When at the point of wondering how to invest $200,000, that’s definitely a good sign. After all, having this amount to invest means you’re on the fast path to building long-term wealth.

This is especially true if you can invest $200,000 and leave it alone for a decade or two, giving compound interest plenty of time and space to do its job.

But, how much can you end up with if you invest $200,000 wisely, today?

That really depends on how you invest your money and the average return you get. If you found a way to invest $200,000 and could leave it to earn a 6% return for 20 years, you’d have $641,427.09 after two decades of growth.

If you can manage to get a 10% return, on the other hand, you’d end the next two decades with $1,345,499.99.

Table of Contents

How to Invest $200,000 Starting Today

Still, the real problem is figuring out how to invest hundreds of thousands of dollars. As a financial advisor, I suggest spreading out a $200,000 investment into several different buckets. That way, you can diversify your $200,000 investment and increase exposure within different areas of finance that have the potential to grow.

Although your personal investment allocation can — and should — vary depending on your age, your investing goals, and what you hope to achieve, here are some basic guidelines and allocations to consider.

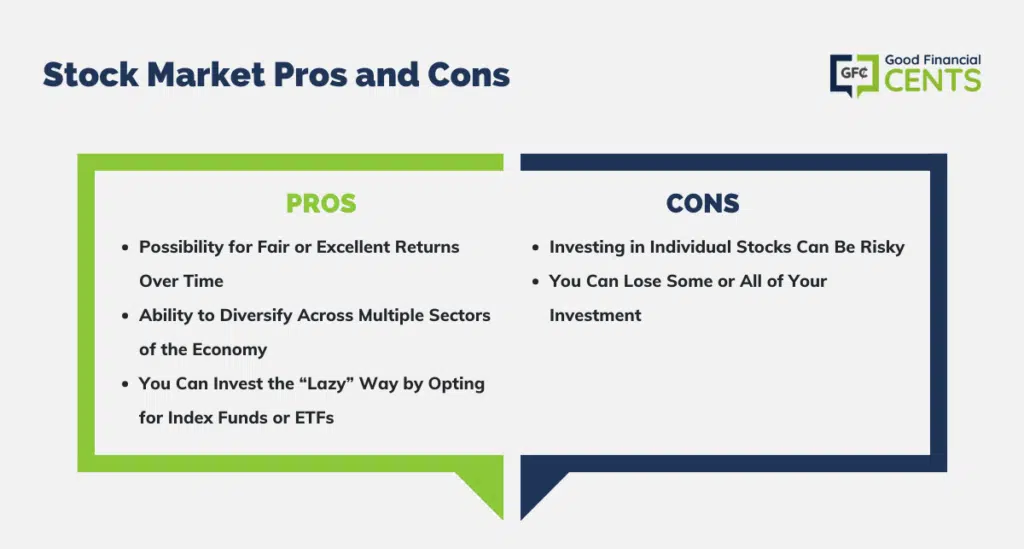

1. Invest in the Stock Market

Suggested Allocation: 40% to 50%

Risk Level: Varies

Investing Goal: Long-term growth

The stock market is where most of us save for retirement already, mostly through the use of tax-advantaged retirement plans, like a 401(k), SEP IRA, or Solo 401(k). Yet, you can also invest in stocks, bonds, index funds, and any other type of securities with the help of a brokerage account.

Although brokerage accounts don’t offer any upfront tax advantages, you get the chance to invest in any number of stocks, ETFs, and more. Also, the brokerage account you open is considerably more liquid than any tax-advantaged retirement plan.

Where most retirement accounts charge penalties if you need to make a withdrawal before retirement age, you can sell stocks and other securities and access your money without penalty whenever you want. You’ll just need to account for capital gains taxes when you do.

How to Get Started: M1 Finance is a popular app that makes investing in stocks, bonds, and ETFs a breeze. You can set up automatic trades, and you can spread your original investment amount far and wide thanks to the availability of fractional shares.

It also lets you choose an expertly curated “pie” of investments that are already designed to meet a specific investing goal. The best part? When you open an M1 Finance account, you can invest without any commissions or platform fees.

