Car dealerships are notorious for making the car buying process overly difficult. Try figuring out how much a car actually costs, and you’ll see exactly what I mean.

First, there’s the sticker price a car dealership advertises.

From there, you can find the manufacturer’s suggested retail price (MSRP) to compare to.

Table of Contents

If you negotiate well, you may even work your way down to the dealer’s bottom line.

Unfortunately, the path from the sticker price to bottom dollar pricing is often shrouded in mystery. And if you’re not careful, you can wind up paying more than a car is truly worth – or paying more than you can afford.

But pricing isn’t the only way car dealerships can screw up your finances. Not only do they make negotiating prices a weird and stressful experience, but they’re awesome at convincing you that their new cars are worth outrageous sums of money.

Keep in mind that, as of late 2023, the average new car loan came in at well over $48,000. And the average new car payment, according to Yahoo! Finance, is over $700 per month – for 68 months!

When you consider the fact that the median household income was only $59,039 in 2017, those numbers are absurd.

If you already have an idea of what you’re in the market for, check out our Car Affordability Calculator to see what your payment and price range should be.

BONUS:

Four Steps to Help You Nail Down a Monthly Payment You Can Afford

Like it or not, it’s up to you to figure out how much you can truly afford to spend on a car. No matter what, don’t leave it up to your sales guy to decide how much you can borrow.

Why? Because according to their facts and figures, your credit and income may qualify you to buy just about anything on the lot.

True “affordability” is never dictated by lenders or big banks. At the end of the day, only you know how much you can afford to spend on transportation and your other bills.

So, how do you determine how much you can afford?

Step #1: Figure Out Your Monthly Income

If you’re not using a budget already, you may not know exactly how much you earn each month. Before you can decide on a car payment, this step is crucial.

Take out your pay stubs and add up your regular income in an average month. If you get paid the same amount every few weeks, this part is easy. If your income fluctuates, on the other hand, you may have to estimate your average income based on several months pay.

Step #2: Subtract Your Expenses

Once you have a handle on your income, you have to add up all your monthly expenses, too. How do you normally spend your money? Make sure to add up all your fixed expenses (rent, insurance, television, phone, internet, etc.) and estimate your fluctuating expenses (utility bills, gas, food, etc.).

Lastly, you should also plan some savings in your monthly budget. If you’re not saving cash every month, you should be, right?

Once you’re done tallying your monthly expenses and savings goals, compare your income to your expenses. How much money do you have left over every month?

Step #3: Estimate Costs for Gas and Insurance

Will the price of insurance and gas go up or down when you buy a newer car? If you anticipate changes, make sure to add them to the simple budget you created in steps 1 and 2.

Here’s a good example:

Let’s say you earn $1,000 every payday for a monthly take-home pay of $4,000.

Here’s how your expenses look once you add them up:

- Rent: $1,200

- Food: $600

- Cable & Internet: $80

- Gas: $100

- Car Insurance: $80

- Utility Bills: $250

- Health Insurance: $200

- Childcare: $600

- Savings: $400

- Total: $3,510

In this scenario, you should have around $490 left over to spend on a car each month. That’s how much you could spend, but not necessarily how much you should spend.

Step #4: Use a Car Payment Calculator

Once you have an idea of how your monthly income and expenses look, you can gain more insight by experimenting with a loan calculator like the one below.

Enter the price range you plan to shop in, along with the interest rate you hope to qualify for. From there, you can see what type of monthly payment you might end up with.

- Affordability $ to $

- Payment $ to $

Warning: Your car loan term is longer than years to retirement or invalid data was entered. Retirement charts are hidden.

Let’s say you’re looking at an older Toyota Corolla hybrid that’s currently for sale at a local dealership. They’re asking $21,000, but you hope to drive off the lot for $20,000.

By playing around with a loan calculator, you can experiment with different scenarios.

If you borrowed $20,000 at 5 percent APR and paid your car off over 60 months, for example, your monthly payment would be $377.42.

Or, maybe you saved up a $3,000 down payment and wanted to pay your loan off over four years instead of five. If you borrowed $17,000 for four years at the same rate, you would owe $391.50 per month.

5 Important Tips When Buying a New or Used Car

While the above guidelines make it possible to find out how much car you can afford, that doesn’t mean that number should be your actual budget. If you want even more freedom in your monthly expenses, you should strive to spend less on a car than you can afford to spend.

