The FIRE Movement (Financially Independent, Retire Early) has people retiring as early as 35 or 40.

But unless you’re making a seriously above-average income early in life and can live bare-bones, that probably won’t be an option for you.

The next best option may be a somewhat early retirement. Like retiring at 55.

That’s not the same as retiring in your thirties or forties, but it’s a lot better than waiting until 65, 67, or even 70. And you’ll still be retiring in the prime of your life – or at least in the late prime.

Don’t be too upset if you’re not able to retire sooner. In fact, there are even certain advantages to retiring at 55.

(And it’s still a heck of a lot better than retiring at 65.)

Table of Contents

How to Retire at 55 (10 Years Ahead of the Average!)

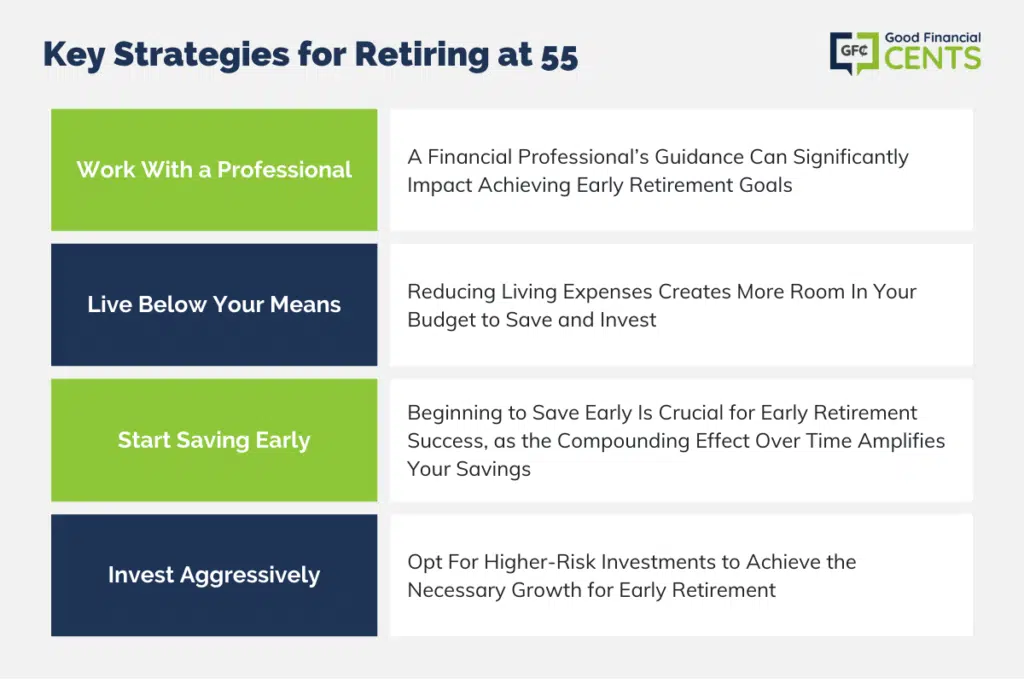

Work With a Professional Who Can Help You Meet Your Goals

A good professional can make a world of difference when it comes to meeting your financial goals. Retiring early can be a complicated mix of saving and investing properly, and most people greatly benefit from proper guidance.

If you’re serious about retiring early, there’s no better investment than getting help charting the right course for you.

Live on a Lot Less Than You Ever Thought You Could

With this strategy, you’re creating extra room in your budget to save money at an above-average rate.

The less money you need to live on, the more you can save, and the more you’ll have available for retirement.

You can cut down a big expense just by refinancing your mortgage and paying it off early.

There are a couple of variables here, too. If you’re really good at cutting your living expenses to the bone, you may be able to retire sooner than 55.

Everyone talks about cutting living expenses, but exactly what does that involve?

And more specifically, how much harder do you have to work at it if you want to retire early? Naturally, it’ll be easier to budget if you make more money.

For example, if you make $150,000 per year, you can free up $30,000 for savings by cutting your expenses by 20%. But if you make $75,000, you’ll need to cut your living expenses by 40%, to free up $30,000.

Cutting expenses can be done on just about any income. After that, it’s mostly a matter of turning it into a habit.

If you’re really serious about cutting expenses, to where you’re considering selling certain assets, you can bank the proceeds. By getting creative, you’ll reduce some of the pressure on cutting your living expenses.

Pro Tip:

Its Savings Builder account encourages you to invest towards goals like retirement with a $100 minimum monthly deposit or a $25,000 balance.

The Earlier You Begin Saving, the Better

It should go without saying that early retirement requires that you begin saving early as well. The sooner you begin, the less effort you’ll have to make.

Let’s use this as an example to demonstrate how this plays out.