Who It’s Best For:

Also, consider checking out Stash to compare your options.

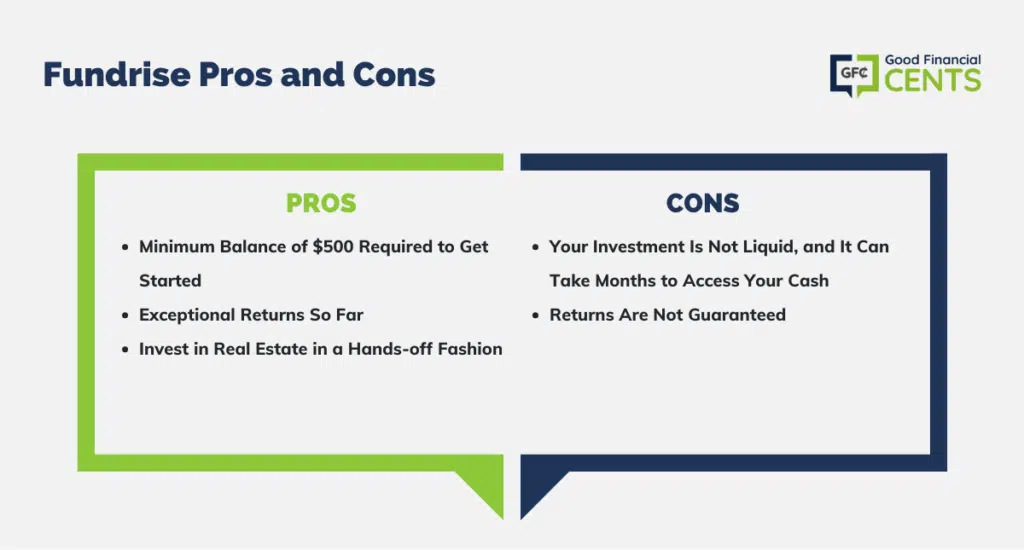

2. Invest in Real Estate

Suggested Allocation: 10% to 15%

Risk Level: Varies

Investing Goal: Growth and income

Investing in real estate can make a ton of sense, but that’s especially true if you don’t need access to your cash right away. You can purchase investment properties and let your tenants pay off your mortgage over time, after which their monthly rent payments would work as a passive stream of income. And the returns support that with historical returns of residential properties at 10.6%.

You can also invest in any number of real estate platforms, or in Real Estate Investment Trusts (REITs). Real estate investment platforms let you get some of the upsides of real estate investing without the work of a landlord.

How to Get Started: A platform known as Fundrise makes it easy to invest in real estate without taking out a mortgage or looking for new tenants. With Fundrise, you can invest in a starter portfolio with as little as $10. Your investments are spread across various commercial and residential properties that are expertly chosen by platform managers.

| I’ve been investing with Fundrise since 2018. Disclosure: when you sign up with my link, I earn a commission. All opinions are my own. |

Who It’s Best For:

Realty Mogul is another option to consider checking out when comparing companies.

