When you are comparing banks, you likely seek out the ones you know by name first.

While that is, of course, just fine, you may want to keep your eyes up if you want something specific from your bank or lending institution, especially personal loans, savings accounts, and business accounts.

BBVA is one of those you may want to research a little further.

BBVA AT A GLANCE

| Year Founded |

1964 |

| Coverage Area | BBVA Is a Brick-And-Mortar Bank in Seven States. It Also Offers Its High-Apy Money Market Account in 41 States and Washington, D.C. |

| HQ Address |

15 20th St S, Birmingham, AL 35233 |

| Phone Number |

1-844-228-2872 |

BBVA Company Information

Table of Contents

BBVA has over $86 billion in assets, and 672 branches, mostly in Texas, but also in Alabama, Arizona, California, Florida, Colorado, and New Mexico.

In fact, it’s the second-largest bank in Alabama, the fourth-largest bank in Texas, and the fifth-largest in Arizona.

BBVA is a full-service bank, with a strong online banking platform.

They offer a full range of checking and savings accounts, as well as CDs, money markets, credit cards, personal and auto loans, and home loan financing.

BBVA Features and Benefits

Accounts Available: In addition to CDs, and checking and savings accounts, BBVA also offers traditional, Roth, SIMPLE, and rollover IRAs, as well as Simplified Employee Pension Plans (SEPs). They also provide 529 plans and Coverdell Education Savings Accounts (CESAs).

ATM Access: You will have access to 64,000 BBVA and Allpoint ATMs across the U.S., all with no ATM fees.

Overdraft Management: Among other strategies, BBVA enables you to set up account alerts so you always know what’s going on with your accounts. Key alerts can be set up for account management including account balances, account summary, and insufficient fund alerts.

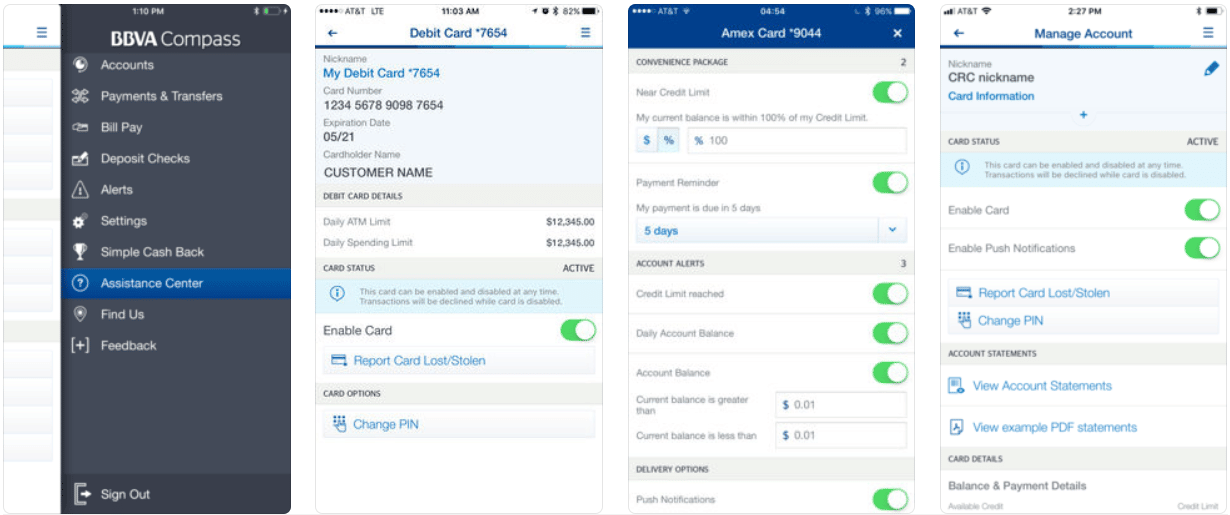

BBVA Wallet: This feature gives you convenient access and control over your payment cards, and includes the following benefits:

- Keep Track of All Your Purchases in Real-Time and Keep Them Organized on the Go

- Activate Bbva Debit and Credit Cards

- Make Your Bbva Credit Card Payments

- Change the Pin on Your Bbva Cards From Your Wallet App

- Report a Lost or Stolen Card in a Flash or Temporarily Block Transactions if You Misplace Your Card

- Redeem Rewards in Real-Time at Any Merchant

- Receive Custom Offers to Earn Cashback Based on How You Spend With Simple Cash Back

You can download BBVA Wallet from Google Play or the App Store.

