Waking up in a place of your own with the birds chirping right outside your window is a great feeling.

You go outside and enjoy your coffee on the back porch, simply enjoying the quiet that comes with not living in an apartment.

Your neighbors are friendly, the sun is shining, and you know it is going to be another great day of owning a home.

Everything is going great… until the peaceful morning is ruined by the sound of your air conditioner going out.

As romanticized as owning a home has become in America, there are some significant costs associated with buying, owning, and maintaining a place of your own.

Table of Contents

The True Cost of Home Ownership

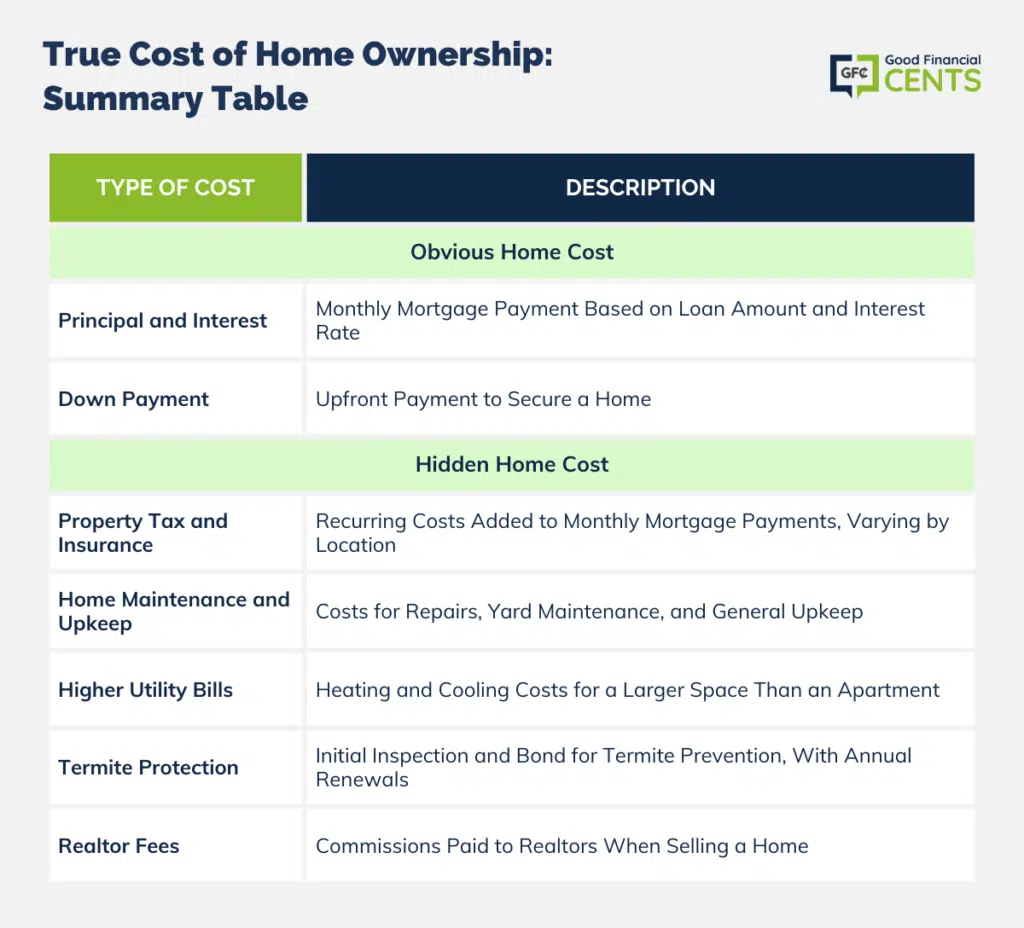

Let’s break down some of the areas on how to value home ownership. There are some obvious costs, like your monthly mortgage payment, but hidden costs sneak in there and can break the bank.

Obvious Home Cost: Principal and Interest

For most, the cost and financial benefits of renting versus homeownership are the deciding elements. The traditional logic is that renters are throwing away their money by paying someone else’s mortgage. Though true, this is a simplistic view.

On a $150,000 home purchase with 20% down (so a mortgage loan of $120,000) at 3.5 percent APR, the monthly principal and interest payment is $538.35 per month.

This sounds like a smart deal since most houses increase in value over time while the monthly payment lowers the principal balance and increases the equity. If you are paying $600 per month in rent, owning your own home for about the same amount sounds like a great deal.

While principal and interest are a big chunk of your monthly costs of owning a home, there are a lot of other costs to consider.

Hidden Home Cost: Property Tax and Insurance

When you speak to a real estate agent about looking at homes, they generally speak of how much a home is going to cost you in a monthly payment.

Many agents will focus on quoting you prices based just on the principal and interest because it means they can get you into a more expensive home — pulling you toward that dream home — and thus earning a larger commission check on the sale.

Unfortunately, your monthly payment will have other costs associated with it, namely property tax and homeowners insurance. Depending on the area, these costs can increase the payment significantly.

