Starting a new business always requires some sort of upfront investment, but you should try to avoid paying any extra fees if you can help it. Fortunately, plenty of banks make it easy to open and use a free business checking account.

You might need to maintain a minimum balance, sign up for paperless billing, or meet additional requirements to avoid monthly maintenance fees, however.

While plenty of banks offer a checking option for businesses with the potential for no fees, we created this guide to help you narrow down the best free business checking accounts of 2024.

If you’re in the market for a business checking account but need to keep costs at a minimum, we suggest checking out the seven banks below:

- RunnerUp: NorthOne

Table of Contents

How We Picked the Best Free Business Checking Accounts

The business checking accounts that made our list are fairly basic. However, they can work well for your needs if you need business banking and you want to keep costs at a minimum. Here are some of the factors we looked at to come up with the checking accounts we selected:

- Lack of Fees: Banks that made our list offer a no-fee business checking option or an affordable one. We gave preference to business checking accounts that don’t have a minimum balance requirement.

- Minimal Fine Print: We also chose to compare checking accounts based on fine print and limitations. While some of the business checking accounts that made our list have some fees in certain situations, we looked for accounts with fees that are easy to avoid.

- Digital Banking: Accounts with benefits like mobile check deposit, a mobile app, online bill pay, and other digital features stood out for the purposes of our ranking.

- FDIC Insurance: All of the business checking accounts on our list come with FDIC insurance.

- ATM Access: Finally, we looked for business checking accounts that come with an ATM card and generous access to free ATMs.

Best Free Business Checking Accounts

As you compare the best free business checking accounts below, take special note of minimum balance or activity requirements. Also, look for the features you want the most, whether your preferences include an option for paper checks, online banking benefits, or a mobile app.

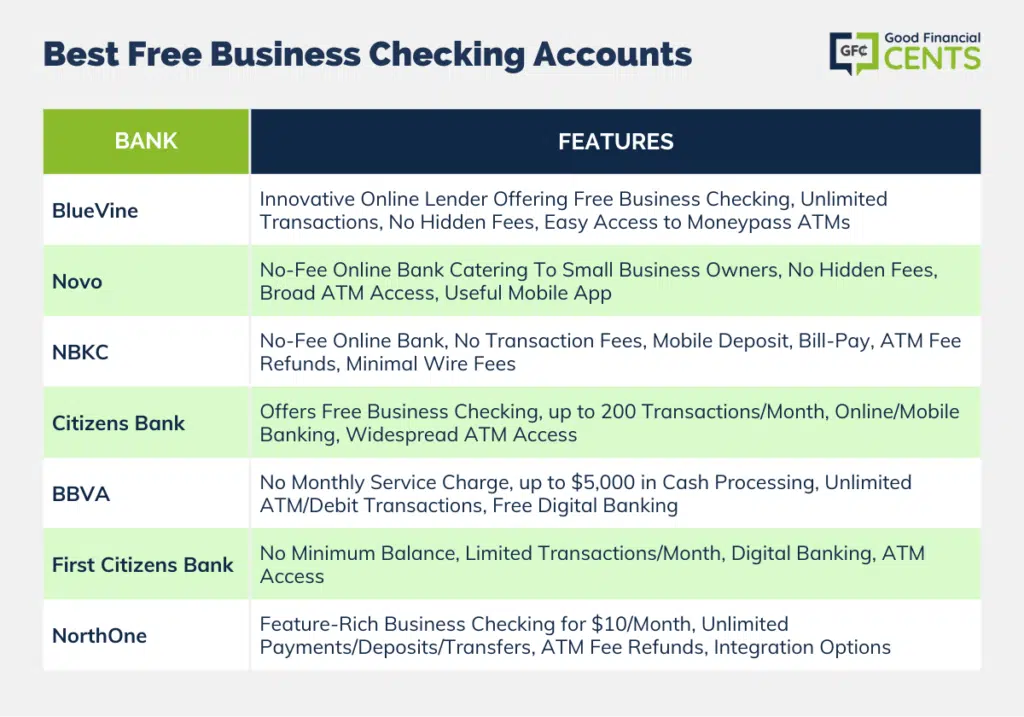

BlueVine

BlueVine is an innovative online business lender that’s known for its invoice factoring and business line of credit products. However, it also offers a free business checking account that helps you streamline your business transactions without additional fees.

With BlueVine free checking for business, you get unlimited transactions, live support, and no hidden fees. For example, there are no NSF fees, no monthly maintenance fees, and no incoming wire fees.

You can also activate your account (and keep it open) with no minimum balance amount required. BlueVine will even pay you 1.0% interest on balances up to $100,000.

Other features include online bill pay, two free checkbooks, and access to your money with no fees via 38,000 MoneyPass ATMs nationwide. Finally, you should know that your deposits are traditionally insured by the FDIC for amounts up to $250,000.

Why We Like It: BlueVine lets you open a business checking account with no minimum balance required, no hidden fees, and easy access to your money with no fees via the MoneyPass ATM network.

Novo

Novo is another online bank that offers no-fee business checking products that are “built for small business owners, entrepreneurs, and freelancers.”

Its free business checking account comes with no fee transfers, no hidden fees, and FDIC insurance. You can also access an array of online banking tools and services and a useful mobile app.

Interestingly, Novo accounts don’t have a minimum balance requirement, so you can get started regardless of how much your business has in cash reserves. You can also open an account easily within a few minutes by offering details, like your business and personal information.

Novo business checking accounts also come with a debit card you can use to get cash or make purchases. Note that when you use your Novo debit card to get cash out of an ATM, Novo will refund all ATM fees you were charged.

