Shopping around for a mortgage or a personal loan can be a tedious and boring task, but it can also take up a ton of your time.

After all, getting multiple quotes may require you to call several banks and answer the same questions over and over.

Fortunately, some lending aggregators make it possible to compare quotes from multiple lenders in one place, saving you time and precious mental energy in the process.

GuidetoLenders.com is one such website that connects consumers with quotes for personal loans, home loans, and home equity loans.

With Guide to Lenders, all that’s required is filling out a simple form to gain access to multiple loan quotes for you to compare and find the best deal.

If you’re in the market for a mortgage, home equity loan, or personal loan, you may want to check out Guide to Lenders and what they have to offer.

Keep reading to learn more details about their loans, their process, and the best ways to use this website to your advantage.

A great personal loan option is LendingPoint.

Table of Contents

My Guide to Lenders Review: Key Takeaways

Here are the quick and dirty facts on Guide to Lenders:

- Guide to Lenders offers home loans, mortgage refinancing, home equity loans, and personal loans.

- Mortgage rates start at 5.64% APR.

- You can compare multiple quotes from lenders on a single platform.

- There are no hidden fees for using the Guide to Lenders website, but you may need to pay fees associated with your loan.

- You can see loan quotes without a hard pull on your credit report, and loans are available in all 50 states.

How Guide to Lenders Works

Since Guide to Lenders is a lead generation website, it doesn’t loan money on its own.

The website’s main function is connecting consumers with multiple loan quotes so they can compare offers to find the best deal.

Applying to see your loan options with Guide to Lenders is easy.

All you are required to do is fill out a simple questionnaire with personal details such as your:

- name

- address

- credit score

- employment status

- annual income

- zip code

- address

- email address

- zip code, and

- Social Security number

These will grant you access to multiple loan quotes tailored to your exact borrowing needs.

There are no fees required to use the Guide to Lenders website, nor is there any obligation to apply for any loan available to you.

In terms of the interest rates and loan terms you’ll be offered, this depends entirely on factors such as your credit score, your income, and your employment status.

Loan terms will also depend on the type of loan you apply for, whether that’s a personal loan, a home loan, or a home equity loan.

In addition to helping consumers compare quotes from multiple lenders, Guide to Lenders offers a helpful resource section with tips on how to find the best mortgage and how personal loans work.

If you have questions about their products or wonder whether a specific type of loan is right for your needs, you can also explore their very helpful FAQ section for more information.

Is Guide to Lenders Legit?

If you’ve never heard of Guide to Lenders before, you can rest assured that the website is fully legitimate.

Guide to Lenders is owned by QuinStreet Media, which is a publicly traded marketing company that was founded in 1999.

While QuinStreet was investigated in 2012 for using deceptive practices in their for-profit school marketing efforts, they enjoy a mostly good reputation among online lead generation and marketing professionals and firms.

Since Guide to Lenders doesn’t offer any loans themselves, however, you will need to conduct due diligence with any lender you’re connected to once you start the process.

On its own, Guide to Lenders was founded in 2005 and has managed over $16 billion in loan requests since its inception.

Guide to Lenders also works with over 150 different lenders that will compete for your business when you fill out a loan application.

However, you will not be inundated by loan offers from dozens of companies at a time. Guide to Lenders sorts through all the quotes on your behalf, connecting you with only the top five offers for your loan needs.