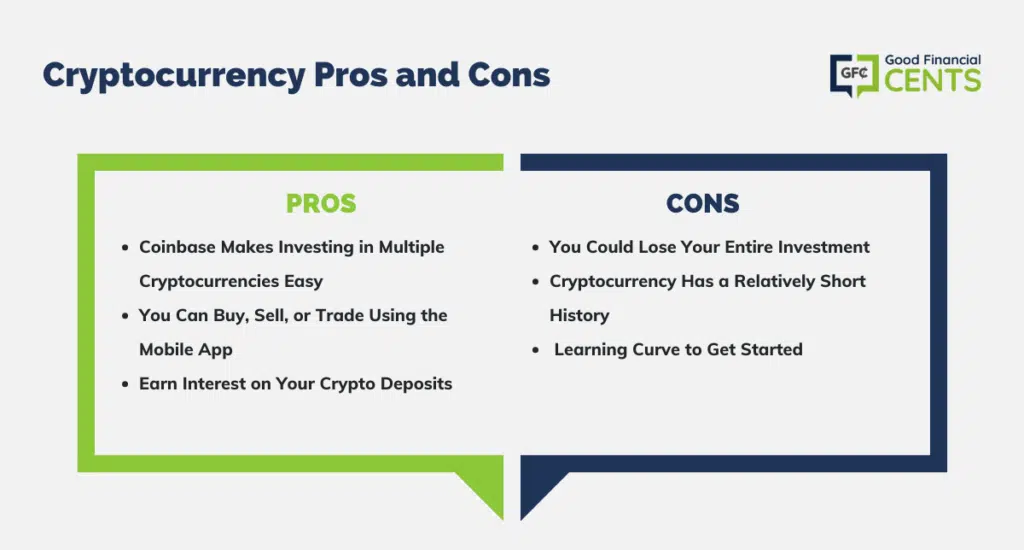

3. Invest in Cryptocurrency

Suggested Allocation: 5%

Risk Level: High

Investing Goal: Long-term growth

Although many thought cryptocurrencies would never gain mainstream acceptance, it appears this isn’t the case. You can use cryptocurrency, like Bitcoin, to make payments at more places than ever before, and Bitcoin ATMs are popping up internationally.

Because of the large-scale adoption of Bitcoin, in particular, some industry experts have suggested a single Bitcoin will be worth $1,000,000 or more within years.

Anyone can invest in Bitcoin or other cryptocurrencies, like Ethereum or LiteCoin through a cryptocurrency app. These apps safely store your crypto until you’re ready to trade or sell.

How to Get Started: Coinbase is a top platform for buying cryptocurrencies, but it also lets you earn interest on your crypto deposits through staking. Interest on crypto deposits accrues daily and is paid out monthly, and some types of crypto offer a return of up to 5.75%.

Who It’s Best For:

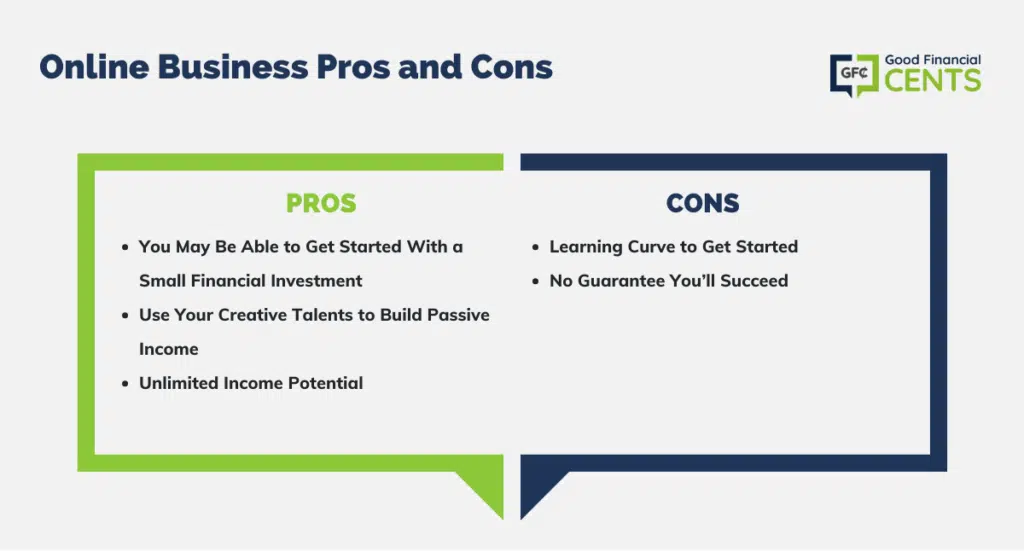

4. Buy a Business

Suggested Allocation: Varies

Risk Level: High

Investing Goal: Income

Buying a business is definitely not for everyone, and it’s true this investment strategy is a lot more “hands-on” than others. However, investing in a business gives you the chance to build something that could bring in long-term income for years or decades to come.

You can even build your business up enough so other people can run it on your behalf. At that point, you could oversee the big-picture planning and enjoy a passive income stream for life.