Unlike principal and interest, taxes and insurance payments are money that you are not getting back.

You might pay an extra $150 to $450 per month in tax and insurance costs depending on the area you live in, what the tax structure is, and how much insurers charge to protect your home’s area.

Tax and insurance costs are not fixed, unlike your principal and interest payments (assuming you get a fixed-rate mortgage). Your local municipality can raise taxes over the years, and homeowners insurance companies are constantly changing annual premiums.

Some states have homestead exemptions that lower a homeowner’s tax burden, so check to see if your state allows this.

Obvious Home Cost: Down Payment

When you rent an apartment, your costs are an application fee, security deposit, your first month’s rent, and renters insurance. With just a few thousand dollars, you can be completely moved in and set up in an apartment or rental home.

When you purchase a home of your own, you need to save up money for a down payment. Back in the heyday of the housing boom, you could buy a property with little or no money down.

Those days are gone. (This is a good thing!)

Homeownership is a serious commitment and requires serious cash to get started. Many lenders want to see you have a 20% down payment in order to be approved for a loan.

On a $150,000 home, that means you need $30,000 in straight cash sitting in an account waiting to be used once you find a home.

That’s a lot of dough to be sitting on. I highly recommend using one of the top online savings accounts, such as Capital One 360 Savings, to hold your down payment so you earn interest until you find the home you want.

Still not sure if you should keep renting or buy your first home? Use this nifty calculator to help you decide:

Hidden Home Cost: Home Maintenance and Upkeep

Owning your own home means you get to decide how your home looks inside and out, including the property’s landscaping.

Unless the home is in a designated historic neighborhood or one with zoning restrictions or homeowners association rules, homeowners are generally free to apply for permits and make changes to a home’s look, structure, and more.

It also means you get the “honor” of mowing, trimming, dealing with weeds, and footing the cost of repairs.

Rental properties usually outsource a maintenance crew for maintenance and lawn care, so you don’t have to spend time on those items.

While a homeowner may have to spring for a new Husqvarna, he or she can landscape as desired. Just remember, it takes time and money to keep up the home and yard.

Most rental management companies will have an itemized checklist of all appliances, flooring quality, and states of repair. Often, these will be accompanied by photos.

Any changes to the rental property outside of normal wear and tear need to be put back to the original state. Renters usually can’t make material changes to the property. You’ll also have to find affordable renters insurance.

This is not the case for a purchased home property. You can change what you like, but all of the cost comes from your pocket.

How much money should you have on hand for home maintenance? A general rule of thumb is to have at least 1% or 2% set aside for home repairs.

If you own a $150,000 home, that means having $1,500 or $3,000 set aside for when the roof leaks or the HVAC unit goes out in the middle of summer.

Even that amount of money won’t cover major repairs, but it is better to have a starting point in paying the repair bill than to start from scratch.

An easy way to make sure you don’t spend your home repair fund is to use a low-risk investment like a certificate of deposit.

CDs allow you to earn higher interest and only charge a few month’s worth of interest if you need to pull the funds out before the CD matures. One of the best places to get a CD is online with Discover Bank.

You might create a separate category in your budget to hold maintenance money and a separate category to hold money for landscaping or yard maintenance.

Hidden Home Cost: Higher Utility Bills

Living in an 800-square-foot apartment can keep your utility bills down simply because you don’t have much space to heat or cool. There can be some financial shock when you get your first set of utility bills after moving into a much larger home.

If you are used to spending $600 on rent and $100 on monthly utilities, buying a home with a $600 mortgage payment leaves you with the same amount of money to heat and cool a much larger space.

Depending on how old the home is, your HVAC unit might be older than the one in your apartment building and, thus, be less efficient. A less efficient unit combined with a larger square foot area can result in some shocking utility bills.

How much should you anticipate to spend on utilities? Ask the sellers.

Pro Tip:

Hidden Home Cost: Termite Protection

It’d be nice if we could buy a home and never have to worry about termites ruining the structure. Unfortunately, this is one of those hidden costs that many people don’t think of.

You can get a termite bond to protect your home. When you purchase a termite bond (usually a couple of hundred dollars), the termite extermination company comes out to inspect your entire house inside and out for signs of termites.

Assuming none is found, they spray a preventative down and right a bond that essentially guarantees against termites.

Each year, the company comes back to renew the bond for a smaller fee, does another inspection, and sprays again if necessary.

After the initial cost of the bond, it is usually $50 to $100 to renew the termite bond. That doesn’t sound like much, but it is just another hidden cost that you need to prepare for.

Hidden Home Cost: Realtor Fees

Where a home can be the cornerstone for growth for some, it can be an anchor that prevents movement for others. Housing markets fluctuate.

The housing values and mortgage rates that make it ideal to purchase a home now may not be there five years from now. When purchasing a house, be prepared to stay with it for at least five years or else plan on losing money.

Selling a home is a giant unknown that you need to consider when first purchasing the home.

