When it comes to shopping for life insurance, what is best for one person may not necessarily be good for another. There are several different life insurance plans that you’ll need to compare to find the one that fits your needs the best.

What About When You’re 80 or Older?

Table of Contents

This is certainly the case when it comes to life insurance for the elderly, specifically for an 80-plus-year-old person looking for affordable life insurance. Once people reach a certain age, they assume that they no longer need life insurance protection, but that isn’t always true.

The main reason that people shop for life insurance at this age is in order to ensure that they do not leave a financial burden on their loved ones after death.

It is for this reason that many elderly people are purchasing plans in order to cover all of the expenses and fees that come with the passing of a person’s life.

The cost of funerals is going in the same direction as many other industries, which is up. An average funeral today will cost anywhere from $11,000 to $14,000. This is a hefty expense to leave as a burden on your family and loved ones. Social Security provides burial insurance, but the coverage is $255. This, of course, will not make a dent in the funeral expenses.

While the majority of people at the age of 80 won’t have much debt, there is a chance that you could leave your family with massive amounts of debt, which can make an already tough situation even worse. It’s vital that you get the life insurance protection that your family deserves. Don’t automatically assume that you no longer need life insurance because of your age.

Because it is true that someone of this age seeking insurance over 80 is most likely concerned with funeral expenses, this type of insurance plan is often referred to as burial insurance. There are several companies that specialize in this type of insurance; however, doing your own research and exploring all the different options can be confusing, and you might not realize some mistakes you might make.

Let us help you find the best life insurance that fits your budget and meets the financial needs to help your beneficiaries. Because life insurance companies look at medical conditions in different ways, we can guide you during the application process. You can complete the Compare Quotes form on the right side of this web page to get started applying for life insurance as a senior in your 80s.

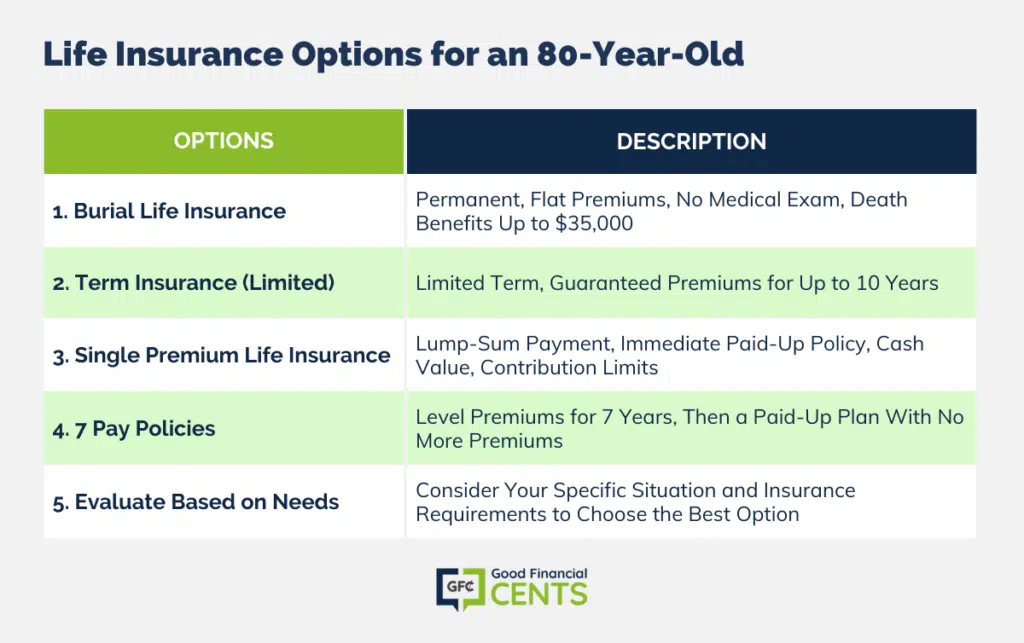

Life Insurance Options for an 80-Year-Old

There are a few considerations that need to be looked at when shopping for life insurance at this age. Burial life insurance is permanent insurance meaning that it will never expire. You do have to either continue paying your premiums or decide to take a paid-up life insurance policy for a lower death benefit.

Not only that, but the premium will continue to be flat for the entirety of the policy. This is extremely beneficial for someone who is elderly and is most likely receiving a fixed amount of income. This allows for planning and budgeting much easier than a variable life insurance premium would.

Another great feature of burial insurance is that it doesn’t require a medical exam. Not only are medical exams time-consuming, but they are irrelevant in this type of scenario. Because there is no medical exam required, the death benefit usually caps out at $25,000, although there are a few companies that will issue a death benefit of up to $35,000. Your medical history is usually obtained by way of a medical questionnaire form instead of a medical exam.

If you are looking for term insurance as opposed to permanent life insurance, then probably the maximum length of the guaranteed premiums on the term life insurance would be 10 years.

