For individuals who are young and in good health, shopping for life insurance is often easy and stress-free. Most of the time, young people only need to decide how much coverage they want and apply for a free quote online. Some companies that market term life insurance coverage even let qualified applicants start their policies without a medical exam.

Once you have reached the age of 50, however, your options for life insurance may not be quite so robust. You may have to buy a lower amount of coverage in order to secure a monthly premium you can afford, and it’s more likely you’ll need to undergo a medical exam and face increased scrutiny over your life insurance application.

Fortunately, you can get life insurance in your 50s and even in your 60s. You’ll just need to adjust your expectations, and you should be willing to shop around to ensure you’re getting the most coverage for a price you can afford.

Table of Contents

- Unique Challenges for Those Over 50 Buying Insurance

- Finding the Right Life Insurance Policy When You’re 50

- Do People Over the Age of 50 Still Need Life Insurance?

- Which Type of Life Insurance Is Best When You’re Over the Age of 50?

- Life Insurance Rates for Over 50-Year-Olds

- The Bottom Line – Life Insurance on 50-Year-Olds

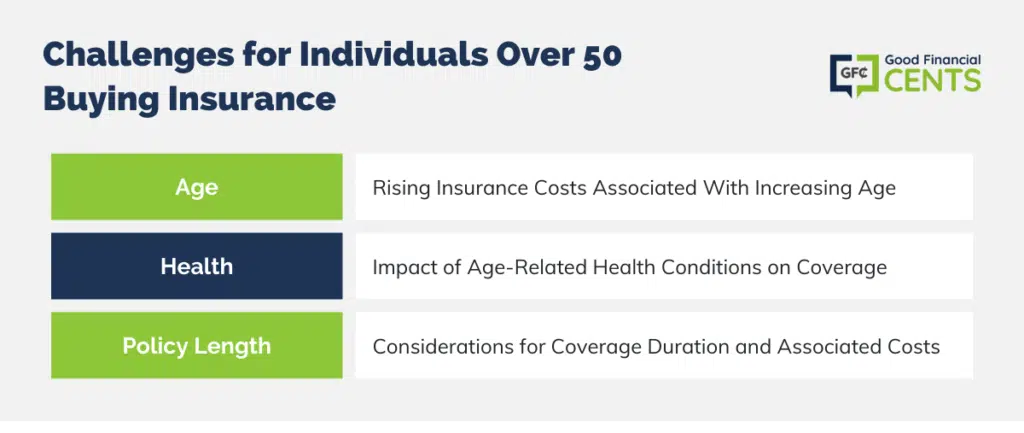

Unique Challenges for Those Over 50 Buying Insurance

As you start shopping for a life insurance policy, you’ll probably notice a few factors that are working against you. These factors aren’t your fault, but they still affect your ability to qualify for life insurance coverage or affordable monthly premiums.

- Your Age: Where life insurance can be downright cheap when you’re young and healthy, policies only get more expensive as you age. Once you’ve surpassed the age of 50, the price you’ll pay for a meaningful amount of coverage can easily balloon. This is why it’s more important than ever to spend time shopping around and comparing life insurance quotes.

- Your Health: The older you are, the more likely you will have acquired a chronic health condition that can make getting life insurance coverage a challenge. You’ll need to answer health questions when you apply for a life insurance policy, and the answers you provide could set off alarm bells with the life insurance provider or bar you from purchasing a policy at all.

- Policy Length: Another issue when you’re older is the term of coverage you can qualify for and purchase. A 30-year term policy will likely be fairly expensive if you’re already 55, for example, whereas a 10-year term policy that only provides a decade of coverage will likely be more affordable. Many older individuals opt to buy permanent coverage that lasts a lifetime, yet permanent coverage like whole life or universal life can also be incredibly expensive.

Finding the Right Life Insurance Policy When You’re 50

When working with only one insurer, you are locked into just that insurance company’s underwriting requirements — as well as that insurer’s prices. And, while it may sound strange, not all life insurance coverage is underwritten or priced identically.

| For example, an applicant who applies to one insurance company may be accepted as a “standard” policyholder and charged an average premium rate, while he or she may be accepted only as a “substandard” policyholder at another carrier and charged a higher rate of premium — even though they submitted the same answers to the questions on the application for coverage. |

This is why it is essential to work with an expert in the insurance field who can submit your information to numerous insurance carriers. Just like when shopping for any other important item, it’s always best to compare prior to making your final determination.

This is where we come in.

When shopping for insurance, we can help you compare dozens of plans and companies in a matter of minutes; just use our site searching tool to find reviews on your preferred carrier. This way, you can compare pricing and coverage amounts without having to apply to each individual insurer.

