Nobody wants to pay off student loans longer than they have to, yet far too many people are stuck in lengthy repayment plans that seem like they’ll never end.

While income-driven repayment plans backed by the federal government ask you to pay down loans for 20 to 25 years before leading to loan forgiveness, even the “standard” repayment plan for federal loans lasts for a full ten years. No matter how you cut it, that’s a long time!

With that in mind, you should know that it’s possible to pay off student loans faster if you are willing to think outside the box and forge your own path along the way.

However, not all early repayment plans will work for every borrower, so it’s important to think through how to pay off student loans faster in a way that helps you reach your goals in a common sense way.

One strategy many borrowers use to pay off student loans faster is refinancing loans with a different lender. Not only do some student loan refinancing companies offer lower interest rates and flexible repayment terms, but you could even earn a cash bonus just for signing up.

Table of Contents

9 Ways to Pay Down Student Debt Faster

The sooner you can pay off all your student loans, the quicker you can move on with your life. Here are some strategies to consider that can help you pay off your student loans much faster than a traditional repayment plan allows.

What You’ll Learn

Make More Than the Minimum Monthly Payment

The minimum payment on your student loans is the absolute minimum amount you’re supposed to pay, but there’s nobody stopping you from paying more.

And, if you make extra payments the right way, you could easily pay down the principal of your student loans at a faster pace.

Unfortunately, many student loan servicing companies won’t automatically apply extra payments you make toward your loan principal.

Instead, they’ll use any payment overages to “pay ahead” on your loans and continue making the next month’s payments as well as the prepaid interest for future months.

If you decide to pay extra toward your student loans, you’ll need to specify that you want overage payments to go toward the principal of your balance.

You can do this over the phone or by written message when you mail in your monthly student loan payment, but make sure you don’t forget.

Try the Debt Snowball

The debt snowball method for getting out of debt is worth considering if you have several different student loan bills to juggle each month. This strategy requires you to make a list of your student loans and each of their balances.

From there, you’ll start the next month by paying the minimum amount on all your largest loan balances and as much as you can on the smallest balance you have.

Over time, you’ll continue paying as much as you can toward your smallest balances until they’re gone, at which point you’ll “snowball” all your extra payments toward the next smallest debt.

With the debt snowball, you’ll slowly pay off your smallest loan balances until you only have the few largest balances left.

Eventually, you’ll only have one student loan left, and you’ll pay all the cumulative payments of all the others toward this debt until it’s gone, too.

The benefit of this strategy is the momentum you’ll gain as you knock out small balances one at a time. Not only will your balances go down, but you’ll have fewer loan payments to make each month as well.

Refinance With a Private Lender

You can also consider refinancing all your student loans into one new one, which has the potential to save you more money than any other strategy on this list.

Many private student loan companies offer fixed interest rates as low as 3.50% right now, which is lower than any federal student loans offer. Of course, you do have to have an income and good credit or a cosigner to qualify.

How much can you save by refinancing your student loans? That really depends on how much debt you have, your current interest rate, and your current repayment timeline.

However, let’s say that you have $10,000 in student loans with an APR of 7%, and you just started a 10-year repayment plan. In that case, you would pay $121.33 per month for ten years and a total of $4,559 in interest before your loan was paid off.

If you were able to refinance your loans into a new private loan with the same repayment plan at 3.50%, however, you could pay just $96.56 per month for ten years and only $1,587 in interest during that time.

Better yet, you could refinance into a new 7-year loan, pay $132.13 per month, fork over only $1,099 in interest during that time, and shave three full years off your repayment timeline.

Enroll in Autopay to Score a Lower Interest Rate

Some student loan companies offer discounts to customers who are willing to sign up for automatic payments. This discount is usually around .25% off, but all you have to do is allow your student loan payment to be debited from your checking account automatically each month.

These programs make it easy to stay on track with your student loan payments, and they also ensure you are never late. All you have to do is make sure you have the cash in your account before the date your payment is automatically debited each month.

Make Payments While You’re in School

If you haven’t graduated from college yet, it’s not too early to start preparing for the inevitability of that first student loan payment. Further, it can be extremely smart to make payments while you’re still in school if some of your student loans are unsubsidized.

