Tax forms should be simple. Avoid confusion and frustration by using tax return preparation software like EZTaxReturn.

There are many tax software programs available, so it can be challenging to figure out which one is best for you.

By the time you’re done with this ezTaxReturn review, you’ll know whether this software is the right choice for you.

EZTaxReturn AT A GLANCE

- Free for simple filers with AGI less than $100,000

- Clean, easy-to-navigate site

- Not the best choice for those with multiple streams of income

Everyone needs a little guidance to file taxes. Free and premium tax services like EZ Tax can help.

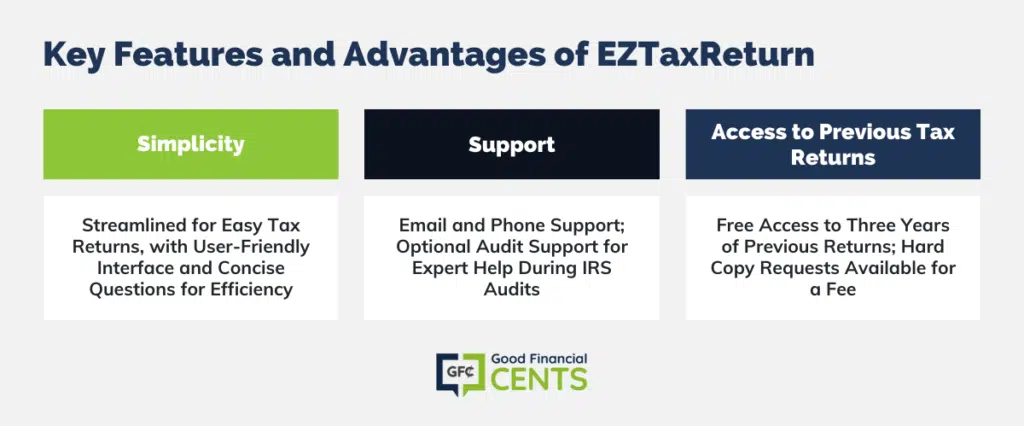

EZTaxReturn Features and Benefits

For people with simple tax returns, the main drawcard with this software is that it doesn’t offer a whole host of features. That means that you are not paying for features that you’ll never use. You also won’t have to deal with an array of confusing options that complicate matters.

Simplicity

The company set out to create software that will enable you to quickly and accurately submit your return. They decided early on that the key to delivering a flawless product was to keep it simple.

They focused on one aspect of tax returns instead of trying to help everyone. The result is software that is simple to use and that will help you generate and file your return as quickly as possible.

The questions are simple and to the point. They’re designed to weed out anyone who the software can’t help early in the process, so there’s no time wasted for you if you don’t qualify.

Also, because the software is geared towards simple returns, the questions are not nearly as extensive. This makes it perfect for someone who doesn’t know the first thing about tax returns.

Support

The company does offer full technical support via means of email and through their call center. As an additional extra, you can opt to buy Audit Support. This service is there to assist those who are audited.

A tax expert will help you deal with your audit professionally. They’ll assist you in getting the right information to the IRS and help you negotiate where necessary.

Access to Previous Tax Returns

One nice benefit that the company offers that you don’t get everywhere is free access to past returns. You are able to access up to three years’ worth of returns on their site. Downloads for these returns are free.

You can opt to have hard copies sent to you for a price. If you want access to returns outside of this three-year period, you can get them; you’ll just need to pay an additional fee. You’ll love the convenience if you have a simple return and want to get done with it as fast as possible.

Why not try it out for yourself? You don’t have to pay a cent until you want to file, so you can see if you like it or not. It’s not for everyone, but it does offer a simple solution for those who need it.

EZTaxReturn Plans and Prices

The plans are very basic and customizable to your needs.

EZTaxReturn does offer a free option for Federal tax filing if you meet the requirements for a simple return. The requirement for a simple return is an AGI of less than $100,000. You will need to pay $19.95 for the state return, so the plan isn’t 100% free.

It’s important to note that individuals with HSA contributions outside of work, student loan interest deductions, or those with dependents won’t qualify for a free filing.

- Federal: For all federal returns with the IRS, a flat fee of $29.95 is payable per return.

- State: For all state returns that you need to file, a flat fee of $19.95 is payable per return.

- Federal and State: This option allows you to file both types of returns at a reduced rate. You’ll pay a total of $39.95 if you select this option.

- Audit Support: This costs a one-off fee of $39.95 per return. You will receive support until the audit is completed.

- Fees for Copies: If you need a copy of your return outside of the three-year period, you can download it for $9.95. A hard copy will cost you $19.95 at any stage for regular mail. If you need it overnighted to you, it will cost $34.95.

- Insurance for Amendments: We all hope that we’ve filed our returns properly the first time. Sometimes, however, we need to amend them after filing. The insurance costs $9.95 and entitles you to a free amendment. Without it, you’ll pay $19.95 to amend your return.