Regardless of your age or health, it’s important that you get the insurance coverage that your family will need. You can start comparing quotes from the best life insurance companies by clicking your state above.

No matter where exactly you are in your 50s, you can definitely get a policy that meets your needs. Planning for your eventual death is not a fun task, but it’s one of the most important things that you can do for your family or loved ones.

Do People Over the Age of 50 Still Need Life Insurance?

You may be wondering if people still need life insurance coverage once they’re in their 50s.

After all, life insurance coverage is geared toward people who need income replacement during their working years, as well as those with children and other dependents at home.

By the age of 50, you should be winding down your working years, and it’s possible your kids have moved out to begin their adult lives. Why would you need life insurance at this point?

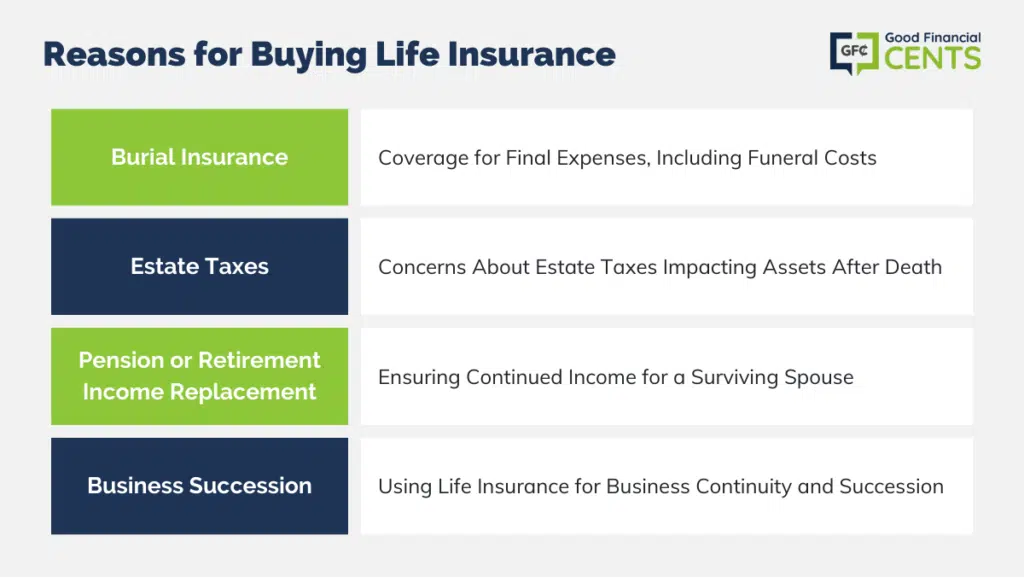

The thing is, consumers can easily need life insurance at any age, and this includes those who are over 50. Although your children may be grown and are no longer depending on your income for their living expenses and needs, there are numerous other reasons for having — or for keeping — this essential financial protection.

Some of the most important reasons include:

- Burial Insurance: Regardless of your age, you’ll eventually need burial insurance to cover your final expenses. Today, the average cost of a funeral can easily exceed $10,000 when factoring in items such as the funeral service, burial plot, headstone, transportation, flowers, and a casket or urn. If there are final medical and hospice costs incurred, this could add significantly to the total.

- Estate Taxes: Estate taxes are another potential area of concern for those who are over age 50. For those who are faced with having to pay estate tax upon death, this liability can erode up to 50% or more of a decedent’s assets. If there is no plan in place, such as life insurance proceeds, for paying these taxes, survivors could end up selling off other assets, such as retirement investments or even precious family heirlooms, in order to come up with the money. Unfortunately, when such assets are sold in this manner, they are often done so at far below market value.

- Pension or Retirement Income Replacement: When a retiree dies, their pension may not continue on for their spouse. Buying a life insurance policy can ensure your spouse has some income to keep up with living expenses and enjoy life once you’re gone.

- Business Succession: Life insurance can help business owners who are over age 50 to use it as a business succession tool. Proceeds from a life insurance policy could be used to keep a company running while a replacement owner or partner is located, or while a suitable buyer for the business is found.

These are just a few of the reasons individuals over the age of 50 may want to purchase life insurance, but there are plenty of others. Just keep in mind that, no matter what age you are, it’s only natural to want to leave something behind. A life insurance policy can help you do exactly that, which is why consumers in nearly every age group purchase this important protection each year.

Which Type of Life Insurance Is Best When You’re Over the Age of 50?

When shopping for a life insurance policy at any age, it’s easy to become overwhelmed by all the options you’ll find online. Before you commit to shopping for life insurance policies, you should know and understand how each type of coverage works.

