The old saying goes there are only two certainties in life: Death and Taxes.

We know we can’t cheat death, but did you ever wonder what happens if you file your tax return late? Or even worse, you don’t file your tax return at all?

Frankly, I’m too scared to find out what would happen if I didn’t file my taxes. Just in case you ever flirted with the idea, here are the penalties you face from the IRS.

If you already missed the boat, here are some options if you missed the tax deadline.

Warning: You don’t want to mess with the IRS. Depending on the nature of the actual return, you are either faced with paying interest or even worse, penalties. Consider, at least, filing a tax extension.

Do you need some help filing your taxes this year? If so, here is a list of my favorite tax preparation softwares to make the process easy and straightforward for you:

Interest When You File Tax Return Late

Interest on underpayments or over-payments runs from the extended due date of the tax return, i.e. April 15th of any given year. Regular interest is set by statute, but underpayment incurs a 1% premium rate, compared with the rate of interest that will be paid by the IRS on over-payments or refunds.

Basically, expect to be paying more interest in you owe money to the IRS, versus if you paid too much. If you are owed a refund, you’ll still earn interest on the amount entitled to you, just at a lower interest rate. It’s kind of like getting a loan from a bank versus how much they pay in their savings accounts.

Table of Contents

Penalties When You Don’t File Tax Return

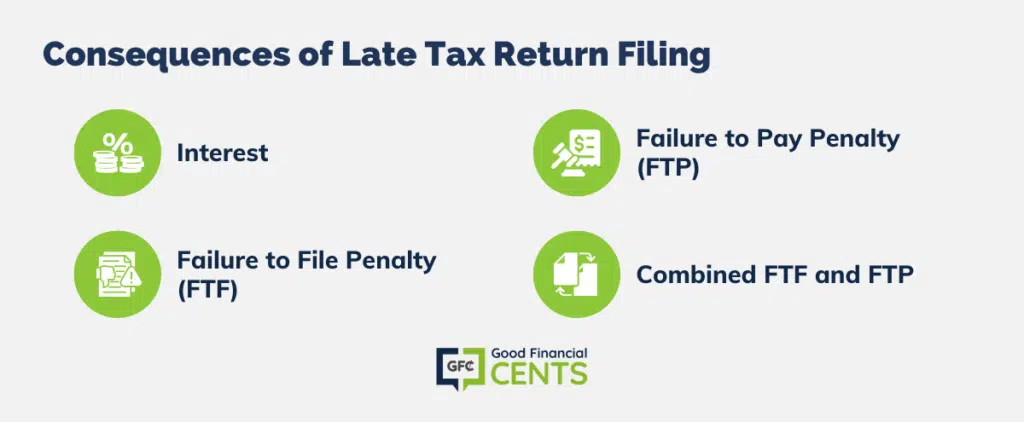

Penalties may be categorized as failure to file or failure to pay penalties which will automatically be assessed by the IRS, and as an underpayment that is related to some negligence or intentional fault of the taxpayer.

The failure to file or (FTF) penalty is assessed by the IRS at a rate of 5% per month or partial month up to a 25% maximum. The failure to pay (FTP) penalty is assessed by the IRS at a rate of 0.5% per month or partial month up to a 25% maximum. If both the FTF and FTP penalties are assessed, the FTF penalty is reduced by the FTP penalty.

Example: A taxpayer files a return 39 days after the due date. Along with the filing of the return, she remits a check for $6,000, which is the balance of the tax owed. Therefore the total FTS and FTP penalties are $600, computed as follows:

- FTP penalty, .5% times $6,000 times two equals $60.

- FTF penalty, 5% times 6,000 times two equals 600.

- FTP penalty penalties run concurrently minus $60. Total penalties, FTF, and FTP equal $600.

The FTF penalty of $600 is reduced by the FTP penalty of $60 making the adjusted FTS penalty $540. Then adding the FTP penalty of $60 is still due even though it reduces the FTF penalty makes up a total assessed penalty of $600. Still confused? If so, the easiest way to avoid this is to pay your taxes!

As mentioned there are also underpayment penalties owing to some fault of the taxpayer. However, there are also the following penalties, listed in order of their severity.

- Criminal fraud. This is simply tax evasion, which is illegal. If convicted of this penalty the taxpayer will be subject to heavy court-determined fines, imprisonment, or both (see pic below for an example).

- Civil fraud: This is essentially taxpayer fraud that does not rise to the level of criminal fraud. If imposed, the penalty is up to 75% of the portion of the tax underpayment attributable to fraud.

- Negligence: This accuracy-related penalty is imposed if any part of the underpayment, is due to taxpayer neglect, or to disregard of the tax rules and regulations without the intent to defraud. The penalty is 20% of the portion of the underpayments attributable to the negligence.

- Frivolous Return: A frivolous return is one that omits certain information necessary to determine the taxpayer’s tax liability, such as her Social Security number. Usually, such a return is filed by a protester who is attempting to pester the IRS and make its job more difficult. The penalty is $500 for each frivolous return filed.

Filing Tax Return Late Example

Let’s look at another example. Charles filed a timely tax return but is later required to pay an additional $15,000 in tax. This amount, 6,000, is attributable to the taxpayer’s negligence. The negligence penalty will be a 20% penalty applied to the negligent component. Therefore, the total amount of penalty imposed on Charles is $1,200. 6,000 times 20%.

Don’t Forget The Tax Extension

If it’s getting close to the wire and you still don’t have all your tax information together, you still can file a tax extension. The key to the extension is paying an estimated tax in the event that you owe. If you haven’t paid any tax throughout the year, or not enough; then the same interest and penalties would apply.

