Our lives are filled with financial decisions.

Sometimes, these decisions are made instinctually – without much thought. While instinctual decisions might turn out to be the right ones, they can also be the wrong ones.

Every once in a while, it’s a good idea to take a step back and examine our financial decisions. Are they smart? Are they generous? How do we make smart and generous financial decisions? These are important questions to ask.

Take a few moments to think through these questions.

Table of Contents

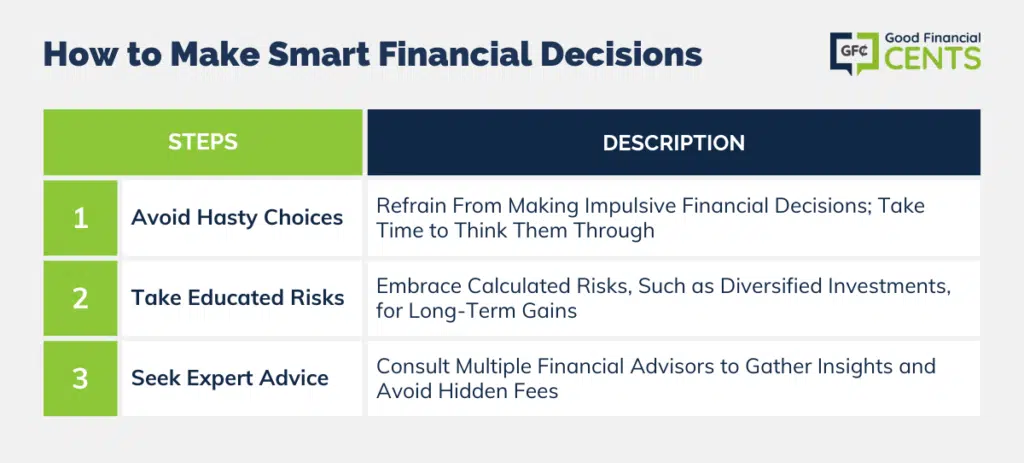

How to Make Smart Financial Decisions

For some reason, high schools don’t seem to teach students how to make smart financial decisions. I certainly didn’t grow up learning how to make smart moves with my money. I had to go to college for that . . . and I still had a lot to learn over the years.

Let me give you a few shortcuts regarding how to make smart financial decisions.

1. Don’t Make Big Decisions Quickly

I once had a client tell me that they wanted to take an enormously large chunk of money out of their retirement account because they wanted to buy a truck. Uh, bad decision.

I doubt that my client had given this idea much thought because if they had, they would have chosen to keep the money in the retirement account.

Don’t make big decisions quickly. It might cost you.

2. Take Educated Risks

It’s okay to take risks. But if you’re going to take them, make sure they are educated ones.

For example, it’s reasonable to diversify your investments for retirement throughout the stock market. Is it a risk? Yes. Is it an educated one? You bet. This kind of risk is reasonable because you’re nearly betting on the entire stock market. Unless armageddon happens, you’re probably going to do fine over the long term.

Some people are afraid to take even educated risks. Too bad for them, they’ll most likely lose out on a lot of opportunities.

For example, I took the educated risk of spending time and money on creating a blog and made over a million dollars from it. It was a risk in that it could have been a waste of time and money and turned out to be a flop, but it worked out!

3. Get the Advice of Many

Before you sign up for that variable annuity, it might be best to talk with more financial advisors to see if it makes sense.

I remember a woman who paid over $3,500 in variable annuity fees and didn’t even know it. Had she sought my input and advice before she signed on the dotted line, she probably wouldn’t have paid those fees because she would’ve known the details about that crummy financial product.

If you would get the opinion of another doctor, why wouldn’t you get the opinion of another financial advisor?

Make smart financial decisions.

