a 5 level deep monthly residual income opportunity that all a person really needs to do is refer 10 new customers to the company and if each person only referred 10 new customers, they would end up with a 6 figure monthly income for the rest of their lives and i can’t seem to get one person to participate.

There are 5 levels of income so 10 to the 5th Power is, in other words, each person referring 10 people down 5 levels is a little over $100,000 a month FOR LIFE.

And I don’t understand why everyone is not jumping at this opportunity being the cost is only $10 a month. Go figure…….

Investing your money should never be taken lightly, especially when it comes to putting it into a business. In this case, the potential return on investment is quite large and the risks are minimal. There’s no reason not to jump on this opportunity if you have the available capital.

Not only is there a large return on investment (ROI) potential but the timeframe for this opportunity is also shorter than other investments. This makes it ideal for investors who want quicker returns or those who are looking to diversify their portfolios without having to wait too long.

When investing in any kind of business opportunities, it’s important that you do your due diligence and take an informed approach. Research the company and its track record thoroughly so that you know exactly what type of ROI you can expect before jumping in with both feet. You should also assess whether or not the venture has a solid management team that is able to execute on their vision correctly.

Great article. I’ve got a great deal of experience with construction, rehab, building maintenance, etc. Besides “hard money lenders” (which charge excessive rates), is there a good source of start up monies for real estate investors?

Hi Steven – You might look into some of the real estate crowdfunding sites. They match developers with investors. But I’m pretty sure they look for developers to have a track record. But some will fund individual property rehabs (fix and flip), so give it a try.

I didnt see the income report you referred to……

Most of these things are not passive incomes!

Hi Matthew – True, but please note the article is about residual income not passive income. Often you need to be actively involved in creating a residual income stream, which only sometimes becomes fully passive at that point.

Great article Jeff!!

I am actually doing some of the ideas you are talking about here and always looking for new ways to create different streams of passive income.

I have to confess it is a really good feeling when I read articles like this because it assures me that even though I might not be where I want to be, I am getting closer and closer to my goal every day and it is for people like you that this is possible. Life is about learning every single day!!

I just wanted to ask you about how much money you have invested in Lending Club? I have only 7K but lately the APY has dropped from 11% to 7% and it seems to be dropping month after month? Have you experienced the same thing? It makes me wonder if it is actually worthy to keep doing it. What are your thoughts about it?

Thank you so much for your advice and keep doing such an amazing footprint in other people’s life!!

Alejandro.

@Alejandro I, too, have noticed my Lending Club returns dropping a bit. I’m still averaging 7-8% so I’m not too overly concerned at the moment. But it is a good reminder to always diversify.