If you can’t pay your taxes, you still have options. As a last result, you could pay your tax with a credit card. Don’t assume it’s as convenient as it sounds.

How Do You File Taxes After It’s Too Late?

When you finally realize that you haven’t filed your tax return, it’s best to file sooner than later (obviously). You’ll want to collect all your tax documents for the years that you didn’t file. Yes, that’s a lot of paperwork to collect, but remember that you are dealing with IRS. The more you can find the better.

- If you filed an extension AND paid at least 90 percent of your actual tax liability by the due date, you will not be faced with a failure-to-pay penalty if the remaining balance is paid by the extended due date.

- SPECIAL CIRCUMSTANCES: You will not have to pay a failure-to-file or failure-to-pay penalty if you can show that you failed to file or pay on time because of reasonable cause and not because of willful neglect.

If taxes seem like advanced chemistry to you, then hire a tax professional (CPA preferred) to help you through the process. Be ready to pay some or all of the back tax that is owed. If you can’t afford it immediately, you should be able to strike a deal with the IRS.

File Your Tax Return and Avoid the Headache

Failing to file a tax return and pay your respective tax bill can be of serious consequence. There are have been many high-profile cases of individuals who failed to pay their appropriated tax bill.

If the big names can’t cheat the IRS, why do you think you’ll get away with it? Just ask our man Wesley.

Moral of the story:

How to File Taxes on Time

Not filing a tax return is a terrible idea unless you want to hang out in prison with people who never filed their taxes like Wesley Snipes.

Avoiding that fate is pretty simple, fortunately. All you need to do is get your documentation together and file your taxes before the tax filing deadline goes by.

You could print off the tax forms from the IRS website, grab a pen and your favorite calculator, and get to work on calculating your return. But why would do that with so many great software options available to not only file an accurate tax return but also guarantee you get your maximum return?

Here is a great option:

TurboTax

TurboTax is the leader in filing your tax return with software. You used to have to buy TurboTax at a retail store, but they have grown their web tools significantly and you can file your return 100% online. (You also get the option of downloading the software to your computer or using their mobile and tablet app options as well.)

TurboTax comes in several editions:

- a free edition for Simple / 1040EZ Returns

- a Deluxe edition which is the best option for most individuals and families

- a Premiere edition for those with investments and rental property; and

- and a Home & Business edition to knock out both issues at the same time.

Simply select the version that best fits your needs — hopefully, you need Premiere because you’ve been investing for your future — and the software asks you questions along the way to fill out your tax return.

It’s incredibly simple and can save you hundreds of dollars compared to using an accountant. Plus, TurboTax comes with an Audit Support Guarantee so you don’t have to face an audit alone.

H&R Block

I know several people that still feel antsy overusing TurboTax and would prefer a more traditional tax service. Well, you cannot get more traditional than H&R Block. What sets them apart from TurboTax is that if you have a serious problem you can always save off your work and head down to a local H&R Block office. The availability of that support makes them a great option.

H&R Block editions include:

- Free edition for simple federal tax returns.

- Basic – great for people who have slightly more complex returns.

- Deluxe – for most people this has the best value of features.

- Premium – Geared toward small business owners and those with rental property.

Once you are on the site you can select which version meets your needs. If you are not sure you can start with the free edition and work out which edition ends up being the best for your needs as you go.

The whole process is very well broken down and filing with H&R Block gives you the comfort of the larger brand,

Filing your taxes online is easy. Get started with TurboTax or H&R Block and avoid all of the late fees, penalties, and investigation caused by missing the tax filing deadline.

Conclusion

In the dance of life, taxes are the partner you can’t sidestep. While the allure of delaying or even skipping the tax-filing tango might seem tempting, the tune quickly changes when faced with the IRS’s stern penalties.

Whether it’s the accumulating interest, hefty fines, or the looming shadow of criminal charges, it’s clear that paying on time is the way to keep the taxman’s two-step in check. And if you’re feeling a bit off-beat or out of sync with the whole process, there’s no shame in seeking a dance partner, be it a savvy software or a seasoned CPA, to guide you through.

After all, why risk a misstep with the IRS when you can simply waltz through tax season and stay on their good side? So, dust off those tax papers, tap into some timely help if needed, and let’s make sure our dance card is in order. Because, folks, the moral remains – it’s always better to file and pay on time than face the music later.

I have a question? If you don’t do your taxes for, let”s say 4 years, and then you do and the government owes you $10,000, do they pay you interest on that money. And if they do, what interest rate do they pay you as compared to the interest rate you pay them if you are late in paying them when you owe them money.

Thank You,

John King

Hi John – They do pay interest on overdue refunds – 4% per year was the latest figure I heard. I do believe that there’s a limit on how far back you can go with a refund – three years I believe. But check with a tax preparer.

Hey! I have a very bug concern. I’ve always filed my taxes on time every year. I just recently got married in June of 2016. My husband pays child support on 4 kids. It comes directly out of his paycheck but he is still behind on each case. He just informed me that he hasn’t filed in probably 5-6 years because the child support just took it all anyway. He works 2-3 jobs at a time so I know he had plenty of income. 30,000-40,000 a year probably. What steps do we need to take to right the years he missed and how can we file this year and I still get the money owed to me for my son and what I’ve worked.

Hi Katrina – My advice is to meet with a tax preparer and discuss your options. Since your husband hasn’t filed in 5-6 years, this can become very involved. Most likely, you’ll be advised to file as “married filing separately” if you believe that you will get a refund.

What if one is exempt all year but has not filed for over 6 years

Hi Maria – If you’re exempt there should be no problem, as long as you were also exempt in all 6 of those years.

