Car insurance-check. Health insurance-check. Life insurance-check. Mortgage protection life insurance–wait.. what? With so many different types of insurance you can purchase nowadays, it’s very easy to get insurance poor. Buying coverage on your home with mortgage life insurance teeters on the fence of being a bit too much. Before I get ahead of myself, let’s look exactly what mortgage life insurance really is, then we’ll look to see if it’s worth buying. Finally, we’ll look at what other alternatives you can consider instead– such as buying a term life insurance policy.

Table of Contents

- What Mortgage Protection Life Insurance Is Not

- What Is Mortgage Protection Life Insurance

- When In Doubt Ask Your Banker

- When Buying Mortgage Life Insurance Makes Sense (Maybe)

- Still Wanting More

- Should You Buy Mortgage Life Insurance or Term Life Insurance?

- The Bottom Line – Should You Buy Mortgage Protection or Term Life Insurance

What Mortgage Protection Life Insurance Is Not

First, I wanted to clarify what mortgage life insurance is not. Don’t get this confused with PMI (Private Mortgage Life Insurance). PMI is what is required by your bank or lender if you aren’t able to make a downpayment (typically 20%) when purchasing or building a new home. I know in the case of the home we’re building, are bank is requiring the 20% to avoid the PMI insurance. For a more official definition, let’s look at what Wikipedia says:

Private mortgage insurance (PMI) in the US, is insurance payable to a lender or trustee for a pool of securities that may be required when taking out a mortgage loan. It is insurance to offset losses in the case where a mortgagor is not able to repay the loan and the lender is not able to recover its costs after foreclosure and sale of the mortgaged property. Typical rates are $55/mo. per $100,000 financed, or as high as $1,500/yr. for a typical $200,000 loan.

What Is Mortgage Protection Life Insurance

Mortgage protection life insurance is an insurance plan that will not be offered by your insurance agent- most likely it will be offered by your bank. If you have recently bought a new home or refinanced, chances are your mailbox has been flooded with offers to insure your home. Before you decide to buy it or not, let’s find out what it exactly is.

Mortgage life insurance is insurance that is typically bought through the financial institution that has your mortgage (like your bank).

