Figuring out how to invest $500,000 can be exciting and stressful, mostly because this much cash can make a huge difference in your life. If you can invest half a million dollars and leave it alone for a few decades, you can easily grow your nest egg to be worth more than $1 million dollars.

Then again, how you invest $500,000 dramatically impacts your returns, and thus how much cash you end up with in the end. For example, leaving $500,000 to grow at 6% for 20 years leaves you with approximately $1.6 million, but finding a way to earn 10% on your money would lead to a nest egg of nearly $3.4 million.

That’s a huge difference!

Table of Contents

Where to Invest $500k Today

You’re probably racking your brain trying to figure out how to get the best possible return on your investment. My first thought is that you shouldn’t put all of your eggs in one basket. When you have $500,000 to invest, you’ll want to spread this much cash out across different sectors of the economy utilizing high-yield investments and income-producing assets.

Although there’s no “right” or “wrong” way to invest $500,000, there are some strategies I can suggest for the best results. The suggestions below are just that—suggestions. However, it’s a good start to see how these options might work for you based on your investing timeline and goals.

1. Stock Market

- Suggested Allocation: 40% to 50%

- Risk Level: Varies

- Investing Goal: Long-term growth

If you want to invest for the long term, you’ll want to throw a good chunk of your $500,000 into the stock market. After all, this is where you most likely have your retirement funds invested, whether you have a 401(k) through work or a self-employed retirement plan, like a SEP-IRA or Solo 401(k). The good news is, you can open a separate brokerage account and invest in stocks, bonds, index funds, and other securities outside of a traditional retirement plan.

Although most retirement plans are tax-advantaged, meaning you can deduct contributions to reduce your taxable income, money invested into a brokerage fund doesn’t give you any tax advantages on the front end.

Then again, you can sell stocks and other securities from your brokerage account at any time without a penalty, making this type of investment more liquid than money saved in most retirement plans. You just have to plan for capital gains taxes and the fact that your investments could be worthless if you’re forced to sell when prices are down.

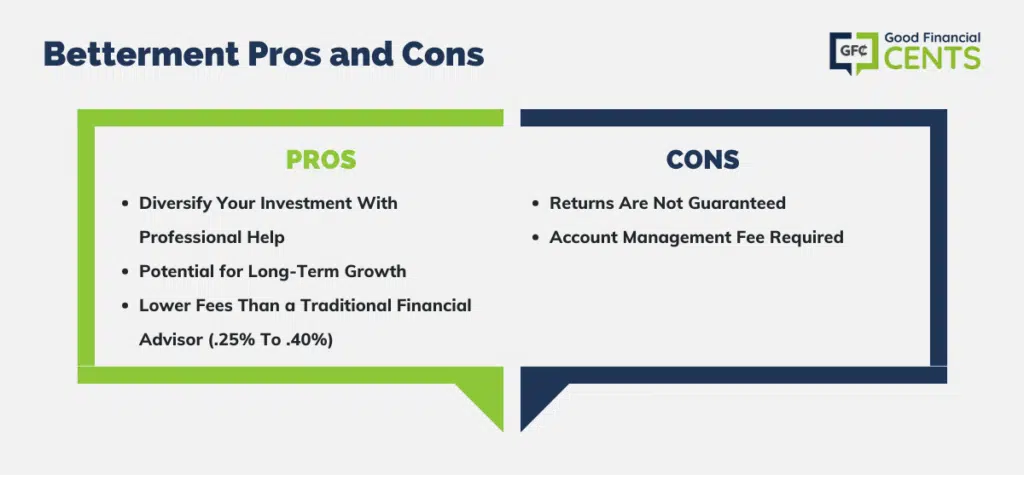

How to Get Started: Betterment is a robo-advisor that uses technology and advanced algorithms to invest your money in a smart and responsible way. It offers automatic investing options, low fees, and included benefits like tax-loss harvesting and flexible portfolios.