EZTaxReturn Company Information

EZTaxReturn was founded in 1999 to make doing taxes easy, fast, and affordable for hard-working Americans. The prices and products offered are transparent, there is no bait-and-switch, no upgrades and no upsell at EzTaxReturn.

As you might guess from the name, filing with ezTaxReturn is simple, starting with the signup process.

You create an account on the site and check whether their services are available in your state.

Where EZTax Operates

The software does not support state returns in the following states, so if you live in one of these, you’ll need to choose a different company to work with:

- Connecticut

- Delaware

- District of Columbia

- Idaho

- Iowa

- Kansas

- Kentucky

- Montana

- Nebraska

- New Mexico

- North Dakota

- Oklahoma

- South Dakota

- Tennessee

- Utah

- Vermont

- West Virginia

If your state is not on this list, you then answer a series of questions that will determine whether or not the software can help you.

If you’re running a company or receive income from several sources, this is not the right software for you to use.

How The EZTaxReturn Questionnaire Works

The questions that EZ Tax asks are aimed at narrowing down your tax situation. They are pretty straightforward.

As the software is aimed at simple tax returns, you won’t need to answer questions that have no bearing on your situation. The program uses the answers provided to establish:

- Which forms do you need to complete

- Whether some deductions or credits might apply

With that information on hand, ezTaxReturn is able to help you file as accurately as possible, without missing out on tax breaks that might be available to you.

What Happens Next

The program populates the tax forms based on your answers, and you will be told what, if any, supporting documents you need to submit. Then you need to review the information, making sure that it’s all correct.

At this stage, if you’re happy that all is in order, you pay the fee and submit the return. You’ll get confirmation that it’s been accepted by the IRS within 24 hours.

How Does EZTaxReturn Compare?

How does EZTaxReturn compare to other popular tax software programs? Check out this table where we compare EZTaxReturn, TurboTax, and TaxSlayer.

| Company | Best For | Price To File Federal & State |

|---|---|---|

| EZTaxReturn | Live chat assistance | $39.95 |

| TurboTax | Preparing multiple returns | $0 |

| TaxSlayer | Simple tax situations | $0 |

Bottom Line: EZTaxReturn Overview

If you want something that is quick and easy to use, this might be the best software for you. That said, its functionality is pretty limited. If you have a very straightforward return, you’re golden, but it can’t handle anything more complex.

In all honesty, some companies offer a similar level of service for free, though these free services might not recommend deductions that apply. Also, to shell out $30 for what is essentially a very basic service might be a step too far if you know something about tax.

If, on the other hand, you’re a complete newbie and don’t know what to do, this is a good service. It definitely makes completing your return a lot quicker and simpler.

Moreover, while there are services that offer the same kind of thing for free, there are plenty of others that charge a whole lot more. Either way, it’s still cheaper than heading off to a CPA and getting your tax return completed in person by a professional.

With a little research, you can find the tax software that’s right for your situation.

How We Review Tax Preparation Software:

Good Financial Cents reviews various tax preparation software options, emphasizing user experience, feature sets, and accuracy in calculations. We aim to provide users with a balanced perspective, assisting them during tax season. Our editorial process is transparent and thorough.

We source data from software providers, testing functionalities and evaluating user interfaces. This hands-on approach, combined with our research, ensures a comprehensive review.

Each software option is then rated based on its strengths and weaknesses, resulting in a star rating from one to five.

For a deeper understanding of the criteria we use to rate tax preparation software and our evaluation approach, please refer to our editorial guidelines and full disclaimer.

EZTaxReturn Review

Product Name: EZTaxReturn

Product Description: EZTaxReturn is an online tax preparation software designed to simplify the tax filing process for U.S. taxpayers. With its user-friendly interface and guided walkthroughs, it caters to both new and experienced filers, aiming to maximize refunds while minimizing tax-related stress.

Summary of EZTaxReturn

Launched to make the annual ritual of tax filing more straightforward, EZTaxReturn has become a trusted platform for many Americans seeking an alternative to traditional tax professionals or cumbersome software. The program offers an intuitive step-by-step guide, ensuring users don’t miss out on potential deductions and credits. Additionally, the software’s accuracy guarantee and in-built error-checking mechanisms aim to prevent common filing mistakes. With options for both federal and state returns, it serves as a comprehensive solution for diverse tax situations.

-

Cost and Fees

-

Customer Service

-

User Experience

-

Product Offerings

Overall

Pros

- User-Friendly Interface: Designed for ease of use, allowing both novice and seasoned filers to navigate seamlessly.

- Comprehensive Guidance: In-depth walkthroughs ensure users maximize deductions and minimize tax liabilities.

- Accuracy Guarantee: Offers protection against potential mistakes with its error-checking features.

- Affordable: Competitive pricing when compared to many other online tax preparation platforms.

Cons

- Limited Advanced Features: May not cater to complex tax situations or those needing advanced tax strategies.

- Upcharges for Additional Features: Some additional services or state filings might come at an extra cost.

- No Physical Locations: For those preferring face-to-face consultations, there are no brick-and-mortar outlets.