What’s the difference between subsidized and unsubsidized student loans? By and large, the biggest difference is the fact that the federal government pays the interest on subsidized loans while you’re still in college, but they do not extend this benefit to unsubsidized student loans.

By making payments on unsubsidized loans while you’re still in school, you can keep student loan interest at bay and keep your loan balances from ballooning until you have a job and can attack your student loan debt with all your might.

Live Like a Poor Student

It’s tempting to inflate your lifestyle once you graduate from college and start bringing in a paycheck, but this is the opposite of what you should do if your goal is getting out of debt faster.

The longer you can live at home with your parents or share an apartment with roommates, the more money you can continue throwing toward your student loans.

And, if you can hold off on buying a house or financing a new car, you’ll be in even better shape when it comes to destroying your student loan debt at a record pace.

Finance guru Dave Ramsey frequently gives the following advice, which I absolutely agree with:

“Live like no one else now so you can live like no one else later.”

Living the poor student lifestyle for as long as possible is a smart way to pay down debt when you’re first starting out.

If you have roommates, keep them.

If you’re managing to get by on Ramen, keep it up.

Once your student loans are paid off, and in your rearview mirror, you can start using your income to pay for the lifestyle you really want.

Earn Money on the Side

If you want to pay your debts down even faster, earning more money is one approach that always works. The key here is to make sure you use the extra money you earn to pay off your student loans instead of paying for stuff you don’t need.

We’ve shared myriad side hustles here on Good Financial Cents in the past, from 65 side hustles you can do, from your kitchen table to ideas on starting an online business.

Some of the easiest ways to earn money include driving for Uber or Lyft, starting a blog, or learning an online skill people will pay you for.

You could become an online freelance writer or sell your design or data entry skills with a website like Fiverr.com.

Heck, you could walk dogs in your spare time or mow people’s yards in your neighborhood.

The basic principle is the same no matter what side hustle suits your fancy. Pour as much time or effort into your side hustle as you can, and use all the extra money you earn to pay off your student loans.

Throw All “Found Money” Toward Your Student Loans

If you get any extra money during the course of the year, you should absolutely throw your “found” cash toward your student loans. This can include your tax refund each year, any Christmas bonuses you get from employment, and money you get from working overtime.

Heck, you can even throw your birthday money at your student loans.

Any extra money you pay toward your loans can be used to reduce the balances of your debts, which in turn lowers the amount of interest you pay over the life of your loan.

Remember that, when it comes to paying off debt, even small amounts of money can add up in a big way. By throwing all the money you come across toward your loans each year, you can expedite your debt payoff process even more.

Ask Your Boss for Help

While asking your boss for help with student loans is a fairly novel concept, it isn’t unheard of.

Actually, nearly anything is on the table when you’re negotiating your salary or benefits – and sometimes, the key to getting what you really want is just asking for it.

Further, some industries and government agencies have already thought of this option. For example, some government employees can receive up to $10,000 a year towards student debt repayment by accessing the federal government’s Student Loan Repayment Program.

Similar programs are also available for nurses and teachers through the Nursing Education Loan Repayment Program and Teach for America, which is part of AmeriCorps.

Students who find work in the public sector can also get help with student loans by applying for the Public Service Loan Forgiveness Program.

With this option, the federal government will forgive the remaining balance on your Direct Loans provided you have made 120 qualifying payments and remained employed with a qualified employer in the public service sector.