With Betterment, you can answer some basic questions about your investment timeline and risk tolerance, and it’ll do the heavy lifting for you.

Who It’s Best For: Investing in the stock market makes sense for anyone who wants the potential for long-term growth. Meanwhile, Betterment is a good option for investors who want stock market exposure but also assistance with creating a balanced portfolio.

2. Real Estate

- Suggested Allocation: 10% to 15%

- Risk Level: Varies

- Investing Goal: Income and Appreciation

Investing in real estate becomes a real possibility once you have $500,000 set aside, and that’s true whether you want to become a landlord or prefer to invest in Real Estate Investment Trusts (REITs).

A nest egg of $500,000 is enough to put a hefty down payment on a few different properties, and it might be enough to purchase an investment property outright. Although managing your own investment property is a goal for some people, not everyone wants to deal with physical real estate or the grunt work involved in managing a property and finding tenants.

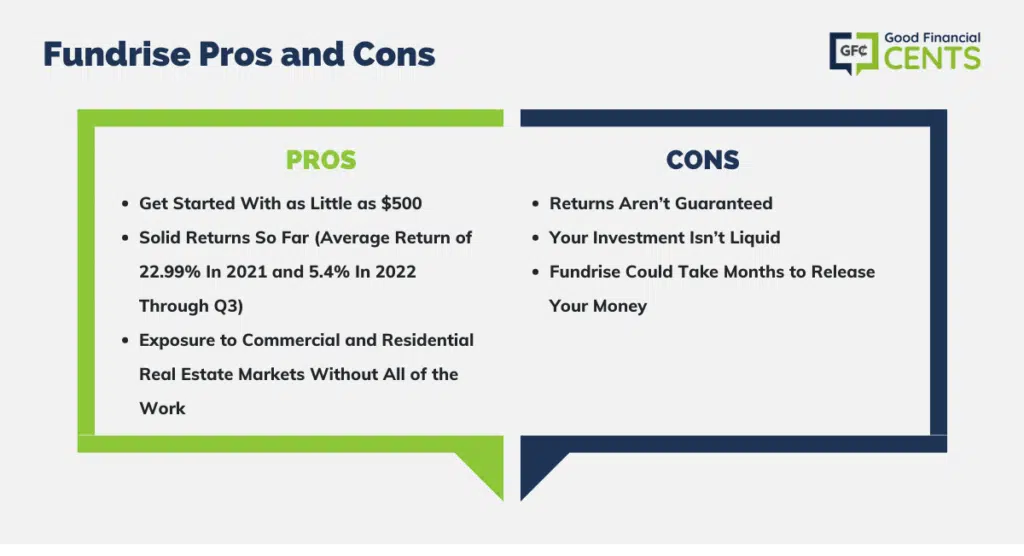

How to Get Started: For investors who aren’t interested in managing property, I suggest a crowdfunding real estate platform called Fundrise. With Fundrise, you can begin investing in real estate with as little as $500, and your money is spread across various commercial and residential real estate properties.

Since your money is invested in a fund along with capital from other investors, investing with Fundrise is a truly “hands-off” experience. Although returns are never guaranteed, Fundrise made investors an average return of 22.99% in 2021 and 5.4% in 2022 (through Q3).

That might not sound that good, but when you compare its return in 2022 to Public REITs which averaged -28.34% and investing in the S&P 500 which lost -23.87%, that’s not too shabby. You can see my own personal Fundrise returns here or watch my video below.

My Fundrise review explains more about this company and how it works.

Who It’s Best For: Fundrise is a smart option for investors who want exposure to real estate without having to be a landlord.

3. Investing in Gold

- Suggested Allocation: 10% to 15%

- Risk Level: Medium

- Investing Goal: Diversification

Investing in gold isn’t a new strategy, yet it’s easy to see why so many people turn to gold and other precious metals as a hedge against inflation. The reality is, gold prices tend to go up over time, especially during times of economic uncertainty. Gold is also often seen as an excellent place to store value.

