If you read many stories about entrepreneurship, you’ve probably noticed that most entrepreneurs have multiple streams of income.

Mostly by design, business owners go to great lengths to make sure they have money coming in from all directions – or, as some might say, “making sure their eggs aren’t all in one basket.”

Entrepreneurship isn’t easy, and income streams dry up all the time.

By having money coming in from multiple sources, entrepreneurs can make sure the money never stops rolling in.

Income rolling in from all over the place sounds great, right? Unfortunately, it’s hard enough for some people to figure out how to create a single income stream, let alone more than one.

I felt the same way when I started learning about money a long time ago. I clearly remember reading Rich Dad, Poor Dad for the first time, then thinking how awesome it would be to become wealthy one day.

While the author of that book is often criticized these days (for good reason), it still helped me a great deal.

Not only was Rich Dad, Poor Dad a great read, but it opened my eyes to how I could get money working for me, not against me.

My Multi-Level Marketing Mistake

Table of Contents

Unfortunately, it took a while for the real lessons to sink in. I was probably 20 or 21 when I read Rich Dad, Poor Dad the first time, which means I wasn’t exactly sure who I was yet.

I knew I wanted to work hard and make money, but I wasn’t sure how. This made me a prime candidate for multi-level marketing pitches, and the dream of “getting rich quick.”

If you’re unsure what multi-level marketing is, it’s a term used to describe any business model that rewards people for sales and recruits others to work beneath them. Think essential oils, AdvoCare, beach body, and all the other annoying sales pitches that clog your Facebook feed.

Since I was young and impressionable, I tried two or three of these companies before giving up. I made some money selling, of course, but not nearly enough to justify the money I spent on products and the time I invested.

On the flip side, however, the experience helped me quite a bit. Even though I knew I wasn’t cut out for multi-level marketing, I did begin to recognize that I wanted more out of life than just selling stuff to make a buck.

I learned I wanted to help people, and that I wanted my profits to be the byproduct of my success.

Where multi-level marketing forced me to put profits over people, I wanted to do things differently; I wanted to build a business that helped people first and made profits last.

Why Multiple Income Streams Is Crucial

If you’re like most people, you probably have one primary source of income. And while there’s nothing wrong with that, relying on a single stream of income can be risky.

For example, what would happen if you lost your job or your primary source of income dried up? Many experienced this during the pandemic with job loss and furloughs.

That’s why it’s important to have multiple streams of income. This way, if one stream dries up, you’ll still have others to fall back on.

Richard Corley, author of “Rich Habits: The Daily Success Habits of Wealthy Individuals.”, analyzed IRS data and found that 75% of millionaires have more than one income stream.

And it turns out that this is a strategy that many millionaires use. In fact, according to the IRS, the average millionaire has 7 streams of income!

