If you’re like me, you like to get every tax credit you can. I mean, who wants to pay more taxes than they absolutely have to?

The only problem with tax credits is it’s extremely hard to keep track of them all.

Tax credits are even more difficult to understand since the tax reform law passed by the Trump administration in December 2017 that doubled child tax credits. Not just that, but during the pandemic there has been talk about expanding child tax credits through the HEROES Act.

If you find yourself confused about what, if any, changes have occurred with the child tax credit, you’ve come to the right place.

Read on for an overview of the 2024 Child Tax Credit, including advice on how to get the maximum benefit from this tax break for your family.

Table of Contents

What Is the Child Tax Credit?

The child tax credit is a beneficial credit offered to parents and guardians to help decrease their tax bill.

Rather than functioning like a deduction, the child tax credit operates as a tool that works toward reducing the amount you pay in taxes. Whatever amount of the tax credit you receive is subtracted from the total of your tax bill, cutting down the amount you pay fairly significantly.

Parents or guardians with qualifying incomes can claim the full child tax credit amount for each of their dependent children.

This tax credit is one of the simplest and most rewarding tax breaks you’ll find, and it has doubled over the last two years, benefiting families even more than before.

How Much Can You Claim?

Your access to the child tax credit depends, in part, on your income, specifically your adjusted gross income.

Like the child tax credit amount, the phaseout limits for it have increased with the tax bill as well.

This year’s child tax credit amounts to $2,000 per child.

Married couples filing jointly who make under $400,000 per year and single individuals, head of household, or married couples filing separately who earn less than $200,000 per year, will be able to take $2,000 per child as their Child Tax Credit.

How Do You Claim the Credit on Your Taxes?

All the calculations and claims of the Child Tax Credit are done on your normal itemized form 1040.

You can do all the calculations on Schedule 8812 to make sure you get the maximum amount you qualify for.

One of the best ways to ensure you get the child tax credit and other tax refunds you qualify for is by filing with a tax software program.

If you are using tax software, all of the top tax software packages will automatically apply the CTC for you as you fill out your family information.

What Are the Income Limits for the Child Tax Credit?

While the income cutoff for the child tax credit used to start phasing out at $110,000 for married couples, it is now at $400,000 for the modified adjusted gross income.

This limit phases out completely at $440,000. For single filers, it begins to phase out with a modified adjusted gross income of $200,000, phasing out completely at $240,000.

Taxpayers who are married filing jointly with an adjusted gross income of $400,000 or less can receive the full credit.

Phase-outs for this credit will start at these income levels.

But beyond the basic income limits, there are a few more stipulations to qualify for the child tax credit.

Who Can Claim the Child Tax Credit?

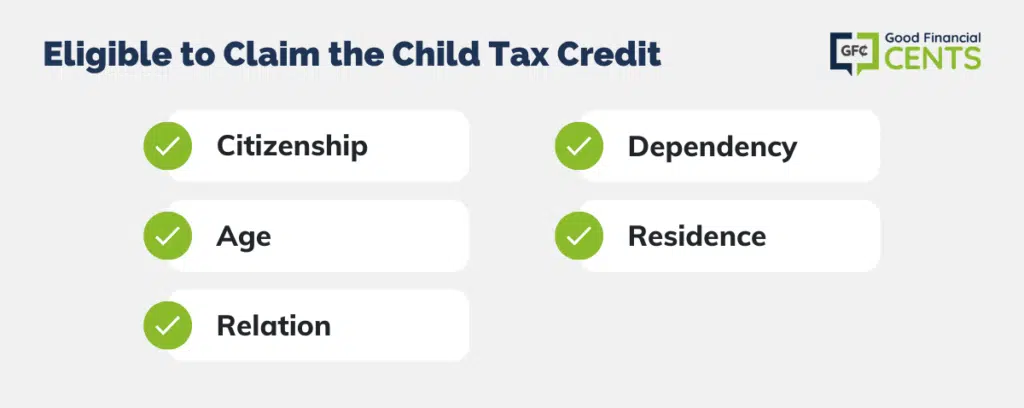

In addition to knowing your income, you should double-check the requirements dictated by the IRS, listed below in order to be certain you qualify for all or some of the Child Tax Credit.

- Citizenship: Qualifying children must be citizens or residents of the United States who can be claimed as dependents by the taxpayer.

- Age: Children must not have reached the age of 17 by the end of the tax year.

