When purchasing life insurance, it is important to have choices. As there are many various needs, policyholders can be better served by being able to essentially “customize” their plans in order to keep up with changes in their lives.

One of the most flexible forms of permanent life insurance is universal life. This type of coverage provides guaranteed death benefit protection, along with a fixed rate of interest on the cash value component of the plan. Cash in the policy can grow on a tax-deferred basis, and because of this, it can grow substantially over time.

Yet, universal life, or UL, also provides so much more than what is offered with more “generic” forms of permanent coverage such as whole life insurance. For example, with a universal policy, if the policyholder’s needs happen to change, then he or she may actually alter the policy to better fit their then-current scenario. This greatly differs from whole or term life policies, which are “locked in” once the policy is in place.

Table of Contents

How Universal Life Insurance Works

Universal life is a form of permanent coverage. This type of policy offers the policyholder death benefit coverage, as well as a cash value component. Yet, while this may sound very similar to whole life insurance, universal policies differ in many ways – starting with the fact that these policies can offer much more flexibility.

Similar to other types of permanent life insurance, the cash that is inside of a universal life insurance plan is allowed to grow on a tax-deferred basis. However, the policyholder is allowed to move the funds between the cash value component and the insurance component of the policy.

What this means is that the policyholder can, in essence, change – within certain stated guidelines – the amount of the policy’s death benefit amount. In addition, the policyholder can also change the amount and the due date of the premium as well.

There are also more underlying options that are available in terms of allowing a universal policyholder’s cash value to grow. For example, policyholders can typically choose from a variety of different investment vehicles from both the fixed-income and the equity investment markets.

Types of Policies

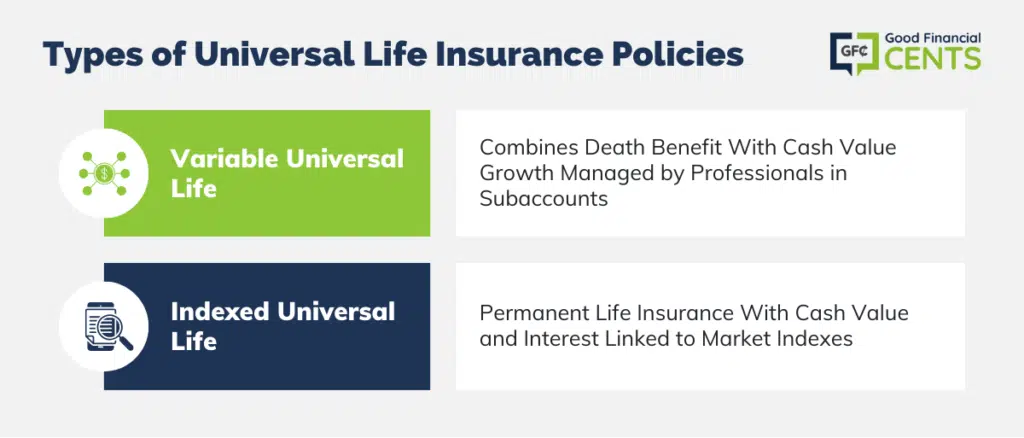

In addition to regular universal life, there are other variations of the product. For example, there are variable universal life and indexed universal life. Variable universal life insurance is a type of permanent coverage that offers both a death benefit, as well as cash value build-up. Just like regular universal life, the policyholder can – within certain guidelines – change both the timing and the amount of the premium.

Rather than growing at a set rate of interest, though, with variable universal life, the funds in the cash component are actually managed professionally (unlike variable life policies that are managed by the policyholder) in underlying “subaccounts” and can be in entities such as stocks, bonds, and mutual funds.

This can allow the opportunity for additional growth. However, it can also present more risk if the market has a negative return.

Overall, variable universal life insurance can provide policyholders with a number of different subaccount options – which can also include fixed option choices that have a minimum rate of interest. These policies also offer flexible premiums, payment schedules, and death benefit options.

The indexed universal policy option allows policyholders the ability to own permanent life insurance protection, along with a cash value component that provides them with not just a guaranteed interest rate but also interest that is based partially on one or more market indexes, such as the S&P 500.

With this type of policy, the policyholder may incur a cap that limits the maximum amount of growth that they can attain in a given period of time. However, in return for that, they are also provided with a minimum “floor.” This means that they are also protected against market losses – essentially guaranteeing them that they cannot lose any of their principal.

In many ways, indexed universal life insurance works in a similar fashion as most other types of coverage in that the policyholder pays their premium, and the net premium is then applied to the actual life insurance death benefit.

A portion of the premium is also credited to the policy’s “index” account, which is credited at the index growth rate. Over time, the cash in the policy’s cash portion can grow significantly – especially as the funds are protected against any downside market losses. Over time, the cash can grow substantially – and can be accessed via withdrawals or policy loans.

As with most other universal life insurance policies, these plans also provide the flexibility to either increase or decrease the policy’s premium within certain limits. In addition, the policy also offers the ability to increase the cash value portion, yet with downside protection. This can be viewed as a true win-win.

Considerations When Purchasing

When purchasing a universal policy, it is important to keep several factors in mind. First, there should be a good mix of different investment options to choose from for the policy’s cash component. This will help to both increase growth opportunities and to diversify.

It is also a good idea to check for policy guarantees. Most universal life insurance policies will provide at least some form of a guarantee regarding their investment options, as well as the minimum amount of premium that it will take to keep the policy in force. Likewise, it is important to ensure that the universal policy is flexible and can be adjusted in the future.

How Much Will a Policy Cost?

When determining the quote on a universal life policy, there are a variety of factors that are considered by the insurance company. This is because the insurer wants to determine whether it is taking on an appropriate amount of risk and that it will not have to pay out a large amount of claim soon after it accepts an applicant for coverage.

