For years, I have been an independent contractor. I’ve grown my home business into something that earns a steady income for my family.

In fact, I’m the primary breadwinner. Becoming an independent contractor is one of the most profitable small businesses to start this year.

As an independent contractor, I have a degree of freedom in choosing my own schedule and even determining who my clients are. I’m also part of a segment of the workforce that is growing in demand.

Many companies are turning to independent contractors because it can be less expensive. My hourly rate might be higher than the rates commanded by “regular” workers, but I save a company in other ways:

- No benefits to pay

- No overhead costs

- No payroll taxes to pay

A few years ago, CNN Money pointed out that an employee working for $14 an hour actually costs an employer $20 an hour.

While most of my clients pay more than $20 for a project, the reality is that they just have to pay me for the project rather than continue to pay me day in and day out and pay the other costs associated with maintaining a full-time employee.

Table of Contents

What Is an Independent Contractor?

An independent contractor is a self-employed individual who provides services to clients on a contract basis. They are not considered employees of the company they work for and are responsible for their own taxes, benefits, and insurance.

Independent contractors typically work on a project-by-project basis and are not bound by the same employment laws and regulations as employees, which can provide more freedom in terms of how they operate their business.

They have the ability to set their own schedule, work from anywhere, and choose the projects they want to work on.

However, they are also responsible for their own business expenses, such as equipment and office space, and they are not eligible for benefits such as health insurance or retirement plans that employees receive.

How Do You Become Self-Employed?

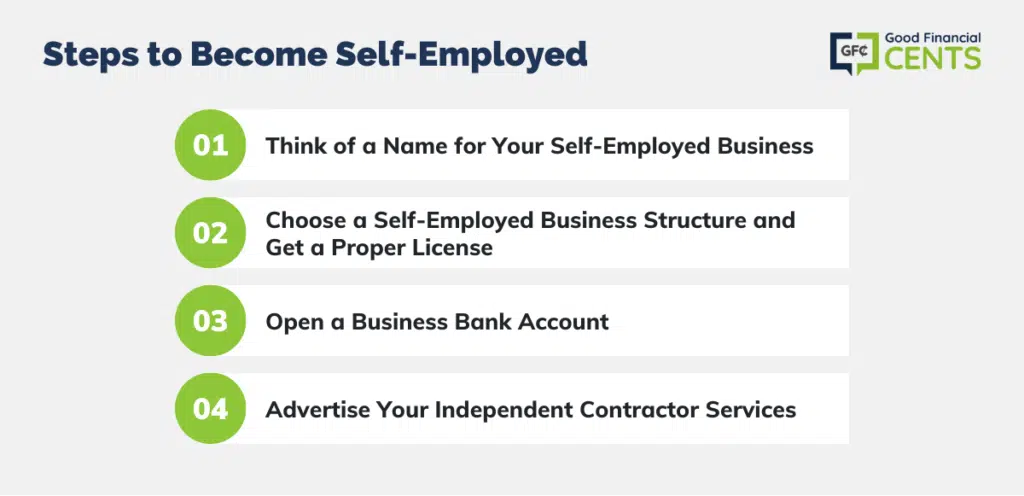

The independent contractor arrangement can be a win-win in many ways. If you are looking to become an independent contractor, either to replace your “day job” or just to make a little extra money on the side, here are some steps you need to take:

1. Think of a Name for Your Self-Employed Business

Consider what services you will offer, and then pick a name that describes what you do. I call my business Miranda Marquit Freelancing.

It’s straightforward, and you know — immediately — what is done and who is offering the services. If you want to offer graphic design or web development services, think of ways to include those descriptors in your business name.

Have a solid understanding of who you are and what you have to offer, and be able to clearly define what you do.

I’m still tweaking my “elevator pitch,” but it’s coming along nicely. When you can encapsulate what you do, it’s easier to convince potential clients to hire you.

2. Choose a Self-Employed Business Structure and Get a Proper License

Next, think about how you want your business organized. My business is set up as a Limited Liability Company (LLC).

I’m the general partner, and my husband is the limited partner. Others, though, find that an S-Corp or C-Corp makes more sense for them. (Here’s a comparison of using LLC versus C-Corp.)

