If you feel that your credit score doesn’t tell your whole financial story, you’re not alone.

Many people feel frustrated by their inability to get good loan refinancing rates based solely on their credit score. The people at Earnest understand that.

Their goal is to help you get a good rate to refinance your student loan even if your credit score is less than perfect.

Table of Contents

What Is Earnest?

Earnest is a private lender that can help you refinance your student loans by offering lower-than-average rates and repayment flexibility.

Earnest refinances loans ranging from $5,000 to $500,000. You can apply for loan refinancing as early as six months before graduation through

Earnest if you have a job offer or consistent income. While Earnest does have strict underwriting criteria, they account for more than just your credit score.

This is ideal for borrowers who have good financial habits but may not have an established credit score yet.

Earnest incorporates your savings, earning potential, spending habits, and personal debt to determine your eligibility.

Users are also able to set their own monthly payment amount. Earnest also allows you to increase monthly payments, make multiple extra payments, and make same-day payments without penalty.

This can help you pay off your student loan more quickly.

Who Is the Ideal Earnest User?

Earnest is a fantastic refinancing option for students or parents with a good enough financial standing to qualify for a loan without a cosigner.

Individuals with credit scores of 650 or higher will have no problem qualifying for loan refinancing through Eligible.

If your credit score is below this, you will need to otherwise prove that you have good financial habits.

You will likely qualify for a loan if you have at least two months of income saved, are current on rent payments, and spend less than you make.

If you are carrying too much personal debt, you may not qualify for loan refinancing.

Private Student Loans

Earnest began offering private student loans earlier this year.

It is a good option for those who need additional assistance outside of their federal loans.

Although Earnest does not allow loan refinancing applicants to apply with a cosigner, those applying for a private loan may apply with a cosigner.

Should I Refinance My Student Loan Through Earnest?

