If you are looking for the best ways to invest 20k-25k wisely, you’ve come to the right place to learn where to start.

I’m going to show you how to invest that money based on your current attitude toward investing, whether your primary goal is to make sure your money is safe and sound or it’s to earn as much money on your money as possible.

Sneak Peek: Top 3 Ways to Invest $20,000-$25,000

Investing $20k is serious business, but no fears, no matter the size of the investment, even if it’s a million dollars, I have great ideas and methods for you to try to maximize your investment to its fullest potential.

Best Ways to Invest $20k-$25k in 2024

Table of Contents

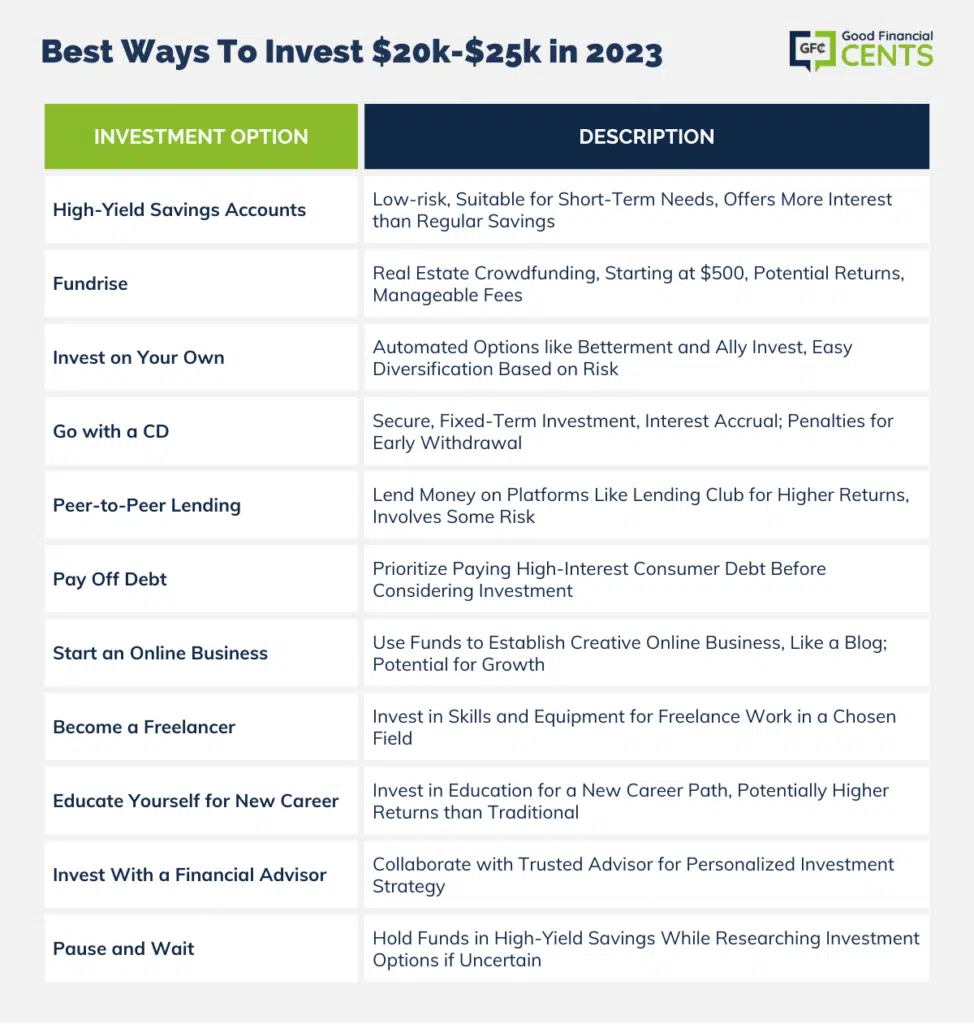

These are the best ways to invest $20K-$25K wisely in 2024.

1. High-Yield Savings Accounts

Ah, the beauty of simplicity!

High-yield savings accounts allow you to earn a low rate of return (when compared to stocks and bond investing, for example) while ensuring that unless armageddon comes, your money will be safe.

Most people use this method when they are investing $10K into an emergency fund or if they need to have immediate or short-term access to funds.