How to Get Started: Whether you want to buy physical gold or prefer to have your gold safely stored elsewhere, there are plenty of online platforms that make buying and selling gold easy. Some examples of where to invest in gold include Oxford Gold Group, Lear Capital, and Goldco. Companies like Orion Metal Exchange even let you invest in gold within an IRA if you prefer.

Who It’s Best For: This investment option is ideal for investors who want to park some of their cash in gold as a diversification strategy.

4. Cryptocurrency

- Suggested Allocation: 5%

- Risk Level: High

- Investing Goal: Long-term growth

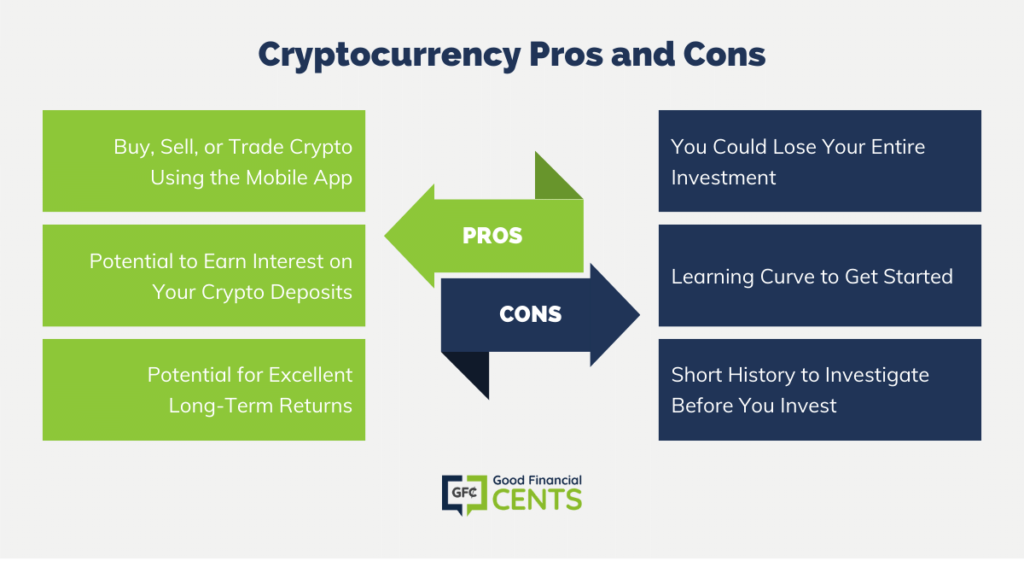

If you haven’t invested in cryptocurrency yet, it might be a good option to get in on impressive returns. The rise of Bitcoin, in particular, has been hard to ignore. Although a single coin is currently trading for more than $50,000, some industry experts believe a single Bitcoin will be worth $200,000 or more within just a few years.

Of course, there are other cryptocurrencies to look into, some of which have the potential for even more growth. The key to investing in cryptocurrency is figuring out where to put your money, how long to hold your investment, and how to make sure you’re not stuck holding the short end of the stick.

How to Get Started: Anyone can invest in Bitcoin and other cryptocurrencies, like Ethereum or LiteCoin, through a handful of mobile apps. I like Coinbase since there are so many cryptocurrencies to choose from, and you get free Bitcoin just for signing up. Coinbase also offers free educational materials that help you learn more about cryptocurrencies before you dive in.

Who It’s Best For: Cryptocurrency is a smart investment option for anyone who wants the potential for explosive growth. However, investors should be prepared for volatility and even the potential loss of all of their funds.