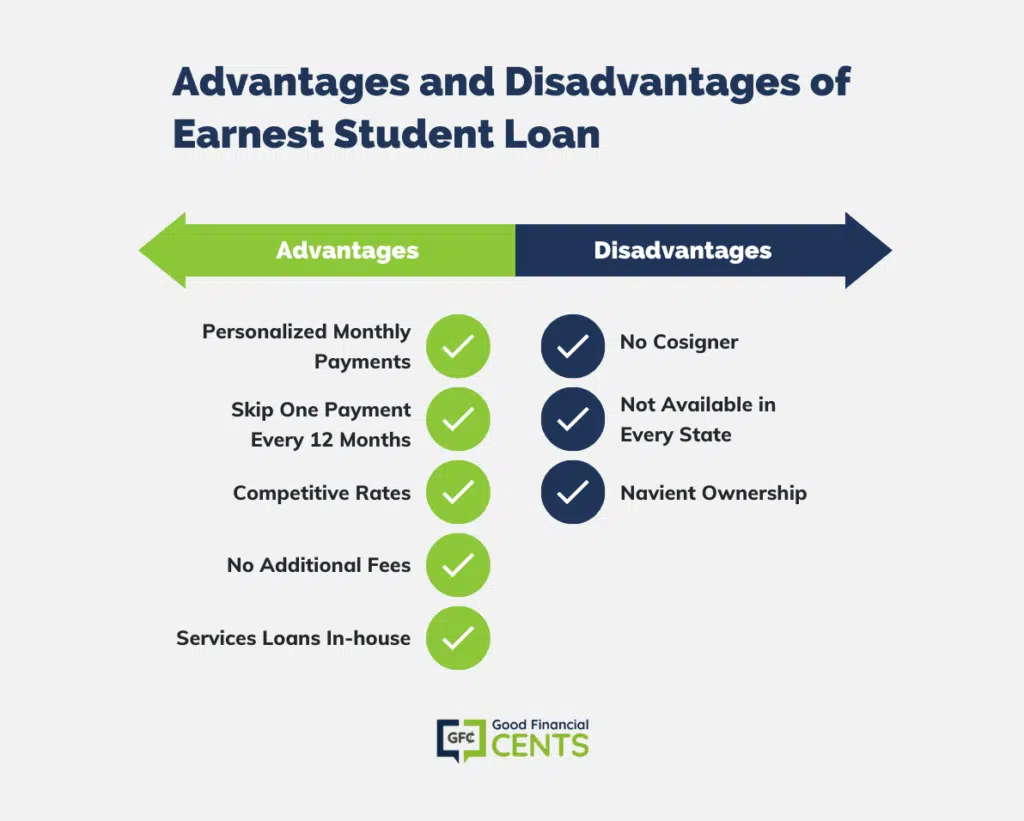

It is always important to consider the advantages and disadvantages of a loan refinancing company before closing on an offer.

Below are some points to consider before closing a loan through Earnest.

Advantages of Using Earnest Student Loans

Personalized Monthly Payments

This is perhaps one of the most unique aspects of Earnest. Known as their “precision pricing” model, this feature allows you to set what you would like your monthly payment to be and adjusts the loan term accordingly.

Many other student loan lenders have set terms regarding repayment. Earnest’s precision pricing allows for unique loan periods that could help you meet your ideal monthly payments.

Skip One Payment Every 12 Months

If you make at least six months of consecutive payments on time, Earnest will give you the option of skipping a payment on your loan every 12 months. It is worth noting that the payment isn’t simply forgiven.

Instead, Earnest will spread that payment over the remainder of your term and adjust your interest rate accordingly. The maturity date on your loan will also be extended.

It isn’t advised that you take advantage of this at every opportunity, but it can certainly help if money becomes tight at some point over the course of your loan.

Competitive Rates

Among its competitors, Earnest offers some of the lowest APRs around. Fixed rates (with the Autopay discount) begin at 4.96% APR for private student loans, while variable rates start at 5.15% APR.

Student Loan Refinance Interest Rate Disclosure

Actual rate and available repayment terms will vary based on your income. Fixed rates range from 4.96% APR to 8.99% APR (excludes 0.25% Auto Pay discount). Variable rates range from 5.15% APR to 8.94% APR (excludes 0.25% Auto Pay discount). Earnest variable interest rate student loan refinance loans are based on a publicly available index, the 30-day Average Secured Overnight Financing Rate (SOFR) published by the Federal Reserve Bank of New York. The variable rate is based on the rate published on the 25th day, or the next business day, of the preceding calendar month, rounded to the nearest hundredth of a percent. The rate will not increase more than once per month. The maximum rate for your loan is 9.13% if your loan term is 10 years or less. For loan terms of more than 10 years to 15 years, the interest rate will never exceed 9.21%. For loan terms over 15 years, the interest rate will never exceed 9.24%. Please note, that we are not able to offer variable-rate loans in AK, IL, MN, NH, OH, TN, and TX. Our lowest rates are only available for our most credit-qualified borrowers and contain our .25% auto pay discount from a checking or savings account.

No Additional Fees

Earnest does not charge any late fees, prepayment penalties, origination fees, or application fees. This means that all payments will go towards paying off the remainder of your loan.

Services Loans In-house

One of the benefits of refinancing through Earnest is that they service all of their loans. Many loan refinancing companies will consolidate your loan and then sell that loan to another company.

This can mean a toss-up in regard to the service you receive on the loan.

With Earnest, you never have to worry that a third party will service your loan.

Disadvantages of Using Earnest Student Loans

No Cosigner

One of the most notable downsides of Earnest is that they do not allow borrowers to apply with a cosigner. This can be a problem for borrowers with below-average credit scores or unestablished credit.

Not Available in Every State

Unfortunately, Earnest loans are not available to borrowers in every state. They do not offer loan refinancing in Alaska, Illinois, Minnesota, New Hampshire, Ohio, Tennessee, or Texas.

Variable rates are also not available to borrowers in Alaska, Illinois, Minnesota, New Hampshire, Ohio, Tennessee, or Texas.

Navient Ownership

It is worth noting that Earnest is owned by Navient. Navient is a student loan servicer that has been the target of several lawsuits regarding questionable servicing practices.

Earnest is run as a separate unit within Navient and continues to service its own loans.

