Roth IRAs can be a savvy retirement savings strategy, but they have one significant drawback: contributions aren’t tax-deductible. However, when taking a closer look at the details, there are also nuances to consider.

Although Roth IRA contributions themselves aren’t tax-deductible, you can claim a Roth IRA tax credit or claim a loss on a Roth IRA. To do so, you’ll need to meet certain eligibility requirements.

If you’re wondering whether your Roth IRA contributions can be tax-deductible, here’s some information and scenarios to consider.

Table of Contents

Non-Deductible Roth IRA Contributions

Unlike 401(k) or traditional IRA contributions, Roth IRA contributions are not tax-deductible. According to the Roth IRA funding rules established by the IRS, all of your contributions must be made with after-tax dollars.

For example, let’s say you earn $40,000, and you’re in the 25% tax bracket. If you want to make a $6,000 tax-deductible 401(k) contribution, you’ll put $6,000 in your 401(k) first, and then you pay your taxes, which leaves you with $25,500 (75% of $34,000).

However, if you make a $6,000 non-deductible Roth IRA contribution, you’ll pay your taxes first, which leaves you with $30,000 (75% of $40,000). By making that $6,000 Roth IRA contribution with after-tax dollars, you’ll be left with $24,000 in disposable income.

Although stashing that money away in your Roth IRA is certainly a smart move, it’ll leave you with less money to spend throughout the year.

The complexity of the situation doesn’t end there. Just because your Roth IRA contributions aren’t tax-deductible doesn’t mean you can’t take advantage of certain provisions that provide a benefit similar to a deduction.

Yes, you read that right. You can potentially get a tax benefit by using a Roth IRA. How is this possible? Keep reading to learn more.

The Roth IRA Saver’s Tax Credit

Although your Roth IRA contributions are not tax-deductible, you can claim the Retirement Savings Contributions Credit (also known as the “Saver’s Tax Credit”).

The Retirement Savings Contributions Credit is a tax credit that is available to certain low- and moderate-income taxpayers who make contributions to a Roth IRA or other qualified retirement plan.

The credit is designed to encourage people to save for retirement, and it can be worth up to $1,000 for individuals and $2,000 for married couples filing jointly.

Using IRS Form 8880, you can receive a credit of up to 50% on your first $2,000 in Roth IRA contributions if you’re single and your income falls within the income limits. The credit applies to a contribution amount of $4,000 if you’re married and filing jointly.

Here’s how the numbers and income limits worked out for the 2024 tax season:

| Credit Rate | Married Filing Jointly | Head of Household | All Others |

|---|---|---|---|

| 50% Of Your Contribution | AGI Not More Than $46,000 | AGI Not More Than $34,500 | AGI Not More Than $23,000 |

| 20% Of Your Contribution | $46,001- $50,000 | $34,501 – $37,500 | $23,001 – $25,000 |

| 10% Of Your Contribution | $50,001 – $76,500 | $37,501 – $57,375 | $25,001 – $38,250 |

| 0% Of Your Contribution | More Than $76,500 | More Than $57,375 | More Than $38,250 |

To be eligible for the credit, you must meet certain income limits and contribute to a Roth IRA or other qualified retirement plans such as a 401(k), traditional IRA, or SEP IRA.

The amount of the credit you can claim is based on your income and the amount of your contributions, and the credit rate can be as high as 50% of your contributions.

The Roth IRA Saver’s Credit is a non-refundable credit, meaning that it can only reduce your tax liability to zero, but it cannot result in a refund.

Claiming Roth IRA Losses

Although some taxpayers were once able to develop a workaround to claim Roth IRA losses, this provision was removed as part of the Tax Cut and Jobs Act of 2017. Whether this will become an option again in the future remains unclear.

In the past, while Roth IRA contributions were not tax-deductible, you could claim losses under certain circumstances. These losses were in relation to your original Roth IRA contribution, not simply a declining balance.

