The current unemployment is still hovering around 3.9% and there isn’t a day that doesn’t go by that I don’t talk to someone who is directly or indirectly affected. If you have been hitting the pavement looking for a new job, you need to be tracking the expenses you incur during your search. Some costs of a job hunt may be tax deductible when you file your income tax return.

Searching for a new job in the same kind of industry will allow you to deduct expenses like phone calls, resume preparation services, and career counseling sessions you pay for out of pocket. You can still be employed during your search and still have your expenses deducted by only the amount that exceeds 2% of your income will be eligible. You may also be eligible to receive the expense deductions even if you did not end up getting the new job.

Table of Contents

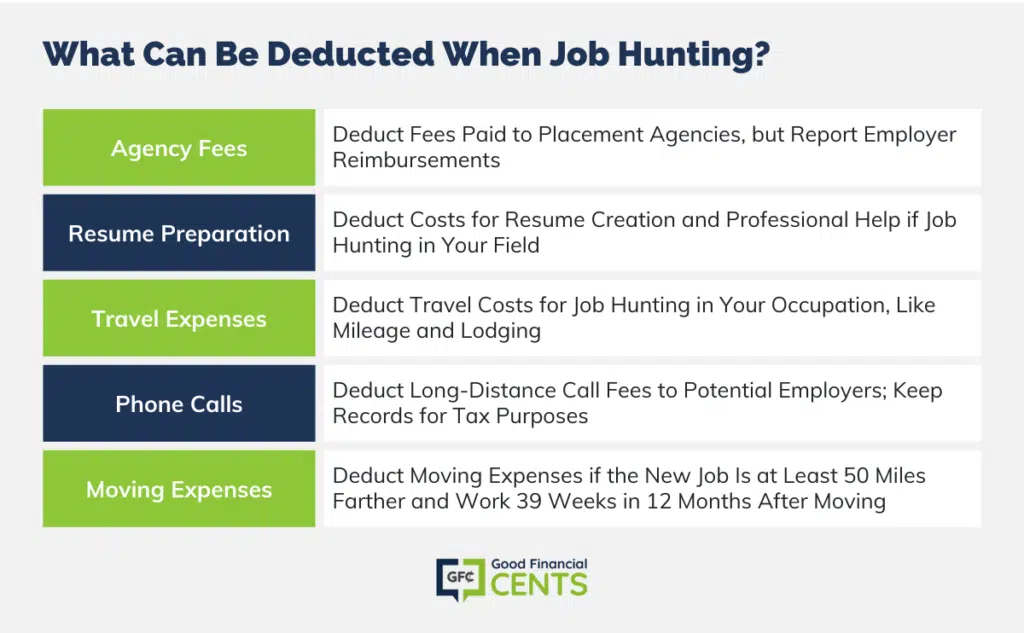

What Can Be Deducted When Job Hunting?

- Agency Fees: If you use the resources of an employment placement agency, fees that you pay can be deducted. The only catch with this deduction is that if your employer pays you back for the agency fees incurred, you must then include the amount as part of your gross income on the following year’s taxes. You may not include agency fees as a deduction if your employer has paid the fee.

- Resume Preparation: Costs associated with typing, printing, and mailing out copies of your resume can be deducted as long as you are looking for a new job that is the same as your current job. Costs involved in hiring someone to help with your resume would also be tax deductible. You may also include advertising expenses and charges for professional photographs if applicable.

- Travel Expense: If you are traveling to a new location to look for work in your present occupation, you may be able to deduct the amount of travel expenses. Expenses can include mileage, airfare, meals, and room accommodations.

- Phone Calls: Fees incurred for long-distance phone calls to potential employers are deductible. Make sure to keep all your phone records to make it easier at tax time.

Moving Expenses

What happens if your new job takes you out of town? If so, there might be some expenses that will be tax deductible. The biggest distinguishing factor is how far your new job is. Your new job has to be more than (pay attention here) 50 miles farther away from your old home than the distance from your old home to the old work location. A little confusing, huh? Here’s another way of looking at it.

Currently, my job is about 15 miles from my house. If I took a new job, for me to get a tax deduction my new job would have to be at least 65 miles from my old home. Clear as mud? Good 🙂

The last part of deducting moving expenses is how long you work at the new job. You must continue to work in the new location for at least 39 weeks during the 12 months after the move. If you’re self-employed you must also work in the new job for 78 weeks during the 24 months following the move. (There are exceptions for disability, layoff, transfers, and other situations.)