Let’s say you decide you’ll need $1 million to retire at age 55. Your average income between now and retirement is $100,000 per year.

You can invest your money in a blended portfolio of stocks and bonds, producing an average annual rate of return of 7%.

- Age 25: If you begin saving at age 25, you can reach your goal by saving 11% of your pay.

- Age 30: At 30, you’ll need to save 16%.

- Age 35: By the time you reach 35, you’ll have 20 years to save, and the rate will rise to 25%.

- Age 40: At 40, with 15 years to go, you’ll have to save 40%.

Without going into any calculations, it’s pretty safe to say that if you’re over 40 and starting from zero, you probably won’t be able to retire at 55. To even attempt it, you’d have to be saving something close to 100% of your income.

Invest Aggressively

One of the challenges of saving for early retirement is that you pretty much need a high-risk tolerance. You won’t reach your goal by investing in safe assets like certificates of deposit.

While you may be able to have some money in safe assets, the vast majority will need to be in higher-risk investments.

This includes primarily stocks and either mutual funds or exchange-traded funds (ETFs) that invest in stocks.

You may also be able to include real estate investment trusts (REITS), since they often provide returns comparable to stocks. The bottom line is that you’ll have to invest heavily in assets that carry a large degree of risk. That means the risk of losing some of your investment.

In any given year, you can lose money on a stock portfolio. In fact, you might even lose money two or more years in a row. You’ll have to be prepared for that.

Investing in risky assets is investing for the long term.

Yes, you can lose money in any given year, but the real returns come through multi-year investing.

Fortunately, the numbers work to your advantage. The stock market has returned an average of between 9% and 11% over the past 90 years.

If you want to be really aggressive, keep 100% of your money invested in stocks. Over 20 or 30 years, that should get you an average annual return of around 10%.

If you want to be a little bit more conservative, a 90% stock allocation will reduce your return to 9%, and an 80% allocation will reduce it to 8%.

But both are still solid returns, particularly if most of your money is invested in tax-sheltered retirement plans.

How to Maximize Your Retirement Savings

Invest in a Tax-Sheltered Retirement Plan

To accomplish early retirement, having as much of your investments in tax-sheltered retirement plans as possible will be an absolute necessity.

You’ll reach your goals faster with money that isn’t subject to immediate taxation.

For example, if you’re in the combined 30% tax bracket for federal and state taxes, a 10% return on investment will produce a net yield of just 7%. To break that down by numbers, if you invest $10,000 per year at 10% for 25 years, you’ll have approximately $1,036,000. Mission accomplished!

But if your net return is reduced to 7% due to being in the 30% tax bracket, after 25 years you’ll have $656,000. Mission NOT accomplished.

Do you see the importance of tax-sheltered investing?

Tax-sheltered investing could be the difference between early retirement and waiting for your traditional retirement age.

It may not be possible to invest all your money in tax-sheltered retirement plans. After all, there are limits on how much you can contribute. For example, on the 401(k) or 403(b) plan, the maximum contribution you can make from 2024 on is $23,000.

Once you reach 50, you can add a catch-up contribution, increasing that to $30,500. And since many employer-sponsored retirement plans also provide an employer-match contribution, all the better.

You may also be able to add an IRA contribution to the mix.

That amount has increased to $7,000 for 2024 and $8,000 with a catch-up contribution beginning at age 50. By contributing to both plans, you’ll be able to contribute a total of $29,000 each year.

What to Do if That’s Still Not Enough

Contributing to the two retirement plans should get you close to your savings goal.

But if it isn’t, you can always save additional funds in taxable accounts.

Even though the return won’t be as good, taxable accounts can still serve an important purpose once you reach your desired retirement age. You won’t be able to access funds from your retirement plans until you reach age 59 ½.

Yes, you can access them early, but not only will you have to pay ordinary income tax on the withdrawals, but you’ll also have to pay a 10% early withdrawal penalty.

The withdrawals won’t be taxable at all.

That could provide a valuable bridge between early retirement and penalty-free withdrawals from your retirement plan.

Plan B: A Roth Conversion “Ladder” to the Rescue!

How a Roth Conversion Ladder Works

There’s another way to deal with the early withdrawal problem with retirement plans. That’s the Roth Conversion ladder.

It’s neither easy nor inexpensive, but it will provide you with tax-free income in early retirement.

As you may or may not know, withdrawals taken from a Roth IRA are completely tax-free if you are at least 59 1/2 and have been in the plan for at least five years. But there’s also a provision to have tax-free withdrawals before reaching that age.

That’s where the Roth conversion ladder comes into the picture. Funds held in either an IRA or a 401(k) or 403(b) plan can be converted to a Roth IRA.

Once there, they’re eligible for tax-free withdrawals.

