Should we even be talking about how to invest for college students?

Or should we just tell them to wait until they graduate before getting started and just call it a day? We don’t normally think of investing when it comes to college students, but it may actually be a more important idea than it seems to be at first glance.

Table of Contents

- Investing as a College Student

- Why Should a College Student Invest – Why Not Wait Until After Graduation?

- How to Invest for College Students

- Managed Investments vs Self-Directed Investing

- Where to Invest With Small Amounts of Money

- Best Advice for Investing College Students

- ”…Roth IRA, Can You Have More Than 1, and Is $1000 the Max Initial Investment?”

- Bottom Line – How to Invest for College Students

Investing as a College Student

A GFC reader recognized the importance of college students investing money and asked the following question:

“Hi, Jeff. What is the best investment advice I can give my 2 college kids? They are still in school (grad students) but work making just under a couple hundred bucks a week. Both are pursuing doctorates, so loans are going to be quite large. What is the best investment plan they can start now? Also, regarding Roth IRA, can you have more than 1, and is $1000 the max initial investment? Thanks.”

I love questions like this because they take us in directions that we never expect to go – and that’s usually exactly where we need to go. The more I got to thinking about this question, the more important I came to realize the topic.

It’s not always possible for college students to begin investing because of finances. The question of how to make money in college can be hard. But for those who choose to invest in college, it’s actually a brilliant strategy on a number of fronts.

Why Should a College Student Invest – Why Not Wait Until After Graduation?

Though we normally think of investing as an activity that can and usually should wait until after graduation, I was able to think of several compelling reasons for starting in college:

- Experience: The student will graduate from college already having investment experience.

- Nest egg: The student will graduate from college and already have at least a small investment nest egg – the future time value of that investment can be enormous.

- Maturity: The student will cross an important “adult” threshold – investing – earlier in life than most.

- Education: Real-world lessons will be learned in the process of investing that could never be learned by reading books, visiting websites, or even watching “how to” videos.

- Initiative: Just getting started is often the single biggest hurdle for a new investor, and if you begin while still in school, you’ll have already cleared it.

- Potential: If you can save and invest while still in school, and on a very limited income, think about what you can do after graduating when you’ll have a full-time income.

The student who gains experience investing in college – even at a very low level – will have a big advantage over those who haven’t.

If investing continues after college, the student will ultimately have an even bigger advantage over their peers, who might wait several years after graduation to begin.

How to Invest for College Students

The single biggest step for how to invest for college students is carving out at least a small space for savings on a very limited budget. That means investing is actually a two-step process – saving money and then investing it.

Since the reader’s two kids are making “just under a couple hundred bucks a week” it will admittedly be a tight squeeze.

But if each could set aside at least $20 a week for savings and investing, that would be over $1,000 for a full year.

Just as important, saving even a small amount is better than nothing at all. Since the kids are still in school, their education is and should be their main priority. Being able to save and invest is a bonus and one that will pay big dividends after they graduate.

As to what to invest in? Stocks! As a young person, very early in life, you should invest in growth. Capital preservation will become more important later in life, but as a college student, you don’t have much capital to preserve. The emphasis needs to be getting to the point where that’s necessary, and that’s best accomplished with stocks.

That doesn’t mean individual stocks necessarily, but you could also invest in low-cost, index-based exchange-traded funds (ETFs) that hold stocks.

Managed Investments vs Self-Directed Investing

Next to committing to saving money for investments, the next biggest decision is deciding whether you want to go with a managed investment account or self-directed investing.

Managed Investing

Managed investing is just what the name implies, turning your money over to a manager who handles all of the details of investment management for you. This includes everything from creating a portfolio allocation to choosing the specific investments and rebalancing the portfolio as necessary. The only thing you need to do with a managed investment account is fund it – everything else is handled for you.

Self-Directed Investing

This is do-it-yourself investing (DIY), where you not only fund your account but also handle all of the investing details. You create your own portfolio allocation, research and choose specific investments, and then decide when to buy and sell them.

In between, you also rebalance your account as necessary to preserve the desired allocations between investment classes, like stocks in fixed-income investments. You can do self-directed investing through popular discount investment brokers (see list below).

Which One You Should Choose

For college students, I think managed investing is the best choice. Since you are primarily focused on your education, it’s just a matter of turning your money over to a manager who will handle it all for you.

There are different ways you can take advantage of managed investing. The simplest is to just invest in mutual funds. You can do this by investing with a specific fund family, such as the Fidelity Funds or Vanguard, or you can open up an investment brokerage account and purchase mutual funds through that account.

The other alternative is to invest through fully managed platforms, commonly known as robo-advisors. These are automated online investment management services which are particularly designed for small investors.

You turn your money over to the platform, and it determines an investment portfolio for you based on a computer algorithm. As you put money into your account, it’s automatically invested according to the target allocation. The platform also handles all of the rebalancing as necessary.

