Submitting an application for life insurance with a mitral valve disorder is something that insurance companies will need to closely consider as these disorders can lead to serious heart problems.

Your rating will come down to what type of disorder you have, the severity of the condition, and your overall health.

If you don’t have life insurance, you could be making a very selfish move. Life insurance plans are a vital financial safety net for your family members.

If you have a severe health complication like mitral valve disorder, then you may assume that you can’t get affordable coverage because of your health, but that couldn’t be further from the truth. Regardless of your health or any problems that you have, you can get the perfect plan for you.

To help you get through the process, we’ve put together the complete guide to life insurance underwriting for mitral valve disorders.

Table of Contents

Life Insurance Underwriting With Mitral Valve Disorders

We’ve listed out some questions you might get from an agent when you first start talking about getting a policy.

- How were you diagnosed with a mitral valve disorder?

- What is your condition (Mitral Stenosis, Mitral Regurgitation, or Mitral Valve Prolapse)?

- What were the results of your latest stenosis report?

- Did you need surgery for your mitral valve disorder?

- Are there any other heart issues you’re dealing with?

- What, if any, medications do you take for your mitral valve disorder?

Common medications for a mitral valve disorder include Aspirin, Anticoagulants, Statins, and High Blood Pressure Medication. All of these medications for a mitral valve disorder could be insurable depending on your symptoms.

Always give your agent honest responses to the questions he asks. You want the underwriter to see that you are doing everything possible to manage your disorder. If your application seems incomplete, the underwriter may take that as a sign of more serious problems and decline your application.

Life Insurance Quotes With a Mitral Valve Disorder

Your life insurance rating will primarily depend on what type of mitral valve disorder you have. If you just have a mitral valve prolapse that isn’t causing regurgitation or other complications, it may not affect your rating at all. Life insurance companies worry more about mitral stenosis and regurgitation.

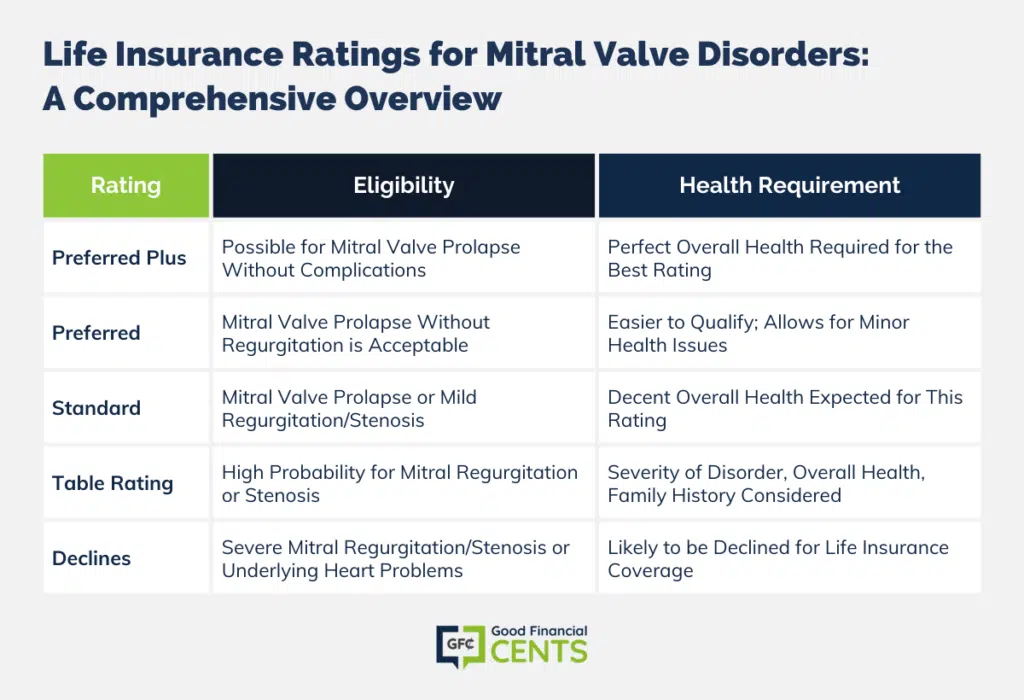

For all these conditions, the company will look at the severity of your disorder. They will also consider your risk factors for heart problems because mitral disorders can make heart disease more likely. We put together a quick explanation of your chances of being approved for each rating category. We don’t promise perfection because most carriers formulate their own restrictions, and standards for health conditions so it could change depending on who you get a quote from.

