A few decades ago, most life insurance sales took place through an agent, and you definitely had to endure a medical exam for coverage to begin. But since online life insurance has turned the entire process upside down, you can now buy digital life insurance plans without leaving your home. With some providers, you can even get coverage as soon as the next business day.

These benefits and others are part of the reason online life insurance is growing in popularity. According to the Insurance Information Institute (III), the percentage of consumers who preferred online life insurance to in-person sales grew from 17% in 2011 to 29% in 2020.

If you’re in the market for life insurance and you want to avoid working with an agent who might try high-pressure sales techniques, the best online life insurance companies are worth considering.

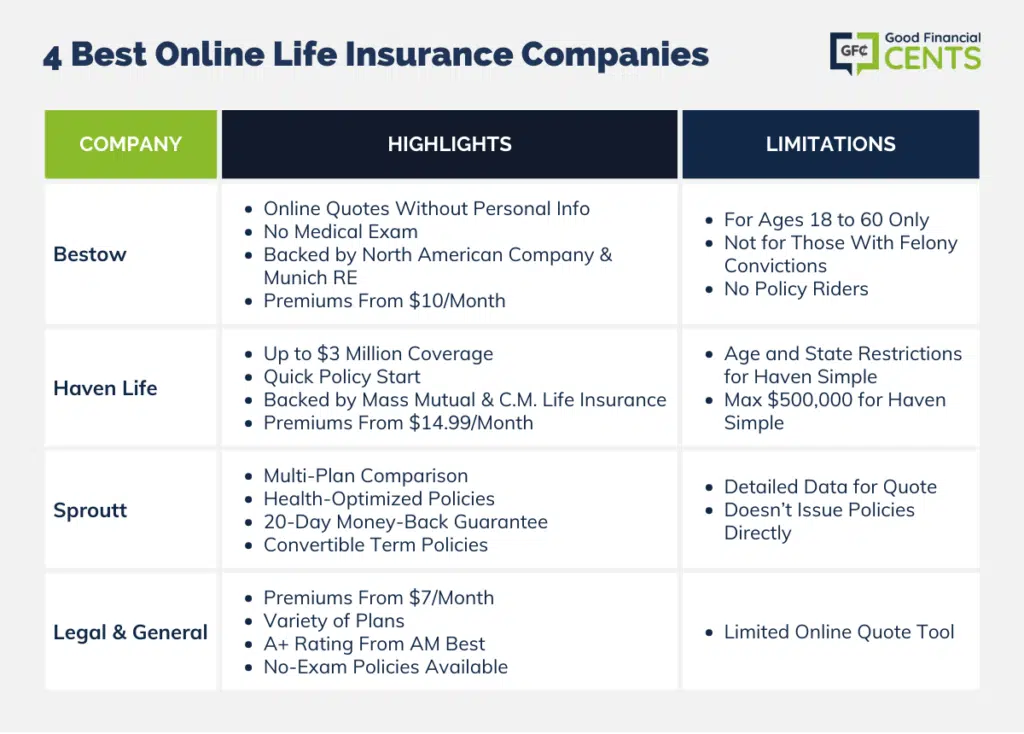

To help you in your search, we compared the top companies in this space in terms of their offerings, processes, and ratings for financial strength. The best online life insurance companies include Bestow, Haven Life, Sproutt, and Legal & General Life Insurance, and we review all of them below.

Most Important Factors for Online Life Insurance

- Free Online Quote: Buying life insurance online means not having to deal with an agent or their high-pressure tactics. With that in mind, we only selected companies that offer free online life insurance quotes for our ranking.

- Strong Ratings for Financial Strength: We also looked at providers based on their ratings for financial strength from AM Best.

- Potential for No Medical Exam: Some online life insurance companies use advanced algorithms to approve you for life insurance without a medical exam.

- Flexible Options: Online life insurance companies tend to offer consumers flexibility in their plans, including the ability to tailor their coverage to their needs.

- Low Premiums: Finally, online life insurance should absolutely have affordable monthly premiums that can fit into any budget. With a free online quote process, they should also make it easy to shop around and compare.

The 4 Best Online Life Insurance Companies of 2024

Table of Contents

- Most Important Factors for Online Life Insurance

- The 4 Best Online Life Insurance Companies of 2024

- Online Life Insurance Reviews

- Other Life Insurance Options to Consider

- How We Found the Best Online Life Insurance Companies

- What You Need to Know About Online Life Insurance

- Summary: Best Online Life Insurance Providers

- Bottom Line – Best Online Life Insurance of 2024

To come up with the providers in this ranking, we looked at dozens of companies based on the features listed above. Ultimately, we found that the following four online life insurance providers offer some of the best options, reasonable pricing, and transparency all along.

Bestow made our ranking due to the fact they offer an easy online quote process and no medical exams ever. Haven Life has a similar process, and the potential for no medical exams and their term policies can come in amounts up to $3 million.

