Table of Contents

- How Much Is a Six-Figure Salary?

- How Much Can I Make a Month, Week, Day, or Hour in 6 Figures?

- How Much Is 6 Figures After Taxes?

- How Can I Earn 6 Figures?

- Jobs That Pay 6 Figures

- How To Maximize 6 Figures?

- What Would a 6-Figure Lifestyle Look Like?

- Conclusion – Making 6-7 Figures

- FAQs – How Much Is Six Figures

How Much Is a Six-Figure Salary?

How Much Can I Make a Month, Week, Day, or Hour in 6 Figures?

How Much Is 6 Figures Monthly?

How Much Is 6 Figures a Week?

How Much Is 6 Figures a Day?

How Much Is 6 Figures an Hour?

How Much Is 6 Figures After Taxes?

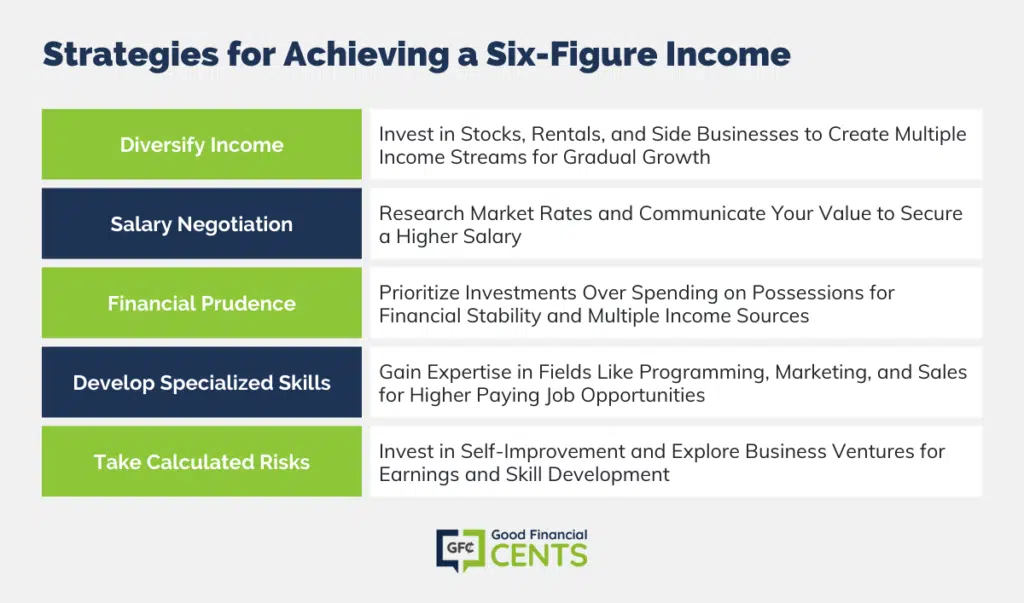

How Can I Earn 6 Figures?

Create Multiple Streams of Income

Negotiate Salary Increases

Be Practical About Your Finances

Develop Specialized Skillsets

Take Calculated Risks

Jobs That Pay 6 Figures

How To Maximize 6 Figures?

Follow a Budget

Build Savings

Pay Off Debt ASAP

Avoid Luxury Lifestyle and Cut Expenses

Invest Your Money To Grow It

What Would a 6-Figure Lifestyle Look Like?

Conclusion – Making 6-7 Figures

However, it’s important to remember that budgeting, investing smartly, reducing lifestyle inflation, avoiding overspending, and planning for the future are essential if you want to make sure you remain within your means with a six-figure income.

With proper management of finances, those who have achieved this milestone will find themselves on their way toward achieving financial freedom.

FAQs – How Much Is Six Figures

When it comes to money, “figures” refers to the number of digits in a number. Usually, figures refer to an annual salary unless otherwise stated. For example, a one-figure number is one digit long — like 7. A two-figure number has two digits — like 45. A three-figure number has three digits — like 365. And a six-figure number has six digits — like 123,456. For seven figures and up, the terms “millions” or “billions” are usually used.

A six-figure job is a job that pays an annual salary of at least $100,000. Such jobs typically require specialized skills and often include managerial positions in different industries. Many tech jobs can easily pay a six-figure salary, and some executives may even get an even or eight-figure salary.

A six-figure salary refers to a full-time job that pays an annual salary of at least $100,000. On the other hand, a 6-figure income includes all sources of income, including salary, investments, business profits, side hustles, and more. Your total 6-figure income could be a combination of your salary and other sources of money.

Zippia reports that around 18% of Americans earn a six-figure income, with 15% of those making between $100,000 and $150,000.

The difference between 6 and 7 figures is the number of digits in the number. A six-figure number has six digits — like 123,456. A seven-figure number has seven digits — like 1,234,567.

Yes, depending on your spending habits and location. With a six-figure salary, you can usually afford a comfortable lifestyle if you live within your means, invest intelligently, and plan for your future. However, the cost of living in certain cities may require an even higher income to stay comfortable.

It certainly can be! The latest BLS statistics reveal that the median weekly income of full-time American workers is $1,003, which adds up to an annual salary of $52,156. Depending on where you live, earning a salary of $100,000 per year could provide a very comfortable lifestyle as it would be a 92% increase from the median salary.

A concerning survey reveals that 60% of millennials who earn a six-figure income struggle to make ends meet and have no savings or plans to pay off their debts. This might be due to lifestyle inflation and overspending.