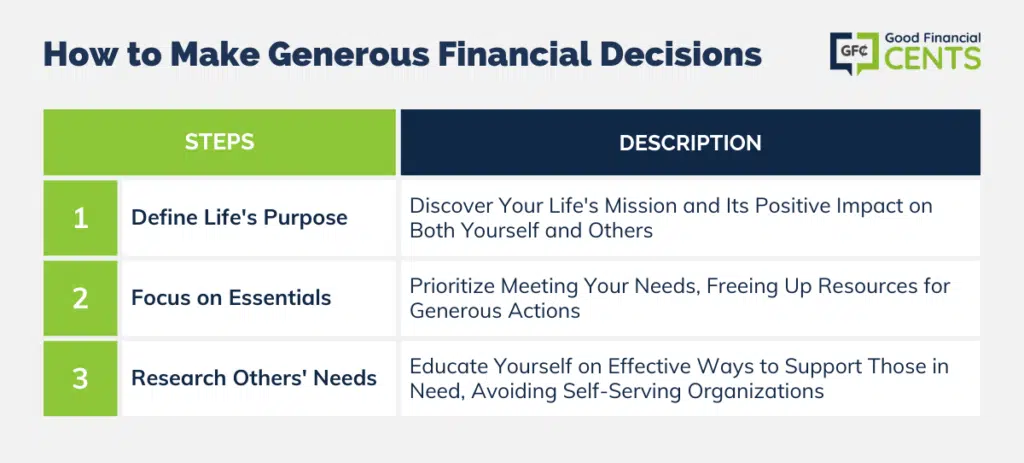

How to Make Generous Financial Decisions

It’s easy to think about me, me, me. But what about the we, we, we?

Our financial decisions not only affect ourselves, but they also affect the people around us.

Here are some ways to make generous financial decisions.

1. Define Your Purpose in Life

Many people are living day to day. Sometimes, they’re working dead-end jobs that don’t accomplish their life goals.

Sometimes, they don’t even have life goals!

Don’t let this be you. Define your purpose in life.

Here are some questions that can help you define your purpose in life:

- “How would you like to leave the world a better place?”

- “What influence do you want to have on others?”

- “Why are you doing what you’re currently doing in life?”

2. Focus on Your Needs

The challenge for all of us is to not live in surplus. This is difficult to accomplish, but it’s the most generous way.

By focusing on our needs and meeting those, we can find ourselves more willing to give our surplus to others. The truth of the matter is, stuff only makes us happy for a short period of time. True happiness, friends, is found elsewhere.

3. Educate Yourself About Others’ Needs

Once we’re willing and able to be generous, it’s important to educate ourselves about others’ needs.

If you’re going to give to the homeless, find the best organizations to give to that are focused on helping the needy instead of their own wallets. This is just one example.

Make generous financial decisions.

How American Century Investments Represents a Smart and Generous Investing Option

Every once in a while, you might run across a great company. American Century Investments is one of those companies.

I believe that investing with them is not only a smart choice, but it’s also a generous one. Here’s how.

More than 40 percent of American Century Investments profits have been distributed to the Stowers Institute for Medical Research, a non-profit basic biomedical research organization.

The Institute is the controlling owner of American Century Investments and has received dividend payments totaling over $1 billion since 2000. This institute is a 550-person, basic biomedical research organization focused on improving their understanding of fundamental biological processes.

I don’t know about you, but when you can accomplish a higher purpose while investing at the same time, that makes me feel good. Asset management companies that donate to worthy causes get the “thumbs up” from me.

Now, did this company come up out of nowhere? Of course not. It was due to the generosity of a couple: James Stowers Jr. and his wife, Virginia. Both cancer survivors, they understood the need for medical research and founded the Stowers Institute for Medical Research in 1994.

Here’s what they said about it:

Virginia and I are both cancer survivors and we know first-hand the fear and loneliness that come with the diagnosis of a life-threatening disease. So it was natural to think about how we might offer help and hope to others facing cancer and other diseases.

This couple is an inspiration. Instead of hoarding all their wealth, they actually dedicated their personal assets to creating the Stowers Institute for Medical Research. What a powerful example.

Health and finances seem to affect each other. My dad, for instance, had so much debt that it stressed him out – which I believe was a contributing factor in his declining health and death. Therefore, a campaign to better both the financial and medical health of people is, in my view, a worthwhile and meaningful campaign.

Not only is American Century Investments a worthy asset management company because of its distributions to the Stowers Institute for Medical Research, but they have some unique characteristics as an investment company.

For example, investment management is their sole business focus. They have had performance focus for more than 55 years and have the goal of delivering superior, long-term, risk-adjusted performance.

Concluding Thoughts: Smart Financial Decision-Making

You can make smart and generous financial decisions. And you know what? Those decisions will affect every other area of your life.

The truth of the matter is that our health affects our finances, our finances affect our relationships, our relationships affect our job performance, and so on and so forth.

Aim to improve your finances. Other areas of your life are sure to benefit as well.

In recent years, I have focused on aligning my spending with my values. So when I make a purchase, especially large ones, I ask myself “does this match my values?” or “will this help me accomplish my financial goals?”

It helps keep things in perspective for me and make better financial decisions.

I think an important part of making any good decision is to 1) make sure you do what is wise for you (and not someone else, and 2) if you’re not sure, get good advice. The second point requires you to choose your advisors carefully. Make sure you seek someone’s advice who has already done (or is doing) what you want to do. Don’t get advice from just anyone.