- Relation: Children may be your blood children, grandchildren, stepchildren, and/or adopted children. Foster children also fall under this category as long as they have lived in your home for the entire year in question.

- Dependency: You must claim the child as a dependent. You need to claim the child as a dependent on your federal taxes in order to be eligible for the credit.

- Residence: The child must live with you. In fact, the child must have resided in your home for at least half of the tax year, although some exceptions apply.

Can You Get the Child Tax Credit as Part of Your Refund?

The short answer: is yes.

Generally speaking, the child tax credit functions as a credit against what the taxpayer owes in taxes.

Sometimes, however, it can translate into an actual tax refund or tax rebate.

Most tax credits fall into one of two categories: refundable and non-refundable.

As the name suggests, a refundable credit can boost your tax refund, whereas a non-refundable tax credit cannot. The Additional Child Tax Credit falls somewhere in between.

Form 1040 ultimately determines your eligibility for the child tax credit, and when you file with tax software you can get an idea of the type of return you can expect to receive.

How Can You Get the Additional Child Tax Credit?

In previous years, the child tax credit was 100% refundable, meaning if your tax bill totaled $0 and you qualified for the credit, you could get the full child tax credit amount in the form of a refund from the IRS.

The 2017 Tax Cuts and Job Act amended that rule, though, capping the amount of the additional child tax credit.

With the Additional Child Tax Credit, you could get a refund of up to $1,400 if the child tax credit amount is higher than the taxes you owe.

If your income meets a minimum of $2,500, you are eligible to receive $1,400 of this credit as a refund, per child.

For a small percentage of families in the United States, the Child Tax Credit will be larger than their tax liability.

In this case, a portion of the unused part of the Child Tax Credit can be refundable as an additional Child Tax Credit.

What this means is, that you can receive a refund from the IRS of up to $1,400 of the child tax credit back even if you don’t wind up owing any taxes.

That number has stayed the same between 2018 and 2024, just as the $2,000 tax credit amount has.

Child Tax Credit History

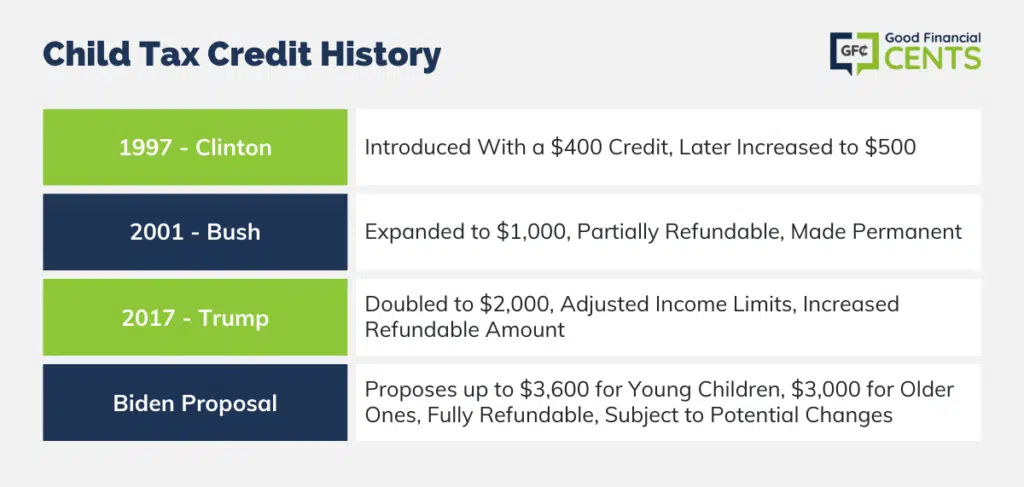

The Child Tax Credit is now more than 20 years old and has helped millions of families afford the cost of raising a child. The credit has been a part of tax reform during three different presidencies.

Clinton – Child Tax Credit Inception

In working with Congress, the Clinton administration signed into law the Taxpayer Relief Act of 1997. While there were many reforms in the bill, the newest innovation was a $400 child tax credit for the 1998 tax year which increased to $500 after 1998.

The idea came from a report published in 1991 by the National Commission on Children as a means to combat child poverty. That report suggested a $1,000 credit, but that was trimmed to the eventual $500 that came seven years later.

Bush – Child Tax Credit Expansion

The Economic Growth and Tax Relief Reconciliation Act of 2001, also known as the “Bush” tax cuts, increased the Child Tax Credit to $1,000 and made it partially refundable up to $1,100.