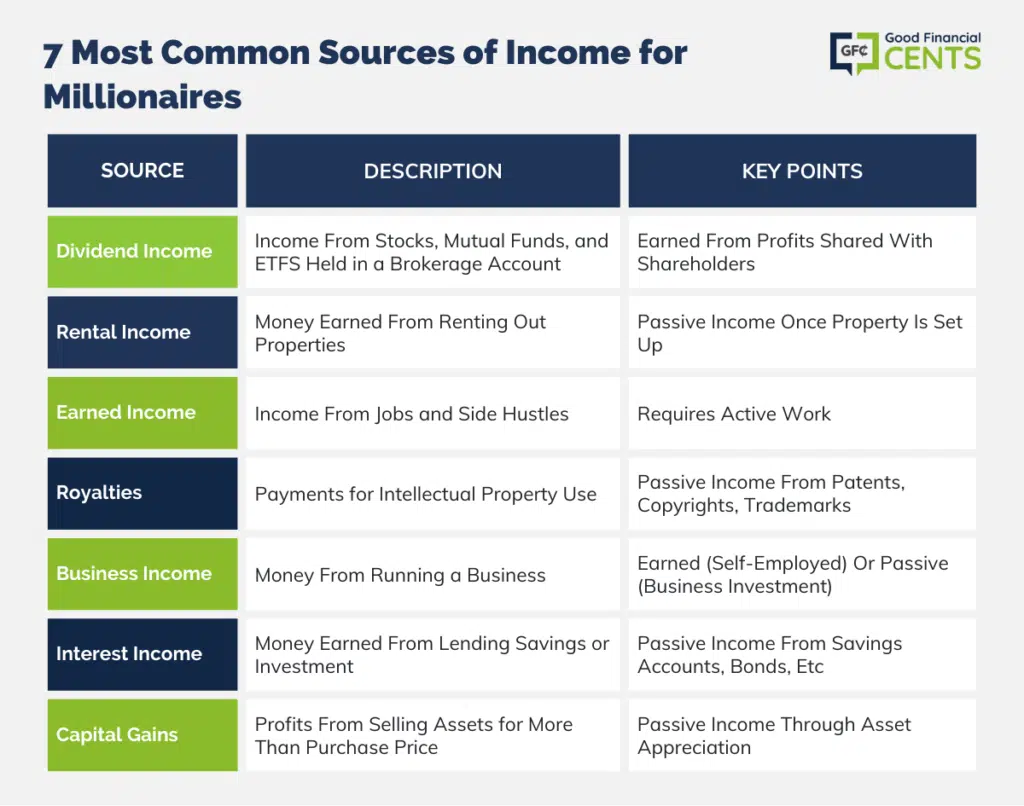

Let’s take a closer look at the 7 most common sources of income for millionaires.

7 Income Streams of Millionaires (According to the IRS)

Here are the 7 most common sources of income for millionaires, according to the IRS:

1) Dividend Income – Income From Stocks, Mutual Funds, and ETFS That Are Held in a Brokerage Account

How do dividends work? When a company makes profits, it can choose to reinvest that money back into the business or pay out a portion of the profits to shareholders as dividends.

Dividends are usually paid quarterly and are taxable at your marginal tax rate.

The more investments you buy that have dividends, the more money you can make.

What I love about dividends is that you can reinvest them to purchase more shares, which then entitles you to even more dividends.

It’s a beautiful thing!

It’s the best form of passive income because you don’t need to do anything other than reinvest the dividends you receive.

2) Rental Income – Money Earned From Renting Out Properties, Whether They’re Homes, Apartments, Commercial Real Estate, or Storage Units

Rental income is passive because all you need to do is collect the rent checks!

Of course, you’ll need to put in some work upfront to find tenants and manage the property, but once that’s taken care of, the money will come rolling in.

Rental income is a great way to build wealth because it’s relatively easy to obtain and maintain properties, and the returns can be very high.

If you’re not comfortable with managing rental houses or investing in rental apartments, you can always invest in a REIT (Real Estate Investment Trust).

REITs are publicly traded companies that own and operate income-producing real estate, such as shopping malls, office buildings, and apartments.

They’re a great way to get exposure to the real estate market without having to deal with the hassle of being a landlord.

Another option is Fundrise, a crowdfunded real estate platform that enables you to invest in high-quality, high-potential real estate projects.

3) Earned Income – Income From Jobs/Side Hustles

Earned income is the money you make from working.

It’s the most common and well-known type of income, but it’s also the least passive.

If you want to earn more money, you have to work more hours.

There’s no way around it.

However, there are ways to make your earned income work for you.

One way is to invest in a business.

Owning your own business gives you the potential to make far more money than you could ever earn working for someone else.

Of course, it takes a lot of hard work, dedication, and time to build a successful business, but it can be very rewarding both financially and personally.

Another way to make your earned income work for you is to invest it in assets that will generate passive income.

For example, you could use your earned income to purchase rental properties or invest in a dividend stock portfolio.

4) Royalties – Royalties From Books, Inventions, Etc.

Royalties are payments made to you for the use of your intellectual property, such as patents, copyrights, and trademarks.

For example, if you invent a new type of widget, you can sell the patent to a company that will then pay you royalties every time they use your invention.

Or, if you write a book, you can sell the copyright to a publisher and receive royalties every time the book is sold.

Royalties are a great way to generate passive income because you can earn money without having to do any work!

The key is to create something of value that people will want to use.

I experienced this firsthand with my book, Soldier of Finance. I wrote the book several years ago and still collect royalty checks.

5) Business Income – Income From Business Profits

Business income is the money you make from running a business.

This can be either earned income (if you’re self-employed) or passive income (if you have an investment in a business).

Either way, it’s money that you’re making from your business.

Business income can be very high, especially if you’re running it.

Types of businesses you can start:

- A Service-Based Business: This is a business where you provide a service to customers. Examples of service-based businesses include landscaping, pet sitting, and home cleaning.

- A Product-Based Business: This is a business where you sell products to customers. Examples of product-based businesses include online stores, brick-and-mortar stores, and food trucks.

- A Franchise: This is a business that is based on an existing business model. Franchises are popular because they offer a proven business model and support from the franchisor. Examples of franchises include McDonald’s and 7-Eleven.

