Now could be one of the best times to refinance your mortgage over the next ten or twenty years. Mortgage rates are nearing record lows thanks to “declining inflationary pressures,” according to Freddie Mac’s chief economist Sam Khater. At the same time housing prices are not suffering like other parts of the economy right now, mostly due to demand.

These factors have created a situation where you can potentially refinance your home using its new, higher value and get cash out in the process. You can also refinance to save money on interest, move into a lower monthly payment, or both.

Should you refinance the mortgage on your home? The answer depends on an array of factors as well as whether you have the time and energy to devote to the process. But if you do decide to refinance your home, you should also keep in mind that the steps you take now could leave you in a better position later on.

Table of Contents

What You Need to Know About Refinancing Right Now

- As of September 2023, the mortgage rate for a 30-year home loan is 7.92% APR. This makes refinancing your mortgage an attractive proposition if your current interest rate is at least half a percentage point higher than that.

- Approval requirements for a mortgage can vary from lender to lender, but an array of sources seems to indicate that lenders are making it slightly more difficult to qualify. This can mean tightened credit requirements and more money down. For example, Chase now requires 20% down and a credit score of at least 700 to qualify for one of their mortgage loans, per a news release from HousingWire.

- While requirements may be somewhat tighter overall, technology has made it easier than ever to shop around for a mortgage. You can compare quotes online and complete the entire refinancing process from the comfort of your home. Some mortgage refinance companies will even send a representative to close your home loan in person.

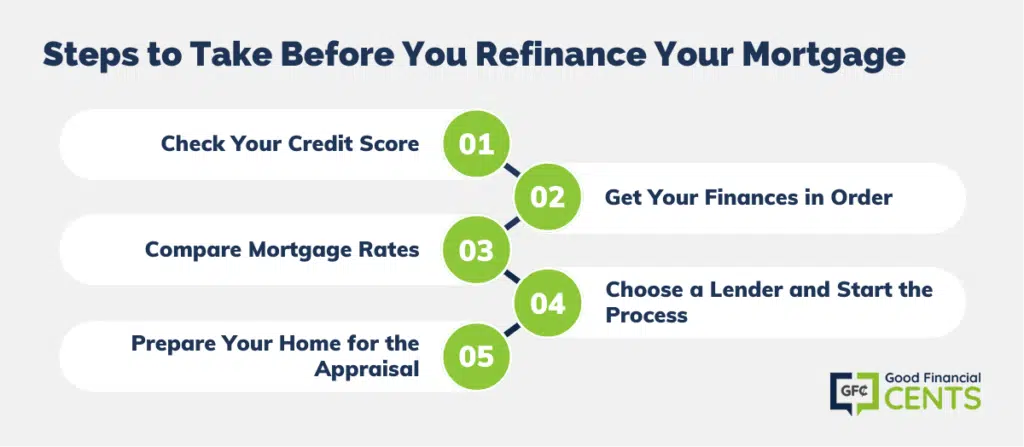

Steps to Take Before You Refinance Your Mortgage

If you believe you may be eligible to refinance your mortgage right now, there are steps you can take to prepare your finances and make sure you can qualify for the best rates and terms. Here’s everything you need to do before you move forward and apply.

Step 1: Check Your Credit Score

With many lenders tightening their credit requirements for mortgage refinancing, having an idea of your credit score can help you prepare. You may find your score is better than you think, or you may find that it needs some work. Either way, you’ll never know unless you check.

If you don’t have a credit card that offers a free credit score on your monthly statement, you can sign up for a free account with Credit Karma or Credit Sesame to see where you stand. Both require some basic personal information to get started, but you’ll get access to at least one version of your credit score as well as credit-tracking tools.

Step 2: Get Your Finances in Order

When you apply for a new mortgage or a refinance, several aspects of your personal situation are considered. For the most part, this includes your credit score, your history of employment, your income, your down payment amount, and the amount of debt you have in relation to your income.

Saving up a considerable down payment may not matter as much for a refinance, but you may be able to qualify for better mortgage rates and terms if you keep your credit in great shape and keep your debt-to-income ratio on the lower end.