For instance, if you contributed $25,000 to your Roth IRA over the years, but your account is now only worth $20,000, then you experienced a $5,000 loss from your original contribution. In this situation, you could claim that loss on your tax return, but only if all of the following applied:

- You closed all of your Roth IRA accounts,

- You claimed your loss on an itemized tax return,

- The loss exceeded 2% of your Adjustable Gross Income (AGI), and

- You were not subject to the Alternative Minimum Tax (AMT).

Assuming your situation met each of the above factors, you were eligible to claim a loss on your tax return. However, there’s another caveat — you could only claim the amount that was above 2% of your AGI as a tax deduction.

Since the above provision is no longer in effect, the Saver’s Tax Credit is likely the next best option.

Benefits of Investing in a Roth IRA

Now that we’ve covered the most viable option to score a tax break through a Roth IRA, let’s highlight the many instances in which opening this type of account makes sense.

A Roth IRA Offers One More Way to Save for Retirement

If you’re building a hefty nest egg for retirement, a Roth IRA offers another option to do so. The best part is you can contribute to a Roth IRA (or traditional IRA) even after you max out your company-sponsored retirement or 401(k) plan.

For the 2024 tax season, the contribution limit for both your Roth IRA and traditional IRAs combined is $7,000, although individuals age 50 and over can contribute up to $8,000 as a “catch-up contribution.”

Roth IRAs Allow You to Diversify Your Exposure to Taxes

When you contribute to a 401(k) or other tax-advantaged accounts, you save money on taxes now with the promise to pay them when you begin taking withdrawals.

A Roth IRA, on the other hand, requires the opposite approach. By investing in a Roth IRA with after-tax dollars, you can look forward to tax-free withdrawals when you reach retirement age.

If you believe you might be in a higher tax bracket upon retirement, investing in a Roth IRA is also one way to shield yourself from higher taxes in the future.

Unlike other retirement plans, the Roth IRA offers some pretty generous rules when it comes to removing your funds from an account. You can withdraw any contributions from your Roth IRA at any time without penalty.

You’ll notice I said contributions and not earnings, however. Let’s say you contributed $6,500 to your Roth IRA in the last few years for a total contribution of $13,000 but managed to accumulate $3,000 in earnings during that time.

Per Roth IRA rules, you can only take out your initial contribution without penalty, which includes the original $13,000 you put in.

You Won’t Be Forced to Take Distributions Once You Reach a Certain Age

One reason so many people love the Roth IRA is that it offers flexibility in retirement. Not only can you take out your contributions early if you need to, but you aren’t forced to take distributions once you reach a certain age, either.

A 401(k) and traditional IRA, by comparison, force you to take distributions at age 70 1/2 or pay a penalty. If you want as many financial options as possible when it comes to riding out your retirement, this is a huge benefit.

You Might Not Be Able to Contribute in the Future if Your Income Grows

If you think you might earn more money in the future, contributing to a Roth IRA now is a very smart move. Even though a high income might preclude you from using this investment vehicle in the future, any funds you stash away in a Roth IRA will continue growing until you need them.

| BENEFIT | DESCRIPTION |

| Additional Savings | Contribute Even After Maxing Out Other Retirement Plans; 2024 Limit: $7,000 ($8,000 for 50+) |

| Tax Diversification | Funded With After-Tax Dollars, Allowing Tax-Free Retirement Withdrawals |

| No Penalty Withdrawal | Withdraw Contributions (Not Earnings) Anytime Without Penalty |

| No Forced Distributions | Unlike 401(k)s and Traditional IRAs, No Required Distributions at Age 73 |

| Income Limitations | Invest Now If You Anticipate Higher Future Income That May Disqualify You |

How to Qualify For a Roth IRA

You might be wondering what it takes to qualify for a Roth IRA to begin with. Here are the main factors to consider when figuring out whether or not you can contribute to a Roth IRA this year:

- You Must Have Taxable, Earned Income. During the year you want to contribute to a Roth IRA, you must earn income from a full-time or part-time job, self-employment, or a small business.

- Your Contribution Limits Are Based on Your Age. If you’re under the age of 50, you can contribute a maximum of $7,000 combined to a Roth IRA or traditional IRA account. If you’re over age 50, the maximum you can contribute is $8,000.