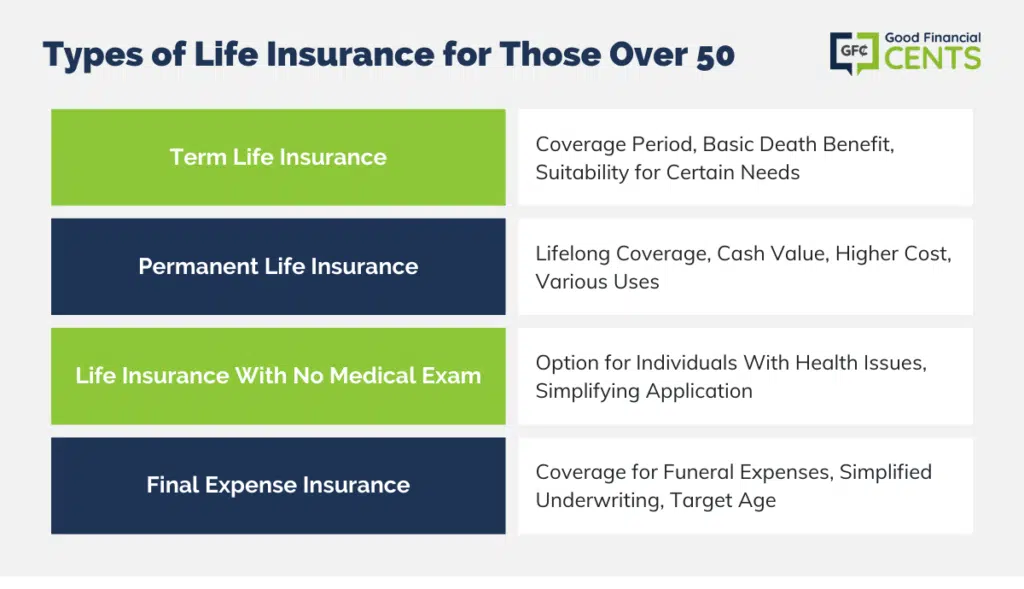

Term Life Insurance

Term life insurance is sold for a certain length of time, or a “term,” which means that the policy will cover you for only a certain period before it expires. Most term policies are sold for 10 years, 15 years, 20 years, or 30 years. With a term life insurance policy, you are purchasing basic, “no-frills” coverage.

This means that you are obtaining pure death benefit coverage without any cash value or savings component.

Even though the coverage on a cheap term life insurance policy runs out after a given period, these policies can be beneficial in certain situations. For example, term policies are often considered for “temporary” needs, such as providing protection during the length of a 15- or 30-year mortgage balance.

In other words, if an individual wanted to make sure that the balance of their home mortgage was paid off for his or her survivors in the event of death, they could purchase a term life policy for the same length of time in which they would have a remaining mortgage balance.

If a term life insurance policyholder wishes to continue their coverage upon the policy’s expiration, they will need to reapply at their current age and health condition. This will typically mean that the premium amount for the new coverage will be higher, and that’s true even if the face amount of the policy remains the same.

For many people, this is no problem because the premiums on term policies are much lower than the alternative options.

Related >> How Much Does a Million Dollar Term Life Insurance Policy Cost?

Permanent Life Insurance

If you don’t like the idea of your life insurance expiring, then go with a whole life insurance plan. Permanent life insurance plans never expire, but they are more expensive.

The money that accrues in a permanent life insurance policy’s cash value component can typically be borrowed or withdrawn by the policyholder for any need that he or she sees fit. This can provide the policyholder with additional funds for the down payment on a home, the purchase of a car, debt repayment, or even supplemental retirement income in the future.

Although the premiums for permanent life insurance can be more expensive than premiums for a term policy, the amount of the premium on a permanent policy will typically be locked in for life. This means that the policyholder will not need to worry about his or her premiums increasing in the future — even if they get sick or wind up with a chronic health condition.

In addition to all of the other uses of life insurance for those who are over age 50, a permanent life insurance policy can also be used for the simple purpose of supplementing one’s savings.

For example, a whole life insurance policy can help you build up cash on a tax-deferred basis that can be drawn upon in the future in a number of different ways. Unlike money that is invested in the unpredictable stock market, funds that are inside the cash value of whole life insurance are provided with a guaranteed rate of growth.

In addition, because of their tax-deferred nature, funds are allowed to compound over time with no tax due on the gain until the time they are withdrawn in the future.

This can provide not just safety, but also peace of mind in knowing that the principal is protected regardless of what is happening in the market, as well as in the economy overall. In addition, the death benefit on these life insurance plans is also tax-free for the named beneficiary (or beneficiaries). This means the money can be used by survivors for their financial needs, and all without having to hand over a portion of it to the IRS.

While whole life is the most popular type of permanent life insurance coverage, you can also look into universal life insurance, variable life insurance, or even variable universal life. These niche policies tend to work better for consumers who have a specific financial goal, but they could work well for your needs depending on your situation.