How to Get Started: Although you can buy a franchise or buy a local business in your area, I suggest looking into buying an online business through Flippa. This site lets you choose fully-developed websites, domain names, and other online businesses. You can then use these sites to build a passive income via ads, affiliate marketing, product sales, and more.

Better yet, you can get started with your own online business with as little as $1,000 in some cases. This option requires significant research to find an online business that you can work with and monetize over time.

Don’t think you can do it? I truly believe anyone can find a way to bring in at least some income through web traffic and various online marketing techniques. My guide on how to make money blogging explains all of the different monetization strategies that can be executed from home and on your own time.

Who It’s Best For:

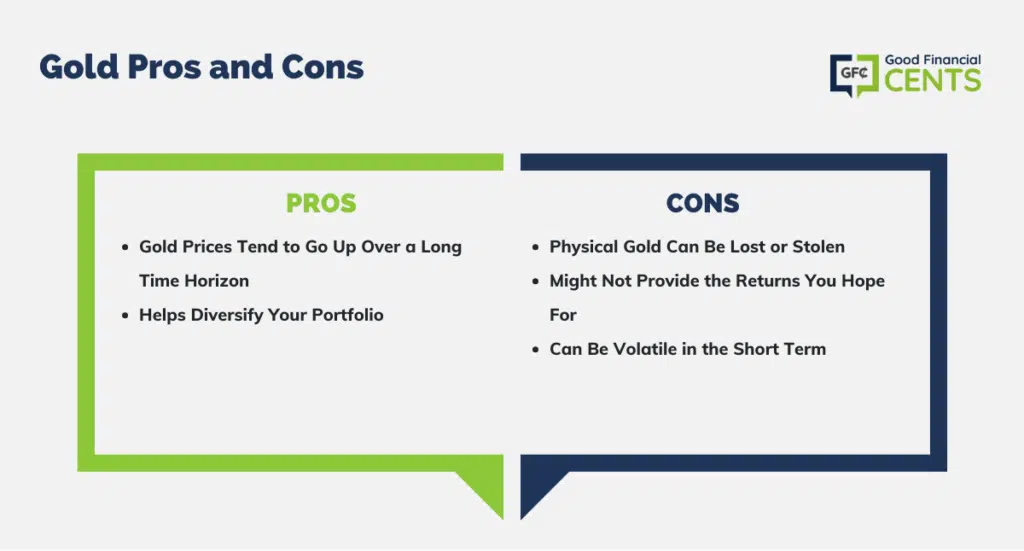

5. Invest in Gold

Suggested Allocation: 10% to 15%

Risk Level: Medium

Investing Goal: Diversification

Plenty of experts believe that investing in gold and other precious metals is crucial, mostly because these options provide a hedge against inflation. Many investors also turn to gold during economic downturns, which raises its price and increases the value of your investment.

How to Get Started: There are plenty of online platforms that make it easy to invest in physical gold, and you can even bundle your gold purchases within an IRA. For example, Orion Metal Exchange lets you invest in gold within an IRA. Other vendors like Oxford Gold Group, Lear Capital, and Goldco also let customers buy physical gold.

Who It’s Best For:

With the recent concerns of banks becoming insolvent, investing in gold carries more risk to many. A recent report from CBS News shares how to invest in gold in today’s climate.

