The best credit monitoring services are critical tools to help you catch identity theft and other types of fraud right away. Without credit monitoring, you could be a victim of fraud or other problems on your credit report and not find out for months or even years, which can have a serious impact on your life.

While some credit monitoring services come with a monthly fee, others offer free basic services you never have to pay for. Just remember that, for the most part, the breadth of services you receive will be commensurate with the monthly premium you’re willing to commit to. Where free credit monitoring services offer a very basic suite of benefits, paid credit monitoring services from companies like Identity Force and LifeLock take extra steps to protect your identity and your credit score, even offering additional perks like dark web monitoring and identity theft insurance.

Before you choose a credit monitoring service, it helps to know which features the top companies offer and how much they charge. In the meantime, you should compare credit monitoring companies in terms of the quality of their offerings, their overall success rate, and their user reviews. To help in your search, we compared more than 20 free and paid credit monitoring services that are available today.

Most Important Factors When Selecting a Credit Monitoring Service

Table of Contents

- Most Important Factors When Selecting a Credit Monitoring Service

- The Best Credit Monitoring Services of 2024

- Reviews of the Best Companies

- What You Need to Know About Credit Monitoring

- How We Chose the Best Credit Monitoring Services

- Summary: Best Credit Monitoring Services of 2024

- Final Thoughts – Best Services for Monitoring Your Credit

Your choice of credit monitoring service could mean all the difference for your life and your credit score, but that doesn’t mean there’s one “best” service for everyone. In reality, different services may work best for different people based on their needs, their credit habits, their family size, and more. Here’s everything you should consider as you compare the credit monitoring services that made our ranking:

- Costs: While several credit monitoring services that made our liar offer a free version, keep in mind that the perks they offer are limited. You can also pay for credit monitoring services to achieve a broader range of coverage, but make sure to compare pricing so you’re only paying for the services you need the most. If you decide to pay for this kind of help, expect to pay between $9 and $40 per month.

- Normal Credit Usage: If you’re someone who doesn’t post a lot of credit movement each month, it’s possible a free credit monitoring service may be all you need. If you have an array of open lines of credit and lots to keep track of, on the other hand, you may be better off with a more robust credit monitoring service plan.

- Identity Theft Protection: The more you have to lose, the more identity theft protection becomes important. Some of the most comprehensive credit monitoring services offer up to $1 million in reimbursement for stolen funds, which may be worth paying for if you have a high net worth.

The Best Credit Monitoring Services of 2024

We selected the following credit monitoring services based on the value they offer clients and the broad range of services they include. If your goal is protecting your credit and stopping identity theft in its tracks, this list is a great place to start your search:

| COMPANY | PLANS OFFERED | BEST FOR | GET STARTED |

|---|---|---|---|

|

| Identity Theft Prevention | Get Started |

| Comprehensive Coverage | Get Started | |

|

| Online Security | Get Started |

| Free Credit Scores | Get Started | |

| Security Features | Get Started | |

|

| Credit Monitoring | Get Started |

| Basic Credit Monitoring | Get Started | |

|

| Financial Monitoring | Get Started |

Reviews of the Best Companies

Credit Sesame

Credit Sesame is well known for its free credit monitoring service, and it’s easy to see why. Once you sign up and create an account, you can get a look at your credit scores for free. You also get access to free credit monitoring and identity theft monitoring, as well as an array of tools that can help you figure out how to improve your credit score over time.

If you decide to pay for a plan, Credit Sesame also offers premium credit monitoring services in three different tiers — Advanced Credit, Pro Credit, and Platinum Protection. Where all three paid services include credit score updates from all three credit bureaus, you can pay more for perks like 24/7 phone access to credit repair experts, dark web monitoring, and public records monitoring. The highest level of coverage from Credit Sesame also tops out at $19.95 per month, which is a good value considering all that is included.

Get Started With Credit Sesame

Why It Made the List: Get your credit score for free each month, or you can opt to pay for premium services that include dark web monitoring, social security monitoring, 24/7 customer support, and more.

What Holds It Back: Credit Sesame doesn’t offer identity theft insurance in any of their plans, nor do they offer any specific software that protects your identity online.