My GF got a note from the IRS saying that she didn’t file one of her W-2’s from 2015. She filed as quick as she could in early 2015 before it arrived (if it even did), she needed her refund STAT. Even if she did file that missing W-2, she still believes she would have been under the threshold of owing because she made so little.

Can she add it to her 2016 taxes to account for it or does she need to submit some type of amendment to her 2015 taxes?

Thanks!

Heather

Hi Heather – Filing an amended tax return for 2015 would be the cleanest and most conclusive way to put an end to it. Also, if she had withholding on the missing W2, she might be entitled to a refund.

Hi,

So while cleaning up around my apartment I found my taxes from 2015 ready to be mailed stamped and addressed. Clearly it was never placed in the mail. I am owed a refund on both state and federal. Should I put them in the mail now or email the IRS first? How should I handle this? I have never been late before, have always filed and have always received a refund.

Hi Kate – You should be OK just mailing them in. It’s only a problem if they’re more than three years late. Since they owe you, there should be no penalties.

Hi, my husband and I have been married 10 years and have never filed together due to my student loans and his different job situations, as well as us separating a few times. I’ve always filed head of household at our address and he’s always filed head of household at his home he owned before we were married (he still owns this home) we have never put married on our returns. we just purchased a home together (our 1st one) Nov. 2016. How should we file? I don’t want to get penalized for previous years not filing together, I still want to file separately, by the way we were advised to file that way by our tax preparer.

Hi Velma – You can still file separately, but you’ll have to file as “married filing separately”. You won’t be able to file as head of household however. If your tax preparer has advised you to file that way, it’s probably because it will result in a lower tax liability than married filing jointly.

Hello! Okay here goes my little story…I am 29 years young. I filed my taxes for 2013 and was supposed to get a refund but they IRS took it for my student loans. I THINK 2013 was the year that Obama started that penalty for not having health insurance (I’m not exactly sure what year it started) and I didn’t get health insurance until March of 2016. Also, since May of 2013, I haven’t had a job. I’ve been living with my boyfriend and he works. Well, in March, I had a baby and I want to try to get myself in order for the 2016 year to file in January but I don’t know what to do. What kind of penalties will I have? Will they be super expensive? Is there even a penalty for not filing even though you did not have a job? Kinda nervous because I know the IRS is not anything to mess around with and I really want to get all of my stuff together. I usually do my own on TurboTax, in fact I have always done mine on TurboTax, so I’m not sure if I should go to a CPA since I’m not even sure what to do. Thanks in advance!!!!

Hi Olivia – You didn’t have to file the past few years because you had no income. If you do need to file for 2016, go ahead and don’t worry about not having filed in the past. Since you had no income you won’t hear from the IRS.

Hello so you telling me if you had no income in 2016 you don’t have to file ? What about the healthcare fine ,will that be exempe d? What is the amount of money that is too much to be exempt? Is it $10,000 or$20,000 you have to make under in order to receive that exemption?

Hi Rachel – Yes that’s what I’m saying. You had no income so you don’t have to file. I would also think that if you have no income you’d qualify for an exemption under Obamacare – or Medicaid.

Hi,

I am an international student on F-1 visa. I haven’t earned any money in the year 2015 but started a job from Feb 2016. I didn’t file my tax return for the year 2015.

Is it fine?

Hi Vickey – Since you didn’t have any income in 2015 you don’t need to file. You can go ahead and file for 2016, since you’ve worked most of the year.

I have been paying an IA for a few years now. I had to roll 2011, 2012, 2013 all into the agreement. 2011 is paid off, 2012 is just about there so 2013 is on deck. In total it’s about $1700. I failed to file 2014 and 2015. Tonight I downloaded software and put my returns together for those years. I do owe for both years, roughly another $5000 total. Since I have failed to file, will this cancel my agreement and make me ineligible for a new agreement? Or is it possible to roll this balance into my existing balance and keep making payments? I adjusted my w4 for 2016 to get agressive and mitigate 2016 balnce due. Lesson learned but hopefully I can a dress these others and get back in proper standing.

Hi Rocky – You should be able to add it to the existing agreement. File the returns, wait to get a tax bill from the IRS, then call and tell them your situation. It should work out fine. It will help if you can pay at least some of the $5,000 when filing, that way both the amount of the installment agreement and the monthly payment will be as low as possible.

Hi I filed my 2015 taxes. Received state, but no federal. I did move and maybe mail got lost. Never received any forward mail from irs or any record of “where’s my refund” I don’t owe for sure. Will it affect me filing my 2016 tax?? It’s so hard to get a hold of them on the phone /:

Hi Stacey – With the IRS it’s always best to write a letter. They will respond typically within 30 days. Phone calls usually work about the way it happened to you, and you can never be sure if the information you get is accurate. Does your 2015 return indicate that you’re due a refund?

My husband just told me that he hasn’t filed taxes in 3 years, we were just recently married. He is an auctioneer and has his own company. I know that he hasn’t made a ton of money, but he still needs to file yearly doesn’t he?

Thanks

Hi Jami – He probably does need to file, especially if he’s self-employed or is paid by 1099. In either case, he’ll probably have to pay Social Security taxes, even if he doesn’t owe regular income tax.

What are the penalties…i havent file my taxes for three years i had no transportation and plus the lady at jackson Hewlett said that i owed them 127 to file my taxes because my student loan took my whole refund before they could take out their fair share cut..i talked to the lady at jackson hewlett aboutthe what if i didnt over 3 years she told me that as long as i owe on my student loan the irs can’t penalize me.. Is this true

Hi Alyssa – You’ll have to pay penalties and interest on any unpaid tax balances from the three years. Both are tied to the amount of tax you owe for each year. But the interest charges are based on an annual rate of (I think) 3%, so that should be minimal. I’m not aware that penalties are waived if you owe student loan debt. That doesn’t mean that isn’t true, only that I’ve not heard of it. You might want to check with a tax preparer, other than Jackson Hewitt on that.