- You Must Meet Income Guidelines. Depending on your income, you might be able to contribute up to the maximum limit, be allowed to contribute a reduced amount, or might not be eligible to contribute to a Roth IRA. Also, keep in mind that if your income fluctuates, you might be able to contribute to a Roth IRA in certain years and not others.

| Type of Income | Age-Based Contribution Limits | Income Guidelines |

| Must Have Taxable, Earned Income From Full-Time/Part-Time Job, Self-Employment, or Small Business | Under 50: $7,000; Over 50: $8,000 | Eligibility to Contribute Based on Income; Can Very Year to Year |

If you file taxes as a single person, your Modified Adjusted Gross Income (MAGI) must be under $161,000 for tax year 2024 to contribute to a Roth IRA, and if you’re married and file jointly, your MAGI must be under $240,000.

Where to Open a Roth IRA

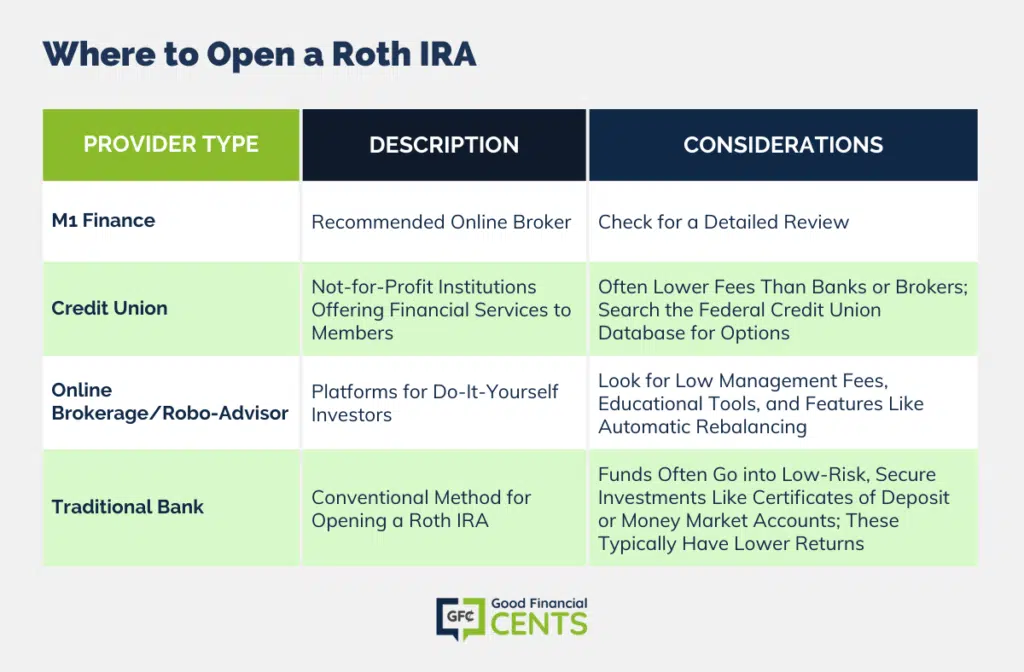

Our favorite option for Roth IRAs is M1 Finance. You can read our full M1 Finance review here.

Opening a Roth IRA is always a good idea, but if you fall into one of the above income categories, then going without a Roth IRA could cost you a huge break on your taxes. The beautiful thing about tax credits is they’re a direct reduction in the amount of tax you owe, whereas tax deductions only lower your taxable income.

If you can benefit from funding a Roth IRA and getting a Saver’s Tax Credit, there are plenty of ways to get a Roth IRA account activated.

Before opening an account, ask about any account maintenance fees. Also, you’ll want to get an idea of how each provider handles customer service. Here’s where you can find a Roth IRA.

Credit Union

Credit unions are not-for-profit institutions that offer their members financial services. Since their mandate is to serve their members, credit unions are often known for having lower fees than traditional banks or brokers. If you’re not already a member of a credit union, you can search the federal credit union database to get started.