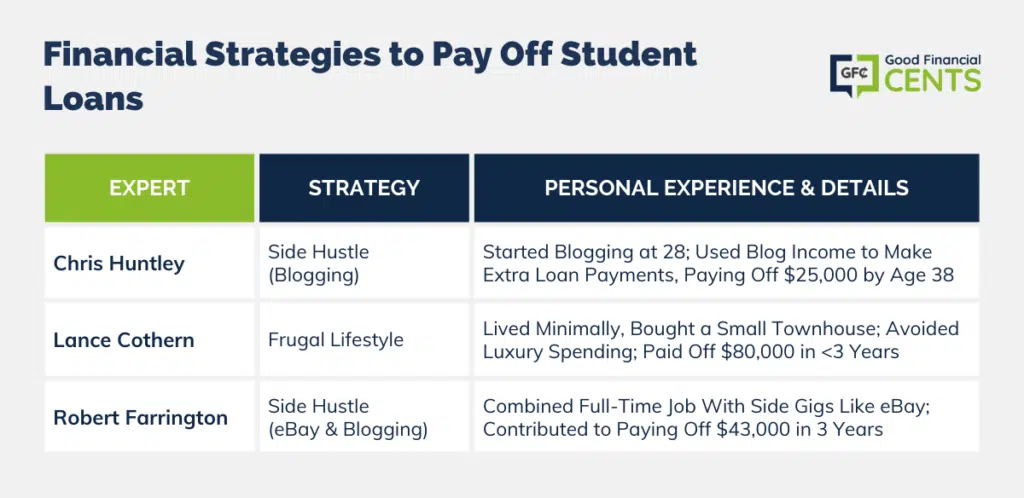

Which Strategy Made the Difference? 3 Financial Experts Weigh In

Plenty of people have used these tips and others to pay off their student loans once and for all. We reached out to several people who have paid off their loans for good to find out how they did it and which strategies they suggested. Here’s what they said:

Paying Off Student Loans With a Side Hustle

“In my early 20s, I was paying a very affordable $160 per month on my $25,000 of student loan debt. It wasn’t much to pay, and it seemed my balance never decreased. That’s one of the reasons I decided to start blogging at 28 years old.

After about six months, I started earning extra income from my blog and began sending extra payments toward my student loan.As my blog income grew, I was able to send chunks of $1,000 to $2,000 pretty regularly in my 30s, and I finally began making a dent in my balance.

I made my final student loan payment at 38 years old, and it was glorious. Had I not been able to send in extra money, I probably would have been paying student loans into my 50s.”

— Chris Huntley, co-founder of Credit Knocks.

Living the Poor Student Lifestyle

“My wife graduated with over $80,000 of student loan debt, but we managed to pay it all off in just under three years. We had to make sacrifices to pay that much debt off quickly, but we also had other things going for us that made it easier.

My wife is a registered nurse, and I was an accountant at the time, so we earned a reasonable income.We didn’t have anyone else relying on us, so our spending decisions only impacted ourselves. We kept our expenses to the minimum and continued to live like college students to put as much money toward the debt as we could.

We bought a small townhouse that resulted in a monthly mortgage payment of only $500.We had a very limited fun budget and didn’t go on traditional vacations. We refused to buy new furniture (except for a much-needed mattress) or go out to eat multiple times per week.

Instead, we cooked at home and relied on hand-me-downs or used furniture to get by until the debt was paid off. We also put off decorating and renovating our home unless the cost was minimal and we could do the work ourselves.”

— Lance Cothern, founder of Money Manifesto.

Earning Money on the Side to Pay Down Debt

“I paid off almost $43,000 in student loan debt in three years. First, I worked full-time during college, and that helped minimize expenses. After graduation, I was promoted at my same company and earned a starting salary of $45,000 per year.

However, while working, I was also side-hustling and earning extra money. My main side gig was buying things to resell on eBay. At my peak, I was making a profit of about $2,000 per month. I would also do off jobs, and I started my blog, The College Investor.

Between my day job and side hustle earnings, I was able to knock out my student loans in a short amount of time.”

— Robert Farrington, co-founder of The College Investor.

The Bottom Line

There’s no reason to pay off your student loans any longer than you have to. Any of the tips on this list could help you get out of debt faster, and it’s even possible to use more than one of these tips to annihilate your debts at lightning-fast speed.

As the nation’s total student loan debt levels continue to rise, we all have to take responsibility for ourselves. Let the numbers fall where they may; it’s up to us to find ways to get our finances straight – and if that process includes paying off student loans the hard way, so be it.

Just remember, you’ve got a wealth of tools at your disposal.

Using everything from debt calculators to budgeting tools, you can dream up dozens of ways to get out of debt faster and, most importantly, smarter.

With student loan debt levels at an all-time high, you’re going to need all the help you can get.