Hi Jeff,

I hope you are still responding on here. I haven’t filed my taxes in three years due to some financial and health issues, and frankly being scared of the outcome nor being able to pay it at the time. I was 1099. After a few years of hard work I have stashed a decent amount of money and I am trying to get my life in order and settle all of my issues. How would you recommend going about this? Would you talk to a CPA first, or go straight to the IRS? I don’t want them to take everything I have saved up for :(. Please help. Thanks-

Hi Max – Definitely go the CPA route! #1, if you’re not familiar or comfortable dealing with the IRS you will need representation. Second, since you’re income was from 1099s, you’ll need an expert to calculate your tax liability. A CPA can handle all of that for you.

What happens if you’re an LLC and are part of a partnership with only 7.5% ownership and manager fails to file partnership returns on time?

Hi LeBron – As a minority partner, you can’t force them to file. But you can file your return without the partnership K-1. Once the K-1 becomes available, you can amend your return with the partnership information. When you do file your return, you might include an explanation that the partnership K-1 has not been provided.

I have a serious question,Im 39 years old and my oldest son is 24 I’ve owed child support since he was a baby.Since I had owed back pay on child support the IRS never gave me my refund check…The last time I can remember me filing was when I was 21 years old…Now all these years I’ve been incarcerated most of my life so I only worked 3 months from 21 until 35 years old..Then I worked from 36 years old a whole year straight and 37…So my question where do I start at???I never got a letter from the IRS but for me to drop this back pay of child support via they want a 2015 tax return…I only worked 2 months that year..See??Im trying to do that but will a tax office be able to get all my W-2 forms I need or should I just found ask them to get me 2015 W-2 form and start filling starting now??? Basically forget those earlier years..Please help me out so I.can get some kind of answer and guidance on what I should with this problem..

.

Hi Thomas – Your tax situation is complicated, so I’d recommend that you set up a meeting with the IRS and see if it can be straightened out. They have all of your tax records, including past w2s. If you have the money, you might want to go to a CPA, but you will still need to get records from the IRS. But I don’t recommend that you try to fix this by the do-it-yourself method. There’s a lot involved. Since your income is so sporadic, I don’t think you’ll be looking at any penalties. Good luck!

My 27 year old daughter just informed me she’s never filed her tax returns as long as she’s been working. she’s been a waitress for 9 years so i’m hoping she’s never owed. Can you instruct me on how to help her please?

Thank you

Hi Nina – She should file as soon as possible for two reasons:

1) To claim any refunds owed her, though this may be limited on the earlier years, and

2) To clear her conscience and her record with the IRS

This will enable her to go forward without fear of problems with the IRS.

Hi, i have not filed tax return since 2010, but i have been unemployed since then and had no income. Do i still have to file.

Hi Roy – You don’t HAVE to file, since you had no income. But you may WANT to file in case you’re entitled to a refund. Since you had no income, you might be eligible for the Earned Income Tax Credit, which can get you a refund, even if you paid no tax.

Hey Jeff rose the IRS been calling my phone in all I never filed my daughter or my self what should I do

Hi Mesha – It’s almost certainly not the IRS calling you – the IRS send letters, they do not call. There are a number of scams of people claiming to be with the IRS and threatening a lawsuit against you. Don’t ever cooperate with them – they’re just looking to get information from you for fraudulent purposes. I’ve been called by some myself – I think everyone has. The IRS has put out statements confirming that they have nothing to do with these and that they’re scams.

If you’ve never filed, talk to a tax preparer and see if you even need to. You may also be entitled to a refund if you had tax withheld but you are under the amount of income where you will be required to file.

I have the same mind of question I haven’t files for a few years but also have.not worked only receive calworks and child support at the moment to I have to file I never new if I had to or not

Hi Deanna – There’s no way to know without seeing your income numbers. Sit down with a tax preparer and see what they recommend. Be sure to bring all of your income documentation with you.

I was employed for 10 months in California and moved to Minnesota in late October where i continued to work through 2015. It was my first time working out of state so I did not understand about the non resident forms and only applied for my CA taxes.

What kind of penalties/ jail time am i facing right now if i wait to submit my MN tax forms before January 2017? I only made about $7,000 during those last couple months so I am not sure how much tax I would owe. Any feedback would be appreciated.

Relax Adam, there’s no jail time! You’ll have to pay taxes and penalties to Minnesota, but the penalties won’t be severe. But make sure you file yourself, and do it now. You don’t want to delay and have Minnesota tax authorities contacting you two or three years from now. By then the penalties will be a lot higher. As to how much tax you’ll owe, you’ll have to run it through your tax prep software, or your accountant. When you file multi-state tax forms you typically do apportionments of income and deductions, so it’s not as easy to say how much tax you’ll owe on a certain amount of income.

Hey, I haven’t filed my 2015 taxes. I wanted to know how do I go about filing. I know it’s too late to avoid fees. I just want to file and get it over with.

Just go ahead and file your return as you normally would. If you are owed a refund, there will be no problem. If you owe money, there will be penalties and interest added to the unpaid balance. But it will be better if you file now, before those fees add up, and increase the amount you owe. These things are always best handled immediately.

I just found out that my son didn’t file his state or federal tax returns this year. He’s 23 and I’m sure is due a refund. Does he need to file and extension now or just file the tax return?

Hi Joella – It’s too late to file for an extension, that would have to have been done by April 18. But there shouldn’t be a problem filing the actual return and claiming the refund. After all, he is owed the money. There shouldn’t be any penalties and certainly no interest charges assessed, so go ahead and file and feel good about it!