Customer Service: BBVA can be contacted by phone or by message via Online Banking (24 – 48 hour response time). They have a third method – Request a Call.

By clicking the “Request a Call” button on the website, a bank representative will contact you by phone. That will keep you from having to navigate the phone system.

Customer Service is available Monday – Friday, 7:00 AM to 10:00 PM, and Saturdays, 8:00 AM to 4:00 PM, Central Time.

Video Banking: With this service, you can connect to a live teller, 24 hours a day, seven days per week.

You can do virtually anything with Video Banking that you can with a visit to a local branch.

That includes making transfers, asking questions, making deposits and withdrawals, getting cash back, printing monthly statements, reordering checks, making payments, or issuing a stop payment.

Mobile Banking: BBVA’s Mobile App enables you to take advantage of Mobile Bill Pay, and Picture Bill Pay, as well as to transfer money between your own bank accounts, or to other parties.

It also offers Mobile Deposits, where you can make a deposit by taking a photo of your check, and then submit it for processing.

You will also receive real-time alerts, daily activity notices, and periodic account alerts.

BBVA Security: The Bank uses a combination of online and mobile banking alerts, as well as online security.

They also offer BBVA ClearBenefits which can provide you with benefits in the event that you are a victim of identity theft. Those benefits include:

- Identity Theft Restoration: This is available 24/7 to investigate fraudulent activity, issue fraud alerts to state agencies and financial institutions, and more.

- Identity Theft Insurance: This provides up to $25,000 to cover lost wages, legal expenses, and defense costs for civil and criminal lawsuits.

The fee for the ClearBenefits program is $5 per month.

FDIC Insurance on all Deposits: As an FDIC participating bank, BBVA provides $250,000 coverage per depositor on all savings products.

BBVA Checking Account Offers

BBVA offers multiple checking account options:

BBVA Online Checking Account

This account has some stellar features, listed below:

It comes with the following features:

- Apply With Only $25 Opening Deposit

- No Monthly Service Charge

- Complimentary Online Banking and Mobile Banking, Bill Pay, and Online Statements

- No ATM Withdrawal Fees at Any BBVA or Allpoint® ATM

- BBVA Is a Member of the FDIC

The Online Checking Account is highly recommended.

BBVA Free Checking

This is a free checking account with the following full-service features:

- Apply With Only $25 Opening Deposit

- No Monthly Service Charge

- No ATM Fees at BBVA ATMs

- BBVA, Member FDIC

This free online banking service is a great option for your checking account.

Premium Checking

Like the other checking account options, Interest Checking can also be opened with as little as $25.

But in this account, you also earn interest on your balance. You also enjoy certain benefits including:

- Tiered Interest Rates on Your Checking Balance

- Unlimited Check Writing

- Complimentary Online Banking, Mobile Banking, and Bill Pay

- Complimentary Premium Checks and 50% Off Other Styles

- Automatic Rebates on ATM Fees Charged by Other Banks (Two per Statement Cycle)

The account has a Monthly Service Charge of $25, but this can be waived under certain conditions, including if you maintain an average daily collected balance of at least $5,000 in the account.

If you apply for a BBVA checking account and don’t qualify, BBVA can offer a second chance with Easy Checking. Easy Checking has a monthly Service Charge of $13.95.

BBVA Savings Products and Rates

BBVA offers at least three different savings accounts, as well as a money market account and certificates of deposit (CDs).

BBVA Build My Savings

With this account, you can earn a Match Bonus on regular transfers.

How much you will receive in the bonus will depend upon the amount of your opening balance, your regular transfers to the account, as well as the term of your plan.

The term can be six months or 12 months.

6-Month Plan: With an opening balance of $25 and a monthly contribution of $25, you can earn a match of $1.75; with an opening balance of $2,350 and a monthly contribution of $25, you can earn a match of $25 (maximum).

OR, with an opening balance of $25 and a monthly contribution of $415, you can also earn $25.

12-Month Plan Terms: With an opening balance of $25 and a monthly contribution of $25, you can earn a match of $3.25; with an opening balance of $4,700, and a monthly contribution of $25, you can earn a match of $50 (maximum).

