Key Takeaways:

- Hippo offers “modernized” home insurance policies that provide protection for the way homes are used today.

- The company promises to help you care for your home so you can avoid claims whenever possible. They do this by including complementary smart home devices and advanced home maintenance services.

- Hippo offers home insurance policies in 37 states.

- Unlike other insurance providers, Hippo focuses on home coverage only and does not offer auto insurance, life insurance, or other types of coverage.

- Get a free quote for homeowners insurance online to see how much you can save.

- Hippo boasts that many of their customers save up to 25% off their premiums.

Hippo has been virtually unheard of in the insurance industry, but that trend is starting to change.

This company has been featured in publications like Bloomberg, USA Today, and Fortune over the last several years, and this is mostly due to the unique way they approach insuring and caring for your home.

Hippo makes it easy to get a free quote for homeowners insurance online in 60 seconds or less, and they have their own home care app that lets you set up ongoing maintenance or get advice from home care professionals.

This provider also includes smart home devices in your home insurance plan, which can help you ensure small issues with your home don’t turn into big, expensive problems down the line.

If you’re in the market for homeowners insurance and you’re thinking of trying something new, Hippo could offer the protection you need for a price you can afford.

Read on to learn how Hippo coverage works, what makes it different, and why you may want to consider this technology-based home insurance provider.

Table of Contents

About the Company

Hippo Home Insurance was founded in 2015, which means this provider has been around for less than a decade. This makes it slightly difficult to gauge the quality of this company, as well as past user experiences.

However, all signs point to good news so far, as Hippo has accrued some important ratings since its founding.

For starters, Hippo partners with insurers who have an A- rating for financial strength from A.M. Best, which means the company is positioned to remain fiscally sound for the long run.

Hippo Insurance Services also boasts a B+ rating and accreditation with the Better Business Bureau (BBB). The insurance company also shows an average of 3.66 out of 5 stars among user reviews on the BBB, although they have closed 20 complaints in the last three years.

Additionally, Hippo has more than 2,000 user reviews on its website, which feature an average rating of 4.9 out of 5 stars.

A few different factors help Hippo stand out, including the fact that this provider does not offer other types of insurance. This could be seen as a downside since many people like to bundle all their insurance policies with a single company for savings and convenience.

However, Hippo does claim they can save you 25% off your premiums.

Hippo also does things in their own unique way. For example:

- Hippo provides its customers with free smart home devices that can help them care for and prevent problems with their property.

- Hippo customers get access to a home care app that lets them schedule maintenance or get professional advice relating to their home and its upkeep.

- Hippo uses advanced technology to make sure you’re paying for the exact amount of home coverage you need and nothing more.

- Hippo includes 4x higher coverage limits on your electronics than other providers

As we mentioned already, Hippo is available in 37 states. You can use their website to get a quote for your home coverage in as little as 60 seconds.

To get started, you should plan on providing the following information:

- Your Home Address

- Information on Occupancy

- Date of Birth

- Email Address

- Phone Number

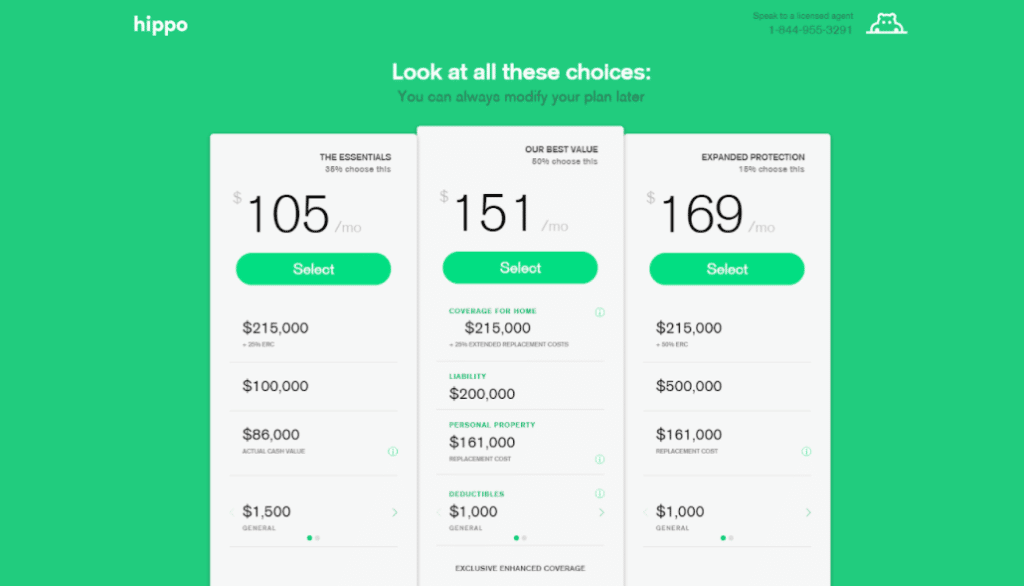

Once you enter this required data, you’ll be presented with quotes for three levels of coverage — good, better, and best.

You can choose a home insurance plan with higher coverage limits and extra coverage types, but you can also opt to cover the basic essentials at a lower price point.

Additionally, you get the opportunity to choose a policy with a deductible that makes sense for your finances.

You can also check to see which Hippo discounts you may be eligible for, including discounts for living in a community with a homeowners association (HOA) or a discount for not having a mortgage.

You can also score a discount on coverage if you get a free quote and begin your plan at least 8 days before coverage is set to begin or if you have a brand new home.

In terms of the types of coverage that can come in your Hippo homeowners insurance plan, they offer the following coverage types:

- Computers and Home Office Coverage, With 4X the Limits of Average Policies

- Coverages for Appliances and Electronics

- Coverage for House Cleaners and Babysitters

- Water Backup

- Service Line Coverage

- Coverage for Local Ordinance Changes

- Enhanced Rebuilding Coverage

- Liability Coverage

- Loss of Use

- Mortgage Payment Protection

Home insurance coverage for your personal possessions also comes with a full replacement cost, meaning you’ll get the full amount to replace an item without a deduction for depreciation.

Unique Features

- Home care app lets you schedule maintenance and get professional advice on home repairs

- Included smart home devices make it easier to discover problems with your home early on

- Technology-based pricing lets you save up to 25% off your homeowner’s insurance premiums

Who Hippo Home Insurance Is Best For

Because Hippo doesn’t offer other types of insurance, this provider is best for people who don’t mind shopping around with different companies to insure their home, their car, and other possessions they have.

Ultimately, Hippo Home Insurance is probably best for people who want tailored coverage based on how they live, as well as those who find the premiums offered by Hippo are better than they can get elsewhere.

Ideal customers for Hippo Home Insurance could be:

- Anyone who wants to get a fast and easy quote for homeowners insurance online

- Someone who already has a separate auto insurance policy they’re happy with

- People who want a plan with extra coverage for water backups, service lines, domestic workers, home office equipment, and more

- People who are comfortable using technology as part of their homeowners’ insurance experience

How Hippo Calculates Your Home Insurance Premium

Once you apply for a homeowners insurance quote with Hippo, you may find you’re being asked to pay more or less when compared to other quotes you have received.

While Hippo does promise you can save up to 25% on your homeowners’ insurance premiums, these savings may or may not materialize for you.

This all depends on the home you’re trying to insure, your personal claims made in the past, and the coverage levels you’re asking for.

According to Hippo, the main factors used to calculate your homeowner’s insurance premium include:

- Coverage Limits You Choose

- Endorsements/Optional Coverages

- Discounts (Such as Smart Home Devices or Other Loss Prevention Devices)

- Deductible Options

Note that Hippo lets you pay your homeowners insurance premiums via your bank account with an ACH transfer, a credit card, or the escrow account attached to your mortgage.

While payments made through escrow are standardized, individuals who pay via their bank account or a credit card have the option to pay monthly, quarterly, twice a year, or annually.

Hippo vs Other Home Insurance Competitors

If you’re in the market for homeowners insurance and wondering if Hippo is right for you, it never hurts to see how this provider stacks up to the competition.