I was notified today that my husband did not file 2013 or 2014. I know we owed on both of those years close to 2000. My husband just figured out it was due to not putting my social security number in correctly….What kind of fees are we looking at and what exactly should we do.

Hi Kari – I believe the penalty and interest work out to about 6% per year, which will charged on the outstanding balance going back to 2013. It should add a few hundred dollars to the amount of tax owed. If you can’t afford to pay the full amount, you can work out a payment plan with the IRS. You can make the payments over up to 72 months, but just remember that the penalties and interest will continue to add to the liability until it’s fully paid.

Hello – I didn’t file my taxes for three years for a couple different reasons but the main one was I was waiting for my wife to receive her SSN. We obviously procrastinated on this and is our own fault but the IRS told me that I couldn’t retroactively receive credit for my spouse before she received her SSN. Is this true? These returns are for 2013, 14, and 15 and we were married in 2010. We were married the whole time and our status never changed. Her first year she immigrated to the US was 2013. Additionally, I’m a veteran and was going to school during this time frame. The IRS also said that I couldn’t receive the student credit due to receiving VA benefits and receiving the ‘Yellow Ribbon’ benefit from my university. Is this true? Thank you very much for your help.

Hi Bryan – I do believe that’s true about the SSN, but you should be able to file for the part of the refund that’s attributable to your own income and tax withholding. You’ve got a complicated tax situation, and this could be an open issue for a long time. My advice is to hook up with a good CPA, see what he/she says, and be prepared to go through any necessary hoops.

I filed 2012 through 2015 on April 18th because I knew I was due a refund from State (MO) and Federal. Federal accepted all with no problem, however my state declared my 2012 late and kept the refund. I have 60 days to dispute the holding of my state refund. I found information on the IRS website that stated April 18, 2016 was the final date to receive a refund from 2012. I am unable to find any info for my state showing they were not honoring the April 18th date and that the 2012 had to be postmarked by April 15th even thought the IRS was closed. Is there anything I can do?

Hi Dee – You don’t indicate how much money the refund is, but if it’s substantial, you may want to hire either a CPA or a tax attorney to fight it. However, if there is a section of the state tax code that indicates it’s too late to get the refund from 2012 you may be out of luck.

Hello there! I just finished filing my 2014 and 2015 tax returns I was about to leave to go drop them in the mail when I stumbled across a pay stub from a job I had dec14-feb15. I’m in college so I put my home address for W-2’s to be sent to. In both years I made way below $10,300 which is the minimum income required to file a return for someone under 65 filing as single. My question is, what will happen if I just send in my returns as is with the other W-2? Will I be penalized or will I just not receive what I withheld at that job as a refund?

*just send in my returns without including the W-2 from the job Dec ’14-Feb ’15

-additional information

In both 2014 and 2015 I didn’t make enough income to require that I file but I realized I could still get my refunds so that why I’m filing now. Would omitting that W-2 cause me to be fined or get in trouble or would I just simply not receive a refund for the amount I withheld on that W-2. Also a secondary question, should I technically get two W-2’s from that job? (One for the period of time from my date of hire until the end of the month (mid december-end of 2014) and one for the period of time from the beginning of 2015 until mid feb when I quit?) Thanks!

Hi again Hannah – Basically, it’s the same as my original answer. But in regard to your last question, you are correct that two W2s should be issued, one for 2014, and the other for 2015. If you’ll get a larger refund for both 2014 and 2015 even with the additional income, I’d go for it, even if it meant filing an amended tax return for both years. Unless of course the cost of filing the two returns would exceed the amount of the refund. There is a possibility that the IRS will discover the error, recalculate the refund, and mail you the difference, although it may take a few years before that happens.

Hi Hannah – It really depends on whether or not the undeclared income creates a tax liability or not. If it does, there will be interest and penalties. If it doesn’t – and you’d be refunded the tax withholding from the job – you’ll be out the amount of the refund.

You might want to investigate this. Get a copy of the W2, then recalculate your income taxes. You may want to file an amended return (Form 1040X) if it means you will either have to pay additional tax, or if you are owed a refund. It’s always better to act before the IRS starts asking questions.

I believed I had filed my parents taxes (both Federal and State) through TurboTax (until my father asked to check because they haven’t gotten their refund.) There must have been a computer glitch because they are not saved to TurboTax but they are saved in PDF file. I am refilling them ASAP. Is there any way to avoid a penalty as it was my fault they technically didn’t file? They are due a refund from both Federal and State. Any suggestions appreciated. Thanks!

Hi Michelle – Since there is a refund involved, there will be no interest on the unpaid tax. There may be a small penalty for non-filing, but you might pay that yourself if you want to avoid having your parents pay it. The IRS may deduct it from the refund, so take a close look if the refund is less than the amount shown on the return.

This has happened to me. I was sure I had filed via Tax Act and we were expecting a refund. When we tried to find out where our refund was they said they never got it. Since they owe us money should I just resend through Tax Act again? Is there a place where I could explain?

Hi Susan – I’d check with TaxAct as to how to proceed. You may have to resend. Fortunately, since you’re owed a refund you shouldn’t have any penalties to pay.

If the owner of a small business pays regular quarterly taxes for a year and then closes the business, I assume you would still have to pay annual taxes, right? Is there a certain amount that must be earned for the year in order to pay in to the irs? Also, if the business does not have receipts, does the irs calculate what they believe you owe?

Hi Crystal – If you no longer have the business, or the income, you shouldn’t need to pay quarterly tax estimates. You only pay tax on the income you expect to earn, and if you won’t have an income, there is no tax.