Privacy Guard

Privacy Guard is another credit monitoring company to consider if you’re especially fearful of having your identity and financial information stolen. This company offers three plans — identity theft protection for $9.99 per month, credit protection for $19.99 per month, or a combination of both plans for $24.99 per month.

Their top tier plan, which includes all services the company offers, comes with perks like credit monitoring of all three bureaus, debit and credit card monitoring, public records monitoring, dark web monitoring, and $1 million in identity theft insurance. You’ll also get some unusual benefits like neighborhood reports, registered offender locator tools, and emergency travel assistance.

Why It Made the List: Privacy Guard’s top-tier credit monitoring plan offers some of the most comprehensive and robust coverage against identity theft and other types of fraud

What Holds It Back: This company doesn’t offer any free credit monitoring help, so you’ll have to pay to play.

Lifelock

LifeLock is one of the most well-known players in the credit monitoring niche, but its notoriety is very well-deserved. This company offers several different credit monitoring plans to suit any budget or family size, and they also include online software that aims to protect you as you use the internet for shopping, banking, and more.

LifeLock offers three plans, all of which include Norton 360 computer software for additional online computer security. Select coverage starts at $9.99 per month, an Advantage membership is $19.99 per month, and Ultimate Plus coverage is $29.99 per month. These rates are good for the first year.

Why It Made the List: All of LifeLock’s credit monitoring plans come with Norton 360 computer software, which protects your identity when you bank and shop online. They each come with up to $1 million in identity theft insurance to pay for lawyers and experts, as well as tiered coverage for stolen funds, personal expenses related to identity theft, and more.

What Holds It Back: LifeLock doesn’t offer any free services.

Credit Karma

Credit Karma offers a very basic list of benefits without any additional insurance or extensive monitoring involved, but the services they do offer are absolutely free. Once you sign up for an account, you can see your credit score for free at any time. You’ll also be notified of any changes to your credit score or your reports, including any accounts opened in your name.

Credit Karma also offers valuable tools that can help you determine which factors may be hurting your score and the steps you could take to improve it.

Why It Made the List: Credit Karma is free to use and may be ideal for someone who only wants basic credit monitoring services and a free look at their credit score each month.

What Holds It Back: This company doesn’t offer any in-depth credit monitoring services or perks. For example, you won’t get social security number monitoring, dark web monitoring, or identity theft insurance.

IdentityForce

IdentityForce offers two different plans that can help you protect your credit and your identity — an UltraSecure plan for $17.95 per month and an UltraSecure + Credit plan for $23.95 per month. Both plans include perks like fraud monitoring, court records monitoring, Medical ID fraud protection, and dark web monitoring. The biggest difference is that the more expensive plan also includes credit monitoring of all three credit bureaus — Experian, Equifax, and TransUnion.

It’s also important to note that IdentityForce plans come with $1 million in identity theft insurance coverage.

Get Started With IdentityForce

Why It Made the List: This company offers two plans that include an array of features to protect your identity, although you should probably splurge for the pricier plan if you want credit monitoring included.

What Holds It Back: IdentityForce doesn’t offer a free credit monitoring service, and their cheapest plan is more expensive than other basic plans on this list.

MyFICO

If your main goal is credit monitoring, you may want to pay for credit monitoring directly from the source. MyFICO offers three different credit monitoring plans, each of which offers a higher tier of coverage for a higher monthly premium. Their basic plan, for example, is only $19.95 per month and includes one bureau coverage (Experian), credit monitoring, and $1 million in identity theft coverage, among other perks.

One detail to note is that the lowest tier plan offered doesn’t include identity monitoring, so you’ll need to pay more to get this important coverage. The basic plan also only monitors your Experian credit report, which could leave you vulnerable if the first signs of fraud on your account take place on your TransUnion or Equifax credit reports.

Why It Made the List: This company lets you pay for comprehensive credit monitoring directly from MyFICO.com.

What Holds It Back: The basic plan is $19.95 per month, yet it doesn’t include identity monitoring and it only applies to your Experian credit report.