- Preferred Plus: Possible for applicants that only have a mitral valve prolapse that isn’t causing regurgitation or other complications. Applicant should be in perfect health otherwise to qualify for the best rating.

- Preferred: Also possible for applicants that only have a mitral valve prolapse that isn’t causing regurgitation. The Preferred rating is a bit easier to get so the applicant can have other small issues affecting them.

- Standard: Most likely rating for an applicant that only has a mitral valve prolapse. The best possible rating for applicants that have mild mitral regurgitation (very little blood backflow) or minimal mitral stenosis (valve opening > 1.5 cm2). Applicant should otherwise be in decent health.

- Table Rating (substandard): High probability if you have mitral regurgitation or stenosis. Applicants with a mitral valve prolapse caused by an underlying heart problem could also receive a substandard rating. The applicant’s rating will depend on the severity of the mitral valve disorder, overall health, and family history of heart disease.

- Declines: Those with severe mitral regurgitation (heavy blood backflow) or severe mitral stenosis (valve opening less than 1.0 cm2) are likely to be declined. Also, applicants who have a mitral valve disorder plus underlying heart problems are also likely to be declined.

Mitral Valve Disorder Insurance Case Studies

When you apply for life insurance, you can increase your chances of getting a good rating by properly handling your application. Check out these real situations that show the importance of planning.

Case Study 1: Male, 49 y/o, non-smoker, diagnosed with a mitral valve prolapse at 46, no underlying cause or complications, otherwise in great health

This client was in pretty perfect health besides his mitral valve prolapse. Since the condition wasn’t causing any problems like regurgitation, it shouldn’t have been an issue for life insurance. However, when this applicant tried applying for a policy, he received a substandard rating. After reviewing his case, we realized he applied to a company that didn’t regularly deal with mitral valve disorders and doesn’t rate them well. We put this client into touch with a few of the top 10 life insurance companies. We also recommended he take an EKG before applying to show that his heart was in good health. With this extra research, the client received a preferred rating and could buy his policy at a discount.

Case Study 2: A 62-year-old female with moderate mitral stenosis at 58, a former smoker, recently started taking care of her health dropped her blood pressure w/ meds, and lost some weight in the process.

Before, her lifestyle was very unhealthy. She smoked, had high blood pressure, and was overweight. When she was diagnosed with moderate mitral stenosis at 58, she realized she needed to start taking better care of herself. She quit smoking, exercised more, and started taking the right medication regularly. However, when she turned 62 her life insurance application was declined. Our stance on the decision was that the insurer placed an emphasis on her past history. Our suggestion was to get a statement from her primary physician which shows her improved lifestyle. Because of this, she was able to get better rates.

Get Cheap Life Insurance

Even if you’ve been diagnosed with mitral valve disorder, that doesn’t mean that you have to pay for an expensive life insurance plan that’s going to drain your savings account. Before you apply for a plan, take a long and heart look at your situation and your health.

Your bad habits could not only be harming your health, they could be hurting your wallet as well. Smoking and excessive drinking are going to force you to pay higher rates. Cut those out, and you can save some serious cash.

Qualifying for life insurance with a mitral valve disorder isn’t always easy, but with the right planning, it’s definitely possible.

The key to getting cheap life insurance is to shop around. Different companies have different prices. It’s as simple as that.

Conclusion

This article effectively guides individuals with mitral valve disorders through the intricate process of applying for life insurance, underlining the critical nature of honest disclosure and comprehensive understanding of the condition. It highlights that while mitral valve disorders can potentially lead to serious heart issues, having such a condition does not automatically disqualify one from obtaining affordable life insurance.

The severity of the disorder, the specific type of mitral valve condition, and the overall health of the individual play significant roles in determining insurance eligibility and rates. The article encourages individuals not to make the ‘selfish move’ of forgoing life insurance, emphasizing its importance as a financial safety net for family members. Through real-life case studies, the reader is shown that proper preparation, lifestyle changes, and choosing the right insurance company can lead to favorable insurance outcomes, even for those with mitral valve disorders.

Ultimately, the article serves as a comprehensive guide, demystifying the application process, and offering actionable advice for those seeking life insurance with a mitral valve disorder.