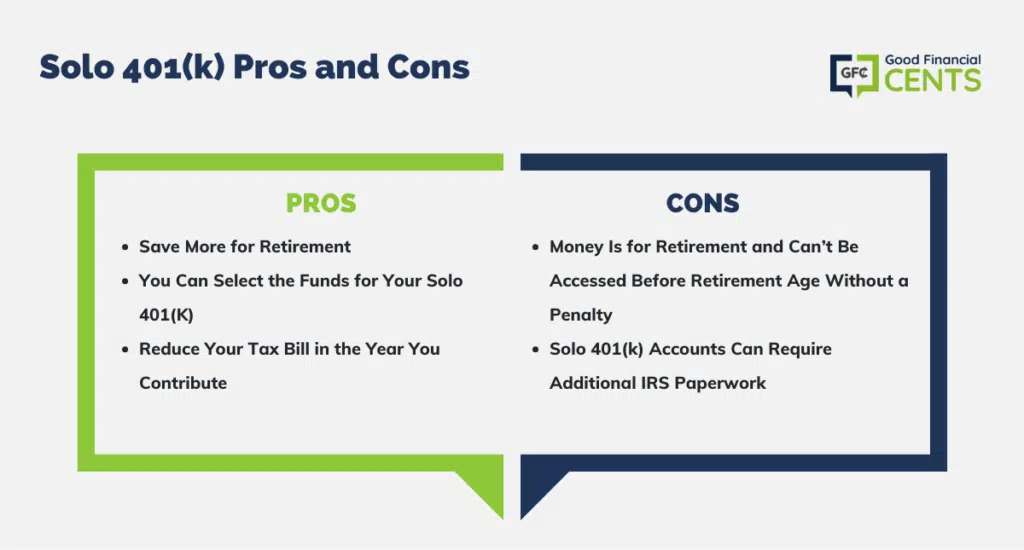

6. Open a Solo 401(k)

Suggested % Allocation: Varies

Risk Level: Varies

Investing Goal: Long-term growth

If you own your own business or have any sort of self-employment income, you can stash away a large chunk of income for retirement using a Solo 401(k). This type of account lets investors save a lot more for retirement than is possible with a 401(k). Contributions are also made on a tax-advantaged basis, so you can lower your tax bill in the year you contribute.

The Solo 401(k) lets small business owners and self-employed workers defer up to 100% of their compensation up to a maximum of $23,000 in 2024 (or $30,500 if you’re 50 or older).

Meanwhile, you can also contribute up to 25% of compensation as your own employer with a maximum total cap of $69,000 in contributions for most people in 2024 (not counting catch-up contributions).

How to Get Started: You can open a Solo 401(k) with the best online brokerage firms. Top options include Fidelity and Charles Schwab.

Who It’s Best For:

Your Investment Style

Although any of these investment options can be a good choice for your $200,000, think long and hard about what you hope to accomplish.

Do you want to invest for the long term and not have to worry about changing up your strategy over time? Are you hoping to turn a quick profit instead? Also, consider how soon you’ll need access to your initial investment amount or if you plan to let your $200,000 investment ride for 10 or 20 years.

If you want to invest for the long-term, then options like investing in a Solo 401(k) or a brokerage account might be wise. However, the same could be true for real estate cryptocurrency, or even buying your own business.

If you need access to your money within the next few years, however, I probably would go a different route. Instead, consider opening a high-yield savings account and stashing your money there. You won’t get a great return on your investment, but you can easily access your cash without the risk of losing it.

The Bottom Line on Investing $200k

Having $200,000 to invest means you’re on your way to a financially successful future, but your work isn’t done yet. Investing your $200,000 in a strategic way can help you build your nest egg over the next few years or decades.

That’s a lot better than letting all your money languish in a bank account where it will likely fail to keep up with inflation, let alone grow. Consider your age, and life goals, and learn more about your risk tolerance to land on an investment strategy that’s tailored to your needs. If you ultimately decide to invest only a portion of your money, consider exploring the best ways to invest $100,000.

FAQs on Best Ways to Invest $200k

The best place to invest 200k would depend on your individual goals and risk tolerance. Some options could include investing in a stocks and bonds portfolio, real estate, or even cryptocurrency. For those looking for something more secure, they should consider income-producing assets over options more risky. It’s important to research all your choices and make sure you understand the risks before investing.

here are several ways you could invest $200,000 to generate monthly income, depending on your investment goals and risk tolerance. Some options to consider include:

Dividend-paying stocks or mutual funds: Dividend-paying stocks or mutual funds can provide a stream of regular income in the form of dividend payments.

Renting out a property: If you own a rental property, you can generate monthly income by collecting rent from tenants.