Another life insurance option for someone in their 80s would be a Single Premium Life insurance policy. This means you make one lump sum payment upfront, and you have a paid-up life insurance policy that starts building cash value right away.

When you start looking at these types of plans, there are limits on how much money you can deposit compared to the death benefit amount. Otherwise, the IRS considers it a Modified Endowment Contract, and there are tax consequences. Of course, the taxation of life insurance policies by the IRS is always subject to change.

In addition to a Single Premium Life Insurance policy, there are 7 pay policies. On these plans, you pay the same level of premium for 7 years, then you have a paid-up life insurance plan, and you don’t have to pay any more premiums.

As you can see, each life insurance option has its own set of advantages and disadvantages that you’ll have to weigh based on your specific situation. Each person has different needs when it comes to life insurance protection.

Are Pre-existing Health Problems an Issue for Seniors?

The great thing about burial life insurance is that there is a long list of pre-existing health problems that are not a huge factor in obtaining insurance. Depending on the extent of the medical issue, the insurance policy will be graded on a tier-like basis. This is called a Graded Benefit policy in the life insurance industry. For more serious types of health problems, the benefit of the policy may not be 100 percent payable until a couple of years out from the start of the policy.

There are those who tend to believe a graded policy is not worth the costs for someone who is over 80 years old. However, if the policyholder can’t obtain any other type of insurance due to serious medical issues, a graded policy is certainly better than nothing because they are guaranteed to be issued no matter what medical conditions someone has. Regardless, the acceptance of most people with pre-existing conditions is one of the best benefits associated with life insurance policies for an 80-plus-year-old.

There are also plans that can be had with a medical exam if that is what is preferred. The benefit of this is a lower monthly premium. The negative is that a medical exam is somewhat time-consuming in and of itself. Not to mention it often takes at least several weeks before test results come back. Additionally, the life insurance company may want to order medical records, and this process seems to take longer and longer as medical professionals seem to be cutting down their staff who handle insurance paperwork.

However, there actually can be a benefit to having to schedule a medical exam, especially if you haven’t been to a doctor in a long time. Most medical exams are usually pretty extensive and could uncover an issue that was not otherwise known. The insurance companies will also send you a copy of any blood work completed, which is also good to review with your medical provider.

If you do apply for traditional life insurance for seniors over 80, you will be asked some questions like the following:

- Have you had surgery lately, been advised to have surgery, or been hospitalized?

- Have you had symptoms of, or have been treated for, any heart diseases, stroke, cancer, or AIDS?

- What other medical conditions have you had symptoms of or been treated for in the last 5 years?

- Are you planning on traveling outside the US in the near future?

- Do you use illegal drugs or any type of tobacco product?

- What medications are you taking?

- And also, you will be asked about your driving history and any other amounts of life insurance you own.

If you need coverage immediately, the best route may be to obtain a no medical exam on a temporary basis while you pursue a policy that requires a medical exam. This could also be a good strategy if you need a greater death benefit that only one insurance company might offer to you.

As is always the case, one size does not fit all when it comes to life insurance policies. It may be argued that this is even more true as a person ages and many more variables come into play. It is for this reason that it is advisable to seek the advice and guidance of an experienced life insurance professional, such as those in our offices.

Sample 80-Year-Old Term Life Insurance Quotes

For 80-year-olds, the number of carriers that will offer life insurance becomes slim. Here are some sample quotes from one of our top carriers.

| 10 Year $25,000 Policy | 10 Year $50,000 Policy | 10 Year $75,000 Policy | |

|---|---|---|---|

| Male | Transamerica $209.87/mo | Transamerica $414.49/mo | Transamerica $619.11/mo |

| Female | Transamerica $147.74/mo | Transamerica $290.24/mo | Transamerica $423.73/mo |

The Bottom Line for Seniors Looking For Life Insurance

Getting life insurance when you’re 80 years old is not impossible. Your age is going to be one of the most important factors that the insurance company looks at when they are processing your application. It’s going to drastically impact your chances of getting affordable life insurance coverage, but there are still plenty of options.

If you’re 80, you can still get coverage, but the earlier you buy life insurance, the better!

It’s important you work with an independent agent who can work with several different life insurance carriers. As an older applicant, insurance companies are going to have extremely different views on coverage and premiums. Some companies are much better for older applicants. You need to find one of these companies.

Mom had a stroke, I need burial insurance on her & me.

I’m looking for insurance for my 84 year old dad

I’m looking for insurance to get for my mom she is 82

Looking for a quote for $25,000 life insurance for my 83 year old mother. Thank you.

@ Viola Contact our toll free # and we’ll review your options.

Hi…I am looking for possible life insurance for my elderly mother and maybe myself please. Thanks.

Like qoute for 82 yr female

@ Lupe Just contact our office and we’ll happy to run you some quotes.