These were passed as temporary changes but made permanent during the Obama administration.

Trump – Child Tax Credit Expansion

President Trump signed the Tax Cuts and Jobs Act on December 22, of 2017. This doubled the tax credit up to $2,000 and changed the income limits from $110,000 to $400,000 for married couples, and from $75,000 to $200,000 for individuals.

The legislation also increased the refundable amount to $1,400. These provision changes were designed to hedge inflation, as well as, help both upper and lower-income families.

Biden – Child Tax Credit Proposal

President Biden proposed increasing the child tax credit to $3,600 for children under six, and up to $3,000 for children up to age 18.

Equally important, the President’s proposal would make the credit fully refundable. That means the credit will be paid to taxpayers, even if it exceeds the taxpayer’s tax liability. Taxpayers who have no tax liability would receive 100% of the credit as a refund.

This is of course a proposal and while some version of the President’s plan may become law, significant changes are likely before it does.

My Top Picks for Tax Software

While there is a longer list of the best tax software services, there are three that stand out among the rest. The best software includes:

- TurboTax: TurboTax will ensure you get every dollar of credits available to you. You can read more in the full TurboTax review here.

- H&R Block: H&R Block also offers comprehensive tax filing assistance. You can learn more in my H&R Block review.

- Tax Act: Tax Act is user-friendly, affordable, and can help you file easily. Get all the details in my TaxAct.com review.

Signing up for any one of these services will make sure you get your maximum credit.

Bottom Line: Child Tax Credit Updates 2024

If you have kids and earn less than $400,000 as a married couple or $200,000 as an individual, changes to the Child Tax Credit will save you money on taxes in 2024.

However, your savings may be wiped away in other areas of the tax code, specifically because personal exemptions and several other deductions have been replaced with a higher standard deduction for everyone over the last few years.

Either way, make sure to speak with a tax professional if you’re unsure how the new tax law will affect you.

A bigger child tax credit is always a good thing, but it’s possible you could save even more on taxes with some professional guidance and help.

The definitions of refundable and nonrefundable credit are not presented very clearly on this page. This says a non-refundable credit can’t “boost your refund,” but that is not quite accurate. It can increase the refund dollar for dollar. It helps to define the “tax bill” as the calculated tax owed, regardless of how much of that bill you already paid through paycheck withholding. For a non-refundable credit, as long as the tax bill is more than zero after taking the credit, you will get the whole credit back. It will either be added on to your refund or subtracted from what you owe, depending on how much was withheld from your paycheck. What makes a credit “refundable” is that it will also be paid to you even if your “tax bill” was zero.

Hi ….My wife and I had a new born in 2018 , was born in November 2018, can he still qualify for child tax credit , as online software doesn’t want to include it.

I have 50/50 custody with son’s mother who is now 9 years old. I’m self employed I file a 1099 before April’s deadline every year and she files a W2. However since she receives her form by the end of January she always claims my son. how can I make it official we claim him every other year? how can I take care of this matter?

I was employed with a company that took taxes out of my weekly check for only 2 months last year, but was self employed the entire 12 months, my combined gross income for both is about 16-18,000$. I have 2 kids under 17 & no other deductions. How likely am I to receive the full refundable amount allowed for the child tax credits? & is the full amount allowed $1400.00 or..?

Hi Meagan – The only way to know for sure is the file your return and see how it turns out. The changes are brand-new, and you have to go with however it flows on your return.

To determine the part of the Child Tax Credit that is refundable, there’s a series of steps to be taken

First, you need to work you way down to the point you determine your tax based on your filing status and taxable income on the 1040 form.

From there, you deduct all non-refundable credits including up to 60% of the AOC credit (if you have at least one person in the tax household in college working towards their first bachelor’s degree and have not used the tax credit or it’s predecessor tax credit for any 4 prior tax years, which the credit is worth up to $2,500 for the first $4,000 of qualified higher education expenses spent for an undergrad degree at a qualified higher education institution; as the other 40% of the credit is refundable).

As to the Child Tax Credit, the first $600 credit (the non-refundable portion) is essentially as a replacement for the Exemption Deduction that was taken away, which is also true for anyone that is NOT qualified for the CTC but is still considered as an exemption for the taxpayer (and spouse if MFJ), thus is a non-refundable $500 credit.

As to the $1,400 refundable portion, the $400 bump in the refundable portion is essentially serving as taking inflation into account since 2003 when the Child Tax Credit was first put into place.