- Can you live here long term?

- What happens if the housing market tanks around you?

- Can you afford to pay 6% realtor commissions if you use a real estate agency to sell the home?

The commissions paid to realtors are a hidden cost that reaches into the thousands of dollars. A 6% realtor commission (3% for the buying realtor and 3% for the listing agent) is $9,000 on a $150,000 home.

That means your home has to go up by at least that much in value if you want to sell it, and that’s assuming home prices are going up in your area.

Anticipating Home Ownership Costs: Use a Budget

Putting together a budget is one of the best things you can do before you even begin to consider purchasing a home of your own. You need to have a solid understanding of where you are currently spending money each month.

Having a baseline for your current costs will make it a lot easier to compare to potential home ownership costs than if you are just shooting in the dark.

There is a lot of great personal finance software available. For budgeting, we recommend You Need a Budget for your core budgeting needs. You can use other programs like Manilla and Mint to add additional monitoring as needed, but YNAB is a great piece of software.

Is Owning a Home Worth It?

Don’t underestimate the security and stability of a family home. According to a study from the Pew Research Center, housing stability shows the world you are stable, dependable, and devoted to the community.

Other studies have shown that children of homeowners tend to be better at math and reading, have fewer behavioral problems, and stay in school longer. This is linked to the safety that a child feels when they have a stable home.

Since a house is a long-term investment that can have a mortgage of 40 years or beyond, a house becomes very closely linked to a family’s architecture, community standing, stability, and more.

A Look at the Future

What will life look like in five years? Ten years? Fifty years? Whether playing the role of a savvy investor or a new couple thinking about a family, these are the questions that need to be addressed.

Of course, without a time machine or a crystal ball, there are no certainties as to what will happen with the housing market in your area.

But those weighing the pros and cons of home ownership must have an idea of how they want to spend their future. The online real estate database Zillow recommends having a plan before jumping into the home-buying jungle.

If you plan to live in one area for a long time, then buying a home is a great decision that provides stability to your family. If you don’t know if you will be in the same area five years from now, it usually makes sense to keep renting.

Either way, having an understanding of the true cost of owning a home can help you crunch the numbers to make a housing decision.

Bottom Line – Home Sweet Home: What Is the True Cost of Having Your Own Home?

Homeownership is often depicted as a romanticized ideal, but the reality involves various hidden costs alongside the apparent ones.

From monthly mortgage payments to unexpected maintenance expenses, owning a home is not just about securing a property but also preparing for the financial responsibilities it demands.

Property taxes, insurance, utility bills, and even termite protection can add to the overall cost.

While there’s no doubt that owning a home provides stability, a sense of belonging, and even certain educational advantages for children, it’s crucial for potential homeowners to fully understand these costs and plan accordingly.

The decision to buy or rent should always be made after thorough research, considering one’s financial health, long-term plans, and understanding of the home’s true cost.

That was a great except on the fact that a house because it’s free…

Great article! My sticker shock arrived when I realized I needed to buy a refrigerator/freezer; a stove; a washer and dryer; garbage cans; cable for TV and Computers; and hire someone to mow the lawn!

But it is like living in a bank; it appreciates every single year.

Jaye

Great article. It’s one of the things I’m considering as we prepare to buy a house. How will we stay under our budget. It seems like every homeowner is always spending money. Not something I look forward to. But we want a slightly bigger place, and want more space between the neighbors and us. Is this enough to justify buying a home?

There are also psychological and emotional aspects, such as reassurance of stability versus worrying about your mortgage.

Great Article. If your income was upwardly mobile, and you were in the market for a home, wouldn’t it make sense to stretch your budget bit to afford the nicer home? I say this because I feel like a home purchase in today’s economy is a great investment and view “stretching a bit” as the equivalent of living a little leaner so that you can put more money into your retirement.

Good post. Because of the excitement of owning a home, which can get really overwhelming, some people disregard going into details, top be thorough. That’s why you need to know as much as you can and don’t let yourself be fooled. Make a budget is quite important and plan well.

Great article! There are so many hidden fee’s that come with owning a home that many are not aware of. This is why putting a budget together is essential!

Some great points Jeff. This article explains exactly what most home owners do when buying a home. They forget all the aspects and costs associated with owning a home, and leave themselves vulnerable in the event something bad happens like losing their jobs, or a death in the family. Fantastic article

Home repair and maintenance will not be so hidden once smoke starts coming out of your furnace or something as simple as forgetting to change your units filter every 3 months. You could be hit with a bill in the thousands that you must pay or go without A/C.

Some of these costs can be mitigated with a good home warranty company that costs a few hundred a year. I have heard of people having some bad experienced with them not paying for repairs though.

These are all good points and should be considered when you are thinking about buying a home. If you keep your direct (mortgage, property taxes, and insurance) cost of home ownership below 33% of your income., you will be able to handle your home expenses.

Great post! So many people do not think about the full cost of owning a home. It all adds up so quickly!