Here are some tips that can help:

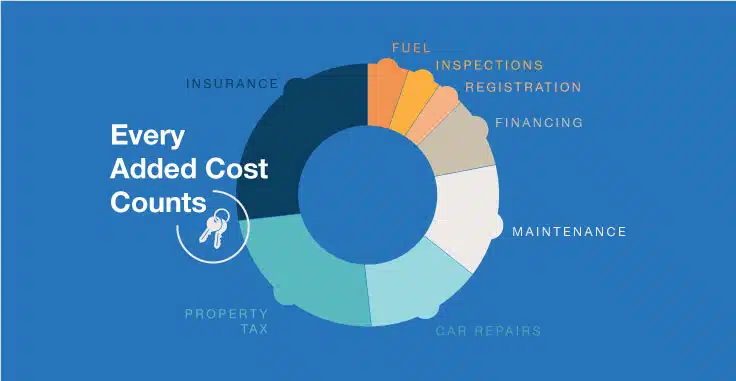

1: Don’t Forget About Added Costs

In addition to the price of your new vehicle, you’ll need to cover license plates, insurance, and any additional taxes levied by your state. You will also need to pay sales tax on your vehicle, although your lender may wrap your taxes into your loan if you ask.

When it comes to plates and insurance, you should also remember that newer cars come with higher expenses in these categories. If you want to save money on plates and insurance, buying an older car (or at least one that isn’t brand new) should help.

#2: Leave Plenty of Wiggle Room In Your Monthly Budget

If you worked out a monthly budget using the guidelines above, you probably know how much you can afford to pay for a car each month. Still, don’t forget to leave plenty of wiggle room in your budget.

Life happens, and surprise expenses pop up. Roofs and cars need repairs. You might have unexpected medical bills or lose your job. The more “extra cash” you have in your budget, the better off you’ll be.

#3: Shop Around for the One Expense You Can Control – Auto Insurance

While you cannot control the price of license plates for your new vehicle, you can shop around to get the best rates on auto insurance. The price of your car insurance policy can vary by hundreds of dollars depending on the agency you buy from. By comparing prices and policies, you can make sure you’re getting the best deal you can.

#4: Buy Used Instead of New

New cars depreciate up to 9 percent the moment you drive them off the lot according to Edmunds, and they continue depreciating rapidly until they’re worth almost nothing. While the same can be said for used cars, you can at least avoid the initial drop that comes in the first few years.

Keep in mind that car payments are determined using more than the purchase price of a new or used vehicle. On top of principal payments toward your loan, you’ll also pay interest.

While new cars tend to come with higher prices and lower interest rates, older cars come with lower prices (on average) and higher rates.

#5: Stick To Your Budget

This final tip may seem obvious, but it’s incredibly important. If you’ve gone through the trouble of setting a limit on how much you can spend on a car, make sure you stick to it!

A savvy car salesman will do anything to get you to buy a newer model or spend more money. Why? Because their income depends on it!

By setting limits ahead of time, you can ensure you’re the one in control.

Related: The One Monthly Payment KILLING Your Wealth

The Bottom Line – Affording a New Car

The bottom line when it comes to affording a new car is that it takes planning and consideration. You need to have a budget in mind, decide what type of car you can afford, and save up for the down payment. Make sure to factor in all of the costs associated with owning a car, including financing, insurance, taxes, registration fees, maintenance, and gas.

Shopping around for the best deals on these costs can help you stay within your budget. With careful planning, saving, and shopping around for the best deals, you can end up with the perfect car for you without breaking the bank.

FAQs – How Much Car Can You Afford?

To calculate your budget for a car, start by assessing your monthly income and expenses. Then, consider how much you can comfortably afford to spend on a car payment each month, factoring in other expenses such as gas, insurance, and maintenance.

The ideal debt-to-income ratio for buying a car is generally considered to be 36% or less. This means that your total debt payments, including your car payment, should not exceed 36% of your gross monthly income.

A good credit score for buying a car is generally considered to be 700 or higher. However, a lower credit score may still qualify you for a car loan, but you may face higher interest rates.

Should you mention depreciation? If you decided to sell the car a year after buying it new, you’ll get a lot less for it than you paid.

I found this article to be very informative. Many Americans can’t do without a car, but few understand how much car they can afford. Keep on posting!

That’s an issue I’m running into: the car that I want/need is too pricey for my taste. I don’t know what to really do when it comes to that because the dealership has to make some type of profit as well yet I want to get it at a price that’s reasonable.

We recently bought a new car and financed it. I was able to get a loan for 1.49% so I knew I would be able to earn more investing the car money compared to what I will end up paying in interest.

Great tips. It helps to get a good auto loan that suits your financial capability. There are many things to consider before buying a car — most car buyers forget to include maintenance costs in their budget and it becomes difficult.