HI. I filed my taxes in 2013 but I accidently omitted one of my employers. He never sent me a W2 or 1099 so I forgot about that job. I was recently contacted by the IRS. I think the amount was less than $4000. Will I incur high late fees and penalties?

Hi Rebecca – It depends. There will likely be a penalty for the omission, but interest rate charges won’t apply unless the W2 information will substantially increase your 2013 tax liability. As long as you had withholding on the W2, the tax liability was likely covered. The IRS contacted you because the employer DID file the W2, so the IRS has both the information and the tax withholding. Now if the IRS sent you a refund based on paid tax on the W2 and the missing income on the 1040, there may be interest charges as well. But for now, see how it plays out. The IRS will calculate the charges and let you know. Since the interest rate the charge is only around 3% and it’s only been about two years, it shouldn’t be that much, if it’s anything at all. Remember, the interest is charged on the unpaid tax, not on the undeclared income.

Hi, my name is Dawn and I am having a difficult time getting my PTIN number. When I tried to get a number, I was told to go to the social security administer office. However, when I went there they have had told me to go to the IRS office in order to receive a PTIN number. But then when I went to the IRS they told me to mail it to the office because they do not give them out by person anymore. So, now I am waiting to get my pay check so I can pay the 50 dollar fee to recieve it.

My question is, when I do receive the PTIN. Am I still able to file my taxes, or should I file them so I don’t owe the IRS anything.

Please keep back with me, I am having a stressed and difficult time with this whole PTIN number situation.

Hi Dawn – I THINK you may be confused. You don’t need a PTIN in order for you to get paid from your employer, or to file your income tax return. A PTIN is a Preparer Tax Identification Number, which is something that someone who prepares tax returns needs to have. If you file your own taxes, you don’t need a PTIN. And if someone else prepares your return they will have a PTIN. Why did you think you need this number?

Hi ,

I didn’t file for 2014 , because I owed $5000 and was going through challenging times financially . I filed for 2015 and it seems that I should get around $2000 back . I don’t want to get in trouble down the road but can’t really pay the $5000 + penalties right now as I am struggling . Coud I ask for an installment , a payment plan ?

Thank you

Hi Rich – Yes, you can set up an installment plan with the IRS. I think they give you up to 72 months to pay, so you should be able to work out a very low monthly payment. You probably want to have the 2015 refund applied to reduce the 2014 balance so the monthly payment will be even lower. Good luck!

Hi. I haven’t filed since 2011…. was on unemployment/extended unemployment for a year or so. Since then I have had part time jobs. IRS has not contacted me. I was going to file 2015 for now (not sure where old stuff is since I moved).

BUT – the IRS site says when you file you need to put in the amount you filed last year!! So how CAN I file for just 2015??

I have just 2 W2’s, no extra income or deductions.

Hi Ruth – I don’t know what the official answer to your question is, but since you didn’t file a return in 2014, then Zero would be amount to enter for the previous year when filing for 2014. Since you haven’t filed in several years, you should probably talk to a CPA to decide how best to handle this.

So this is what happen when you haven’t paid the tax. It could also be an informative one that this wouldn’t happen if you should have it updated. It could also be great if the company have been reminded you. So in order to avoid this and avoid bad record you should know the dos and dots. Big penalties could also appear in this consequences.

I am very bad in paperwork and so I had never filed taxes but I know I shouldn’t owe anything from IRS. I would like to start filing taxes but always worried about getting caught by IRS by never filed any taxes. What can I do and if there is any penalty even if I was supposed to get refunds in the past.

Hi River – Go ahead and file for 2015. Since you don’t owe any money for the unfiled years there’s no risk to you. You should also consider filing returns for the previous years so that you can get the refund money back.

In 2013 I worked in NY, lived in PA. Husband worked in PA only. Filed and omitted my husband’s income in filing the 1040 and the NYS non-resident return. I also did not file a PA state resident return at all. The federal caught this and sent adjustment so I have to pay back. Will the states catch this? Maybe not NY at this point but PA.

Yes Mike, the states will find out. The IRS and the state revenue agencies share information, so it’s just a question of time. You might want to go ahead and file the state returns and not wait for notices. They’ll come in due course.

Hi, I did not file my 2012 taxes (both federal and state) and I know Im getting a refund here…..How much time do I still have to file it and is there a way I can efile online ? Will there be any penalties ? Please advice

Hi Olivia – I don’t think there’s a time limit, and if you expect a refund on both returns, there shouldn’t be a penalty – with the possible exception of a very small late filing fee. I doubt you’ll be able to e-file a return that’s that old, but you might check with the service you use to see if they offer it. Typically you can’t e-file if there’s anything weird about a return, and since your 2012 return is so late it probably won’t qualify. But look into it.

Actually, she has 3 years from the original due date to claim a refund. For 2012 that would be 4/15/13. If she wants the refund she has to file by 4/15/16. Love this page by the way!

That may be true MJ, but I’d go ahead and file for the refund even if the time limit has expired. They may release it anyway.

My finance filed an extension on his 2014 taxes last year, but did not end of filing because he did not have the money to pay for his taxes and he already is on a payment plan from previous years. My question is how does he go about filing for 2014 and 2015?

Thank you in advance.

Hi Tanya – He’ll have to call the IRS and explain the situation. Most likely, they will add the 2014 balance to the existing debt plan, but it depends on how much he owes (over $50,000 will likely require that he provide financial statements documenting his hardship). Take care of that, then file the 2015 return. He may have to do the same on that.

Hi!! I have a problem! For 2014 I worked for one month in the summer only, but didn’t get a W-2 form because the manger changed and the new manager doesn’t care about giving me a W-2 because it’s a small restaurant. What can I do?? Am I in big trouble if I don’t get it filed soon?