Between the two managed options – mutual funds and robo-advisors – robo-advisors will be the better choice for college students. Mutual fund families typically require large minimum initial investments of at least $1,000, but more often several thousand. Several robo-advisor accounts can be opened with no money at all (see list below).

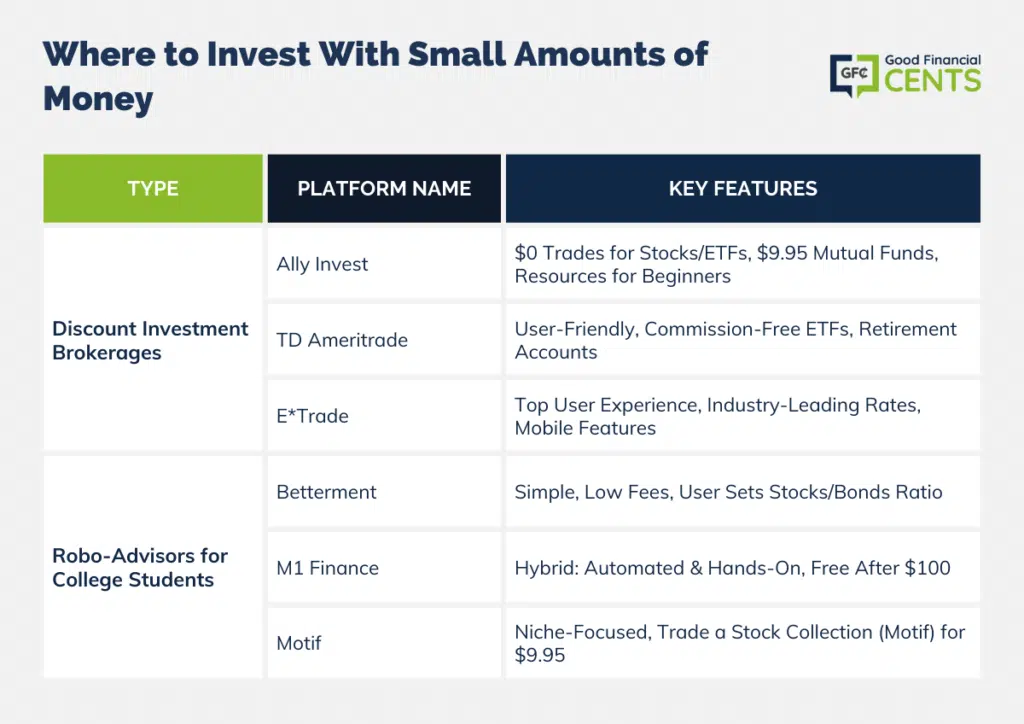

Where to Invest With Small Amounts of Money

If you’re interested in self-directed investing, there are several popular investment brokerage firms that will allow you to open an account with no money whatsoever. However, you won’t be able to begin investing until you accumulate at least a few hundred dollars.

Best Discount Investment Brokerages

Ally Invest: Ally comes with some of the most affordable trades on the market at $0 for stocks and ETFs and $9.95 for mutual funds. It has plenty of resources to help the new investor get started.

TD Ameritrade: TD Ameritrade just might be the easiest brokerage for new investors, and it comes with loads of commission-free ETFs. You can also open a number of retirement accounts with TD, getting a jumpstart on saving for the future.

E*Trade: Look no further than E*Trade if user experience is at the top of your list. Along with leading the industry in investment options and rates, E*Trade offers stellar mobile trading features.

Best Robo-Advisors for College Students

Robo-advisors are great, especially if manual trading doesn’t appeal to you. As money flows into the account, it will be automatically invested. It’s virtually a worry-free investment platform. Perfect for college students who have schoolwork to worry about!

Betterment: Betterment is king in the robo-advisor world, and it couldn’t be simpler. You choose how much to invest, how often, and the breakdown you want between stocks and bonds based on your risk tolerance. Betterment handles the rest, with low fees and no hidden fees.

M1 Finance: M1 is shaking up robo-advising, offering the best of both worlds to investors. With M1, you get automated management but hands-on selection of where to invest. After your $100 minimum investment, M1’s services are totally free.

Motif: Motif is a unique platform that’s ideal if you’re interested in a particular niche or industry but not familiar enough to pick out individual companies to invest in. You just pick a collection of stocks, known as a motif, that houses a whole host of organizations, and you can trade a whole motif for $9.95.

Best Advice for Investing College Students

Simply Put: Invest, and NEVER Stop!

As much as anything else, investing is a habit. We all know there are good habits and bad habits, and investing is one of the best of the good. The earlier the investing habit is developed, the better. That means the college years are actually an excellent time to begin creating the habit.

In fact, from a financial standpoint, investing may be the best habit to develop, next to staying out of debt. But even then, only maybe!

And Debt Brings up Another Important Point

The reader indicates both of his kids, being in graduate school, are accumulating “loans (that) are going to be quite large”. When it comes to student loans, we’re talking about unsecured debt. That means while student loans may be the size of a mortgage, there’s no property securing the debt that could be sold to make it go away.

