This is a post written by me on behalf of Discover Personal Loans. All opinions are my own.

It’s my job to help clients make financially prudent decisions. Not only do I help people maximize their investments for retirement, but I can help them plan out many aspects of their financial lives.

I might tell one client they need to make drastic cuts to their spending while telling another they should focus on earning more money instead. At the end of the day, the advice I offer depends on the specific client, their financial situation, and their goals.

There are times when specific clients need to take out a personal loan. Used wisely, a personal loan can help individuals achieve a number of financial goals.

Table of Contents

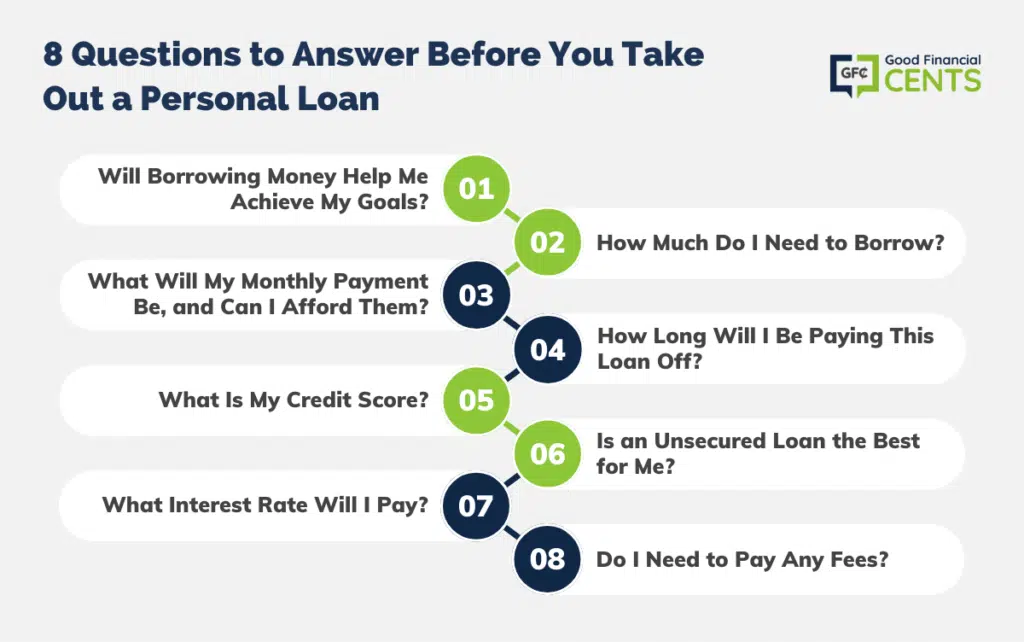

- Question #1: Will Borrowing Money Help Me Achieve My Goals?

- Question #2: How Much Do I Need to Borrow?

- Question #3: What Will My Monthly Payment Be, and Can I Afford Them?

- Question #4: How Long Will I Be Paying This Loan Off?

- Question #5: What Is My Credit Score?

- Question #6: Is an Unsecured Loan the Best for Me?

- Question #7: What Interest Rate Will I Pay?

- Question #8: Do I Need to Pay Any Fees?

- The Bottom Line

Depending on your situation, you may be able to use a personal loan to consolidate higher-interest debts. If your debt load is minimal but you’re short on cash, you can also use a personal loan to fund a small business or complete an important home repair.

Whatever your reason, it’s crucial to think long and hard before you borrow money.

By asking – and answering – the following questions, you can ensure you’ll get the most out of your loan.

Question #1: Will Borrowing Money Help Me Achieve My Goals?

Here’s the most important question to ask before you borrow a single cent: Do I really need this money?

While taking out a personal loan can make sense in certain circumstances, borrowing won’t solve your financial problems if you don’t have a plan to truly take control of your finances.

For a major expense that could potentially wait, like a big vacation, for example, you could open a targeted savings account and save for the goal over time.

If you need to consolidate higher-interest debt, on the other hand, a personal loan could be a great tool to help you potentially pay down your debt faster at a lower rate than you’re currently paying on your debts.

Most importantly, remember that borrowing money to help you get out of debt makes sense when you’re serious about debt repayment.

Question #2: How Much Do I Need to Borrow?

Once you’ve determined you do need a personal loan, it’s crucial to nail down exactly how much you need to borrow.

Applying for a personal loan online can be easy, but you need to have an idea of how much cash you need.

If you’re taking out a personal loan to consolidate debt, add up all your debts to come up with an ideal loan amount. If you’re borrowing for a specific project, on the other hand, it can help to get a few estimates that list potential costs.

Question #3: What Will My Monthly Payment Be, and Can I Afford Them?

While personal loans can provide cash for many different needs, it’s important to make sure you only borrow what you can afford to repay. Since your monthly payment is the best way to gauge affordability, it can pay off to explore potential payment options with a loan calculator.

Keep in mind, however, that several different factors affect your loan payment. Not only does the amount you borrow play a role but your interest rate and loan length will affect your monthly payment as well.

Question #4: How Long Will I Be Paying This Loan Off?

How long you’ll repay your loan is another important question to ask, keeping in mind that this is mostly your decision.

If you don’t mind paying a larger monthly payment, you may want to choose a shorter timeline. On the flip side, a loan with a longer repayment timeline can help you secure a smaller, more affordable monthly payment.

Question #5: What Is My Credit Score?

Your credit score may play a role in whether you qualify for a personal loan at all. And, if you qualify, having good credit could help you secure a loan with a lower interest rate and better terms than if you had poorer credit health.

If you’re curious about where you stand, Discover allows you to see your score for free with no obligation. There’s no cost or ding to your credit, and you can find out in a matter of minutes.

Question #6: Is an Unsecured Loan the Best for Me?

While personal loans are unsecured loans, others are secured, meaning they require some form of collateral. If you prefer not to put up collateral against your loan, then you may want to explore personal loans.

Personal loans also tend to have fixed interest rates and monthly payments, while other loans may fluctuate.

Question #7: What Interest Rate Will I Pay?

The interest rate you’ll pay depends on a number of factors, including your credit score, income, and your requested loan amount. The higher your interest rate, the more interest you’ll pay. Meanwhile, lower interest rates can help you save money over the life of your loan.

Ideally, I’d say you’d want to apply for the loan with the lowest interest rate you can find.

Question #8: Do I Need to Pay Any Fees?

In addition to knowing your interest rate, it’s important to know whether your personal loan comes with any added fees. Additional fees can include origination fees, which can cost between 1 to 6 percent of your loan amount, or closing fees.

Before you take out a personal loan, make sure you understand all the fees you’re expected to pay so you can decide if it’s worth it.

The Bottom Line

Taking out a personal loan can be a highly personal decision. There are times and situations where a loan can leave you better off.

As always, it’s important to read the fine print and terms and conditions before you pull the trigger. By understanding your loan terms and choosing a loan you can truly afford, you’ll be in a strong position to benefit in the long term.

Paid Advertisement from Discover Personal Loans