5. Buy a Business

- Suggested Allocation: Varies

- Risk Level: High

- Investing Goal: Income

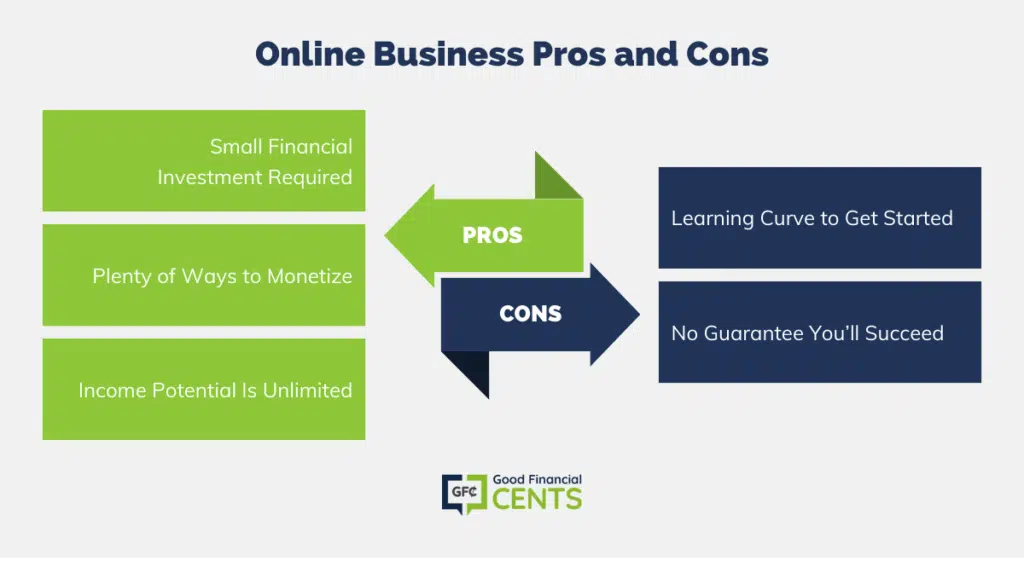

A nest egg of $500,000 could help you get started with a ton of different business ideas. You can open a home-based business, buy a franchise, or invest in any number of online business opportunities.

Keep in mind that owning a business won’t help you create passive income at first. However, you could potentially grow your business over time and hire people to run it for you. Many business owners also start out with the goal of building a business they can eventually sell.

When that happens, business owners can run their business at a profit for years, then sell it for a lump sum that helps them fund their retirement plans.

How to Get Started: Although you can certainly invest in a franchise, doing so can be incredibly expensive. In fact, many franchises require an initial fee of $50,000 to $200,000 or more just to get started.

Instead, I’d suggest investing in an online business. Doing so costs as little as a few hundred dollars, and you won’t have to deal with a physical storefront, either.

To find an online business, check out Flippa. This website helps you find online businesses, domain names, and blogs to monetize, and there are plenty of cheap deals available. After buying a business, you can learn monetization basics to earn income through ads, affiliate marketing, product sales, and more.

My guide on how to make money blogging explains all of the different ways you can make money with a website. Make sure to check it out.

Who It’s Best For: Investing in an online business can make sense for people who want to invest time into something they can grow.