There’s a provision in the Roth IRA plan that enables you to withdraw either Roth IRA contributions or conversion balances tax-free and penalty-free. These are known as Roth IRA withdrawal ordering rules.

Those rules mean that the first money withdrawn from a Roth IRA is either contributions or converted balances. Only when those have been taken are investment earnings withdrawn.

Now you have to be in the Roth for at least five years to avoid the 10% penalty, so timing is everything with this strategy. That’s where the Roth conversion ladder kicks in.

By making annual conversions, beginning five years before you will need to begin making withdrawals, you can create a tax-free source of income for early retirement.

The strategy works especially well if you are planning on retiring at 55.

Since you only need to cover less than five years until you reach age 59 ½, when you can begin taking regular withdrawals from your other retirement accounts penalty-free, the ladder will have you covered.

If you’re looking to do some trading during your retirement planning years, Ally Invest is at the top of the list of the best places to open a Roth IRA.

With low trading fees and a nice selection of investment offerings, the platform is a solid choice for your Roth IRA.

A Roth Conversion Ladder Example

Let’s assume you’ll need $50,000 per year when you retire. Let’s also assume your Roth IRA will be the entire source of that income.

You do this by making annual conversions from your IRA and/or 401(k)/403(b) plan to your Roth IRA at $50,000 per year.

Once you reach 55, you’ll be able to begin taking annual tax-free withdrawals of $50,000 from your Roth IRA as a result of the successive conversions.

This is how it will work:

| YEAR | AGE | AMOUNT OF ROTH CONVERSION | AMOUNT OF ROTH WITHDRAWAL | SOURCE OF FUNDS WITHDRAWN |

|---|---|---|---|---|

| 2019 | 50 | $50,000 | 0 | N/A |

| 2020 | 51 | $50,000 | 0 | N/A |

| 2021 | 52 | $50,000 | 0 | N/A |

| 2022 | 53 | $50,000 | 0 | N/A |

| 2023 | 54 | $50,000 | 0 | N/A |

| 2024 | 55 | $50,000 | $50,000 | 2019 Conversion |

| 2025 | 56 | $50,000 | $50,000 | 2020 Conversion |

| 2026 | 57 | $50,000 | $50,000 | 2021 Conversion |

| 2027 | 58 | $50,000 | $50,000 | 2022 Conversion |

| 2028 | 59 | $50,000 | $50,000 | 2023 Conversion |

What’s especially convenient if you begin taking withdrawals at 55 is that those distributions will cover you straight through to age 59 ½. At that point, you’ll be able to tap other retirement plans penalty-free.

In the table above, we’ve shown Roth conversions continuing even after age 55.

But in truth, you may not need to make additional conversions after that point.

The ability to take distributions penalty-free after 59 ½ might make additional conversions unnecessary since you’ll just be transferring the tax liability from one stage in your retirement to another.

The Downside of Creating a Roth IRA Conversion Ladder

As good as the Roth IRA conversion ladder strategy looks on paper, there is one major downside.

It applies to Roth conversions of all types. You must pay income tax on the amount converted in each year a conversion takes place.

Depending on your tax bracket in the year the conversion is done, that text bite can be substantial.

For example, if in the year of conversion, you’re in the 24% tax bracket for federal, and 6% for your state, a total of 30% of the conversion will go to taxes. With a $50,000 conversion, that’s $15,000.

That doesn’t mean it’s not worth it to create a Roth IRA conversion ladder for early retirement. But you will have to weigh the costs before implementing the strategy.

As mentioned earlier, an alternative strategy is to build up a portfolio of non-tax-sheltered investments. You can use those funds to pay for living expenses between retirement at 55 and reaching 59 ½, when you can begin withdrawing funds from your retirement plans penalty-free.

Why You Should Want to Retire In Your Fifties

50 is a common age at which people want to retire early. 45 is another common target, and for the more ambitious, it’s 40. Yes, you can really retire at 40.

But as attractive as it can seem to retire that early, retiring at 55 can actually work much better.

There are several reasons why this is true:

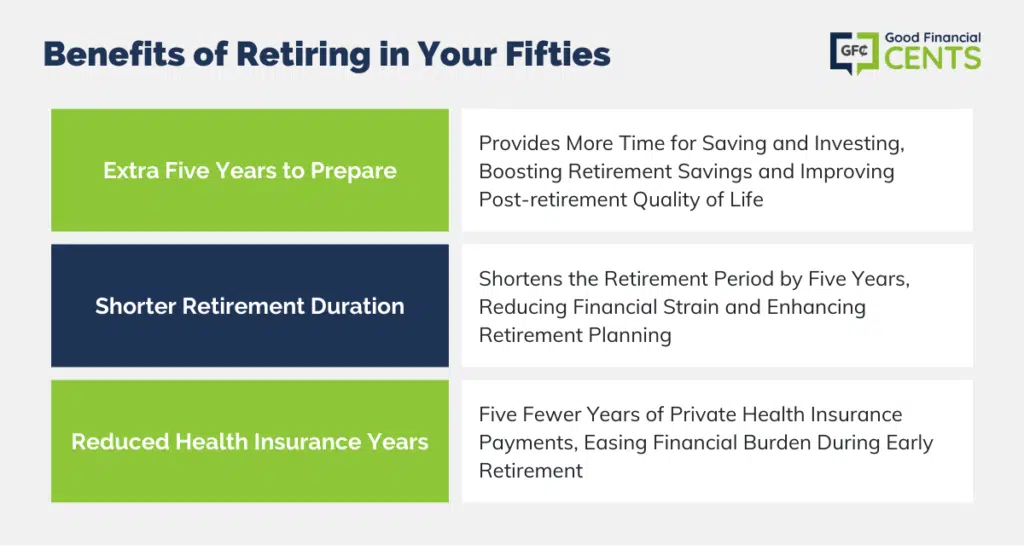

You’ll Have an Extra Five Years to Prepare

Let’s say you begin saving and investing at 25.

Over the next 25 years, you save and invest an average of $20,000 per year at an average rate of 7% per year. By age 50, you’ll have $1,181,209.

But if you continue saving and investing for an additional five years, by age 55, you’ll have $1,776,038.

That’s almost $595,000 by delaying your retirement by just 5 years. And it’ll make a real difference in how well you’ll live in retirement.

Still, another benefit is that you’ll have an extra five years, just in case your retirement investment plan doesn’t quite go as well as you hope.

You’ll Need Five Fewer Years to Cover in Retirement

If you expect to live to be 90, you’ll need to provide for yourself for 40 years if you retire at 50. But if you retire at 55, that number drops to 35 years.

Your money won’t need to last quite as long, a benefit you’ll appreciate throughout the entirety of your retirement years.

You’ll Have Five Fewer Years Paying for Private Health Insurance

Health insurance is one of the biggest issues with early retirement. You won’t have the benefit of Medicare, so you’ll have to get coverage on the health insurance exchanges.

Use Healthcare.gov’s plan estimator to see what you’ll pay. It’ll help you appreciate why retiring five years later will be good for your wealth.

People often think of early retirement as something of a pipe dream.

And if you have a low income or high expenses, it’s admittedly a difficult goal to achieve. But it’s a worthwhile goal no matter what your circumstances are.

Consider the possibilities of what may develop by the time you’re 55:

- You may be over your current career. By the time you hit your 50s, you may want to get into something completely different. Early retirement will enable you to transition into something that pays less.

- Your employer may be done with you. While it’s nice to think we’ll all be able to exit our careers on our own terms, layoffs are a fact of life. And people over 50 are often the first to go.

- You may want a new adventure. Maybe you want to live at the beach and fish or shift into volunteer work. If you’re able to retire early, you’ll be able to do those things.

- You need to take care of personal issues. It could be a change in your health. You no longer want to work as hard and want more time to improve your health. You may also need time to care for an aging family member or a loved one in crisis. If you can retire early, you’ll have that ability.

- You may not have as much time in life. None of us know how long we’re going to live. But if your family history suggests a shorter-than-normal life, retiring early will be highly desirable. And who knows – it may even lengthen your life!

In the end, early retirement is mostly about creating options in your life. And by the time you reach your 50s, you’ll almost certainly need those options.

Bottom Line: If You Retire Early, Retire Safely

Based on our discussion, you can see that to retire at 55, you’ll need to create a series of strategies.

It’s almost impossible to carry out one without also doing the others.

But if you can get everything working in the same direction, you will be able to retire at 55 or sooner. Just remember that preparing for early retirement is a long-term process.

Realistically, you’ll need at least 20 or 30 years to make it work. Be realistic and persistent, and you’ll get there.

I respectfully disagree with my colleague. I made less than 90k for years and easily saved more than 20k annually. I started early and saved far more than the slightly under 2 million cited. Of course cost of living and family size make a huge difference so it is tough to generalize.

You are smoking crack if you think your average worker can save $20k per year. I make over $90k and I can’t even put away that much. Maybe you want to re-figure your numbers.

how much can you put away?

James Barrett, I was making a lot less than you make and still managed to save that and more and invest more. So, no, nobody is smoking crack. As Jeff Rose stated above, it depends on the lifestyles you live and how badly you want to want to achieve that early retirement, regardless of age. My wife and I were able to achieve that and more. I am getting very close to 55 and we really have the luxury and privilege of achieving that if we want to.