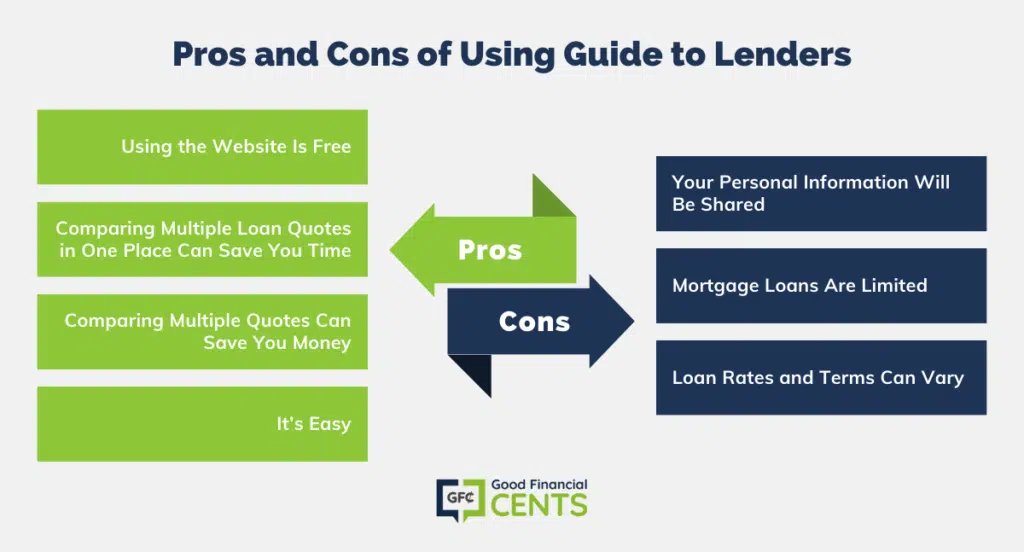

Pros and Cons of Using Guide to Lenders

Before you apply for any type of loan online or in person, it’s important to understand the pros and cons involved in your transaction.

While Guide to Lenders doesn’t offer any loans on their own, there are still advantages and disadvantages that come with using this service.

Here are the main factors you’ll want to consider before you move forward with your loan inquiry:

Advantages of Using Guide to Lenders:

- Using the website is free. You won’t pay any additional fees to use the Guide to Lenders website to compare loan quotes.

- Comparing multiple loan quotes in one place can save you time. Filling out one questionnaire to receive multiple loan quotes across several lenders can help you maximize your experience and your time.

- Comparing multiple quotes can save you money. According to a 2012 study from the U.S. Department of Housing and Urban Development, Guide to Lenders cites comparing quotes from multiple lenders can help you save thousands of dollars on a typical mortgage note.

- It’s easy. Guide to Lenders is free to use but it’s also easy and entirely online. You won’t have to visit a stuffy lender’s office to apply for a loan, and the entire process only takes a few minutes.

Disadvantages of Using Guide to Lenders:

- Your personal information will be shared. The biggest downside of applying for a loan with Guide to Lenders is the fact that your information will be shared with third parties who may contact you on their own.

If you’re careful about sharing your personal information, this may make you uncomfortable.

- Mortgage loans are limited. Guide to Lenders only offers home loans and refinancing on residential property and not on commercial real estate.

- Loan rates and terms can vary. Because Guide to Lenders connects you with third-party lenders instead of loaning money themselves, you will have no idea the type of rates you’ll be offered until you apply.

You will also need to conduct more due diligence before you choose among the lenders that offer you a free quote.

The Bottom Line

If you’re going to apply for a personal loan, a home loan, or refinance your mortgage, you should definitely get multiple quotes so you can compare them in terms of interest rates, fees, and loan terms.

Doing so can help you save money on interest while ensuring you get the best loan available based on your credit score and loan needs.

Guide to Lenders can help in this effort by connecting you with multiple loan quotes on a single platform.

The website is free to use and you can get started by filling out a simple questionnaire online and from the comfort of your home.

Also, note that getting preliminary quotes from Guide to Lenders will only result in a soft pull on your credit report.

In summary, you have very little to lose by accessing the Guide to Lenders website to compare loan quotes.

You do, however, have a lot to lose if you don’t compare quotes and wind up paying a higher interest rate or more fees than you would otherwise.

Disclaimer:

Offer Terms and Conditions: To help the government fight the funding of terrorism and money laundering activities, Federal law requires all financial institutions to obtain, verify, and record information that identifies each person who opens an account.

What this means for you: When you open an account, we will ask for your name, address, date of birth, and other information that will allow us to identify you. We may also ask to see your driver’s license or other identifying documents.

Applications submitted on this website may be funded by one of several lenders, including: FinWise Bank, a Utah-chartered bank, member FDIC; LendingPoint, a licensed lender in certain states. Loan approval is not guaranteed.