The following chart shows how Hippo compares to a few highly-rated providers in the home insurance space — Allstate Insurance and Lemonade.

| HIPPO HOME INSURANCE | ALLSTATE HOME INSURANCE | LEMONADE HOME INSURANCE | |

|---|---|---|---|

| Financial Ratings | Partners With Companies That Are Rated A- Or Better for Financial Strength From A.M. Best | Rated A+ for Financial Strength From A.M. Best | Financial Stability Rating® of A-Exceptional from Demotech Inc. |

| Discounts Offered | Multiple Policy Discounts Safety Feature Discounts Full Payment Discounts New Home Discounts | Multiple Policy Discounts Responsible Payment Discounts Claim-Free Discounts Loyalty Discounts Early Signing Discounts Discounts for Protective Devices New Home Discount | Multiple Policy Discounts Safety Feature Discounts Full Payment Discounts |

| Customer Star Rating (Trustpilot) | 2.9 Out of 5 Stars | 1.4 Out of 5 Stars | 4.1 Out of 5 Stars |

What You Should Know About Homeowners Insurance

According to the Insurance Information Institute (III), standard coverages found in most homeowners insurance plans include:

- Coverage for the Structure of Your Home

- Liability Protection

- Coverage for Your Personal Possessions

- Coverage for Additional Living Expenses

With this being said, there are lots of variables to consider from there. For example, you can choose to add additional riders or coverage for unique components of your home.

You may also need to purchase additional types of home coverage depending on where you live, such as earthquake insurance or flood insurance.

You’ll also need to make sure you are happy with the coverage limits in your policy and that these limits are sufficient to help you recover financially in the case of a total loss.

Further, you’ll need to know if your home insurance offers actual cash value, replacement cost value, or guaranteed or extended replacement cost coverage.

The Bottom Line

Does Hippo Home Insurance make any sense for your home and your lifestyle? This really depends on whether you want coverage that is tailored to the way you live, and whether they offer premiums that provide a solid value in return.

To find out if Hippo might be a good fit, we recommend taking the time to get a free quote and then comparing the different levels of coverage Hippo has to offer for your home.

In the meantime, you should also make sure you inquire about various home insurance discounts you may be eligible for with Hippo, including discounts for having a new home or paying your bill in full for the year.

With that being said, don’t stop your search for home insurance at Hippo. When it comes to finding the best home insurance coverage, your best bet is to shop around with at least 3 to 4 different insurers. However, you should make sure you’re not comparing policies based on pricing alone.

In addition to premiums, you’ll want to compare the types of coverage you’re being offered, policy limits and the amount of your deductible. From there, you can make an informed decision about which of the best home insurance providers fits your needs best.

How We Review Insurance Companies

Good Financial Cents systematically reviews U.S. insurance companies, emphasizing policy offerings, customer experiences, and overall reliability.

Our goal is to present a balanced and comprehensive perspective to potential policyholders. Editorial transparency remains a cornerstone of our approach.

We actively collect information from insurance companies and place significant weight on customer feedback. By integrating this feedback with our research, we can offer a well-rounded evaluation.

Each company is then rated based on multiple criteria, resulting in a star rating from one to five.

For a deeper understanding of the criteria we use to rate insurance companies and our evaluation approach, please refer to our editorial guidelines and full disclaimer.

Hippo Home Insurance Review

Product Name: Hippo Home Insurance

Product Description: Hippo Home Insurance offers modernized home insurance policies that cater to today's homeowner. Utilizing technology-driven solutions, the company seeks to provide a streamlined application process and comprehensive coverage that reflects contemporary needs.

Summary

Hippo Home Insurance has emerged as a refreshing alternative in the home insurance landscape by recognizing and addressing the evolving demands of homeowners in the 21st century. Through the use of advanced technology, Hippo simplifies the insurance application process, often delivering quotes in minutes. Additionally, their policies often encompass modern-day concerns, such as electronics and home office coverage, ensuring a more tailored protection for homeowners. Their tech-savvy approach extends to claims processing, aiming for quick and hassle-free settlements.

-

Cost and Fees

-

Customer Service

-

User Experience

-

Product Offerings

Overall

Pros

- Get a free quote in 60 seconds or less

- Flexible coverage options

- Discounts available

- Save up to 25% on homeowners insurance

Cons

- Cannot bundle other types of insurance

- Less personalized experience

- No dedicated agent to guide you