WalletHub

WalletHub offers a free credit monitoring service that applies to your TransUnion credit report. This service gives you free access to your credit score, access to your TransUnion report, and free daily updates that show your credit progress over time.

Like other free services on this list, you can sign up for free credit monitoring from WalletHub without a hard inquiry on your credit report.

Why It Made the List: WalletHub offers free credit monitoring of your TransUnion credit report.

What Holds It Back: This service is very limited, considering it only applies to your TransUnion credit report. Also note that you won’t get access to many features, including identity theft monitoring.

IDShield

IDShield is another credit monitoring company to consider, but it may be best for you if you want the most comprehensive financial monitoring available today. This company offers individual plans and family plans that include only your TransUnion credit report, but you can also select plans that include monitoring of all three bureaus.

All of their plans include credit bureau monitoring, social security number monitoring, dark web monitoring, public records monitoring, address change monitoring, credit score tracking and reporting, and plenty of other benefits.

One interesting feature about this company is the fact that they offer credit monitoring for children in their family plans. All plans also come with $1 million in identity theft insurance coverage.

Why It Made the List: Pay for robust financial and credit monitoring for yourself or your entire family.

What Holds It Back: Note that the least expensive plans offered only include monitoring of your TransUnion credit report and that you’ll have to pay more for monitoring of all three credit bureaus.

What You Need to Know About Credit Monitoring

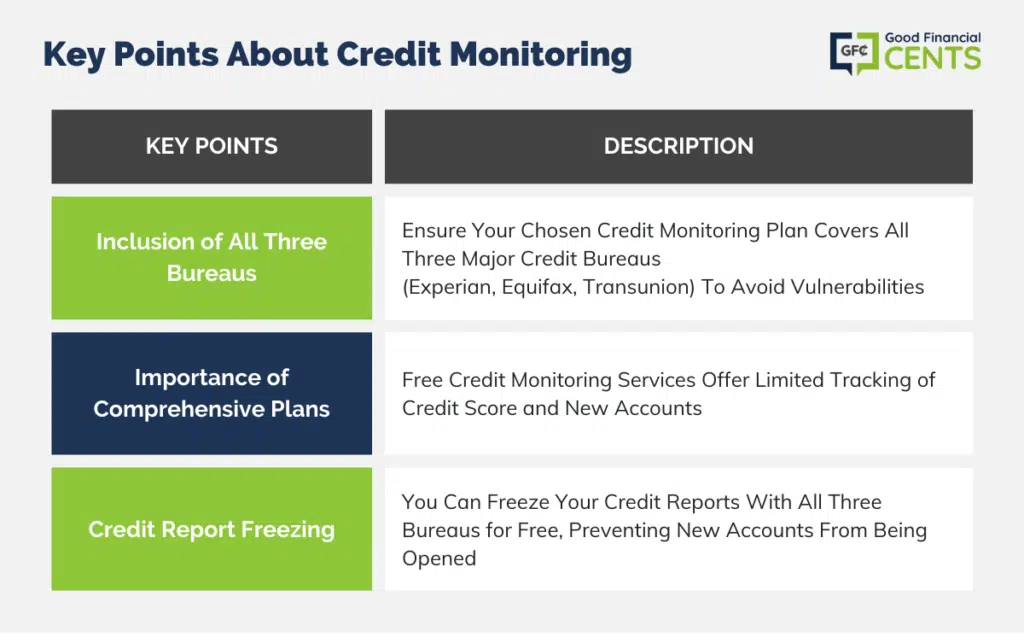

Make Sure All Three Credit Bureaus Are Included in Your Plan

You’ll notice that some of the services on our list only include one credit bureau, such as Experian or TransUnion. While these services are certainly better than nothing, keep in mind that you’ll leave yourself vulnerable if you have a company overseeing only one of your reports. If signs of fraud show up on your other credit reports first, you may be a victim of identity theft for months before you find out.

Free Plans May Not Be Enough

When it comes to free credit monitoring services, you really do get what you pay for. Free credit monitoring can help you track your credit score and new accounts opened in your name, but that’s about it.