OR, with an opening balance of $25 and a monthly contribution of $415, you can also earn $50.

The account requires a minimum $25 opening balance and has an interest rate of 0.01% APY.

BBVA Savings Account

This account requires a minimum opening balance of $25 and has an APY of 0.01%.

The account provides you with easy access to your money, 24/7 access to online and mobile banking, and a link to your checking account for overdraft protection.

The account does come with a quarterly service charge of $15.

However, that charge can be waived if you have automatic, recurring monthly transfers of $25 or more into the account from your checking account, or if you maintain a minimum daily collected balance of $500 or more.

BBVA Savings Account

With this account, you earn interest on your balance but pay no quarterly service charge.

It requires a minimum opening deposit of $25 and has an APY of 0.01%.

It has all of the benefits of the BBVA Savings Account.

BBVA Money Market Account

With a Money Market account, you can access your money whenever you need it, and enjoy access to both Online and Mobile Banking.

Here are a few features that come with a BBVA Money Market Account:

- Apply With Only $25 Opening Deposit

- Interest Compounds and Is Credited Monthly

- Easily Withdraw Money at a Branch and via Bbva ATMs With No ATM Fees

- Link to Your Bbva Checking Account For Overdraft Protection

- BBVA, Member FDIC

Certificates of Deposit (CDs)

With a minimum opening deposit of $500, no maintenance fees, and a $500 opening minimum opening deposit, you can earn good rates of return on BBVA CDs.

BBVA CDs can provide you with a great short-term investment.

BBVA Investments

BBVA offers both Self-Directed Investments and Full-Service Investments.

Self-Directed Investments

You can hold your investments through a self-directed brokerage account, that will enable you to trade in equities, mutual funds, exchange-traded funds (ETFs), and options.

You can also establish a margin account.

Full-Service Investments

With this account option, you can have your investments professionally managed. There’s even a wider selection of investments available with this option.

Those include mutual funds, unit investment trusts, fixed and variable annuities, equity-linked CDs, fixed-income securities, and professionally managed portfolios.

You can even have 529 plans and other college savings programs managed through this option.

BBVA Student Banking

BBVA offers its Free Checking account in combination with its ClearSpend Prepaid Card.

With Free Checking students have no monthly service charge, free online and mobile banking with Bill Pay and account alerts, free online and paper statements, and a free Visa Debit Card, which you can personalize with your favorite photo.

By paying a small monthly fee, you could also get no-fee use of other bank’s ATMs.

There are no-load fees when you add money to the account.

No credit score check will be required in order to get the card.

You will receive real-time transaction alerts, as well as the Built-in Budget Tracker feature. This feature enables you to manage your finances and eliminate overspending.

Second Chance Banking

This is a program designed for people who have past credit problems and need a fresh start.

It will provide you with an opportunity to rebuild your credit.

Benefits include:

- No Monthly Service Charge With BBVA Free Checking

- Easy Budget Management With the BBVA Clearspend Prepaid Visa Card

- A Secured Credit Line With the Optimizer Credit Card

- Earned Interest on Your Savings Account Balance With BBVA Savings

The Optimizer Credit Card is designed to help you rebuild your credit. See details in the next section.

BBVA Lending

The bank also offers unsecured personal loans, as well as auto loans.

The auto loans come with same-day decisions on most loans, as well as free online insurance quotes.

BBVA Home Loans

Home Equity Line of Credit (HELOC): The loan has a variable rate APR that’s based on the Prime Rate, plus 0.38% to 2.74%. The current rate ranges from 4.63% to 6.99%, but they are currently offering a 12-month introductory rate at Prime MINUS of 1.51%. Loan proceeds can be used for any purpose.

Home Equity Loans: Like a HELOC, you can use home equity loans for just about any purpose. They have fixed rates, terms, and monthly payments. Rates currently start at 4.94%.

Mortgages: Fixed or adjustable-rate mortgages that are available for refinancing your current mortgage, cash-out refinancing, or buying, renovating, or building a new home.