Online Brokerage

For investors who want to take a do-it-yourself approach to their finances, using an online brokerage or robo-advisor can take the pressure out of the process. Make sure to find one with a low management fee. It’s wise to also pay attention to other services and features that would benefit you, like educational tools and automatic rebalancing, which adjust your investments at set intervals.

Traditional Bank

If you prefer to stick with a traditional method, you can open your Roth IRA at a bank. When you open a Roth IRA at a bank, your money typically goes into a highly secure, low-risk investment vehicle, like a Certificate of Deposit or money market account. Keep in mind these types of investments typically have lower returns.

Read More: The Best Places to Open a Roth IRA

The Bottom Line on Roth IRA Tax Deductions

While Roth IRA contributions are not tax-deductible, they offer significant advantages for retirement planning.

Contributions are made with after-tax dollars, but the potential for tax-free withdrawals in retirement can be a game-changer.

Moreover, certain taxpayers can benefit from the Retirement Savings Contributions Credit, providing an indirect tax incentive to contribute.

With flexible withdrawal options, no mandatory distributions at a certain age, and the potential for tax-free growth, a Roth IRA is a valuable tool for many.

If eligible based on income guidelines, individuals should consider opening and contributing to a Roth IRA, not only for retirement benefits but also for the potential tax advantages.

I came here on accident, and at the end of the article, i realized my Youtube ‘friend’ Jeff is the one who wrote the article? Man, I love your Youtube videos. If no one has seen them, you are missing out on great financial advice! Thank you for your contribution to everyone’s wealth, Jeff! Many blessings to you, and your family

Thanks for watching, Gio!!

Waited a bit too late this year to convert from Traditional to Roth. 2016 would have been a prime year, due to low income from unemployment. Tried the 1st of January, but they could not convert, since it was not filed by Dec. 31st. My accounting friend though they still could, but I intend to this year, even though it may cost a few more dollars tax.

I think 20 years ago, traditional was OK, but I’d never go that route now.

Thanks for clearing up some things, and all your insight on Roth IRAs. Since I’m over 59.5, it will be a smart move for me this year!!

Thx Jeff!!

At age 78, can I convert a Traditional IRA (balance around 36K) to a Roth IRA? If so, what would be the advantage of doing so? Would I have to pay taxes on the amount converted?

Hi Norman – You can, and the conversion will be potentially taxable, depending on your tax situation. The benefit would be that you will be able to make tax free withdrawals once the money has been converted. Since you are over 59.5, you will not need to pay tax on the withdrawals of principal, though investment income will be taxable for five years. No penalty in either case though, due to your age.

Good advice to open a Roth IRA with an online brokerage account. Why are so many people relying on social security when they can take control of their finances by opening their own brokerage account and investing in ETFs and forgetting about it for 10, 20, 30, or even 40 years? There are plenty of books and helpful blogs like your own which explain these matters. I think there are a lot of people who just want that shiny new car rather than to carefully plan their financial future!

In addition to the fact that not everyone has a focus on retirement planning. That’s what I’m trying to do on this blog – raise awareness of both the challenges of retirement planning, and the many options available.

There really are no income limits for Roth contributions. There are just two ways to open Roth Accounts. If you earn more than the Roth allowable limit you can do a backdoor Roth Conversion. This is the same thing but with a few more steps.

1 – Open and IRA

2 – Request an IRA to Roth IRA conversion

3 – Start investing

It’s so simple. I do this every year without talking to anyone, it’s and option of my broker. I just make the change online.

If you are in the 25% tax bracket, you only pay 25% on the portion of your income that falls into the 25% bracket. The rest of your income will be taxed at the bracket it falls into. The oversimplification may have been used for simplicity, but it should be noted somewhere that it is an oversimplification.

Yes, anybody is able to take all their traditional IRA’s and old retirement plans and convert them to a Roth IRA. The amount you convert will be taxed, but it still can be an attractive move for those that feel that the deductions are going nowhere but up.

Awesome video! Thanks for the insight 🙂

Good answer to a question that comes up a lot in my tax office. I also like using the Rollover as a Roth conversion whenever it is practical. Being a tax guy, I have to look at the other things going on on that year’s tax return before a final decision.

Great informative links – love the video, as always! A pleasure to learn.