Let’s just say you had a $0 tax bill prior to the lines dealing with other taxes (i.e., 10% penalty for early withdrawal without meeting one of the exceptions, 20% penalty for withdrawal from the HSA for expenses other than UNREIMBURSED qualified medical expenses, household employment tax, unpaid social security and medicare taxes, and the 15.3% self-employment FICA taxes with the employer half of it as deductible before AGI), you have 4 kids under the age of 16 that qualifies for the Child Tax Credit, thus the most you can get is a refundable credit of $5,600.

However, to determine if you can get that $5,600, you must first subtract $2,500 from your total earned income, then multiply the result by 15%. If this result is lower than the $5,600, then you get the lower result as a refundable credit, else you get the $5,600 as a refundable credit for the Additional Child Tax Credit.

Example, your Earned Income is $25,000

$25,000 – $2,500 = $22,500

$22,500 * 15% = $3,375

As such, your refundable credit for the Additional Child Tax Credit in this case is $3,375, since this is lower than the $5,600 maximum potential for the Additional Child Tax Credit.

i made less than $2500 in 2018 around $2300 to be exact , can i still receive a tax credit for my 3 year old daughter if i had her full time ?

Hi Blake – You’re below the minimum threshold of a $2500 income for the additional credit. But file your return and see what happens. The tax law is brand-new, and adjustments and revisions are still being worked out.

The law should be named the “If you can’t ‘feed’ (AKA all the costs involved in raising kids) them, don’t breed them” law.

Therefore I completelyI agree the law should change so there are no tax refunds/credits for kids YOU make the decision to have. No tax payer should have to pay for your decision to have kids. That is on you only.

Better yet, take a math class. Perhaps that will help you figure out how stupid you sound for even thinking you are ‘owed’ any tax refund for YOUR CHOICE to breed/raise kids.

Hi,

Thanks for the information it really helps to understand more clear on child tax credit.

I m new to the USA and I have 2 kids both are born in INDIA. Is child tax credit applicable for me or not.

Thanks.

Hi Maruthi – I would think so, as long as both you and your children have a social security number, and you have both earned income and a tax liability in the US. But check with a tax preparer if you have any doubts.

I would like for lawmakers to consider adding to the child tax credit an exemption to the cut off 17 year old in the cases of a disabled dependent. While they have reached the cut off age in years, they may not have in mental capabilities. Please consider this, or another tax credit for this category of dependents. Thank you

Determining mental age of kids would be very difficult as there would be a lot of dispute, thus would make it very hard to be enforceable. As such, the regulations needs to have something more concrete, thus why we have the physical age to go by. I know this doesn’t really answer your question, but I hope you can see how this can be a real mess that would be very difficult to solve, which would had more of a mess to our court system.

I think that the whole house Husband/Wife, or Girlfriend with a child instead of who makes more,or just one household member(family) should be able to split each child’s tax credits.. Not just one family member who shares a child be able to get it… They need to change this law… and it should be more than 2,000 for a child, we spend way more than 2,000 in a year to support, feed, buy clothes, and shelter, lights, electric, laundry, and so on…And do not judge, I work a FT job, and go to school full-time working on My Master’s in Health Care!

Thank you,

Kimberly Lach

Hi Kimberly Lach, Don’t judge me that I know you are NOT owed any tax handout (“tax refund) to “support, feed, buy clothes, and shelter, lights, electric, laundry, and so on” for your OWN family.

The law should be named the “If you can’t ‘feed’ (AKA all the costs involved in raising kids) them, don’t breed them” law.

Therefore I completelyI agree the law should change so there are no tax refunds/credits for kids YOU make the decision to have. No tax payer should have to pay for your decision to have kids. That is on you only.

Better yet, take a math class. Perhaps that will help you figure out how stupid you sound for even thinking you are ‘owed’ any tax refund for YOUR CHOICE to breed/raise kids.

Good for you. I know what it’s like too as I also did it including the fact I crammed 4 full years’ worth of education work into 28 months graduating in the top 10% of my class for both of my degrees, BBA and MS in Accounting. But then again, I was wrung through the money game of the higher education system to the point I essentially had to EARN 376.5 quarter credit hours (8.37 years’ worth) just to get my 4 year BBA degree costing me $200,000, all credits earned with the Accounting major with a minor in Information Systems. I then earned another 51 quarter credit hours to get my MS in Accounting costing me $27,000.