Why are they called “high-yield” when you earn a low rate of return? Well, they earn more interest than most savings accounts on the market.

If you feel this is the right type of account for your 20-25 grand, check out some of my favorite high-yield savings accounts.

These types of accounts are great for saving emergency fund money – or any money you don’t want to disappear overnight. These accounts are also great to use after the loss of a loved one when you’re emotional and are more prone to make poor investing decisions.

5.26%

Interest Rate

varies

Min. Initial Deposit

2. Fundrise

Fundrise is one of the best investment sites out there. Fundrise specializes in a special niche: Online real estate and private asset platform. If you’re looking for a way to invest in properties without having to do the day-to-day duties of a landlord, Fundrise can be an excellent way to get your foot in the door.

One of the advantages of investing with Fundrise is you can start with as little as $10. Fundrise uses all of the smaller contributions to invest in larger loans.

Fundrise is a company that owns income-producing real estate. According to Fundrise’s client returns page, they had a return of 22.99% back in 2021, for all investors as a whole.

When you’re looking at fees, Fundrise has a 1.0% annual fee. This includes all of the advisor and asset management fees.

While 1.0% might sound like a lot compared to some other investment options, Fundrise has lower fees than other REITs.

| I’ve been investing with Fundrise since 2018. Disclosure: when you sign up with my link, I earn a commission. All opinions are my own. |

There are several benefits of choosing Fundrise. If their returns stay on course, you’ll get drastically better returns than you would with a traditional REIT or with other P2P sites. On the other hand, these investments are going to be a little riskier than other options.

Getting started and investing with Fundrise is easy. You can create an account and start investing in no time. Even if you don’t have any experience with investing in real estate, Fundrise makes it incredibly easy. In fact, they now have Fundrise 2.0, which will handle all of the investing for you. Fundrise 2.0 will select the eFunds and eREITS and diversify your investments based on your goals.

3. Invest on Your Own

There are a number of ways you can invest yourself into a long-term portfolio. I’d only encourage you to do so, however, if you know what you’re doing. Even when you’re investing using automated, passive techniques, you might find yourself lacking the degree of financial planning necessary to reach your goals. You’ve been warned.

Betterment is a pretty nifty way to invest online in a mixture of stocks and bonds based on the degree of risk you can stomach. If you’re the kind of person who doesn’t mind risk, you’ll find that Betterment will recommend more stocks than bonds – and rightly so.

You will pay a low assets under management fee; however, Betterment automates investing and will re-balance your portfolio based on programmed protocols constructed on expert advice.

If you want your $20,000 to be automatically invested without much input from you, it’s worth it.

Ally Invest is another great option if you want to fine-tune your investing. It’ll only take 10 minutes of your time and you’ll be able to select the exact investments you want to add to your portfolio – and in what proportions. Ally Invest offers some pretty cheap trades but you’ll need to do your own investment research to discover the best strategy for you. Read our in-depth Ally review.

If you’re interested in reading more about the different brokerage platforms, consider our individual reviews for the following platforms:

4. Go with a CD (Certificate of Deposit)

There is no safer investment you can make than getting a certificate of deposit. With a CD, you put your money away for a set term, like a year, two, or even five. Your money accrues interest during that term, so it’s better than placing it in a traditional savings account.

The catch? If you take out your money before its maturity date, you’ll be penalized. If you have patience and time to spare, though, a CD could be worth your while, especially considering that interest rates on CDs are climbing.

While high-yield savings accounts are also a viable option for the risk-averse investor, the guarantee is slightly lower since you can access (and spend) your $20,000 plus interest at any time.

5.51%

Interest Rate

varies

Min. Initial Deposit

5. Money Market Accounts

These accounts are crazy boring, my friend. Yawn.

But the good news is that money market accounts are stable and sometimes offer the same protections as their savings account counterparts. Check with your local bank or credit union to see if they offer a money market account.

How about the interest? You’ll probably earn less than or equal to the amount you would with high-yield savings accounts. Still, if this kind of account is available to you and you need quick access to the money in case of an emergency, this is a good option.

6. Peer-To-Peer Lending

Peer-to-peer lending is a great way to invest money by loaning it to others. There’s certainly risk involved, but my experience with peer-to-peer lending is that it can provide a pretty stellar rate of return.

