Update 6/09/2020: Since writing this post, I now have 3 sons and a daughter! Also, Illinois has increased its state tax rates!! My family also now lives in Tennessee.

As our son rapidly approaches the age of two, the scary reality is that paying for college tuition is just around the corner.

We were fortunate enough to start a 529 College Saving plan for him when he was born and make a diligent effort to add to it on a frequent basis.

For those that reside in the state of Illinois, I wanted to do a quick rundown of what your options are in the event you want to get a head start on saving for your kids’ college education.

First, let’s take a look at the basics of what a 529 College Savings Plan is.

Quick note:

Basics of a 529 College Savings Plan

529 Plans are the most commonly used savings tool for college education nowadays. They are named after Section 529 of the Internal Revenue Code. The 529 savings plans provide a tax-advantaged way to save for qualified higher education expenses.

These plans are generally sponsored by individual states, while plan assets are professionally managed by independent investment firms or state government agencies. Anyone can open a 529 savings account regardless of income level and contribute up to $13,000 ($26,000 for married couples) a year without gift-tax consequences.

You can read the other post I wrote on the topic: 10 Questions About College Savings Plans

Now that we know the basics of the 529 Plan let’s look at the 529 options for the state of Illinois.

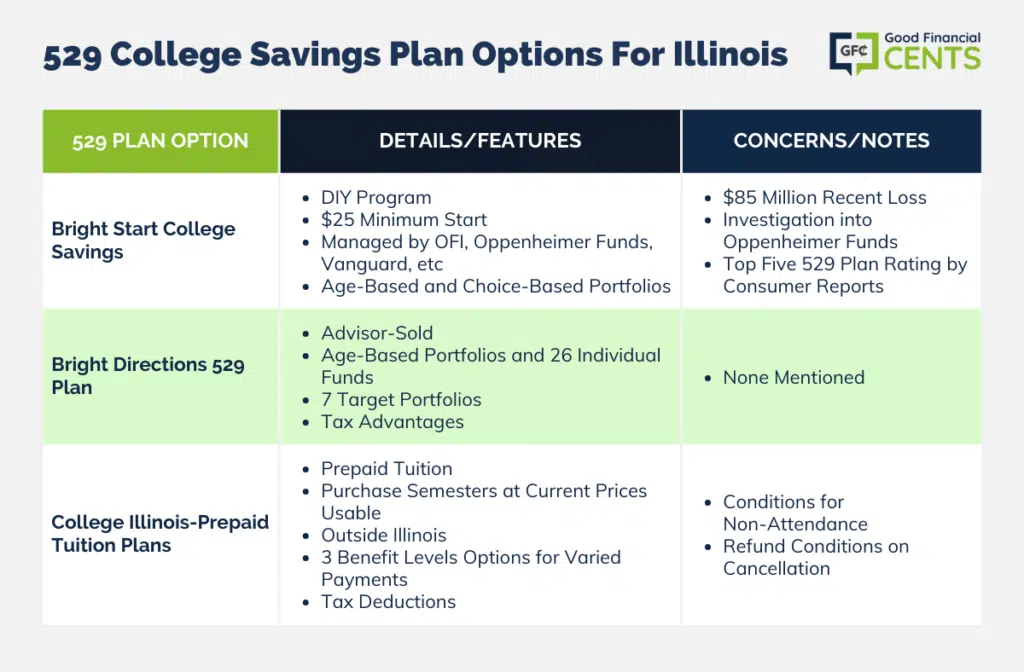

Bright Start College Savings

The first 529 College Savings Plan option for Illinois residents is the Bright Start Program. The Bright Start plan is more of a do-it-yourself program. This is taken directly from the Bright Start site:

Starting a Bright Start plan takes as little as $25 and about 15 minutes when you enroll online. Like the 401(k) plan you may use to save for retirement, a 529 plan allows you to invest in various portfolios of stock and bond investments to save for your student’s college education.

The portfolios are managed by OFI Private Investments Inc., a subsidiary of OppenheimerFunds, Inc., and include investments managed by industry leaders OppenheimerFunds, Inc. and its affiliates, as well as The Vanguard Group and American Century Investments®.

Investment Choices

The program allows investors to choose either age-based portfolios (where the investment options go from more aggressive to more conservative as the child approaches college age) or Choice-based Portfolios, where you choose the investments yourself from all the available fund options.

Troubled Times

Recently, the program has fallen under great scrutiny with the recent loss of $85 million in the fund, which can largely be attributed to steep losses in the Oppenheimer Core Plus Fixed Income bond fund, a fund that sustained steep losses in 2008 due to management’s big bets on illiquid securities.

Currently, the Bright Start program is conducting an investigation concerning possible breaches of fiduciary duty by OppenheimerFunds, Inc., OppenheimerFunds Private Investments, Inc., and OppenheimerFunds Distributor, Inc. I know this may be a big concern for future investors and rightfully so. Don’t be too alarmed, though. There are plenty of other fund choices in the program that you can choose from.

Need more assurance? Recently, Consumer Reports announced that the Bright Start Program was named one of the Best Five 529 plans in the country according to the most recent data. That should give you some confidence in the program.

Bright Directions 529 Plan

If you are looking for another 529 plan option, you can also look at the Bright Directions program. It’s a good compliment to the Bright Start program. The Bright Directions is usually sold through an advisor (such as myself). Here’s some basic info taken directly from their site:

Bright Directions is an advisor-sold, 529-qualified tuition program specifically for those who manage their investments through a professional advisor. This plan allows your advisor the flexibility to build your college savings as aggressively or conservatively as you see fit.