We chose Sproutt for our ranking since they offer a robust online insurance marketplace that lets you compare options and pricing all in one place. Finally, Legal & General Life Insurance made the cut due to their low advertised rates. With Legal & General Life Insurance, you can reportedly buy term life insurance coverage for as little as $7 per month.

In summary, here are the best online life insurance providers of 2024, as well as the categories they stand out in:

- Bestow: Best for no medical exam requirement

- Haven Life: Best for quick coverage

- Sproutt: Best comparison site

- Legal & General Life Insurance: Best for affordable premiums

Online Life Insurance Reviews

Our detailed reviews explain more about each of the best life insurance companies and what they have to offer.

Bestow

Bestow is one of the top providers of online life insurance, and it’s easy to see why. This company makes it incredibly easy to get an online quote without providing any personal information, and they offer term life insurance in amounts that range from $50,000 to $1.5 million.

You also get to tailor your coverage to your needs, with terms available in five-year increments from 10 years to 30 years. Bestow policies also use advanced algorithms to approve you for coverage, so you won’t have to go through a medical exam.

According to Bestow, premiums for term life insurance coverage start at just $10 per month.

What Holds It Back: Bestow policies are only available to individuals who are ages 18 to 60. This provider might not be a good option if you need life insurance during your golden years. Also, people with a felony conviction aren’t eligible and will need to buy coverage elsewhere.

Finally, it’s worth noting that Bestow policies don’t have any options for riders. If you want to customize your coverage with riders for accidental death, an accelerated death benefit, or any other situation, you’ll need to look for another provider.

Haven Life

Haven Life made our ranking due to its flexible coverage options, including policies worth up to $3 million. Best of all, you can apply for coverage with Haven Life and begin your policy as soon as the next business day.

This provider offers two different kinds of term life insurance:

- Haven Simple policies, which are fully digital with no medical exam; and

- Haven Term coverage which offers higher limits and may or may not require a medical exam.

Both types of policies are underwritten by highly-rated insurers, including Mass Mutual and C.M. Life Insurance Company, a subsidiary of MassMutual. Haven Life also offers affordable premiums to those who qualify. According to the insurer, a $250,000, 20-year Haven Term policy starts at just $14.99 per month, depending on your age and other factors

What Holds It Back: Although Haven Life offers affordable term coverage, its Haven Simple plan with no medical exam does come with limitations. For example, you must be 20 to 55 years old to be eligible, and you can’t live in the following states: CA, DE, SD, ND, or NY. Haven Simple policies are only available in five-year, 10-year, or 15-year terms, and the maximum coverage you can buy is $500,000.

Sproutt

Sproutt Life Insurance is a little different because it’s an insurance marketplace, meaning you can compare plans across multiple insurance providers. This company also focuses on your total health, and it provides life insurance options that are optimized based on your lifestyle and your health-related goals.

Since Sproutt is an independent broker, however, you’ll have to do some research on the companies that offer you policies once you apply for a quote. That said, this online comparison site lets you compare pricing and policies from multiple providers in one place, including options with and without a medical exam.

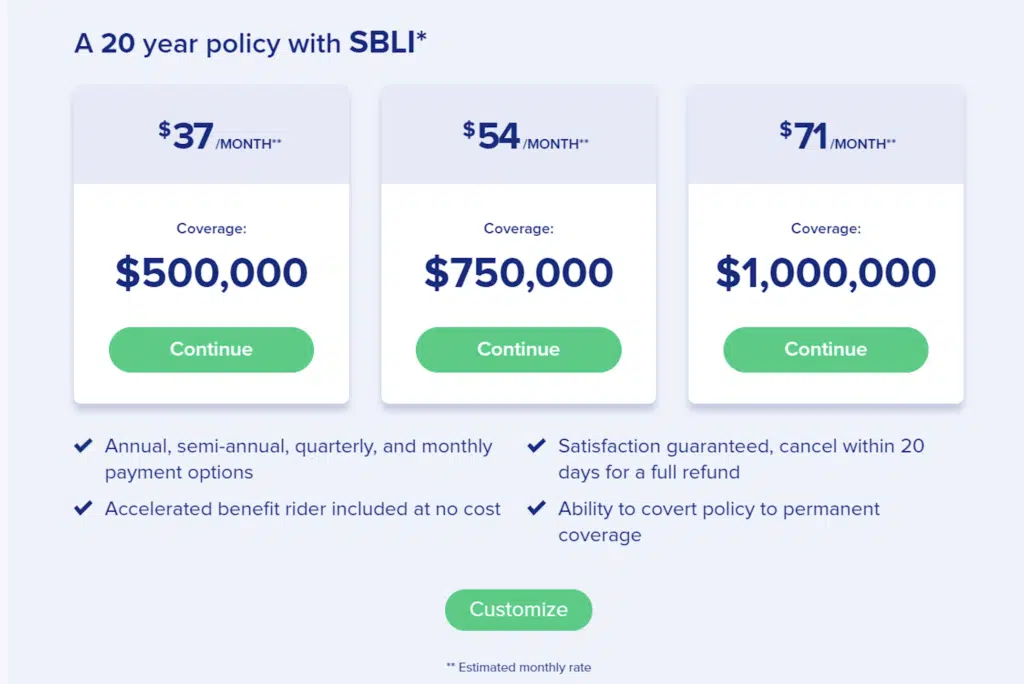

We also like the fact that Sproutt has a 20-day money-back guarantee on all its policies and the fact that many include an accelerated benefit rider at no cost. You can also convert its term policies to permanent coverage later on.