Whole life insurance will cost considerably more than a basic term life policy, as mentioned previously. Further down, will look at a comparison of term life vs whole life insurance for 50-year-olds.

Life Insurance With No Medical Exam

Many who have severe health issues may have to look into the option of no medical exam life insurance. This is often the only option for those who have been declined life insurance in the past.

Each time an individual applies for life insurance coverage, the underlying insurer is essentially taking a risk on whether or not it will be required to pay out a claim. If the insurance carrier feels that the risk is too great, it will either charge the insured a higher rate of premium or it will deny the applicant for coverage altogether.

The good news is that people over 50 in the market for life insurance still have plenty of options — you just need to know where to look. You may assume that you won’t be able to get affordable coverage, but that’s why we suggest that you look into a no-medical exam plan from Haven Life to get your life insurance protection.

Final Expense Insurance

Another type of insurance is referred to as “Final Expense” insurance. This is typically bought to pay for funerals and heavily marketed to 50-85-year-olds with lower incomes.

The premise of final expense is to cover any burial costs, final debts, etc. – so the policies are typically $10k-$25k simplified issue whole life policies. Most people who purchase these are without savings to cover their final expenses.

What’s attractive about them is they have simplified underwriting (no medical exam) and offer a quick approval.

Carriers that offer these types of policies include Mutual of Omaha, Foresters, and AIG.

Life Insurance Rates for Over 50-Year-Olds

A healthy man who is 50 years old can pay as little as less than $15 a month for $100,000 in term life insurance coverage, whereas a healthy 59-year-old can pay as little as $27 a month for the same policy. Even at the age of 59, a $400,000 policy can cost less than $100 a month. Note that these are non-smoker rates for a 10-year term policy.

If you have health conditions like cancer, heart disease, or diabetes while looking for life insurance, you can expect increased rates. Smoking will also increase your life insurance rates, regardless of your health.

Here are some sample quotes for life insurance on 50 year-olds:

Annual Term Life Rates for a 50-Year-Old Man

| AGE | POLICY AMOUNT | 20 YEAR TERM | 30 YEAR TERM |

| 50 | $250,000 | $477 | $853 |

| $500,000 | $864 | $1,561 | |

| $1,000,000 | $1,630 | $3,006 | |

| 60 | $250,000 | $1,370 | Not Available |

| $500,000 | $2,533 | Not Available | |

| $1,000,000 | $4,905 | Not Available |

Annual Term Life Rates for a 50-Year-Old Woman

| AGE | POLICY AMOUNT | 20 YEAR TERM | 30 YEAR TERM |

| 50 | $250,000 | $378 | $639 |

| $500,000 | $667 | $1,154 | |

| $1,000,000 | $1,190 | $2,176 | |

| 60 | $250,000 | $977 | Not Available |

| $500,000 | $1,777 | Not Available | |

| $1,000,000 | $3,362 | Not Available |

As mentioned above, the cost between a basic term life policy compared to a whole life policy is noticeably different. Here’s a look at some sample rates for whole life insurance for both 50 and 60-year-old men and women.

Annual Whole Life Rates for a 50-Year-Old Man

| AGE | POLICY AMOUNT | WHOLE LIFE INSURANCE |

| 50 | $250,000 | $5,462 |

| $500,000 | $11,120 | |

| $1,000,000 | $22,648 | |

| 60 | $250,000 | $9,076 |

| $500,000 | $18,217 | |

| $1,000,000 | $35,783 |

Annual Whole Life Rates for a 50-Year-Old Woman

| Age | Policy Amount | Whole Life Insurance |

| 50 | $250,000 | $4,583 |

| $500,000 | $9,082 | |

| $1,000,000 | $18,078 | |

| 60 | $250,000 | $7,476 |

| $500,000 | $15,098 | |

| $1,000,000 | $29,538 |

As you can see from the tables above, whole life insurance, since it is permanent in nature, will command a much higher premium. For a 50-year-old man to purchase a $250,000 term policy (assuming he’s in good health), he will only have to pay $824 per year in premiums.

That same man would have to fork over $5,462 per year to secure a whole-life policy. That’s a difference of $4,638 per year!

The Bottom Line – Life Insurance on 50-Year-Olds

At the end of the day, you’ll never know how much you might need to pay for life insurance unless you shop around. And really, that’s the main piece of advice I hope to impart to individuals ages 50 and older.

Purchasing life insurance coverage can be more challenging when you’re over the age of 50, but with careful consideration and exploring different options, you can still secure meaningful coverage to protect your loved ones’ financial future.

Can you help? a 7 year insurance on my mother’s life. She is aged 80 Thank you