- Online Business: This is a business that can be operated entirely online. Examples of online businesses include blogging, drop shipping, and affiliate marketing.

6) Interest Income – Income From Savings Accounts, Bonds, Etc.

Interest income is the money you earn from lending your money to someone else.

For example, if you have a savings account, the bank will pay you interest on the money in your account.

Or, if you invest in bonds, you will receive interest payments from the bond issuer.

Interest income is a great way to generate passive income because you can earn money without having to do any work!

The key is to invest your money in a safe and reliable investment that will pay you a consistent interest payment.

7) Capital Gains – Capital Gains From Selling Highly Appreciated Assets

Capital gains are profits you make from selling an asset for more than you paid for it.

For example, if you buy Tesla stock for $100 and sell it for $200, you have made a capital gain of $100.

Capital gains are a great way to generate passive income because you can earn money without having to.

If you’re ready to start creating multiple streams of income, check out the ideas below!

Want Multiple Streams of Income? Check Out These Ideas

If you’re tired of getting a single paycheck every week, now is the perfect time to pursue multiple income streams of your own. Whether you want to become an entrepreneur or not, having more than one income stream is always a good idea.

Maybe you need extra money to pay down debt. Or, perhaps you want to save up to buy a new home. Whatever your goals, having more money can help you get there faster. And, who knows? Your “side hustle” may even become your full-time job one day.

Ready for more income? Check out these extra income ideas that work:

#1: Start a Blog

Although I didn’t earn any money with Good Financial Cents for the first 18 months, the time I invested was totally worth it. While it takes time to earn money blogging, the payoff can be huge if you’re patient and hard-working.

I have made well over $1 million dollars blogging over the years, yet my advice for anyone considering this path hasn’t changed. If you’re interested in starting a blog as a side hustle, the best thing you can do is get started.

Don’t overthink it, and don’t let your doubts get in the way. [Related: How I Earned $1,097,757 Blogging] You’ll also want to access our Make 1k Challenge, which is a free email course that walks through the steps to start your first blog and make your first $1,000.

#2: Take Paid Surveys

Recently, I shared a post on the many ways you can earn money with paid surveys. You see, various companies will actually pay you to sit down at your computer and answer survey questions from the comfort of your own home.

Signing up is easy, and you can complete these surveys at any time of the day or night. Check out companies like:

- Swagbucks

It isn’t gobs of money but it is something you can do while watching TV to make extra cash.

#3: Investing for Smart Returns

While I always suggest investing for the long haul, some low-risk investments come with higher returns than you might expect.

Lending Club, for example, has repeatedly helped me earn returns of 10% or more. Prosper is another company that lets you invest cash into loans and earn a hefty payout over time.

If you’re more interested in real estate, consider a company like Fundrise to earn extra cash. With Fundrise, you’re buying notes with real estate as the underlying investment. In 2015, the company posted average returns for investors of 13%.

If you choose to invest as a side hustle, make sure you understand what you’re getting into. You could earn money for sure, but you could also lose money. Make sure you read the fine print and understand the risks before you invest your hard-earned dollars.

#4: Become a Freelance Writer

If you love to write, it’s not that hard to start freelancing on the side from home. With websites like Contently, Upwork.com, Freelancer.com, and LinkedIn ProFinder, you can create an online profile and bid on new jobs as they are posted.

While most writers start at around $50 per article, it’s not that hard to earn more money over time if you put in the work. Like any other hustle on this list, however, your first step is just getting started.

#5: Market Your Online Skills on Fiverr

If you have digital skills, marketing them on Fiverr.com is a solid first move towards having multiple income streams. If you can design web pages, write copy, design mailers and client products, or perform other web-based tasks, it’s easy to create a Fiverr profile and get started.

While jobs start at $5 (hence the name), you can upsell your clients by offering more work or value-added services that cost more money. A lot of people also use Fiverr to build their initial client base, and then move on to create their own digital business from there.

#6: Become a Virtual Assistant

Virtual assistants perform a wide range of tasks for online entrepreneurs who need help. Depending on the job, duties can include anything from responding to emails to managing social media, creating Word documents, or answering online inquiries.

While pay varies a lot, you can easily earn $20 per hour or more as a virtual assistant if you find the right type of client. Generally speaking, you can find VA jobs on websites like Freelancer.com and Upwork.com.

#7: Start a Home-Based Business

In my post on home-based business ideas that are easy to start, I highlight a number of business opportunities with low start-up costs and plenty of potential.