Why We Like It: Novo offers free business checking with no hidden fees and broad ATM access with all fees refunded. You don’t need a minimum balance to get started or to maintain your account over time.

NBKC

NBKC is another winner when it comes to free business checking accounts. This online bank doesn’t charge any transaction fees, and you can also utilize mobile deposit and bill-pay without any fees. There’s no minimum balance requirement to get started, and there are no fees for overdrafts, NSFs, stop payments, or incoming domestic wires.

You can also get a free debit card and access cash for free at more than 34,000 MoneyPass ATMs nationwide and in Puerto Rico. Interestingly, NBKC will even refund up to $12 in monthly ATM fees when you’re charged ATM fees by other banks around the world.

Just note that NBKC does charge two fees you can probably avoid: $5 to send a domestic wire in the United States or $45 to send or receive international wires.

Why We Like It: Like other banks on our list, NBKC offers a free business checking product with no minimum balance requirements. You can even get up to $12 back per month in ATM fees charged by other banks worldwide.

Citizens Bank

While Citizens Bank has several different business banking products, they do offer one free business checking option. With Clearly Better Business Checking, you can open an account with no minimum amount to get started, and you get up to 200 transactions per month without any fees.

If you go over the monthly transaction limit, however, you’ll be charged $.50 for each transaction thereafter. Fortunately, Citizens Bank comes with online and mobile banking features, and you can access your business checking funds at more than 1,100 branches and 3,100 ATMs nationwide. You also get a debit card you can use to access money when you need it.

Why We Like It: Citizens Bank offers brick-and-mortar locations for business owners who prefer an in-person experience. You can also get up to 200 transactions per month with no fees and no minimum balance requirement.

BBVA

BBVA boasts a BBVA Business Connect Checking option that comes with no monthly service charge, up to $5,000 in cash processing per month, unlimited ATM and debit card transactions, and no BBVA fees when you use another bank’s ATM.

However, be aware that you’re limited to a total of five processed checks and in-branch withdrawals (and two in-branch deposits) per month with no extra charge, which might be limiting.

There’s no minimum balance required to open or maintain this account, and you get free digital banking services like bill pay and mobile deposit. You can also access your money without any fees at BBVA, Allpoint, and participating 7-Eleven ATMs.

Why We Like It: While the BBVA Business Connect Checking has some limitations, you can use this account and access all of its benefits for free, with no minimum balance required.

NOTE:

First Citizens Bank

First Citizens Bank also offers a free business checking account that they advertise as a “starter account.” Their Basic Business Checking doesn’t have a minimum balance requirement after your account has been opened, and there are no monthly fees provided you enroll in paperless billing.

With that said, keeping the fee-free status on this account requires you to have 175 or fewer transactions each month and make a minimum deposit of $100 to get started. You can also only deposit up to $5,000 in coins or currency each month.

Why We Like It: First Citizens Bank offers a basic account for businesses with limited transactions each month. You only need $100 to get started, and there are no minimum balance requirements after that. You do need to enroll in paperless billing to avoid a monthly fee.

Runner Up: NorthOne

NorthOne is another online bank that offers free business checking with myriad tools and a mobile app. While it doesn’t offer a free business checking option, it does offer business checking with all kinds of features for just $10 per month. Once the account is activated, it doesn’t have a minimum balance requirement.

For the flat monthly fee, you’ll get unlimited payments, deposits, and transfers and free debit card access. You can also qualify for fee-free ATM deposits and withdrawals, and you can use more than 300,000 NorthOne-network ATMs. Mobile ACH, bank transfers, and wires are also included, and you can pay your business expenses using online bill pay.

Your account comes with FDIC insurance, and you can integrate your business checking account with tools like Quickbooks, Shopify, and PayPal.

Just be aware that you need a minimum opening deposit amount of at least $50 to activate an account.

Why We Like It: NorthOne doesn’t offer free business checking, but it offers an account with ample features for just $10 per month.

How to Find the Best Free Checking Account

Whether you’re just starting your own business or you’re a business owner already, the best business checking account for you will depend on several factors. Here are some tips to keep in mind as you compare all your options:

- Figure Out How Many Transactions You Make Each Month: If your business does more than 150 transactions each month (including deposits, bill payments, and more), you’ll be somewhat limited in terms of the business checking accounts you can get with no fees. Before you choose a new account, look over your past transactions to see how many you normally make within a month.

- Ask Yourself if You Want In-Person Banking: Some of the banks that made our list are online only, which means you won’t be able to visit a physical bank branch. If you mostly bank online anyway, any of the banks on our list could work for your needs.

- Check Which ATM Network Might Suit You Best: Also, check which accounts have the most ATMs where you live and work. If you’re interested in a bank with brick-and-mortar locations, check to see if they have banks in your area.

- Look for the Features You Want the Most: Finally, compare business bank accounts based on features you’ll actually use. For example, look for accounts with a mobile app, online bill pay, the option for paper checks, a free debit card, and other perks you care about.

Final Thoughts – Best Free Business Checking Accounts for 2024

To find the top free business checking accounts in 2024, prioritize avoiding fees and essential features. BlueVine offers no-fee, interest-earning accounts with wide ATM access. Novo impresses with no-fee checking and useful digital tools. NBKC excels in comprehensive fee-free services, including ATM reimbursements.

Citizens Bank’s Clearly Better Business Checking offers up to 200 transactions monthly without fees. BBVA and First Citizens Bank provide solid options. Despite a monthly fee, NorthOne offers extensive features.

As you look into these choices, think about transaction needs, in-person access, ATM networks, and features you need to decide on the best free business checking account for your specific situation.