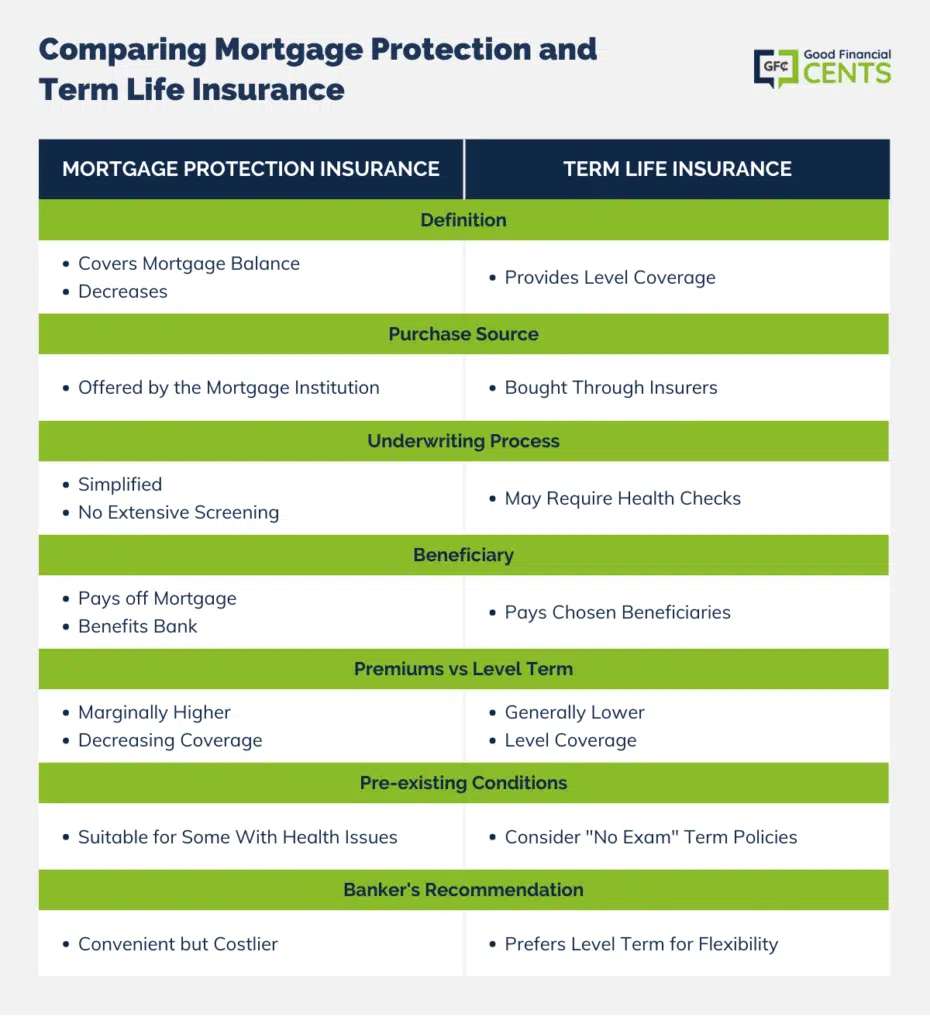

The amount of coverage that is purchased is the amount of your loan where if something happened to you the bank would be the beneficiary and pay off the loan. In most cases, the policy is a decreasing term where as the years go by the amount reduces as you’re paying your home loan down although the premium you pay stays the same. Curious to find more information, I set out to the web to see what I could find. After Googling “Mortgage Life Insurance“, I came across the website below.

I really was hoping to get a true cost comparison between Mortgage Life Insurance and level term life insurance (since that’s what I see it compared to), and this site seemed to have the answer. The website had notified me that if I entered some basic information and agreed that I was okay with 3 insurance agents calling me, then I could get the quote I desired. In the name of research, I went ahead with it.

Immediately after filling out the form and hitting “enter” on my keyboard, my office phone rang and it was a rep calling me from the online company. Wow, that was quick. I explained to them that I was a licensed financial advisor and that I was just doing research trying to compare mortgage life insurance. She was fine with it, but to give me a comparison using me as an example; I had to give some information about my medical history. Sure, no problem. After answering a series of questions, she started rattling me off quotes for term insurance. Wait a minute…I know term insurance. I’m trying to find out about mortgage life insurance. I then inquired how what she was quoting me compared to term life insurance. Her response,

“Oh. Well, we don’t recommend mortgage life insurance. We think it’s overpriced and feel that term is much more suitable for most folks”.

Doh! That’s fine, but didn’t answer my question. Turns out even though the site clear reads, “FREE Mortgage Protection Life Insurance Quote“, they don’t even offer it. I have to sheepishly admit that I was duped. And now for the past few weeks my phone has been ringing with insurance agents trying to sell me something I can buy off myself.

When In Doubt Ask Your Banker

One minor roadblock wasn’t going to prevent me from finding the answer I was seeking. Since I’m currently in the process of building a home, I thought what’s a better way to get some more information than go directly to my banker. I emailed him inquiring if they do offer mortgage life insurance and how it compares to term life. Here was his response:

“We do offer it with our mortgage loans. Premiums vary on a wide range based on loan amount, age of borrowers, and use of tobacco products. One advantage is obtaining life insurance with few questions to answer and almost no underwriting.

The disadvantage is that the cost is marginally higher than the level term, but mortgage life is decreasing term and pays no benefits to the borrower. It pays the benefit to the borrower and the bank to pay off the mortgage. I recommend to borrowers to look into level term before deciding on either one to compare the cost and benefits.

I would prefer to have the benefits paid to the beneficiary and then they can decide how to use those funds. A good example is within the rate environment we have right now. If I have an interest rate below 5%, it may be in my spouse’s interest to take the life insurance funds and pay them out in a monthly benefit or invest the whole amount, rather than paying off a low-interest mortgage. With mortgage life you don’t have that option.”

Finally, something more concrete. It was good to hear my banker say that he preferred term life insurance but he did bring up some good points on when buying mortgage life insurance insurance might make sense.

When Buying Mortgage Life Insurance Makes Sense (Maybe)

Mortgage Life Insurance is considered to be a simplified issue product meaning that you don’t have to go through a series of medical screens and blood work to get approved. For somebody that has pre-existing conditions, it could make sense. Also, if somebody doesn’t want to go through the hassle of filling out additional tons of forms and having a nurse come to your home, it could make sense.

Please note:

Still Wanting More

Still not completely satisfied with the information I had found thus far, I sought counsel from insurance expert Aaron Pinkston. I asked Aaron the following questions hoping to shed some light more on mortgage life insurance and how it compares to term.

How Do the Premiums on Mortgage Life Protection Insurance Compare to Level Term? (Assuming good health)

Mortgage protection life insurance is sold out of convenience. That extra convenience means the cost tends to be higher because the underwriting process can’t be as precise. With a more precise underwriting process, most level term life policies will tend to be less expensive than a comparable mortgage life policy.

Can You Clarify the Notion That Anytime You Refinance, You Have to Reapply for New a Mortgage Life Policy?

Life insurance is designed to protect your family from financial catastrophe in the event of your untimely death (this is different than PMI). Even if you apply for a life insurance policy that requires your mortgage documents as part of the financial underwriting process, once you accept the life policy, it’s yours. As long as you don’t get your life insurance policy through false pretenses (aka. lying), the issuing life insurance companies can’t take it away from you. They also can’t require you to re-qualify for coverage just because of a financial or health change. I think that’s great news.