The type of business you should start depends on your passion and existing skill set. If you love baking, for example, you could consider starting a home-based cake or brownie business.

Love to sew? Spend your free time creating the perfect crafts, then turn around and sell them with your own Etsy store. Love dogs? Consider watching dogs out of your own home and marketing your services on a website like Rover.com.

Whatever your skills are, there are at least a few home-based business ideas that would work.

#8: Create an Online Course

I mentioned earlier how I created an online course for financial advisors who want to take their business online. Since I’m a financial advisor who also blogs, this made a lot of sense to me.

Depending on your skillset, you could also consider creating a course. With a platform like Teachable.com, you can create an online course on nearly any topic and charge as much as you want.

Don’t think your skill warrants its own course? Think again. Right now, Teachable offers courses on anything from becoming a Rockstar to creating web-based cartoons, digital scrapbooking, painting, and “The Foundations of Card Magic.”

Trust me; if you know how to do it, someone wants to learn it.

#9: Drive for Uber

Driving for Uber might be the ultimate way to earn more money and create multiple income streams. Not only can you work as much as you want, but you can work whatever hours you desire as well.

To get started, you’ll need to pass a background check and have a valid driver’s license and auto insurance. You also need a car that’s in good shape and reasonably new. Check out this post to learn more about how to drive for Uber or sign up to drive with Uber.

10: Buy and Sell on eBay

If you have a knack for finding bargains, you may be able to turn those bargains into profits. A lot of people do just that, buying items at a discount and then reselling for huge profits.

If you’re into antiques, for example, you could check out garage sales for hidden deals and then capitalize on your knowledge to turn a profit. Perhaps you’re into video games, specific brands of clothing, or something else.

Whatever it is, with a little research, it’s possible to turn your knowledge into cash with an eBay store. Best of all, you can sell from the comfort of your own home.

How I Created Multiple Streams of Income

My foray into multi-level marketing was embarrassing but also valuable in terms of life lessons I learned. I became a financial advisor shortly after that, mostly because I felt the career met my main criteria for helping people and creating an impact. However, it wasn’t always easy.

#1: Becoming a Financial Advisor

During my first year as a financial advisor, I got a small base salary. After that, it was up to me to figure out how to find and retain new clients. Fortunately, I quickly learned how to market myself, meet new people, and set myself up for success.

And over time, I made the connections I needed to grow my base of clients, earn a real income, and produce the type of results my clients wanted.

Anyone who is self-employed knows how hard it is to get out there and “eat what you kill. “I did have a big firm backing me so that definitely helped, but it was still up to me to go out and find new clients.

And really, this is why financial advisors have one of the largest failure rates of any profession. Meeting people and acquiring new clients is hard – especially when you’re first starting out.

#2: My Life Insurance Website

In addition to my financial practice and this website, I’ve cultivated other income streams over the years. One example is LifeInsurancebyJeff.com where, until recently, I earned a side income while helping people choose the right insurance for their needs.

A lot of people don’t even know about my life insurance business, but it’s a huge part of my success. Like my other big projects, however, I started it to help people. Over the years, I’ve seen so many people who are uninsured or underinsured.

For whatever reason, they don’t understand the importance of life insurance. Worse, they don’t understand how affordable it is for the average family.

A lot of people also dramatically underestimate their needs. They think a $250,000 term policy is enough to cover their family. Heck, some people think $50,000 is enough when really, they should have a whole lot more because they have a high income or a lot of debt.

Unfortunately, it can be financially devastating when a spouse – and especially a primary breadwinner – loses their life while their family is still young.

LifeInsurancebyJeff.com was created to help people realize just how much coverage they need, then to steer them toward companies that offer quality life insurance policies for a price they can afford.

#3: Investing

When it comes to earning extra income, let’s not forget about the most obvious income stream I have – investing. While everyone who invests for extra income does it differently, most people rely on mutual funds, ETFs, or dividend investing.

As for me, I love investing in lending marketplaces like Lending Club and Prosper. Each of these provides side income in the form of dividends, interest, and even capital gains paid out at the end of the year.

While investing for side income can work out well, most of my personal investments are tied up in our retirement accounts.

For starters, I have a 401(k) through my business. I also have a Roth IRA, although I can’t add to it anymore due to income requirements. I also have taxable investment accounts, but I would much rather invest via our retirement accounts to avoid paying extra income taxes whenever possible.

#4: Media Deals

My sixth income stream is one I just added two years ago – scoring awesome media deals. This is something I never really imagined happening years ago, but works out rather well today.