Hi Ai – For a month’s worth of income, I wouldn’t lose any sleep over it. You probably don’t have any tax liability after your standard deduction and personal exemption, and probably had withholding to cover it if you did. The IRS may send you a letter at some point, and maybe even a refund check. It’s nothing to lose sleep over.

Here’s something else to ponder – maybe you didn’t get a W2 because the employer never filed one. They sound like the kind of business that might do just that.

so I just found a 2014 tax return that I got and laughed at because it was a tax return for like one month of work because I started my job in November. , no one has ever taught me anything about taxes so I’m pretty in the dark about all this and everything I read is saying il owe big money and freaking out. what do I do?

Hi JT – I’m not sure what your question is. If the return is filed, it’s history, so relax and forget about it. Going forward, you know not to panic. The owing big money thing is a scare tactic used by services that offer to negotiate with the IRS on your behalf. You’re usually better off doing that yourself, and saving the fee you’d have to pay to these services. Otherwise just relax about your taxes and enjoy your life!

Well I haven’t filed for a few years now and would like to catch up but I have a bad memory and travel a lot and work different jobs. How can I get all of the w2 forms easy. I don’t remember the places I’ve worked.please help thanks

Hi Jasmary – I’d suggest that you do your best to assemble the W2s from past employers to the best of your ability, but – I hope you don’t take this the wrong way – by your own admission this is not your strong suit. Also, you aren’t clear on how many years you haven’t filed. Have you been contacted by the IRS? You may owe, but then you may be due some refunds, which may be why you haven’t heard from them.

My suggestion is that you pay a visit to an IRS field office and explain the situation to them. Here’s the thing, you may not have a copy of your W2s, but rest assured the IRS does. You can ask them to prepare your returns based on those W2s and any exemptions/deductions/credits you’re entitled to. They can do that, and that will get you caught up with them.

But now that we’re in the 2015 income tax season, you should go ahead and file for 2015. You don’t want to add another non-filed return to the list.

An irs field office can file your taxes for you? Do they charge?

Yes Tamara. The IRS has all of your income information, as long as it all came from W2s and 1099s. However, if you’re self-employed or have investment transactions, they won’t have all that’s needed to file. They don’t charge for this.

But please keep in mind that since it will be prepared by the IRS it won’t necessarily be the best outcome for you. While tax prep normally involves income tax minimization, the IRS will be looking to go in the opposite direction.

what will happen since i didnt file my 2014 federal return? i owed 350 dollars and did not have the money to pay,i also was incarcerated at the end of april 2015 til oct 2015. what kind of interest or penalties am i looking at for the 350 i owed for 2014? Thanks Mike

Hi Mike – You can file the return, and pay as much of the balance as you can. The IRS will send you a notice to recover the remaining balance, plus interest and penalties. But on $350 they won’t be that high. What ever balance you can’t pay you can contact the IRS to workout an installment plan with them. You can take up to 72 months to pay the balance, so the monthly payment should be tiny.

Story: didn’t file 2013, barely worked but was a full time student on campus, I filed last year and this year and gotten back refunds especially since I was a student… Soo should I file my 2013 even though it’s been a while and made less than $500

Hi Bond – You haven’t revealed why you received refunds for 2014 and 2015, so it’s not possible to say that you’d get one for 2013. I’d say go ahead and file 2013, and see what comes back. Since you’ll probably get a refund there won’t be any penalties. And if you do get a refund, what ever the reason, you’ll be that much better off. Go for it, definitely.

What if I forgot to file my taxes for 2014 will there be penelities or will they hold my taxes this year .Would have got refund both years.

Hi Angie – If you didn’t file but you’re due a refund for both years, you need to file as soon as possible. You’re lending your money to the government on an interest-free loan. Don’t worry about penalties for 2014. If there are any they’ll likely be a lot smaller than the amount of the refund.

Hi! Great advice on th site! I worked one job but have two w-2 because I was first a temporary employee than became full time. Turbo tax calculated I receive significantly less in a return once I added the add’l w-2. Should I only file one w-2 and what is the penalty for “not adding” all earned income for 2016 taxes? I ask, in the past I have had temporary or short assignments that were not reported / didn’t receive a w-2 for

Hi Azzy – If the employer filed a W2 then the IRS has a record that you received the income. It may take them a year or two to figure out the omission, but they will come back to you sooner or later. Whatever benefit you receive for not declaring the income now will be due and payable in the future – plus penalties and interest. Also, if you fail to report the income two years in a row, the IRS may conclude that the omission is not accidental, and that could lead to bigger problems.

What happens if you missed filing a tax return where you worked for a part of a year. Will I get in major trouble for missing that one tax return. What can I do. Do I need to file it this year? Will it take my child credit this year?

Hi Ann – Best thing is to file the return for the year that you earned the income. If you had withholding, you probably won’t owe anything. And if you had withholding but you fell below the filing requirement (about $10k per year), you may be due a refund. Better to file than to wait for the IRS to contact you about it.

The child credit for this year is a separate issue. File for 2015 and claim the credit by all means. But I’d file the missing year return first. You have plenty of time to do that before April 15th.

Same issue im having. I just received 2015 w2s but still waiting on w2s from 2014 that I never received. Was 17 and on my own never knew I had them. I have dependents . Do I file 2014 first then 2015? Am I allowed to claim my dependents on 2014 too?

Hi Jayla – I’m not sure if there’s a scientific answer to your question. I’d file 2014 first if you can. But if you can’t, what ever the reason, I’d go ahead and file 2015 no later than April 15. At that point, the 2015 return will be no less due than the 2014 return, so you may as well file the one that you can. You should be able to claim your dependents for 2014, as long as they were born by then, and you provided at least half of their support.