Actual loan offers and loan amounts, terms and annual percentage rates (“”APR””) may vary based upon LendingPoint’s proprietary scoring and underwriting system’s review of your credit, financial condition, other factors, and supporting documents or information you provide.

Origination or other fees from 0% to 6% may apply depending upon your state of residence. Upon final underwriting approval to fund a loan, said funds are often sent via ACH the next non-holiday business day.

Loans are offered from $2,000 to $36,500, at rates ranging from 9.99% to 35.99% APR, with terms from 24 to 60 months.

A $10,000 loan with an origination fee of 6% for a period of 24 months with an APR of 24.0980% may have a payment of $529.20 per month (actual terms and rate depend on credit history, income and other factors).

The total amount due under the loan terms provided as an example in this disclaimer includes the origination fee financed in addition to loan amount, which is $12,700.80. Customers may have the option to deduct the origination fee from the disbursed loan amount if desired.

1. Alimony, child support, or separate maintenance income need not to be revealed if you do not wish to have it considered as a basis for repaying this obligation.

2. The Federal Equal Credit Opportunity Act prohibits creditors from discriminating against credit applicants on the basis of race, color, religion, national origin, sex, marital status, age (provided the applicant has the capacity to enter into a binding contract); because all or part of the applicant’s income derives from any public assistance program; or because the applicant has in good faith exercised any right under the Consumer Credit Protection Act.

The federal agency that administers compliance with this law concerning FinWise Bank is the FDIC Consumer Response Center, 1100 Walnut Street, Box #11, Kansas City, MO 64106.

The federal agency that administers compliance with this law for LendingPoint is the Federal Trade Commission, Equal Credit Opportunity, Washington, DC 20580.

How We Review Mortgage Lenders:

Good Financial Cents evaluates U.S. mortgage lenders with a focus on loan offerings, customer service, and overall trustworthiness. We strive to provide a balanced and detailed perspective for potential borrowers. We prioritize editorial transparency in all our reviews.

By obtaining data directly from lenders and carefully reviewing loan terms and conditions, we ensure a comprehensive assessment.

Our research, combined with real-world feedback, shapes our evaluation process. Lenders are then rated on various factors, culminating in a star rating from one to five.

For a deeper understanding of the criteria we use to rate mortgage lenders and our evaluation approach, please refer to our editorial guidelines and full disclaimer.

Guide to Lenders Review

Product Name: Guide to Lenders

Product Description: Guide to Lenders is an online platform designed to connect borrowers with a range of potential lenders to suit their financial needs. Streamlining the loan application process, it allows users to compare offers from various lenders effortlessly. This service aims to simplify the borrowing journey, ensuring consumers find the best fit for their financial circumstances.

Guide to Lenders - Online Platform for Borrowers

In today’s digital age, Guide to Lenders stands out as a pivotal tool for borrowers navigating the lending landscape. Recognizing the challenges and complexities of securing loans, the platform offers a curated selection of potential lenders based on the borrower’s profile. Instead of visiting multiple lenders or websites, users can now access a consolidated list of matches tailored to their needs. The strength of Guide to Lenders lies in its commitment to simplifying the loan acquisition process, placing power and choice directly into the hands of consumers.

-

Cost and Fees

-

Customer Service

-

User Experience

-

Product Offerings

Overall

Pros

- Convenience: Eliminates the need for borrowers to individually approach multiple lenders, streamlining the process.

- Tailored Matches: Offers curated lender suggestions based on individual financial profiles, enhancing the chances of approval.

- Comparative Insight: Allows borrowers to easily compare loan offers, ensuring they get the best terms and rates.

- Free Service: Most services like these don’t charge the borrowers, earning from lender partnerships instead.

Cons

- Limited Options: The platform might not cover all available lenders in the market, potentially missing out on some offers.

- Data Sharing: Users might have concerns about how their financial data is shared or used by affiliated lenders.

- Varied Experiences: As Guide to Lenders connects users with third-party lenders, experiences might vary based on the selected lender.

- Potential for Marketing: Users might receive promotional offers or communications from associated lenders, which could be seen as a downside for those seeking minimal contact.