Investing in a crowdfunding real estate platform: Crowdfunding real estate is an alternative financing model that allows people to invest in real estate projects and receive a return on their investment. It allows investors to pool their resources to fund larger real estate projects, such as apartments or office buildings, without requiring them to make large investments individually.

Investing in an annuity: An annuity is a financial product that provides a stream of monthly income in exchange for an upfront payment.

Investing in a bond ladder: A bond ladder is a strategy in which you invest in a series of bonds with different maturity dates, allowing you to receive regular income payments from your bond investments.

It is important to carefully consider your investment goals and risk tolerance before choosing an investment and to carefully review the terms of any investment you are considering.

It is possible to become a millionaire with an initial investment of 200K. To do so, you will need to formulate a plan and invest in high-yield assets such as stocks, bonds, and real estate, or start a business. You will also need to budget wisely and establish goals that you can work towards over time. Patience and discipline are key when aiming to become a millionaire — it takes time and dedication, but with the right approach, you can maximize your resources and achieve success.

Great article! Thank you. I’m 45 and have no idea what to do with my 200k. I have it in a bond with only 1.6% return. I need to decide which way to go as you state it should be primarily in stocks. I’m hesitant now because stocks are expensive and wondering if there would be any benefit to waiting until the market falls a bit.

“Stocks are expensive”

If you think you can time the market, you’re kidding yourself. I’ve even fallen to that mental trap and I assure you it doesn’t work.

If you know you need to invest but not sure when/how to get started, I would suggest to dca your way in. Start with small chunks so over time you’re fully invested.

Where and how can I get 12.5 return on $200,000 cash in vestmen. Like it to be close to home in n.w.fl. Town of Niceville,in Okaloosa county,fl. O.k. Thank you.

Good luck!

thank you for what appeasers to me to be reasonable sound advice and educational comments.

you’re welcome! Thanks for reading.

Help help help please,please please. Need bad now in niceville,fl. Am 75, bad.health how to get just 12 percent return on $200,000 investment to upgrade house and pay for all sorts of health care costs for me and some for wife who try’s to take care of me and in bad health her self,that will barely take care of all sorts of needed health care and medical insurance needed now,do not have.

Hi Hoyt – Unfortunately, no one can guarantee you a 12% annual return every year, especially not on a totally safe investment. Since everyone’s situation is a little bit different, I’d start by sitting down with one or more people you know who are familiar with your finances and your circumstances, to come up with a plan. But don’t be overly aggressive – the worst outcome would be to lose a bunch of money trying to get a return that is impossible.

This article was a great help to me as it spells out everything in layman’s terms. I have no experience and not much knowledge about investing but I am about to receive around $230,000 from the sale of an overseas property and have been wondering how to invest it in order to generate a monthly income. I am 68 and on my own.

Hi Rehanna – Take a close look at the suggestions in this article and decide which will work best for you. I’d recommend being more conservative though since you’re 68 and on your own. Talk with other people you trust as well. You have a big decision to make, and don’t do anything until you’re sure of what you’re doing.

You do realize that the end of your article here on the web where you urge getting professional advice that you actually say that it will guarantee that your nest egg will be “squandered in a free for all”?? Your proofreaders really screwed up on that one!! Here is the direct quote…It’s virtually the only way to ensure that your final wishes will be honored, and your life’s savings will be squandered in a postmortem free-for-all!

Hi Alan – Good catch! We do proofread all posts, but still find errors. And unfortunately, spell check won’t pick up on an erroneous use of a word as long as it’s spelled correctly. There’s probably an error or two in ever post on the site, despite our best efforts.

This is an excellent article. I think I will go with a robo advisor for 75% of my funds with the rest going to an Ally savings account. The two robo advisors I’m looking at are WiseBanyan with an underlying .07% ETF fee and FidelityGo with a .35% fee including The ETF fees. Fidelity because of all the features of a Fidelity account.

The idea is great. But what to do if you don´t have 200K?

@ M.D. You can start investing here.

WiseBanyan would be perfect for any amount. See how your money is invested, how it grows and WiseBanyan will make choices for you and they do all the paper work. I wish it existed 30 years ago.