Investments may be the next best alternative. Sure, by the time the reader’s kids get out of school, they won’t have nearly as much money in their investments as they will have in student loan debt.

But as the years go by, and their student loan debts gradually decline due to amortization, their investments will increase in value. At some point in the future, their investment portfolios may rise to a level where the money can be used to pay off student loans.

That creates a situation in which very large student loan debts – that might take 20 years to pay off – could be paid off in 10 years or less.

”…Roth IRA, Can You Have More Than 1, and Is $1000 the Max Initial Investment?”

This is the reader’s last question, and I want to address it because it’s an opportunity to point out the unique advantages of a Roth IRA, specifically for college students.

To answer the reader’s question directly, yes, you can have more than one Roth IRA. And $1,000 is not the maximum initial investment. A college student – or anyone else – can invest as much as $7,000 per year in a Roth IRA (or $8,000 if you’re 50 or older).

But let me get back to the advantages of a Roth IRA for a college student. I actually think a Roth IRA is one of the best investments for college students and for young people in general.

Here’s why:

- Since the contribution isn’t tax-deductible, it can be withdrawn from the account at any time without either an income tax liability or an early withdrawal penalty. Should the student need access to the money early, he or she can always get it.

- The money in a Roth IRA accumulates on a tax-deferred basis. This enables a faster accumulation of investment earnings in the account.

- A Roth IRA is a retirement account, so by starting while you’re still in school, you have a big advantage when you get out and start working and begin making contributions to an employer plan. The Roth IRA will be a big head start on what will be the biggest savings mission in your life.

The reader didn’t specifically ask for this information, but I think the Roth IRA is such a good investment for college students that it’s worth starting one if you’re thinking about investing in general.

Would you suggest any different strategies on how to invest for college students?

Bottom Line – How to Invest for College Students

Investing as a college student might seem unconventional, but it presents a strategic opportunity.

Beginning the investment journey early provides college students with invaluable experience and a financial foundation, setting the stage for future financial security.

Engaging in investment during these formative years offers real-world financial education beyond traditional academic learning.

With many investment avenues available, from managed investments like robo-advisors to self-directed options, even small amounts can make a difference.

Moreover, the benefits of instruments like Roth IRAs are especially pronounced for the younger demographic.

Ultimately, early investing not only provides financial growth but also nurtures discipline, foresight, and the habit of smart money management.

Hey, Mr. Rose.

I am wondering, you mentioned investing with a manager is the way to go, does that still apply if u want to invest in the Roth IRA? Since you said the Roth IRA is the best investment for college students, which I am, should I just invest in that or through the robo-advisor?

Thank you,

Wanna-Be- Rich College Girl

If you happen to be in possession of collectibles with value for a certain cultural movement or zeitgeist that are still relevant and have continuity (even the more valuable with original packaging and documentation), you are already sitting on an untraditional investment that could be worth even hundreds of thousands. Toy collectibles like Transformers, Barbies and rare accessories, GI Joe’s hold the biggest value ascribed to scarcity and condition, and several toy parts are going on the market for thousands if not over 10K each. It is a nontraditional class, certainly, but one that can hold immense value with time based on the factors cited above, not unlike rare artifacts, paintings, memorabilia, classic cars.

Another way is to lend your technical expertise to market research, and invest the earnings. A lot of platforms offer flexible, fun, lucrative projects for $150-300/hour (especially for postgraduate individuals, who are recruited in harder to fill quotes) and can be done online. Forget the overcited survey sites offering low incentives for a lot of work; seek the established firms paying for technical expertise, particularly data science UX. Any doctoral student has experience with that, regardless of field, and those projects pay the most.

On your second bullet point under the Roth IRA paragraph at the end of the article, you state that a Roth IRA accumulates on a tax-deferred basis. I thought the traditional IRA accumulates on a tax-deferred basis, and the Roth is taxed now? If you could clarify for me, I would really appreciate it. Thanks

Hi Ken – Roth IRA contributions are not tax deductible when made (traditional IRA contributions generally are). The investment income in the Roth IRA is tax deferred (you’ll pay tax on it if you withdraw it early). But if yo hold it until age 59.5 it can be taken tax-free.

This article is really helpful to me. It has actually answered most of my questions, but I’m a Nigerian citizen don’t know where to invest in,cos most of the platforms are for U.S citizens.pls I would like to know where I can invest as a Nigerian.Betterment and wealthfront are for d U. S

Hi Oma – Since I’m US based I cover only investment platforms in the US. Please check the web to see if there are any available in Nigeria. I don’t have that information, nor do I have it for other countries.

Hi Jeff,

I have the same issue with Oma. I am a Nigerian citizen studying in the US at the moment and I have tried signing up to a few of these investment platforms and they only cater to american citizens or permanent residents. Are there ways to work around this? it’s kind of strange studying and working part-time in the US but being unable to invest here.

Thank you.

Hi Orode – The only possibility may be going for citizenship once you graduate. Though some companies will accept US residents with a green card. You can work it out, but you’ll have to be patient.