What Holds It Back: One big downside of working with Sproutt is the fact that you have to provide an array of personal data to get a free quote, including how often you exercise, what you like to eat, and more. Since this is an insurance marketplace, you should also be aware that Sproutt doesn’t actually issue life insurance policies themselves.

Legal & General Life Insurance

Legal & General Life Insurance made our ranking due to the low premiums they advertise, which start at $7 per month. You can apply for a free quote online or over the phone with very little personal information. In addition to term life insurance, Legal & General also offers universal life insurance and annuities that provide lifetime income.

Interestingly, Legal & General lets you apply for up to $10 million in life insurance coverage on its website, and it lets you choose your coverage length from a variety of timelines that last for up to 40 years. This company also boasts an A+ rating for financial strength from AM Best, and it currently has 1.3 million U.S. life insurance customers.

Although some policies from Legal & General might require a medical exam, it does offer policies with no medical exam to eligible applicants. This is due to its accelerated underwriting process, which lets you apply for life insurance and get coverage within a matter of days or even the same day.

What Holds It Back: One downside of Legal & General is its wonky free quote tool. You can find out how much you would pay for a life insurance policy online, but you can’t change your quote to compare pricing for different coverage amounts or term lengths.

If you want to compare pricing among different coverage options, you have to apply for a new life insurance quote each time.

Other Life Insurance Options to Consider

As you compare life insurance quotes, make sure you’re only looking at companies with excellent financial ratings and a strong online presence. In addition to the companies that made our ranking, we suggest comparing quotes from companies like Ladder, AIG, American National, and National Family Assurance.

How We Found the Best Online Life Insurance Companies

While there are many companies that offer life insurance online, we looked at several important factors to find the absolute best. The following criteria were considered when compiling our list of the best online life insurance firms.

Strong Financial Ratings

All the companies that made our ranking have excellent ratings for financial strength, with the exception of Sproutt, which is an insurance marketplace that does not offer its own policies. Generally speaking, we looked for companies that have policies underwritten by A+ insurers.

Option for No Medical Exam

While some of the providers that made our ranking may require medical exams for some of their policies, we only included online insurance companies that offer life insurance policies with no exam required.

Flexible Coverage Options

We also looked for companies that let you tailor your coverage to your needs, including the amount of life insurance you buy and how long you want your policy to last.

Online Quote

Finally, we only considered online life insurance companies that let you get a quote online and without speaking with an agent. We also looked for companies that offer free quotes without collecting your contact information.

What You Need to Know About Online Life Insurance

Online life insurance is the same as traditional life insurance, although you may find limited coverage options you can apply for with an online provider. For example, term life insurance is typically the only type of life insurance you can get without enduring a medical exam, and you may face coverage caps or limits as well.

If you plan to buy permanent life insurance, including whole life insurance, you will likely need to work with an agent.

Other details you should know about online life insurance:

- With no medical exam, approval is gauged using advanced algorithms and proprietary data. This means the insurance company will use technology to estimate how much risk you pose as a customer, and they can approve you for a policy based on that information.

- Many online life insurance companies are actually backed by large, reputable insurers. This should give you peace of mind if you want to make sure you’re buying reliable coverage, but you have never heard of the companies in our ranking before.

- Since online life insurance is available without having to speak with an agent, you’ll need to do some of your own research upfront. For example, you’ll need to decide the amount of life insurance you need and how long you want your plan to last.

Summary: Best Online Life Insurance Providers

| Best For | How to Apply | |

|---|---|---|

| Bestow | No Medical Exam Ever | Apply Online |

| Haven Life | Quick Coverage | Apply Online |

| Sproutt | Comparison Site | Apply Online |

| Legal & General Life Insurance | Affordable Premiums | Apply Online |

Bottom Line – Best Online Life Insurance of 2024

In the swiftly evolving landscape of life insurance, the surge in online offerings has significantly streamlined the purchasing experience for customers.

The ease of obtaining digital life insurance, coupled with the possibility of bypassing medical exams with some providers, has made it a preferred choice for many.

Bestow, Haven Life, Sproutt, and Legal & General Life Insurance have emerged as leading providers in 2024, each excelling in specific areas.

As the paradigm shifts from traditional methods to online platforms, it’s crucial for consumers to diligently research and choose policies tailored to their individual needs. These digital transformations not only offer convenience but also herald a new era in the life insurance industry.