It remains unclear the role that Navient plays in servicing loans taken out through Earnest.

How Do I Get Started With Earnest?

In order to get a rate, Earnest will perform a credit check. Earnest claims that their credit approval takes only two minutes, but there are some caveats to this.

Because Earnest takes a big-picture approach when it comes to your finances, this means verifying a lot more information than just your FICO score.

In order for Earnest to get a sense of your finances as a whole, this means lots of paperwork and information to verify.

Frustrating as it is, this could mean that you can get a lower rate than you otherwise would through another private lender.

What About Loan Deference or Forbearance?

In terms of deferment after graduation, Earnest will continue any grace period from your previous lender for up to nine months.

Earnest also allows borrowers to defer their student loans for up to 36 months if they are pursuing a graduate degree, in the Peace Corps, or in the military.

Interest will continue to accrue during this deferment period.

Borrowers can apply for forbearance if they are experiencing economic hardship, such as unemployment or excessive debt burden. Voluntary resignation does not qualify as terms for unemployment and will likely be rejected as a reason for forbearance.

They will allow borrowers to put their loans into forbearance for up to 12 months. Earnest typically requires that borrowers make at least three months of loan payments before applying for forbearance

Like loan deferment, a forbearance period will continue to accrue interest. Any forbearance period will also be reported with credit agencies but likely will not affect your credit score.

Should You Choose Earnest?

Earnest is the only lender to offer low rates to people with average credit scores because of their expanded definition of financial well-being. This is wonderful news for people with credit scores in the mid-600s, but may not be the best option for those with credit scores above 700.

Earnest certainly doesn’t offer the lowest rates on the market, so it is always wise to shop around before deciding on a company to refinance your loan. There are several tools to help you do this, such as Credible. Be sure to consider all options to ensure you are getting the best rate for your loan.

How We Review Brokers and Investment Companies:

Good Financial Cents conducts a thorough review of U.S. brokers, focusing on assets under management and notable industry trends. Our primary objective is to offer a balanced and informative assessment, assisting individuals in making informed decisions about their investment choices. We believe in maintaining a transparent editorial process.

To achieve this, we gather data from providers through detailed questionnaires and take the time to observe provider demonstrations. This hands-on approach, combined with our independent research, forms the basis of our evaluation process. After considering various factors, we assign a star rating, ranging from one to five, to each broker.

For a deeper understanding of the criteria we use to rate brokers and our evaluation approach, please refer to our editorial guidelines and full disclaimer.

Product Name: Earnest Product Description: Earnest is a financial technology company that specializes in offering personalized student loan refinancing and personal loan solutions. They leverage technology and data-driven insights to provide borrowers with competitive interest rates and flexible repayment options, making it easier for individuals to manage their student debt and achieve their financial goals. Summary of Earnest Earnest is a reputable player in the fintech industry, known for its commitment to helping borrowers take control of their financial future. The company primarily focuses on two key areas: student loan refinancing and personal loans. For student loan refinancing, Earnest stands out by offering customized interest rates based on a borrower’s financial profile, rather than relying solely on traditional credit scores. This approach allows many borrowers to secure more favorable terms. Additionally, Earnest provides flexibility in loan terms, including the ability to choose the monthly payment amount, making it easier for borrowers to align their loan repayment with their financial situation. Pros Personalized Rates: Earnest’s approach to underwriting considers factors beyond credit scores, allowing borrowers with strong financial habits to secure competitive interest rates. Flexible Repayment Options: Borrowers can tailor their loan terms, including choosing their monthly payment amount, to better fit their budget and financial goals. Transparent Process: Earnest is known for its transparent and user-friendly online platform, making it easy for borrowers to understand and manage their loans. Cons Eligibility Criteria: While Earnest’s approach to underwriting is inclusive, some borrowers may not meet the eligibility criteria, particularly if they have a limited credit history or income. Limited Financial Products: Earnest primarily focuses on student loan refinancing and personal loans, so it may not be the best choice for individuals seeking a broader range of financial products and services.

Earnest Review

Overall