Consider Freezing Your Credit Reports

Also be aware that you can simply “freeze” your credit reports with all three credit bureaus, and you can do so for free. The Federal Trade Commission (FTC) offers information on how to do so on this page. Freezing your credit reports prevents anyone from opening a new account in your name, including you. If you decide to open new credit once your accounts are unfrozen, you’ll have to take steps to temporarily “unfreeze” your credit report

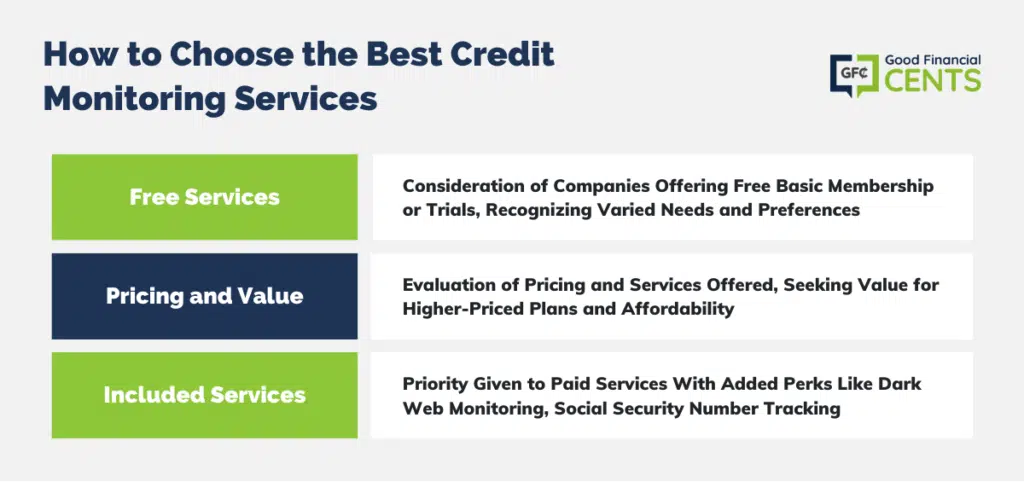

How We Chose the Best Credit Monitoring Services

Choosing the best credit monitoring services of 2024 was no easy feat, mostly because there are so many companies offering identity theft and credit monitoring help. Here are the main factors we considered as we compared plans to see how they stack up:

Free Services

While free services don’t offer the most comprehensive credit monitoring available today, we did give precedence to companies that offer a free basic membership or a free trial. We recognize that paid credit monitoring may be overkill for some people who just need basic information on their credit reports each month. We also know that some consumers prefer to give services a try for free before they commit to paying a monthly premium.

Pricing and Value

While pricing for the plans that made our ranking may be all over the place, we looked for credit monitoring services that offer a lot of bang for your buck. Higher priced plans were definitely considered provided the included services were commensurate with the monthly premium required. On the other hand, we definitely looked for companies that offer basic credit monitoring for a reasonable monthly rate, and even less than $10 per month.

Included Services

We gave precedence to paid credit monitoring services that include perks like dark web monitoring, social security number monitoring, and identity theft insurance. We also looked for companies that offer the option to monitor all three of your credit reports instead of just one.

Summary: Best Credit Monitoring Services of 2024

| Company | Best For | |

|---|---|---|

| Identity Theft Prevention | Get Started |

| Comprehensive Coverage | Get Started | |

| Online Security | Get Started |

| Free Credit Scores | Get Started | |

| Security Features | Get Started | |

| Credit Monitoring | Get Started |

| Basic Credit Monitoring | Get Started | |

| Financial Monitoring | Get Started |

Final Thoughts – Best Services for Monitoring Your Credit

Credit monitoring services are indispensable tools in the fight against identity theft and fraud. Delaying detection can lead to severe repercussions for your financial well-being. The selection process involves balancing costs with the extent of protection required, as different individuals have distinct needs.

Companies like Identity Force and LifeLock offer comprehensive paid plans with advanced safeguards, including dark web monitoring and identity theft insurance. Evaluating services based on their offerings, success rates, and user reviews is essential.

Ultimately, choosing a credit monitoring service is a crucial step toward safeguarding your credit and identity.