6. Open a Solo 401(k)

- Suggested % Allocation: Varies

- Risk Level: Varies

- Investing Goal: Long-term growth

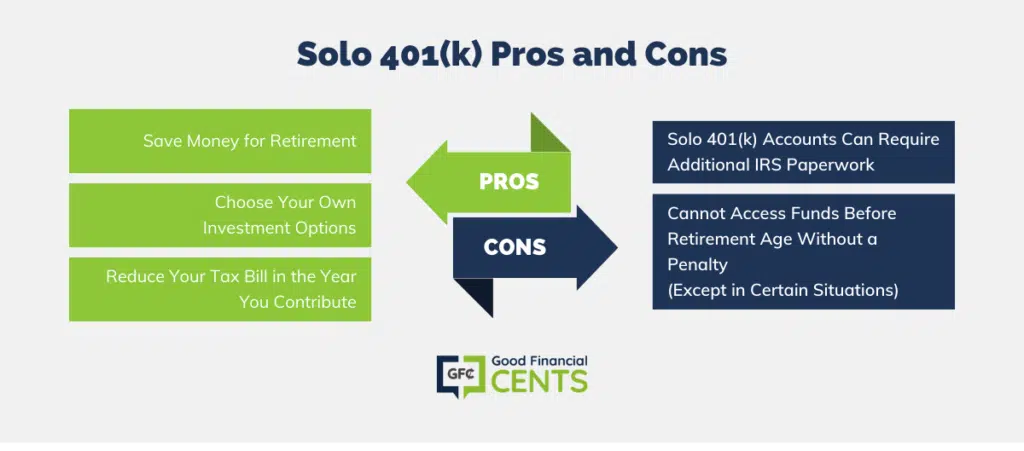

A Solo 401(k) is one of the best ways to invest for the long term, yet not everyone can use this type of account. To be eligible for a Solo 401(k), you have to have some self-employment income. If you own your own business, you must also be the only employee, with the exception of business partners or a spouse.

Why is the Solo 401(k) so advantageous? This account lets self-employed workers defer up to 100% of their compensation up to a maximum of $23,000 in 2024 (or $30,500 if you’re 50 or older). On the employer’s end, you can also contribute up to 25% of compensation with a maximum total contribution cap of $69,000 for most people in 2024 (not counting catch-up contributions).

How to Get Started: Open a Solo 401(k) with any of the best online brokerage firms. Make sure to research which providers offer this type of plan.

Who It’s Best For: Investing in a Solo 401(k) is smart for anyone who can qualify.

Your Investment Style

Any of the investment options I suggest here could be a good choice for part of your $500,000 fund, yet you have a lot of thinking to do before you move forward. In fact, I suggest asking yourself a lot of important questions before you invest a dime. For example:

- What is your investment timeline?

- How high is your tolerance for risk?

- Will you need your money in the next two years? Five years? 10 years?

- How comfortable are you with technology?

- Do you want some help investing your money?

The right way to invest $500,000 depends a lot on your answers to these questions. For example, investors who want help figuring out how to build a portfolio might want to turn to a third party like Betterment for help. Meanwhile, do-it-yourself investors might be fine opening a brokerage account and picking their own investment options.

If you have a long investment horizon and you won’t need your money for a decade or longer, it might make sense to invest in the stock market, real estate, or even cryptocurrency. These options, however, require you to have some tolerance for risk.

The Bottom Line on Investing $500k

The best way to invest $500,000 depends on what you hope to accomplish and how soon you’ll need access to your money. The best way to decide on a strategy is by answering the questions above and thinking about what you really want.

There’s never a “right” or “wrong” way to invest, but you can seriously regret it if you fail to do anything. Remember, the opposite of investing is losing your capital due to inflation every single year.

FAQs on How to Invest $500,000

How to invest $500k right now depends on where you’re at financially and what are your specific financial goals. Here’s some important items to consider that most financial planners would suggest:

First, you may want to consider setting aside some money for short-term financial goals, such as building up an emergency fund or saving for a down payment on a home. This will help you to protect your money and ensure that you have the funds you need to meet your immediate financial needs.

Next, you may want to consider diversifying your investment portfolio by allocating a portion of your funds to a range of asset classes, such as stocks, bonds, real estate and cash. Diversification can help to manage risk and potentially improve your overall returns over the long term.

It is also a good idea to review your financial plan regularly and make adjustments as needed to ensure that it aligns with your long-term financial goals.

The income potential of a $500,000 investment portfolio will depend on a number of factors, including the type of investments owned, their risk and the overall performance of the financial markets.

Let’s say for example we were comparing a $500,000 invested in a fixed annuity paying 3% versus a dividend stock portfolio that had an average dividend yield of 3.5%, the income could look like:

An annuity with a fixed payout rate of 3% has the potential to generate a steady stream of income for a specific period of time, such as 10, 20, or 30 years. For example, a 500K annuity with a 3% fixed payout rate and a 20-year payout period would generate an annual income of around $15,000, or $300,000 in total over the course of the payout period.