Some of the key factors that life insurance carriers consider when reviewing an applicant for coverage include the following:

- Age

- Gender

- Height and weight (primarily, weight as it pertains to the individual’s height)

- Smoking status

- Alcohol consumption

- Marital status

- Employment and income status

- Overall health condition

- Family health history

- Hobbies (whether or not risky or dangerous hobbies such as sky diving or scuba diving take place)

In addition, policies that are “traditionally” underwritten will typically require the applicant to take a medical exam, though if needed, we can find those carriers that will offer a policy for life insurance with no medical exam. This will entail meeting with a paramedical professional who will take a blood and urine sample.

These samples will be tested for certain types of health ailments that could also pose certain risks to the company in terms of having to pay out a potential insurance claim.

Depending on the applicant’s overall health, after all of the information has been reviewed, the insurance underwriters will be able to obtain a much clearer picture of the person’s risk status. At that time, a coverage determination can be made, as well as a premium price can also be determined.

If the individual is considered to be of “average” health – and will also likely have an “average” life expectancy given his or her health – then they will typically be rated as a Standard policy.

If, however, the individual has a slight health issue – but not enough to be declined altogether for coverage – then they will typically be rated as a Substandard. This means that they will still be offered coverage. However, that coverage will be provided at a higher premium rate.

Conversely, if the individual is in excellent physical and mental health, then it could turn out that the insurance company rates him or her as a Preferred. In this case, they will be able to obtain their policy at a lower-than-average premium rate.

For applicants who are declined for coverage due to health issues, there are other options for coverage. These can include going the route of a no-medical exam policy or a guarantee issue policy. In these cases, an applicant will not be required to go through a medical examination in order to obtain a policy.

While the premium for this type of coverage is typically much higher than for comparable coverage that is traditionally underwritten, it could be the only option in some instances.

How and Where to Get the Best Quotes

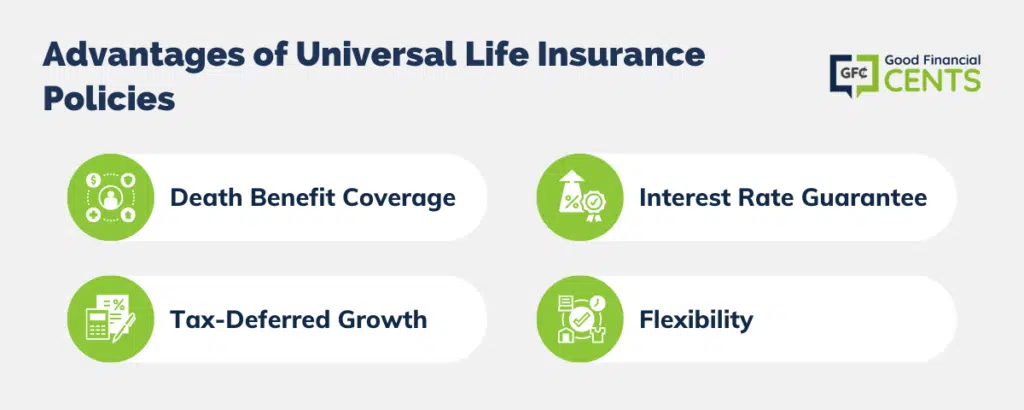

For those who want death benefit protection, along with additional benefits, universal life insurance should certainly be a consideration. These policies offer many advantages, such as:

- Death Benefit Coverage: UL policies provide lifetime death benefit protection – provided that premium payments are made within the policy’s grace period.

- Tax-Deferred Growth: The cash within the policy’s cash value component is allowed to grow on a tax-deferred basis. This can allow funds to increase exponentially, as tax will not be due until the time of withdrawal.

- Interest Rate Guarantee: The cash in the policy’s cash value component is also provided with a guaranteed rate of interest. This means that the growth is guaranteed not to fall below a set level.

- Flexibility: Because UL policyholders are allowed to change the amount and timing of their premium payment, these policies come with a great deal of flexibility to grow and alter as one’s coverage needs change over time.

When searching for the best universal life insurance quotes, it is important to ensure that you obtain several different options. This will allow you to compare the policy features – as well as the premium quotes – from a number of insurers and then decide on which option will provide you with the best scenario for you and your specific needs.

In doing so, it is typically best to work with an agency or company that has access to more than just one insurance company. When you’re ready to begin your search for universal quotes, we can help. We work with many of the top universal carriers in the marketplace today – and we can provide you with all of the important information and details that you need that help you with your purchase decision.

We can do so directly via your computer – and without the need to meet in person with an agent. When you’re ready to begin the process, just fill out and submit the form on this page.

We understand that the purchase of life insurance can be a big decision. That is why we want to ensure that you have all of the pertinent information that you need in order to make the right decision. We will assist you in the following ways:

- Choosing the right type of coverage – whether it be term, whole life, or universal protection

- Determining the proper amount of death benefit

- Finding the company that will offer you the benefit – and the premium quote – that will suit your needs and your budget

Final Thoughts – Finding the Best Universal Life Insurance Quotes

When it comes to finding the best life insurance fit, having options and tailoring your plan to your needs is key. Universal life insurance offers flexibility, guaranteeing death benefits and letting your cash value grow without immediate taxes. Unlike other types of coverage, universal policies allow you to adjust your plan as your situation changes.

Variations like variable and indexed universal life bring more choices for investing and unique ways to earn interest. Remember, the cost and benefits of universal life insurance depend on factors like your health, age, and market conditions. So, seeking advice and comparing quotes from different companies is essential to make the right choice.

Does MetLIfe a good choice? But I heard the MetLIfe does not have any investment/financial advisors to help policyholders, is it truce? How to find and get assistance from investment or financial advisors for life insurance?

yzou