Do I still need to file if I didn’t work at all in 2015? I was a full time student and received some grant money and have a loan to pay for school. If I don’t need to file, is there anything I do need to do?

Generally no, Cynthia. If your income is below $10,300 for 2015 ($6,300 for standard deduction and $4,000 for personal exemption) you don’t need to file a return. However, you have to see what the income threshold is in your state and if you need to file on a lower amount. Also – very important – you will want to file a return if you are entitled to a refund. (I know you said you didn’t work in 2015, but you may have other taxable income, so I gave a broader answer to your question.)

I have been owed child support for the last two years and because the person knows there tax return will be garnished they refuse to file that they have worked.Even if it was a few months here and there each year.Plus they are going to school for free and receive a school check what can I do about any of this???

Hi Darren – If they’ve been earning money, the employer should report that to the IRS, and that will tip them to come after the person to make them file. But you might want to speed the process, by contacting the IRS and reporting the non-filing. They will have zero interest in your child support dilemma but it may get the process going of forcing the filing of returns.

Ok need to know if someone never file their taxes for 2011 threw 2014 can they still file and how would they file it and can they do it threw turbo tax. Do they have to amend their taxes then file the 2015 or do it all together.

Hi Jennifer – You should be able to file for all four years, but see how far back TurboTax will allow you to go. Since tax apps typically work one year at a time, you will likely need the versions for each year. But check with TurboTax to see if there’s any way to work around it (I doubt it). If earlier versions aren’t available or are too expensive, you may have to paper file.

You shouldn’t need to do an amended return, since the originals were never filed. But you do need to do all four years plus 2015. You should do this as soon as possible. The IRS can assess taxes based on W2s and 1099s filed for each year, and cleaning up that mess once they do won’t be easy.

what happens if you forgot to file your Missouri state taxes for 2014 and were due a refund and just now realized it but did file your 2014 federal taxes?

Hi Sarah – Since you were due a refund, you should file the 2014 return. It will enable you to get the refund and there should be no penalty. Unless the state imposes a non-filing penalty, which is highly doubtful in a case where they owe you. File the return without further delay.

My son graduated high school May 2014 and started working so he filed his first tax return in 2015 but….used turbo tax and apparently never hit the ” submit” button but was charged $29.99 + tax on his credit card for the state return portion.

He was even able to retrieve the electronic return he had emailed himself to print it off, sign and date it to get it sent in now.

Question is, I’m trying to verify the IRS zip code. Online it states 2015& 2016 returns get sent to zip code 93888-0014, yet 2014 info states zip code WAS 93888-0002

We are sending from Michigan.

Do you suggest I send to the 0002 or 0014 zip?

Hi Karen – My suggestion would be to call Turbo Tax and ask them. If you want, you may also want to check directly with the IRS. This page from the IRS website should help you locate the right field office to contact in Michigan, depending on where you live specifically.

What are the penalties if you will be getting a refund but file, say, 18 months late? Again, you do not OWE anything, the government has gotten to hang onto your refund for an extra period of time.

Hi Mary – According to this article, you have nothing to worry about. The IRS is much more interested in collecting the amount of tax you actually owe, than it is with your filing your return on time. Just make sure that you’re owed a refund; if you actually owe, the situation reverses – dramatically too!

I got a notice from the California tax board that I did’nt file my 2012 tax returns although I did. I responded to the notice and faxed my 2012 return. Then I got a notice saying they will calculate penalties and interest and send me another notice. Note: I don’t owe taxes and was even due a minimal refund. How much penalty and/or fine should I expect to pay?

Hi Brad – Logic would suggest that you’ll owe a late filing penalty only, since there was no liability when the return was filed. But you should be able to get that waived if you can provide evidence that the return was filed on time. That said, a lot of states have become really aggressive in collecting taxes, and California is probably at the top of the list.

My suggestion is to hire a CPA who is extremely familiar with CA income taxes and dealing with this kind of situation, and have him or her handle it for you. As a taxpayer, this is a one-time event for you. But a CPA will have faced this on a regular basis and will know exactly what to do. I’m not familiar with CA state income tax, but from what I’ve heard, this is business as usual with CA tax authorities. Get help before it gets worse.

I have student loans and I knew they were going to take my money so I didn’t file. Now I’m in “good standings with them. Can I just file next year?

My 24yr old son moved to his dad’s house around the second week of Jan 2015 before his w2s came. I don’t exactly know where to send them to him, I don’t know his dad’s new address. My son had a falling out with his stepdad here & I’ve not been able to reach him. I guess this is a special circumstance but should I call the IRS for him or does turbotax have a special circumstance option? His taxes are always simple, easy form. Should I try helping & type the turbotax or call IRS? I wanna help him & when I hear from him I’ll tell him I have money for him (hopefully he’s a refund) & he’ll be thrilled! I know he needs any dime he could get. I just don’t know if I can do this legally? Any suggestions please?

I wonder how many kids working their first job forget to file their taxes, and if they have the IRS knocking at their door? All I know is that if Al Capone can’t get away with it, then I definitely wont. I should be getting money back this year, so I don’t think I would want to not file my taxes.

I agree, such b.s. To put my case in perspective, the ex wife worked maybe 2 months part time out of the year…the rest of the time she lived only off the thousand dollar monthly child support i pay to her. She does her taxes, claims the kids (which is saying she provided at least 50% financial responsibility to the children) and has a nearly $7,000 return. I do my taxes and end up paying $2000. Im sorry, but just cant figure out how this seems fair. This type of BS is the exact reason some of us consider not filing