In some cases, it can even make sense to remain a sole proprietorship for a time. Consult an accountant or tax professional for more information about what might be most appropriate for you.

You should also get a proper business license. Your state or locality likely requires you to have a license, even if you are providing independent contractor services and making money from your own home.

If you plan to have an LLC, LLP, or S-Corp., you definitely need a license. However, there are cases in which sole proprietors need licenses, too. Check the requirements, and make sure you abide by them.

3. Open a Business Bank Account

Even sole proprietors should keep business expenses separate from personal expenses. Open a business bank account to keep everything separate and to improve your ability to keep good records.

Many of the best checking account providers for consumers also have business accounts you can use.

This is a critical step that many new independent contractors miss. You must separate your personal money from your business money.

If you are self-employed and someone sues you, and your money isn’t kept separately, then everything you have can be pulled into the lawsuit.

Even if your new independent contracting business just made $200 this year and you have $50,000 in the bank together with that money, it can all be targeted in a lawsuit.

You need to keep good records so that you are prepared to come tax time. Make sure that you are setting aside some money in your business bank account to help you pay quarterly taxes. Don’t forget that you will have to pay your portion of payroll taxes, as well as the employer portion.

This is known as the self-employment tax. Organize your finances now so that you can avoid headaches later.

4. Advertise Your Independent Contractor Services

Finally, you need to get out there with your business. Let others know what you are doing and how you can help them with the services you provide.

It helps to have a home on the web, so set up a website. You can even write a blog. Post your resume and relevant samples online.

Use social media to promote your services and to connect to others. (Social media is one of the key ways you can advertise your self-employed services while still saving money for your small business.)

If you are generous in the way you promote others, and if you offer insightful information and ideas, eventually, potential clients will notice — and hire you.

The Bottom Line – The Skinny on Becoming an Independent Contractor

Becoming an independent contractor can be a rewarding way to work for those who value flexibility and independence. However, it is important to carefully consider the pros and cons before making the decision to become an independent contractor.

By understanding the steps and legal requirements, as well as finding clients, setting your rates, and managing your expenses, you can help ensure a successful transition to being an independent contractor.

Remember, being an independent contractor requires self-discipline, hard work, and good time management, but the rewards can be great!

FAQs Becoming an Independent Contractor

Being an independent contractor allows for more flexibility in terms of working hours, location, and projects.

Independent contractors have the ability to set their own schedules, work from anywhere, and choose the projects they want to work on.

Additionally, independent contractors are not bound by the same employment laws and regulations that employees are, which can provide more freedom in terms of how they operate their business.

The main disadvantage of being an independent contractor is that they are not eligible for the same benefits and protections as employees, such as health insurance, retirement benefits, and unemployment insurance. Independent contractors are also responsible for paying their own taxes and may have to pay self-employment tax.

The legal requirements for becoming an independent contractor vary depending on the state and industry. In general, independent contractors are required to have a business license, register for taxes, and obtain any necessary permits or certifications. It’s important to consult with a lawyer or accountant to understand the specific legal requirements for your area and industry.

Setting your rates as an independent contractor depends on a variety of factors, such as the level of your experience, the cost of your expenses, and the market rate in your area. Researching the going rate for similar services in your area can help you to determine a fair rate for your services.

Independent contractors enjoy flexibility in their work schedule, location, and project selection. They have the freedom to set their own hours and can work from anywhere. Additionally, they are not subject to the same employment laws and regulations as employees, providing more autonomy.

Hello im trying to start my own handyman business I got my ein tax number and my business certificate I’m in the middle of getting my LLC on line it’s all filled out just waiting to finish my web site and I have opened a business account with my bank I’m out of work on leave of absence for recovering from carpal tunnel surgery but I work as an employee for a glass company I want to start my own handyman business I’m very talented and have done lots of work for friends for free they said I should start my own company but it’s scary and need help taking the proper steps please help

I’ll hopefully be referring to this in the near future–great insight. Thank you!

This is a great way to make side income or start a side business, however it is incredibly important that a person marketing themselves as an independent contractor be very, very competent and capable of performing the work. This business is based on references.

This is great advice for people getting started in business for themselves. These tips will put many new entrants ahead of the game.