I had some clients that had moved out of state thinking that the move was permanent. After a few months, they realized the error in their decision and decided to move back. Luckily, they hadn’t filed their taxes yet so an amendment wasn’t necessary.

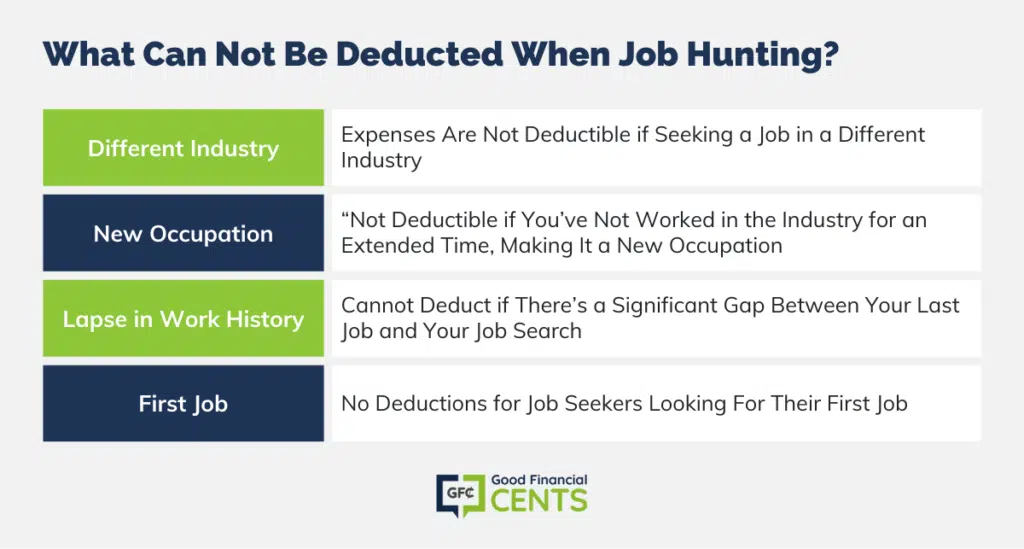

What Can Not Be Deducted

Certain expenses are tax deductible provided you are seeking employment in your present occupation but there are scenarios where the deductions will not be allowed including:

- You are looking for a new job in a different industry or occupation

- You have not held a job in an industry for an extended amount of time so your new job will be considered as a position in a new occupation

- You have a sizeable lapse in work history from the end of your last job until the time you have started to look for a new job

- You are looking for your first job

Keeping Track

When you begin a new job search, you should keep a separate file for your job search-related expenses. Tally expenses on a spreadsheet and save all receipts for postage, gas or travel-related expenses, and copy/typing expenses. Examine all billing statements such as the phone bill and highlight the job-related phone calls made that resulted in charges and make copies to keep in your file.

When you are ready to file your income taxes, consult with a tax professional to discuss which expenses are justifiable and present all receipts and billing statements. Do this and you and your tax preparer will thank me later.

Looking for a good resource? Check out the IRS publication “Six Tax Benefits for Job Seekers”. Here is a rundown of the tips the IRS has to offer below.

Did you know that you may be able to deduct some of your job search expenses on your tax return?

Many taxpayers spend time during the summer months updating their résumé and attending career fairs. If you are searching for a job this summer, you may be able to deduct some of your expenses on your tax return. Here are six things the IRS wants you to know about deducting costs related to your job search.

1. To qualify for a deduction, the expenses must be spent on a job search in your current occupation. You may not deduct expenses incurred while looking for a job in a new occupation.

2. You can deduct employment and outplacement agency fees you pay while looking for a job in your present occupation. If your employer pays you back in a later year for employment agency fees, you must include the amount you receive in your gross income up to the amount of your tax benefit in the earlier year.

3. You can deduct amounts you spend for preparing and mailing copies of your résumé to prospective employers as long as you are looking for a new job in your present occupation.

4. If you travel to an area to look for a new job in your present occupation, you may be able to deduct travel expenses to and from the area. You can only deduct the travel expenses if the trip is primarily to look for a new job. The amount of time you spend on personal activity compared to the amount of time you spend looking for work is important in determining whether the trip is primarily personal or is primarily to look for a new job.

5. You cannot deduct job search expenses if there was a substantial break between the end of your last job and the time you begin looking for a new one.

6. You cannot deduct job search expenses if you are looking for a job for the first time.

This information is not intended to be a substitute for specific individualized tax, legal, or investment planning advice. We suggest that you discuss your specific tax issues with a qualified tax advisor.