And really, media deals are a great fit. I already love doing YouTube videos and interviews and putting myself out there. With media deals, I can use my video skills and personality to represent big financial brands and help them market their products.

As long as it’s something I believe in and support, it’s a win-win. Companies I’ve been approached by in the last two years include John Hancock, Credit Karma, Discover, Capital One, MasterCard, and GM, just to name a few.

It’s been so fun helping these awesome companies create their own marketing plans, whether through video or other online media.

Last year was my best year ever in terms of media deals, but it looks like I have a few locked up for 2023 already. Considering one of them might pay me more than I earned last year, I’m stoked!

But the important thing to remember here is that it all started with this blog. I didn’t really know what I was doing when I started, but I kept plugging away.

Over time, all the YouTube videos I made taught me how to present myself better on screen. I didn’t know how it would pay off at the time, but I’m so glad I followed my instincts and kept going anyway.

#5: Creating a Course

Last year, I also launched an online course for financial advisors – The Online Advisor Growth Formula. Last year alone, this resource brought in more than $100,000 in revenue.

I’m especially proud of this accomplishment because it took me a few years to build up the courage to get started.

Fortunately, a good friend helped me hone in on the idea for my course a few years ago. I wasn’t sure what I should create a course on, but he reminded me that a ton of financial advisors struggle to market themselves online. Right away, I knew it was true.

Why? Because so many financial advisors have talked to me over the years and many have asked if they could pay me for consulting. Why not create a course they could buy instead?

So, that’s exactly what I did. I created video tutorials showing advisors how to market their businesses online, then formatted them into a single course financial advisors could purchase. And guess what; it worked!

If you want to create your own course, you can set up a free account at Teachable.com. I’ve used them to create all of my courses and love them!

The Bottom Line on Creating Multiple Streams of Income

These are just a few of the ways you could start earning extra income in the next twelve months. Obviously, a ton of other opportunities are available depending on where you live, your level of skill, and your income goals.

Just remember that, like anything else, padding your income takes time. You’re not going to get rich overnight with any of these gigs, just like you won’t with a multi-level marketing business.

Money doesn’t grow on trees, but it does tend to multiply when you work hard. And with multiple streams of income, you’ll have your money working hard for you.

Related:

Do you have more than one income stream? How many streams do you have?

MAKE MONEY

Thank for all of this great information. I am a senior citizens and would like to make some extra money.

NICE INFORMATION TO GENERATE THE EXTRA INCOME APART FROM JOB.

HOW TO BE A BLOGGER THAT IS THE QUESTION IN MY MIND.

Hey there! I stumbled across your blog and read the entire thing. Great information! I learned a lot. Have you heard of One Stop Taxes! It is another great home based business opportunity! Out of courtesy, I won’t leave the link to the video but go on youtube and check their video. The Founder’s name is Mowbray Rowand. If you’d like to know more, please drop me an email! Have a great day and I’m looking forward to your next blog post for sure!

We do extremely well with our direct sales business. The model is sounds and extremely lucrative. Plus it is a win win for our customers and I have experience in other business, an MBA, and have run successful businesses in finance and education. Not sure why you are giving incorrect information, but I guess you are selling your snake oill article to sell ads, courses, affiliate clicks, etc. Sad. The recommendations you have listed for businesses are terrible. Uber? Are you serious. Start a blog? Jeff, I know you needs leads to sell your financial products but this is nonsense. Good luck with the book sales. Next time do more research pease. There is enough bad information out there. Don’t make it worse.

The area i wanted to study is about MLM andfreelancewriter and Blog.

Wondering where you go to invest in a real estate note? Also, what platform do you recommend for creating a course?

@Eric I found my real estate note through a local investor. I’m sure if you dig around your local area you could find some options. Another one to consider is Fundrise.

As far as courses go, I’m a big fan of Teachable.com. I’ve created 3 courses on their platform and love them!

Multiple streams of income is crucial for surviving online, thanks for an outstanding article. And I fully agree with your realistic expectation of 12 months. People should approach making money online with the primary focus to learn, not to earn. It’s a sequence of tiny steps in the right direction, there’s no such thing as a Giant Leap…Only Hard Work!

#7 is my favorite. ; )

I’ve tried most of the items on this list, fiverr.com is a great source for all of them but you should also consider the various webmaster and marketing forums out there. Sure, you can find work there such as article writing etc but it’s also a good place to see how other people are making money also. I spend as much time checking out the services other people are offering to see if it’s anything I could get involved with as I do looking for jobs personally.

Good advice Jennie, thanks!