A recent survey from College Ave Student Loans revealed that student borrowers continue to rely heavily on parents when it comes to paying for higher education. Students said they were relying partially on their parent’s income or savings.

The survey, which included 1,057 undergraduate students, found that these students and their families use a variety of resources to pay for college. This includes federal student loans (51%), student income and savings (45%), private student loans (13%), and the work-study program (12%).

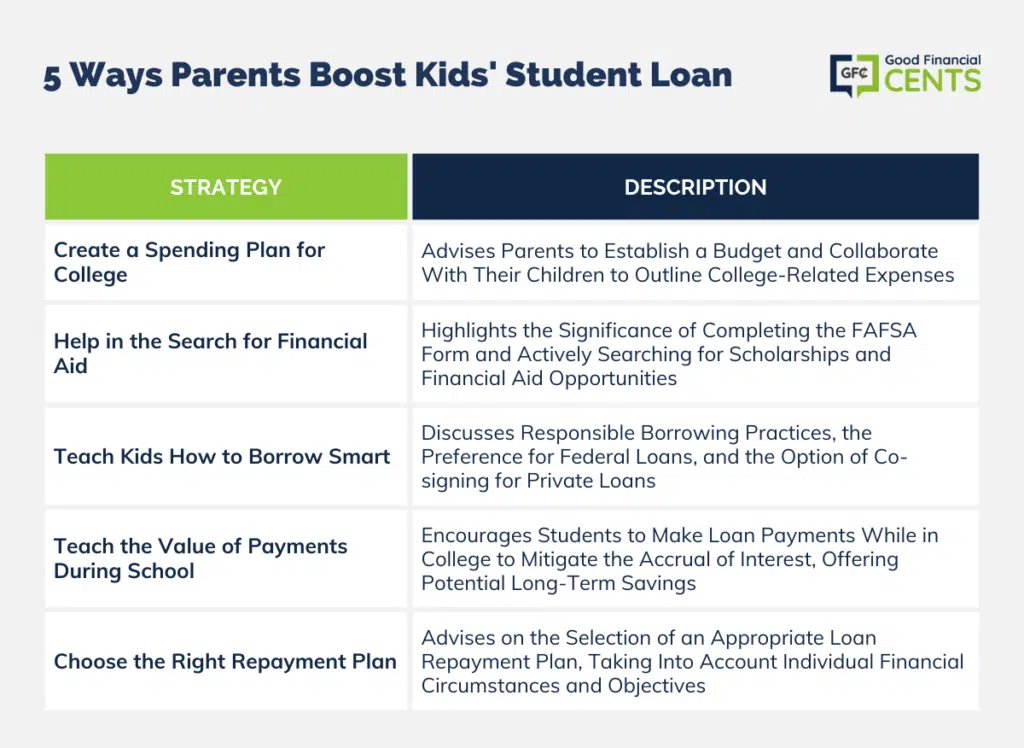

If that all sounds like a lot, you should know there are ways you can help your dependent cover the cost of tuition and fees, or even spend less to begin with. Parents can also help their kids minimize the amount of student loans they have to take out, which can make a huge difference once they graduate from college and begin their adult lives.

Table of Contents

If you’re a parent who is hoping to get through the college years with your finances intact, consider these tips.

Create a Spending Plan for College

Also, make sure to sit down with your college-bound kid to come up with a budget or spending plan for school. Not having any sort of plan is the best way to make sure you fail, yet having a budget and some sort of agreement on what college spending might look like can be a big help.

For example, you might have a talk with your dependent about how much “spending money” they’ll be able to have on a weekly or monthly basis. You can also sit down and write out all the regular expenses they’ll have that you’ll need to cover, including tuition, books, housing, a smartphone, technology expenses, transportation expenses, and other bills.

It might also help to ask family and friends who have recently had a kid in college what some of their expenses were so you can plan accordingly.

Help in the Search for Financial Aid

Also, make sure you’re helping your child qualify for all the financial aid they may be eligible for. This process always starts with filling out the Free Application for Federal Financial Aid, or FAFSA form. This form can help you determine whether your dependent is eligible for grants or work-study programs as well as other aid. Meanwhile, filling out the FAFSA is how you’ll find out your Expected Family Contribution (EFC), which can help you figure out what your out-of-pocket costs for college will look like.

In the meantime, you can also help your child search for scholarships that may be available, including ones from local organizations or industries in their field of study.

Teach Kids How to Borrow Smart

Chances are good your child will have to borrow some money for college even if you provide financial assistance, but you can still help them make good decisions. Filling out the FAFSA form will help your family determine how much you can borrow with federal student loans, which you should use first. From there, you can also look at student loans from private lenders like College Ave Student Loans, which can help you fill in the gaps after federal loans are maxed out.

Either way, make sure your dependent is not taking on too much debt for their degree. A general rule of thumb says that, if your total student loan debt at graduation is less than your starting salary, you can afford to repay your student loan debt over the standard ten-year timeline.

Teach the Value of Payments During School

Parents can also help their children by teaching them how and why to make payments on their student loans while they’re still in college. The reality is, that doing so can help them make a dent in their balances all along, or even keep ballooning interest at bay.

That all depends on the type of federal student loans your child has. While the government covers accruing interest on Direct Subsidized Loans, there is no such benefit on Direct Unsubsidized Loans. This means that not making any payments on Direct Unsubsidized Loans during college could mean you wind up owing a lot more than was borrowed due to capitalized interest.

If students want to keep interest on Direct Unsubsidized Loans from adding to their loan balances, making interest payments during college can help.

Choose the Right Repayment Plan

Finally, you should make sure your dependents are on the best repayment plan for their needs. This could be standard ten-year repayment on federal student loans if they can afford the monthly payment and want to get out of debt as soon as possible. However, you can also look at extended or graduated repayment plans for federal loans that let borrowers repay a smaller monthly amount over a longer period of time. Just keep in mind that extending your loan term may lead to paying more interest over the entire repayment timeline, even if the monthly payment is smaller.

Income-driven repayment plans like Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), Income-Based Repayment (IBR), and Income Contingent Repayment (ICR) are also popular for borrowers since they let them repay federal loans over 20 to 25 years before ultimately forgiving remaining loan balances. You can also look into Public Service Loan Forgiveness (PSLF), which lets borrowers repay loans on an income-driven plan for 10 years before the remaining loan balances are forgiven. Just keep in mind that PSLF applicants are required to repay their loans while working in an eligible public service position.

If you can afford it, encourage your student to pay down student loans while in school. Any amount, as little as $25 a month, can help your child save money on the total cost of their loan.

Finally, you could even consider helping your dependent refinance their student loans (federal or private) to get a better deal. Just remember that refinancing federal loans with a private lender means giving up benefits like income-driven plans and deferment or forbearance.

You should also make sure refinancing makes financial sense before you move forward. A student loan calculator can show you how much you could save if you refinance your loans at today’s low rates.

The Bottom Line

Parents may not be able to cover the entire cost of higher education, but that doesn’t mean they can’t help in other ways. For example, parents can make sure their kids are considering all potential forms of aid they may be eligible for, including ones they may not have thought about. Plus, any advice that helps kids borrow less for college can go a long way toward helping them have more choices once they graduate.

No matter what, your best bet is planning ahead and thinking about college before it gets here. If you wait to plan or decide you’re going to figure it out as you go, you could live to regret it.

Hi Jeff, long time fan of GFC.com!

Great message – important for families to plan ahead so they can lower their costs and minimize the need for debt – choose less expensive schools, choose more generous schools, focus on 4 year graduation rate and more:)