A dividend stock portfolio with an average yield of 3.5% has the potential to generate a similar level of income, depending on the size of the portfolio and the performance of the individual stocks.

Cited Research Articles:

- IRS.gov One-Participant 401k Plans https://www.irs.gov/retirement-plans/one-participant-401k-plans

I am 53. Currently no debt. 26 year old who is on her own but who I help slong the way. House is paid for. Will keep the house unless my father needs it for income for his health. He’s 84. I live with him. House willed to me. I’m a teacher but I began late and will only make it to 20 years if I work 4 more years, 25 if I work 9 more years. I am physically exhausted and burnt out from the profession. 30 years is the maximum for teacher retirement. No way I can teach 14 more years, so I will be lucky to get fourty percent of my now 60k year salary which could increase to 70k. I will receive that monet at age 60 if I live to see it. My social security will be cut in half because my employer no longer pays into it, so if I am lucky I will get 500 month. And you know the rules with age pertaining to when you take social security benefits. In addition to that I have 600k in the bank that I have wasted money on my whole life because I am so conservative, don’t know how I should invest, and I don’t trust people. I am exhausted and burnt out and want to work to live and not live to work. My question is, if I can make it to 60 and work 6 or 7 more years, how can I live off 500k by investing it, and how should I invest it? I would appreciate any advice you can give. Thank you.

Hi Keesha – $600k is a lot of money, and too much to be sitting in the bank collecting low interest. If you invest the money adequately you should be able to retire at 60, or thereabouts. I’d sit down with a financial advisor, one who comes with personal recommendations. There’s no way to tell you how to invest without knowing all your financial details, so you’ll have to share those with that person, and be ready to accept his or her recommendations.

I am coming into a large payoff. Why don’t you mention real estate investing?

Hi JPW – It’s really an investment category all its own. It’s also more “hands on” than most people are comfortable with. Real estate investing in individual properties is part investment, part business, so it’s not as simple or easy as most think.

Hi there.

I just came into $500K. I want to know the best way to invest it and maximize my return.

Please help!

Hi Vince – If you have no idea whatsoever, you really need to sit down with a qualified financial advisor. You need to determine your goals, requirements and risk tolerance. It isn’t a question that can be answered by a blog comment. The answer is different for everyone based on personal considerations. The tips in the article are just suggestions, but if you don’t know for sure, you need direct advice.

I have a little bit of a different question. I’m thinking about selling my house and not buying a new one but renting for a while instead and buying a house later. After commission, taxes, etc my profit will be 363k. My question is in the tithe, do I tithe 10% of that? I want clear about tithing from the “increase.” Thanks

Hi Evelyn – You need to pray about that, and read the Bible verses that pertain to the tithe. But the Bible does say that the tithe is to be based on your increase. That comes from a lot of different sources, not just wages and salary. (In biblical times, the “earnings” were often crops, livestock or fish, so it’s actually a lot more general.)

I’d be careful about selling the house unless you have definite plans for the money. You don’t want to do anything that will risk losing that kind of money, especially since it probably took a lot of years to build it up.

I just came into 2 checks 1for 140k and another for 570k. I never really invested before and always lived well day to day working. I am really lost having this money cause I feel I will blow it making bad decisions. Any advice

Cm

Hi Dd – You’ll want to invest the money in a diversified portfolio. Since you are new to investing, you could try using a robo advisor, like Betterment or Wealthfront. If you want more personal attention, you could also try using a full-service broker. They will appoint an investment advisor who will manage your investments for you though the management fee will be higher.