Had I not pushed it as hard as I did, I would have ran through the maximum of 6 years of Pell Grant prior to getting my degree, but rather the last semester I was able to get the Pell Grant was also the last semester I needed to get my BBA in Accounting.

I had already earned 286 quarter credit hours prior to dropping out the first time, which all I had was an Associate degree in Accounting from a college that no longer exist (Cincinnati Metropolitan College), which I earned that degree within 15 months while I went through 2 phases of medical testing and had the laser brain surgery done to be rid of the seizures permanently (ever so grateful for it as it was not only a life changer for the good, but also a life saver as those things were only progressively getting worse and worse to eventually kill me off if I didn’t qualify for the surgery and have it done), then also did 20 hours a week COOP for 10 weeks as was required by the 2 year program. I attended from January 7th, 1991 to March 19th, 1992 earning the 93 quarter credit hours with an overall GPA of 3.87 on a 4.0 scale. 80% of that course material was repeat from what I had in high school.

When I went back to college after having been out of college for 16 years, and only because the plant I worked at was shut down by the parent corporation, and I didn’t land on any other employment, I felt I had to go back to college to finish out my degree in Accounting, though I hated the idea because of the money game of the higher education system. I earned 90.5 quarter credit hours between September 21st, 2011 and December 11th, 2012 for the BBA pulling an overall 3.88 GPA on a 4.0 scale. Not only that, but I was the most outstanding BAP member in 2011 for bringing and running the FSA version of the VITA program to the college as per the suggestion of one of my connections at the EITC program in Price Hill neighborhood area of Cincinnati, Ohio.

Still not landing on any other employment, I went on and worked on my MS in Accounting while also raising a family of 7 (5 girls, my wife and myself). On the one had, you would say I went about average pace for completing my 34 semester credit hours (51 quarter credit hours) within the year of 2013, but add to it, I worked on and passed all 4 CPA exams within a single 6 month window, which 4 of those 6 months, I was a full-time student working on my MS in Accounting. Of the 141.5 quarter credit hours I earned at University of Cincinnati, 74.5 of those hours were repeat of prior courses including 75% of the senior level college course of Accounting Information System being repeat of what I had in high school at Genesee Area Skill Center for the 2-year Accounting program that specialized in information systems. The only difference there were between the 2, the high school one focused more on the computer side and less on the direct threats against the system vs the college course 22 years later focused more on the paper side and the direct threats against the system.

As to working and going to school, I was also working as a TA/GA in International Business at University of Cincinnati (about 10 hours per week), tutoring other students (mostly in Accounting), and I was also doing some work for another person dealing with train models about 15 hours per week. Therefore, if you add in my TA work, tutoring, work outside of school, volunteer time (4 hours per week running the FSA site during tax season), participating in the BAP program (4 hours per week) while carrying on a course load that ranged between 15 and 20 credit hours per term, and still taking care of my family, that’s a lot too. I felt though I had to get through ASAP but only come out with the documents. The dates and results of my CPA exams are as follows (AUD exam: 8/12/2013, scored 75; BEC exam: 8/27/2013, scored 88; REG exam: 1/3/2014, scored 75; FAR exam: 2/1/2014, scored 87). As to the FAR exam, not only did I score high on it compared to most people, I only spent 1 hour and 22 minutes on it out of the full 4 hours given to take the 4 part exam. The FAR and BEC exams, I wasn’t the least bit concerned about passing them. It was mainly the AUD and REG exams. As to the AUD, I spent a lot of time preparing for that exam (2.5 months as compared to 2 weeks for the BEC exam). The other exam I was a bit concerned about was the Regulation exam because of the social and monetary stuff in that exam, but figured it was going to be my tax knowledge that would pull me through that exam, which is exactly what happened. I did only give myself 3 weeks time to prepare for it after the graduation of my MS in Accounting, that included Christmas and NYD, but given I had both business law courses and one of the tax courses in that last term for my MS, I figured that would also help me be prepared for that exam, which was true to some extent.

As to having the IRS split the benefits between both parents filing separately, I don’t foresee that happening anytime soon as that can get really messy in so many ways. As to spending way more than $2,000, I agree with you, but think about this, the idea is that the IRS isn’t to tax you on what it takes to provide support for the kids, so if you are in the 12% marginal tax bracket, then that $2,000 would really be more like an additional earned income of about $16,667 before you would start to have a tax bill by the IRS.