Current mortgage rates look like this:

| Product | Interest Rates | Discount Points | APR |

|---|---|---|---|

| 30 Year Fixed Rate | 4.750% | 0.875% | 4.967% |

| 20 Year Fixed Rate | 4.500% | 1.125% | 4.824% |

| 15 Year Fixed Rate | 4.000% | 1.250% | 4.427% |

| 10 Year Fixed Rate | 4.000% | 1.125% | 4.589% |

BBVA Pros and Cons

BBVA Pros

BBVA Cons

History of BBVA

BBVA was founded in 1964 and is headquartered in Birmingham, Alabama.

Between the years 2004 and 2014, BBVA acquired several banks in the US, including Compass in 2007. For a time, BBVA went by BBVA Compass. Now it is just BBVA.

Bottom Line

BBVA will work best for smaller deposits, particularly on the Money Market Account and the 12-month CD.

Their rates on other accounts, as well as for larger deposits or longer-term CDs are not competitive.

But some of their products are innovative, particularly the Second Chance Banking program, which gives you access to both a checking account and a secured credit card so that you can rebuild your financial life following credit troubles.

If you’d like to get more information, or you’d like to open an account, visit the BBVA website.

How We Review Banking or Financial Institutions

Good Financial Cents undertakes a comprehensive review of banking and financial institutions, analyzing service offerings, customer satisfaction, and financial stability. Our intention is to provide readers with a balanced overview, aiding them in their financial journey. We consistently emphasize editorial transparency.

We source data from these institutions, reviewing account offerings and other key services. This data, when combined with our in-depth research, forms the foundation of our evaluation. Institutions are subsequently rated on a range of criteria, resulting in a star rating from one to five.

For further insight into the criteria we use to rate banking and financial institutions and our evaluation approach, please refer to our editorial guidelines and full disclaimer.

BBVA Review

Product Name: BBVA

Product Description: BBVA, Banco Bilbao Vizcaya Argentaria, is a global financial institution offering a wide range of banking and financial services. With a strong international presence, BBVA provides customers with banking solutions that include savings accounts, loans, credit cards, and investment options.

Summary of BBVA

BBVA is a prominent multinational bank known for its comprehensive suite of financial products and services. Operating across numerous countries, BBVA offers a diverse array of banking solutions, from traditional savings and checking accounts to mortgage loans, credit cards, and investment opportunities. The bank emphasizes innovation and digital banking, with user-friendly online and mobile platforms that facilitate easy access to accounts and financial management.

-

Cost and Fees

-

Customer Service

-

User Experience

-

Product Offerings

Overall

Pros

- Provides Global Banking Services

- User-Friendly Online and Mobile Platforms

- Comprehensive Range of Financial Offerings

- Emphasis on Responsible Banking

Cons

- Smaller Branch Network in the United States

Some Accounts May Have Fees

Limited Compared to Specialized Firms

Variable Customer Service

What are money markets & cd’s earning?

HI,

Can I invest in a money market or CD if I live in Illinois?

You have a 1year 2.7% available?

Are there fees associated with this, as well?

Thank you..

I was trying to finishh applying for checking and I hit a wrong key and it all went away! how can I retrieve it?

I just opened an account with Compass. Very nice people that treated me as a customer.

Hello,

I love the Financial Tool on the BBVA website. It is amazing and I use it constantly. The only issue I have is that I am paid every 28 days and there is no where on the frequency of pay for me to reflect that. It has monthly. They should have where you can customize your frequency of pay. Such as every 4 fridays. That is my only suggestion. Otherwise a great website.

Have tried for weeks to talk to someone about redeeming points no one will answer phones day or night if online service is all you are offering then you should let customers know my time is also valuable

My account was compromised twice. No one seem to know anything and your placed on hold constantly and or sent to another department. They wanted me to travel 3 hrs away to a branch to verify my information. I instead closed my accounts by which it took 3 hrs to do after being placed on hold and calls dropping. The worse bank i have came in contact with thus far. When other banks tout customer service I for one took that for granted. When you deal with this bank you will see that customer service is something all banks do not have. Bank with them at your own risk.

Worst credit card company in the country. They offer a 0% interest rate credit card for a few months, like many other credit card companies. But, until you sign up, you don’t realize that they don’t accept electronic payments. If you pay your credit card bill online, they force your bank to print an actual check and mail it. On top of that, their “system” takes a full week to “process” this check after it comes in the mail. This means that your payment is always late. Once it is even a few days late (mine was 3 days), they immediately close your account and report your card as “closed by company due to late payment” on your credit report.