My daughter has a student loan of about $50,000. I inherited an annuity. It’s slightly less than $300,000. I’m a senior pensioners, plus reasonable soc.sec. Payment, so I’m not destitute; by no means well off. Would you advise paying off her student loan or leaving it as her inheritance

Hi Dorothy – It depends on how well you’d be without the 50k. Since it’s inherited, you’ve obviously been living without it, so giving it to your daughter now could really help improve her financial situation. You can parcel it out to her over 3-4 years if you aren’t sure. Just make sure that giving her the money now won’t leave you short-handed. One of the best things you can do for your daughter is to not be a burden to her. If paying off her loan will force you to depend on her financially, you may be replacing one obligation with another. But that’s an attempt to look at both sides of the question.

Great article Mr. Rose. Outline, structure, and finish. Good info and easy to understand. Thank you.

Jeff:

Why do you not recommend annuities as good, stable investments? Is it because they do not represent good, stable investments?

Thanks!!

Bob

Hi Robert – First, annuities are complicated investments. Second, some of them have provisions that don’t work to the investor’s benefit. Third, they generally charge very high fees. Fourth, some of the people who sell them are less than reputable (they don’t fully disclose what the annuity involves or charges). Fifth, annuities aren’t right for everyone.

That said, there are some good annuities, that when properly structured can do exactly what investors want them to do. Those are the good kind, and they’re out there too, at least for the right kind of investor. They certainly aren’t an investment for the average person.

Hi, Im 54 year and my wife is 52 we both not working , apllied to ssdi due to physical ilness, i have over half a million on 401k two rental properties paid for and a good size of equity in my own home, we need 6k net as monthly income to support our monthly expenses, without income from working , how can we get to that point, I was thinking in selling our property and use equity to put down in several properties, to live in one and rent the others adding to our rental income portofolio, and also also rollover our 401k to a roth ira or something similar where we can get the interest paid to us monthly( dont know if its possible), any help on this issue would be apreciated.

Hi Joaovitor – You’ve got a pretty involved financial profile, so I think it would be good for you to sit down with a financial advisor and consider your options. Without knowing you personally, I’d be hesitant to provide direct advice. Plus you’ve got some variables to consider, like how much will SSDI be, and how much rental income can you receive on the rental properties. You may also need ongoing advice as your situation develops. But overall I think you’re in a good position to get the income you need, based on what you’ve written here.

i am very surprised,or i missed, max out retirement accounts!! fully fund you IRA’S, if you continue to work, max the 401k’s. take advantage of every pre-tax investment you can.

I have $500,000, as I sold my house and am renting for one year. In that year, the plan is to buy a house, so I’ll need the money any time. What investment would work for me? I’m 76 yo, pensioner, and dumb about investment. I must buy in a year, or lose my pension. My super is zero.

Hi Shelagh – Since you must buy a house within a year, and risk losing your pension if you don’t, then you can’t take chances with the money. Have it on deposit with a local bank, invested in money markets funds or very short term certificates of deposit. Your biggest concern is protecting the principal value of the money, not earning a large return on it.

With $500,000, you’ll exceed the $250,000 FDIC insurance limit, so you should split the money evenly between at least two banks that way you’ll be covered.

Hope that advice helps!

Right Cat! Hahah. I have no problem knowing what to do with $500k. It would be gone tomorrow. $124k to my student loan debt, a couple hundred in retirement, a house, and some investing. It would go fast.

Right now our student loan balance is about $500,000 between the two of us since hubs went to med school and I got a graduate degree. If we got an inheritance of that size we’d probably put most of it toward paying off those student loans.

Great advice and it’s laid out very well. No wonder you are so successful, I’m sure your clients appreciate your approach. One thing I would do if I were in this situation is automatically pay down the mortgage. My reasoning for this is that it increases your cash flow by your mortgage amount. This, in turn can lead to other opportunities. Say you’re unhappy in your job and want to make a career switch, but you would have to start off at a lower salary. With a binding mortgage payment, this might be out of the question, but if you suddenly don’t have to make that payment, you now have the flexibility to consider that leap.