Lending Club is the largest peer-to-peer lender right now and you can get started by investing in one loan for as little as $25 per loan you invest in. That means you could invest 100 dollars and diversify into four different loans.

If you’d like to learn about peer-to-peer lending, I recommend that you check out my Lending Club review to get a feel for how the two largest P2P lender works.

7. Invest With a Financial Advisor

If investing $20,000 in a portfolio on your own doesn’t sound like a walk in the park, consider working with a financial advisor. A financial advisor can help you come up with a comprehensive strategy to reach your goals. But please, please! I beg you! Don’t just hire anyone!

Some financial advisors are out to practically rob you. In fact, if you haven’t yet, read my story of the woman who was duped into paying over $3,500 in variable annuity fees and didn’t know it.

Hire someone you trust and do your own homework too. You should understand the investments being proposed before you plop down your $20,000. Invest your money wisely by making sure your financial advisor knows what they are talking about, and before you know it, you will be asking them, “What is the best way to invest $500K!”

8. Pay Off Debt

“I’m in consumer debt up to my eyeballs and I’m not sure I should invest.”

Your hunch is a good one. You shouldn’t be investing yet, my friend.

How much consumer debt do you have? If it’s under $20K, consider using your stack of cash to pay off the debt. If it’s over $20K, you just might want to consider using it all. Just make sure you have somewhat of an emergency fund before you do.

Debt is like the anti-investment. And unfortunately, it’s quite a bit worse than that – debt almost always comes with a guaranteed condition of interest that you would owe to the lender. You see, your investments could go up or down in value. With debt, you’re always going to pay more than what you borrowed.

Not only that, but if you are carrying high consumer debt, it is probably losing interest much faster than you can gain it. Let’s say you had $1,000 of credit card debt burning you for 25% interest. That means every year you would pay $250 in interest payments. A good average for investments is 8%. That means you would have to invest $3,125 to just break even with the interest on your debt. So if you were to take $1000 and pay off debt, you can take the other $2,125 and start making money, instead of treading water financially.

9. Start an Online Business

“I’m entrepreneurial and creative. Seriously, I am. What should I do?”

You’re my kind of person. Here are some ways you can invest your money and have fun doing so…

Now, you may not be able to buy a building and start a restaurant with $20,000-$25,000. But you know what? That kind of money would take you pretty far if you were to start an online business.

You can use the money to have a professional web designer work on your website or pay a few writers to craft some informative pages for quick and easy reference for your readers. Really, the sky is the limit.

10. Become a Freelancer

You might even consider becoming a freelancer and buying some quality equipment for your business. Perhaps you love photography – invest in a great camera! Maybe you enjoy fishing – buy some extra rods, fishing gear, and become a river guide! $20,000 will take you quite far into starting your own freelance business.

11. Educate Yourself into a New Career

That $20,000-$25,000 can be used to invest in your education. Education, my friend, can turn into a lucrative career.

You may not have thought about the possibility of investing into your education, but that doesn’t mean it’s a bad choice. In fact, when you consider the return on your investment, you might make many times more than if you were to put the money into the stock market.

Investing in yourself is rarely a bad idea. The only time it might turn into financial waste is when you don’t use the education you receive to pursue a new career and actually land the job. That’s a risk, though, that’s usually worth taking.

12. Pause and Wait

“I’m not sure what I should do – even after reading this article.”

Don’t fret. It might just be time to flex your brain muscles and discover new opportunities. If you’re clueless on how to do that, this article should give you some ideas.

If you’re not sure how you should spend your money, please don’t until you’re absolutely sure. As I mentioned, you can park your money in a high-yield savings account while you figure out your options. It’s better to do nothing than to make a grave mistake.

Start Here

If the thought of investing your money absolutely terrifies you, don’t invest yet. Read all about The Money Uprising Movement™ and get a game plan for how you deal with money. Over time, as you practice these rules, you’ll gain the confidence you need to move forward.

I believe in you. That’s why I put this information out there – I believe you have what it takes to learn how to invest with confidence and manage your money better than ever. You can do it, and I’m here for you.

Final Thoughts – How to Invest $20,000-$25,000 in 2024

When you’re dealing with 20K to 25K bucks, you wanna be smart about it.