What Would You Suggest for Someone Shopping Between the Two?

If convenience and speed is your number one priority, consider mortgage life insurance policies along with other simplified issue policies. If other things like price, company quality, and so on are more important to you, another life insurance option might work better. We’re all different – there’s no one right answer for everyone.

Should You Buy Mortgage Life Insurance or Term Life Insurance?

To truly answer that questions depends on many questions:

- What’s Your Age?

- How Is Your Health?

- Are You a Smoker?

- How Much Insurance Do You Need?

- Is Your Primary Concern Paying off the Mortgage? Or

- Providing an Income Stream for Your Family After Your Passing?

I think it’s safe to say that in most situations purchasing term life insurance makes more sense than purchasing life insurance. In case you missed it, I had wrote a post that talked about how much term life insurance I bought. The purpose for my life insurance coverage was to pay off our mortgage and to take care of my family if I wasn’t here. If you have a similar desire, then take a serious look at term life insurance. When you do go to get quotes, be sure to shop around. Your age and health, among other factors, will determine which insurance carrier will have the best rate for you.

The Bottom Line – Should You Buy Mortgage Protection or Term Life Insurance

Navigating the world of insurance can be perplexing, especially when it comes to mortgage protection life insurance. This type of coverage, often pushed by banks, aims to pay off your mortgage if something happens to you. However, it’s important to distinguish it from Private Mortgage Insurance (PMI), which lenders may require if you don’t make a substantial down payment.

Mortgage protection life insurance is offered through banks and, unlike term life insurance, typically involves no medical exams. While it may be convenient, experts often advise against it, favoring term life insurance for its affordability and flexibility. To make the right choice, consider factors like age, health, and financial goals.

I’m a licensed Realtor in the State of Texas. I’m really surprised most institutions financing your home don’t offer the MIP.

I think we goofed. At the time of closing on our house my husband had just had removal of prostate. The cancer has returned but no way to know his chance. Am I right to assume $196.00 a month would have been beneficial in our case of a $196,000 mortgage.

Hi Sharon – That’s a tough call. Mortgage life insurance isn’t a requirement, and most people don’t take it because money is tight. Hopefully you have other life insurance on your husband. Naturally, getting a policy, especially that large, now that the cancer has returned. But maybe your story will serve as a warning to other homeowners who have insufficient life insurance.

So helpful! Thank you!

I am a life/health agent and I sell anything from mortgage protection insurance to Medicare Advantage. I write business through about 14 different providers. Not one of them pays the lender off. They all, as they should, pay the family. Some are decreasing term, but most are not. Carefully listening to the client and writing a policy that fulfills those goals is the point. The right product may be a term, a whole life or even a universal life policy depending on their needs. Many of the products we offer come with living benefits which will pay an accelerated death benefit should the insured become critically or terminally ill. Several of our simplified issue terms can be converted to a whole life product within the first 5 years with no medical exam required. It’s whatever benefits the client the most.

Hi Page – You’re doing it the way it should be done, customizing the coverage to the client. Keep up the good work!

We are looking into mortgage life because my husband had cancer 50 years ago and life insurance companies are still taking that into consideration and charging very high premiums. He is in amazing great health now but that doesn’t seem to matter to them. Any advice?

Hi Ann Marie – Unfortunately the criteria is the same in both cases. Mortgage protection is still life insurance, and the history won’t be ignored completely. But give it a try, you have nothing to lose.

Thanks for one’s marvelous posting! I genuinely enjoyed reading it, you can be a great author.

I will make sure to bookmark your blog and will come back in the future.

I want to encourage you to definitely continue your great job, have a nice evening!

I agree with Dave. Actually not all mortgage protections policies are guaranteed issue. But they are usually “simplified issue” – meaning no medical exam. If you are in good health you can sometimes get a better rate by getting a fully underwritten policy. It’s basically a marketing deal by the insurance companies – and a good one, since most people do need term life to protect their families.

I am not sure Jeff agree with me or not. Whatever, i would like to give thanks to Jeff to write about an important issue.

Nice post Jeff. Just wanted to add a couple of points on top of what you covered. Most mortgage protection plans are accident only plans, which as you know aren’t the best option if you can qualify for comprehensive life insurance. They’re very cheap, but they rarely pay. Also, mortgage lenders often sell their loans to other lenders, so what happens if your loan is one of them? There’s no guarantee that your new lender even offers a mortgage protection plan. I looked into Bank of America’s mortgage protection plan – it offers 6 months of mortgage payments in the event of a death, disability, unemployment, or hospitalization, and it’s not cheap! 90% of the time, people are better off with a term policy.