Generally speaking, lenders prefer to approve borrowers with a debt-to-income ratio of 43 percent or below, meaning your monthly debt payments make up less than 43 percent of your gross monthly income. If you earn $10,000 per month, for example, your monthly debt obligations would be less than $4,300 each month if you hoped to meet this standard.

Step 3: Compare Mortgage Rates

The mortgage refinancing business is highly competitive, but that doesn’t mean all lenders can offer the best rates to every consumer. Your best bet is shopping around among several different lenders to see which one might offer you the lowest rate based on your credit profile, your income, and where you live.

Step 4: Choose a Lender and Start the Process

Once you’ve found a lender who appears to offer the best rates and terms based on your situation, you can move forward with them by filling out a full loan application.

However, you may want to spend time comparing estimates from more than one lender, and potentially getting a Loan Estimate from each. This simple document includes the loan terms, how much you’ll owe each month, and the estimated closing costs you’ll be expected to pay to refinance. Getting a Loan Estimate from multiple lenders is the best way to shop around and make sure you’re not overpaying for fees or settling for a new loan with inferior terms.

Once you decide to move forward with a lender, you’ll want to lock your interest rate so you are no longer at the mercy of the market. The goal at that point will be closing your loan before your locked rate expires, which should be doable since mortgage mortgage refinance loans take 30 to 45 days to complete.

Once you fill out a loan application, you’ll typically need to supply your lender with the information required for your home loan. This usually includes two years of tax returns, at least one month of pay stubs, further proof of employment or an explanation for any employment gaps, 60 days of bank statements, and proof of any other income you have.

Step 5: Prepare Your Home for the Appraisal

Part of the refinance process involves getting an appraisal for your home. After all, you need to be able to prove how much your property is worth before a lender will let you trade out your current home loan for another.

Whether your goal is refinancing to get a lower monthly payment or to get cash out, you’ll want to make sure your home is in tip-top shape for appraisal purposes. Steps you should take include repairing any obvious damage to your home, sprucing up the indoors and outdoors for a clean, updated look, and cleaning your entire property inside and out. Also, make a list of updates you’ve made to your home that could help an appraiser reach a higher value. If you’ve replaced your HVAC system or your roof, for example, you should tell your appraiser about these improvements.

The Bottom Line

If you’re paying a higher rate than the lowest rates advertised right now and your finances are in relatively good shape, you really have nothing to lose by checking mortgage rates to see if refinancing could be worth it. If you were willing to put in the effort to apply and gather all the documentation required, you could easily save thousands of dollars in interest payments on your loan, pay off your mortgage faster, or both.

But it all starts with shopping around among mortgage lenders online and in your area. Since interest rates may not stay this low forever, the time to start shopping around is now.

Refinancing Your Home: Frequently Asked Questions (FAQs)

Refinancing the home you love? These frequently asked questions can help you learn more about the process.

The purpose of refinancing your home varies from borrower to borrower. However, many consumers refinance their home loans in order to secure a lower interest rate that will help them save money. Others want to get a new loan with a lower monthly payment, and homeowners also refinance in order to switch up the term of their home loan — for example, moving from a 30-year loan to a 15-year mortgage.

You typically need to wind up with at least 20 percent equity in your home after a refinance if you hope to avoid paying private mortgage insurance, or PMI. Many lenders will allow you to refinance with less than 20 percent equity, however, although equity requirements can vary depending on the bank.

You can apply for a mortgage online and from the comfort of your home, and this is also true if you plan to refinance a mortgage you already have. Many lenders allow you to upload the mortgage refinance documents online, and some will even close the loan at your home address or any other place of your choosing.

Generally speaking, you’ll need a credit score of 620 or higher for a conventional mortgage refinance. However, COVID-19 has left many individual lenders with no choice but to tighten up their standards, which means some lenders may require a score of 700 or more. Government programs like VA home loans and FHA loans tend to come with more lenient credit score requirements, so make sure to check on these options if you believe you could qualify.

When you close on your mortgage refinance, you’ll pay many of the same fees you paid when you took out your mortgage to begin with. Fees you’ll need to pay include credit report fees, title fees, escrow fees, notary fees, and recording fees. You will also need to pay an appraisal fee and lender fees that cover processing and underwriting. If you’re paying points on your mortgage in order to secure a lower rate, the cost of each point is typically equal to 1% of your new loan amount.