You can stash your cash in a high-yield savings account for safety, but don’t expect a big payday. Or, if you’re feeling a bit adventurous, check out Fundrise. It’s like investing in real estate without needing a ton of cash upfront, and it could pay off nicely.

Now, if you’re a DIY kinda person, Betterment or Ally Invest can make investing feel like a breeze. CDs are cool too, but you gotta wait it out, and Money Market Accounts keep things steady.

Thinking about peer-to-peer lending? Well, it can be rewarding, but it’s got its risks, so tread carefully.

And hey, don’t go it alone. Having a trustworthy financial advisor in your corner is a solid move. And sort out that debt before you dive into investing.

For the bold ones out there, online gigs or some extra education can open doors to success. Just remember, taking your time is better than rushing, and knowledge is your best buddy on this journey.

I am 25, years old , was saving since I was 17 years of age … my biggest dream is being a entrepreneur & having my own business but I just do not know what to invest it in , I find my self a little stuck , do you think I should flip my 20k , or keep saving ?

Hi Nicole – I’m not sure what you mean by “flip your 20k”, but yes, I’d keep saving. If you want to invest in a business, maybe invest half the money, and keep the other half in savings. That’s a way to diversify your money, which I strongly favor.

Hi, my name is Khadeeja Janneh. I am 59 years old and am a full time LPN nurse and am still working. I am about to receive $20,000 and am looking on how to invest. I am debating between a personal care home, a transportation business kind of similar to Uber, or owning my own store. I want to invest it in a way where I can thrive, but need a little help. What should I do?

Hi Khadeeja – Those are business ventures, not investments. You should discuss them with people you know who are already doing those businesses. My thinking though is that since you’re already an LPN, you have a good foundation, since that’s a stable career. You can probably even work at it part-time as you build your new business. Good luck to you!

My wife and I have a combined 270,000 in company 401ks. We also have 30,000 in cash we’d like to put into something. We are abut 7 to 10 years from early 60s retirement. We’ll clear about 100,000 from the sale of our house. What to do?

Hi Carl – It’s not possible to tell you how to invest without knowing your complete financial situation. But you should determine your risk tolerance first, then see which of the investments in this article will work for you. I will offer that since you’re within a few years of retirement you should be a little bit more conservative and avoid too much exposure to the riskiest investments. Also look at what you’ve been investing in up to this point, then decide whether or not it’s been working for you.

I just received a lump sum of 20k! I also just lost my job last month. I definitely need some advice. I’m debating on starting a cleaning business with my wife or possibly flipping houses with a friend. My only debt is my car and school loans which just differed since I’m unemployed. Any advice?

That’s a tough call Jamaal. You’re unemployed, and you have a car loan and school loans. You might try investing SOME of the money in a business, but don’t leave yourself broke. It sounds like you’ll need the money to survive. A better route may be to get a new job, and then decide how much to invest in a business or flipping houses. The problem is that neither the business nor flipping are guaranteed winners, and if it doesn’t work out, you’ll have no income – in addition to losing your $20,000. Please move carefully.

It’s one thing to take a chance with the money if you don’t absolutely need it. But it sounds like you do need it, so I think you need to concentrate on surviving in the moment, then hold any investing until your income situation is more stable.

I’m new in usa and i’m looking for some suggestions of good income small investments, i have a budget of 15 thousand dollars

Hi Majd – First make sure you don’t need the $15,000 for any immediate purposes. You should have some money in an emergency fund with enough to cover your living expenses for at least three months, as well as a stable income situation. If you’ve got that all covered, then look closely at the investment ideas in this article, see which ones interest you – and won’t be too risky for you – then start trying a couple of them.

I currently have around $10,000 in student loans (down from $20,000), I pay them off modestly although they carry low interest rate,s and I find I have make bigger returns by investing my money than immediately paying off the loans.

No consumer debt; have a savings. So, how to invest $20,000 — the Financegirl version: Put $20,000 on your student loans and guarantee your 7.9% interest rate back to yourself! 😉

Natalie,

With student loan interest rates so high, that is a no brainer to get a risk-free 7.9% rate of return. Good on you for recognizing that and putting your $$$ toward it!