Investment Choices

Bright Directions has some features similar to Bright Start in that it offers Age-Based Portfolios as well as the ability to choose from 26 individual funds. The mutual fund companies are as follows:

PIMCO, BlackRock, American Century, Delaware Funds, Eaton Vance, Northern Funds, William Blair, AllianceBernstein, ING Mutual Funds, T. Rowe Price, Barclays Global Investors, Calvert, PaydenFunds, NCM Capital, Ariel Investments, OppenheimerFunds, Sit Mutual Funds, Forward Funds, Adelante Capital Management, FMA, and Earnest Partners.

In addition to those two options, the program also allows you to choose from 7 Target Portfolios that will based on your risk tolerance. For example, if you are comfortable with 60% in stocks and 40% in bonds, then your portfolio will stay in that mix no matter what.

Tax Benefits

What Are the Federal Income Tax Advantages?

- Tax-deferred growth

- Tax-free withdrawals for qualified higher education expenses

What Are the State Income Tax Advantages?

- Tax-deferred growth

- Tax-free withdrawals for qualified higher education expenses

- State of Illinois income tax deduction

- $20,000 if filing jointly

- $10,000 per individual taxpayer

College Illinois – Prepaid Tuition Plans

Most people who are familiar with 529 plans use plans similar to those noted above. If the stock market is not your thing, you can then apply for College Illinois, which is a prepaid tuition program. College Illinois offers plans to purchase university-level semesters (University, University+) and community college-level semesters at today’s tuition prices. You may purchase one semester or several semesters, with a maximum of four at a community college and nine semesters at a university.

College Illinois also does not have to be used for the State of Illinois. According to their website, their program has helped Illinois purchase school credits at such universities as UCLA, Syracuse, University of Kansas, and University of Toronto, just to name a few.

Tax Benefits

Individuals subject to Illinois state income tax can deduct from their taxable income up to a maximum of $10,000 per year for contributions made toward the purchase of any College Illinois! Prepaid tuition contract. Married couples filing jointly can deduct up to $20,000 per year.* This state tax deduction reduces the individuals’ adjusted gross income (AGI) by the amount contributed up to $10,000 (or $20,000 for those filing jointly).

The plan offers 3 Benefit levels: Community College, University, and University+. The first two are self-explanatory, where University+ uses the University of Illinois as its base of tuition and fees. You don’t have to buy all “University+” credits. If you plan on your child going to a community college, you can purchase a portion of those credits in addition to what else you think you may need.

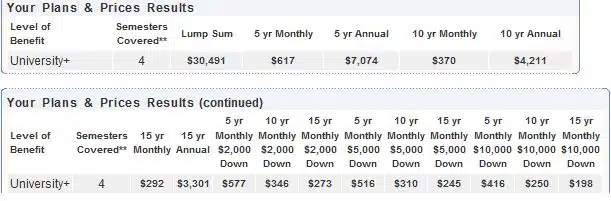

When you decide which benefit level you want, you then can decide how many semesters you want to pay for and the method of payment. To illustrate how much it might cost, I went to the College Illinois website and entered the info as if I was going to prepay for my two-year-old using the University+ benefit level for a total of 4 semesters.

As the chart indicates below, it would either cost me a $30,491 lump sum today, or I can pay $292 per month over a 15-year period. The rest of the columns are a combination of paying some down over the course of different time periods (5, 10, & 15 years).

What Happens if My Child Doesn’t Go to College?

Similar to the 529 Investment Plans, you have the following options:

- Keep the benefits and use them for the beneficiary’s graduate study or continuing education in the future. Benefits applied to graduate study tuition and fees will be paid at the undergraduate tuition rate.

- Change the beneficiary of the plan to another family member.

- Cancel the account and request a refund.

What I was most curious about is if what happens if you cancel the plan. According to the College Illinois website, here are your options:

If you cancel the plan within the first three years of the contract, you will receive a refund equal to the amount of payments made, less applicable fees. After three years, you will receive a refund equal to payments made, less any benefits or other refunds paid, plus two percent interest compounded annually. Cancellation fees will apply. All refunds are issued to the contract purchaser.

Like any other investment plan, the prepaid tuition plan takes careful planning to make sure it’s right for you.

Out-of-State Plans

One of the biggest misconceptions of the 529 plan is that you have to use the one that your state offers. This is farthest from the truth. As a resident of Illinois, you have the choice of using any state’s plan that you want. For example, I am currently using the State of Virginia’s plan. Why, you ask? I felt that Virginia’s Plans have investment options that are better suited to achieve my goals. One caveat: By choosing an out-of-state plan, you will sacrifice the state tax benefit you would receive otherwise.

To further diversify, I am considering adding the Bright Direction program to my portfolio. We are planning on having more kids, so in the long run, this could make sense.

Investment Products: Not FDIC Insured. No Bank Guarantee. May Lose Value.

Just decided to cancel my college illinois program. According to the letter that just arrived, the cancellation fees will be 50% of the refund. Unfortunately I did ask around prior to canceling and did not find this out until after I sent in the paperwork and this informative letter arrived stating that my cancellation was accepted! Never thought that the fees would have been 50%.

Is it better in the state of Illinois to make one large investment when the child is a year old or to invest 20000 every year for four years.