The biggest question I get is why did Congress limit the age to 16 instead of 17 given 17 year olds are also minors. While I don’t truly have an answer to that question, I suspect it’s because 17 year olds has some flexibility that 16 year olds can’t do though they still can’t do things as an 18 year old (in most states depending on the age that the state they are in are considered as at the age of majority as a few of them consider either the age of 19 or 21 as the minimum age of majority).

I’m devorced I have 2 children 11, and 12 I have shared parenting I make approximately 60,000 and my exwife make about the same , who gets the tax benefits , how does that work with the new tax laws and benefits

Hi Michael – The tax benefits are usually spelled out in the divorce decree. But it’s mostly decided by who has primary custody, since there are no more dependent exemptions under the new law.

Like Jeff said, this is normally spelt out in the Court Decree, which also means if it is the Non-custodian parent to get to claim the benefits (mainly the exemption, which is now eliminated with the Child Tax Credit increased with the increased portion being non-refundable for this replacement, the Child Tax Credit, and the Additional Child Tax Credit), a Form 8332 or substantially similar form has to be filled out. This law went into effect in 2009 because the IRS personnel had to spend hours pouring over the copies of divorce decrees and said enough was enough. As such, this form would greatly reduce the amount of time they would have to spend to determine who get what credits. This rule applies to any court decrees that took place AFTER the tax year of 2008.

Who is determined to be the non-custodian parent? One thing, how many nights did the child spend with each parent. Whichever parent the child spent the most nights with, that is the parent that is considered as the custodian parent. Only the custodian parent can claim the HOH (if not married, or is married, but considered as single for tax purposes; all the while also meeting the other requirements to claim the HOH filing status), Dependent Care Credit, and the EIC.

In the absence of the form 8332 or court decree (if it was prior to 2009), then it goes to the tie breaker rules. In regards to who gets to be considered the custodian parent, normally it would be the parent the child is with while the child is in school. However, if that isn’t good enough and it is so even steven, I would like to know how the IRS would treat the New Year’s Eve nights on both ends of the year given each of those two nights are technically only half of the night of those two nights in the same year.

My wife and go to casinos. We have to claim more than $70,000 in income from W2g in most years. We always have more losses than winnings, which we have to write off on Sch A. This new law will really hurt.

I would love to take the standard deduction and write off the income on Sch D or some other allowed form with 1940A.

You’re right John, the new tax law has hurt a lot of people in similar situations. A lot won’t be able to itemize at all any more, due to combining the standard deduction and personal exemptions.

In regards to the itemization of gambling losses, that is still deductible on the federal level, though be sure to check if it is on the state level or not, as some states like Ohio doesn’t allow for such deductions, thus really hurts you in that manner.

For the federal level, the issue you have isn’t as much about the gambling losses not being deductible, but rather in that you must claim the total winnings BEFORE AGI, and then you claim the gambling losses only to the extent of gambling winnings on the Schedule A (still allowed even in 2018 and beyond) which is an AFTER AGI deduction. However, because of the gambling winnings increasing the AGI without the benefit of the decrease of gambling losses before AGI, the increased AGI may very well hurt you in other ways given many of the credits are phased out based on filing status and MAGI (Modified AGI that not only include the AGI, but also includes the non-taxable earned interest)

$1,400 of the credit is refundable as I understand it. If you use a foreign tax credit to reduce your tax bill to zero do you still get the refundable portion regardless of income level? In other words, does the refundable portion phase out with income levels?

Hi Mark – You might want to talk with a CPA about the combination of the child care credit and the foreign tax credit. It looks like the whole tax credit phases out at higher incomes, not just the refundable portion. But the IRS hasn’t yet issued written guidelines.

Can you please point me to the section of the amended code that provides that foster children must have lived in your home for the entire year in question in order to be eligible for the child tax credit? My understanding is they must have been there over 6 months, but your article is being cited as supporting requiring them to have been placed the entire year.

Hi Kate – According to the IRS, it was 6 months up until 2017. However, the IRS hasn’t published guidelines for 2018 yet, so we’ll have to wait and see.

As to the requirement, it is still only MORE THAN 6 months according to the Form 1040 instructions on page 20, which has always been that way to my knowledge and I been doing taxes for more than 30 years. The only exception that I have seen in the tax code, to be considered as a qualified widow/widower, the foster child CAN’T count as a qualifying child for the purpose of the QW filing status, which is specifically stated on page 17 of the same set of instructions, under the subheading of Qualifying Widow(er) in paragraph (2).