The purchase of life insurance is an important piece of nearly anyone’s overall financial portfolio. Even though it’s important, it doesn’t mean everyone has a plan.

Why is life insurance so important?

One reason is that this essential financial tool can help to protect the ones you love from having to spend other assets on things such as final expenses, paying off debt, and/or living expenses in the case of the unexpected. The proceeds from a life insurance policy can also help to keep those you care about from falling into drastic financial hardship and changing their lives at a time that is already emotionally difficult for them.

At the time you are buying a policy, there are several key factors to keep in mind. One, certainly, is to ensure that you obtain proper protection so that your survivors will have plenty of cash to go on. Another is to be mindful of purchasing coverage through one of the most financially stable life insurance companies.

This is because you will want to know that the underlying insurer is strong and stable financially and that it will be there in the future if and when a claim needs to be made. With that in mind, it is important to do some research on the insurer that you are considering before moving forward.

One insurance carrier that is somewhat newer in the industry is Global Atlantic Financial Group. This company, a subsidiary of Global Atlantic, provides security and income products to its customers.

Unlike some other companies, like Allstate or Progressive, Global Atlantic isn’t a household name, but that doesn’t mean they are any less valuable.

Table of Contents

- History of Global Atlantic Financial Group Life Insurance Company

- Global Atlantic Financial Group Ratings and Better Business Bureau Grade

- Life Insurance Products Offered by Global Atlantic

- Get the Best Life Insurance Rates From Global Atlantic

- The Bottom Line – Global Atlantic Financial Group Life Insurance Review

History of Global Atlantic Financial Group Life Insurance Company

Global Atlantic Financial Group is located in Des Moines, Iowa.

It began with more than 200 agents who were already well-versed in the life insurance business.

In just the past decade, Global Atlantic has become known in the insurance and financial industry as a provider of insurance commodities, as it has grown to more than thirty billion dollars in assets. One reason for this company’s success is due to its long-term focus on its policyholders, as well as its emphasis on teamwork that is driven by its experienced leadership from the top.

Global Atlantic Financial Group Ratings and Better Business Bureau Grade

Thought to be a solid and steady company from an economic standpoint, Global Atlantic is rated as an A- from A.M. Best. This is rated as “Excellent” and is 4th out of a possible total of 16 overall ratings.

Global Atlantic Financial Group is not an accredited company by the Better Business Bureau, nor has it been given a grade by the BBB. There have, however, been forty objections filed to the BBB about Global Atlantic over the past three years, and all forty have been closed.

Of these 40 complaints that were filed, 18 centered on the company’s billing/collection issues, 17 centered on problems with the company’s product and/or services, four had to do with advertising and/or sales issues, and one focused on other issues. There are also three negative reviews posted by customers about Global Atlantic on the Better Business Bureau’s website.

Life Insurance Products Offered by Global Atlantic

The products that are offered by Global Atlantic Financial Group are well-designed, and they are focused on meeting the protection, wealth transfer, and small business needs of customers across the country.

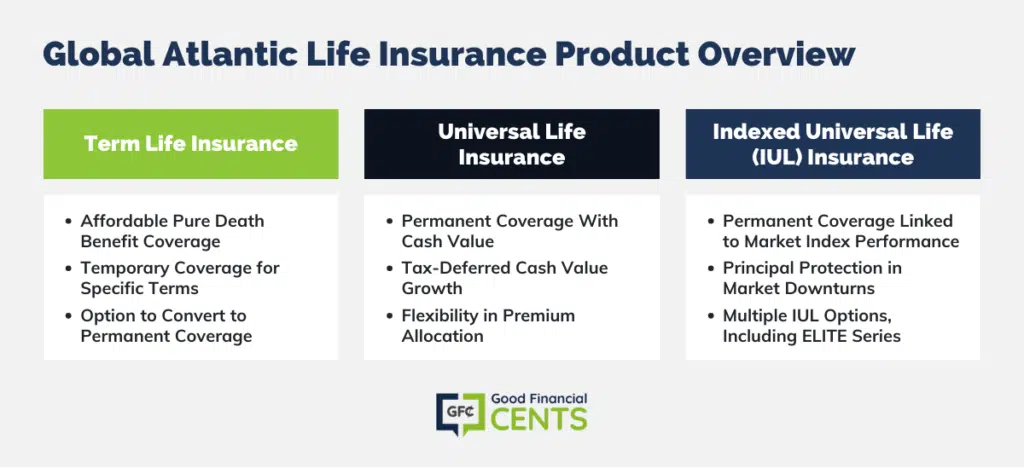

The primary products that are provided by Global Atlantic include term insurance, as well as universal life and indexed universal life insurance coverage. These offerings can help its policyholders to prepare for both short and longer needs.

Global Atlantic Life offers various kinds of life insurance protection to its customers. Doing so allows for its policyholders to create the protection that works best for them, as well as to revise support as their requirements evolve.

Term Life Insurance

One of the primary products that is offered through Global Atlantic is term life insurance coverage. This product gives pure death benefit protection only, without any cash value or savings component. Due to this, the term can be pretty decently priced – and a good way for those who need a large quantity of protection, such as a $1 million dollar life insurance policy, to obtain it at a lower rate.

This is especially the case for people who might be young and in great health at the time of application.

Term life insurance is often thought of as being temporary coverage because it is purchased for a certain length of time, such as for ten, twenty, or thirty years. There is also a 1-year annual renewable term life option. Typically, the premium rate for this will remain level within the policy’s “term,” and then the policyholder will either need to re-qualify for coverage or the policy will naturally expire.

In some cases, a term life insurance policy will provide the option to convert over into a permanent form of coverage, such as a universal life insurance policy. This way, the insured will not need to worry about the policy expiring at any certain time in the future (unless they stop paying the policy’s premium).

Universal Life Insurance

Global Atlantic also offers universal life insurance coverage. This is a form of permanent life insurance protection, so in addition to death benefit coverage, there is also a cash value component in these policies.

The cash in the policy is allowed to grow on a tax-deferred basis. This means that the policyholder will not need to pay taxes on the gain or growth of the funds in this account unless or until the time of withdrawal. This can allow these funds to build and increase exponentially over time.

Universal life insurance coverage is thought to be a more flexible form of permanent life insurance than whole life insurance. This is because the policyholder may choose (within certain parameters) how much of their premium dollars will go into the cash value and how much will go towards the death benefit of the policy. They may also be able to change their premium due date based on their needs.

Global Atlantic Financial Group offers some different additional riders to their universal life insurance policies. These include the following:

- Accelerated Access Rider

- Wellness for Life Rider

- Accidental Death Benefit Rider

- Children’s Insurance Rider

- Primary Insured Rider

- Overloan Protection Rider

- Waiver of Monthly Deductions Rider

Indexed Universal Life (IUL) Insurance

Another form of permanent life insurance coverage that is offered by Global Atlantic is indexed universal life. With this type of universal life, the growth in the cash value component is based on the production of an underlying market index such as the S&P 500.

While the policyholder has the chance to increase his or her funds significantly based on market performance, if the market should decline, the principal in the account is preserved.

There are numerous choices for indexed universal life insurance that can be chosen through Global Atlantic Financial Group. These incorporate the following:

- Lifetime Foundation ELITE

- Lifetime Builder ELITE

- Global Accumulator

Get the Best Life Insurance Rates From Global Atlantic

When looking for top quotes, work with multiple insurers. This is true not only for life insurance but for auto insurance and health insurance as well. That way, you will be able to compare benefits, and from there, you can determine which will work the best for you.

When seeking life insurance protection – along with policy quotes – we can help. We work with many of the best life insurance companies in the market today, and we can assist you with obtaining all of the important details that you require.

We understand that finding the best life insurance plan for your needs can sometimes feel overwhelming. There are many things to contend with – and you want to ensure that you are getting the right coverage for your specific requirements. But now you have an ally on your side. So, contact us today – we are here to help.

The Bottom Line – Global Atlantic Financial Group Life Insurance Review

Life insurance is a pivotal component in a comprehensive financial plan, ensuring protection for loved ones against unforeseen circumstances.

Global Atlantic Financial Group, a relative newcomer in the insurance space, offers a diverse portfolio of products tailored to meet various customer needs.

Located in Des Moines, Iowa, the company has achieved recognition for its robust growth and a policyholder-centric approach.

Although not a household name like some of its counterparts, Global Atlantic has been graded “Excellent” by A.M. Best. They offer term, universal, and indexed universal life insurance, with a plethora of rider options for customization.

When considering life insurance, it’s essential to compare offerings, seeking the ideal fit for individual requirements, and Global Atlantic presents a compelling choice for many.

How We Review Insurance Companies:

Good Financial Cents systematically reviews U.S. insurance companies, emphasizing policy offerings, customer experiences, and overall reliability. Our goal is to present a balanced and comprehensive perspective to potential policyholders. Editorial transparency remains a cornerstone of our approach.

We actively collect information from insurance companies and place significant weight on customer feedback. By integrating this feedback with our research, we can offer a well-rounded evaluation. Each company is then rated based on multiple criteria, resulting in a star rating from one to five.

For a deeper understanding of the criteria we use to rate insurance companies and our evaluation approach, please refer to our editorial guidelines and full disclaimer.

Product Name: Global Atlantic Financial Group Product Description: Global Atlantic Financial Group is a renowned insurance provider, specializing in diverse life insurance products tailored to cater to various individual needs. Though relatively new, they have solidified their place in the market with a customer-centric approach and a wide range of insurance offerings. Summary Founded in Des Moines, Iowa, Global Atlantic Financial Group has swiftly grown its asset base and reputation over the past decade. With a strategic focus on long-term policyholder benefits and an experienced leadership team, the company offers term, universal, and indexed universal life insurance, amongst other products. These offerings are enhanced with multiple rider options, providing customers with a flexible and customized insurance experience. Despite being lesser known compared to some insurance giants, Global Atlantic stands out due to its commitment to policyholder needs and financial stability. Pros Cons

Global Atlantic Financial Group Review

Overall